“Spectacular Momentum Crash” Imminent As Record Human Hedge Fund Selling Meets Furious Robot CTAs Buying

One of the reasons cited for the explosive move overnight in futures – along with the sketchy STATnews/Feuerstein leak of Gilead’s remdesivir coronavirus trial – is optimism over the upcoming reopening of the US. However, as Nomura’s Charlie McElligott writes this morning, “the “TL;DR version” of the U.S. reopening guidelines = there is no “plan,” as there are 1) no deadlines; there are 2) no guidelines or protocols to businesses on protective gear / temperature checks / testing / sanitizing; and 3) offers little to no federal assistance, with states being asked to “independently” secure PPE and medical equipment for their hospitals.”

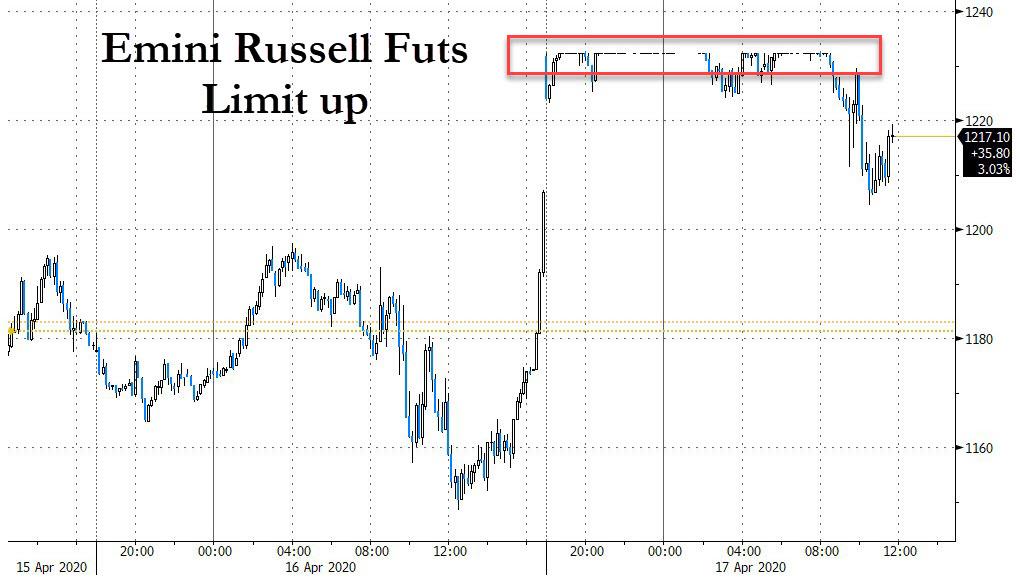

So why this tremendous surge in risk assets, which pushed Russell emini futures limit up overnight?

It is certainly not coming form hedge funds, which according to Goldman, saw the largest monthly dollar net selling since Aug ’16 in the month though April 15, with all 11 US sectors sold MTD, led by Cyclical sectors. In other words, hedge funds are not driving this rally, but instead are (panic) selling in droves into it.

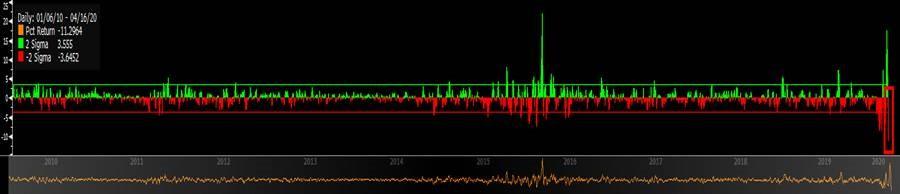

One possible explanation for the move higher – especially in the Russell/small caps – is that, as Nomura notes, “the big talking-point in equities-circles of the past week has been the extreme mega-cap outperformance over small-cap; thus, our U.S. Equities “Size” factor market-neutral strategy has experienced the largest 4d cumulative drawdown experienced over the past decade at -11.3%, which is a a -6.3 sigma event (10Y rel)”

Ok we get the rotation, but someone must be buying into it, and since it is clearly not hedge funds, and retail investors probably have record unemployment to worry about, the answer must lie elsewhere.

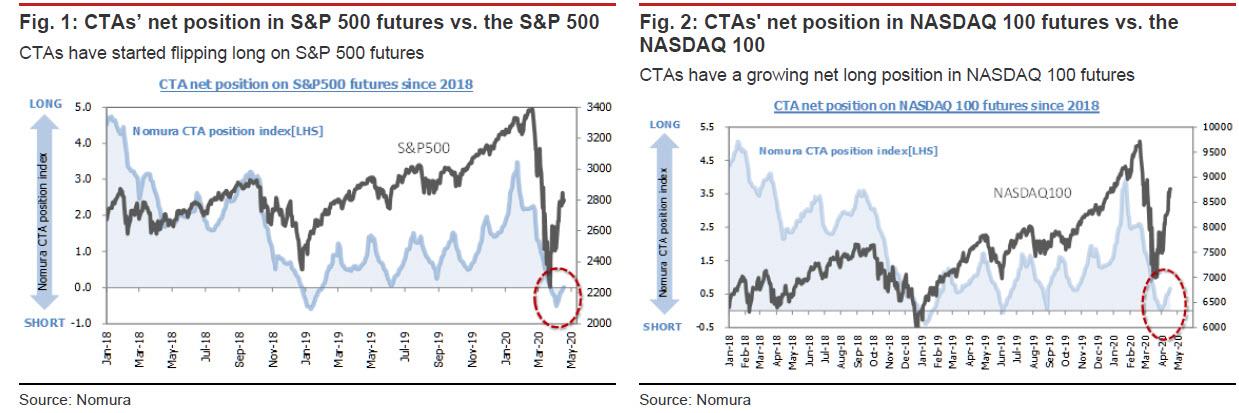

Well, according to Nomura’s other quant, Masanari Takada, that someone is CTAs, with the strategist writing that trend-following buying has picked up speed in US equity futures markets, and CTAs appear to have flipped long not only on NASDAQ 100 futures but also on S&P 500 futures now. Which makes sense: CTAs, which are computer-driven models, do not care about such trivial facts as mass layoffs, millions of people infected with a deadly virus, and instead they only care if others are buying at which point they too join the buying frenzy, making them the dumbest of momentum-chasing investors. This pick-up in trend-following buying is getting a boost from the narrative among market participants having taken on a more positive tone, playing catch-up with a rebound that is already under way.

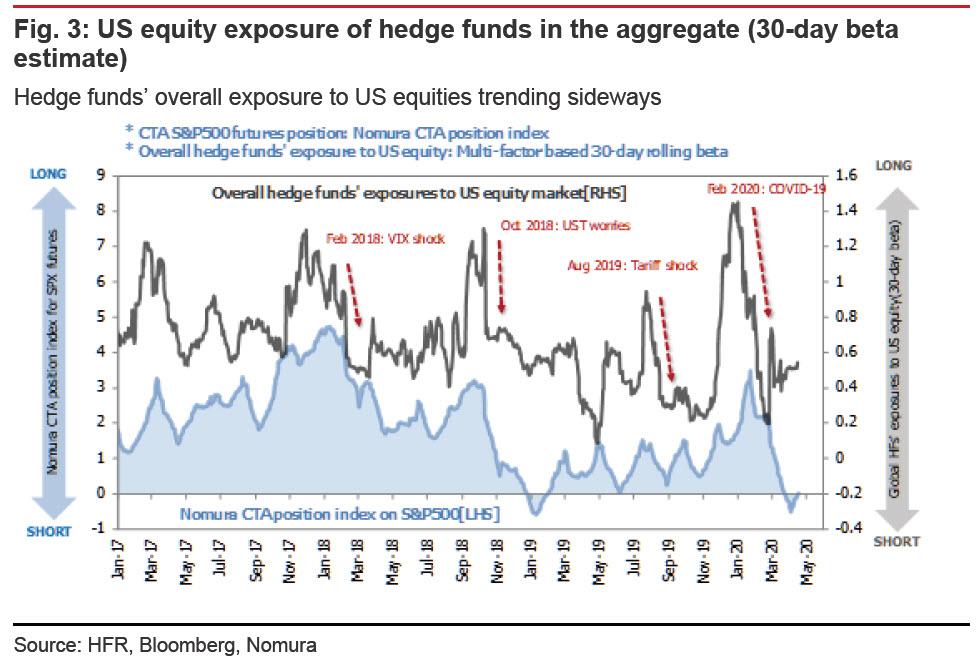

However, as discussed previously, Nomura thinks that CTA buying of NASDAQ 100 futures may hit a slowdown next week (around 22 April). Also, and this goes without saying, the coronavirus pandemic has left a deep imprint on both the real economy and investor confidence, and the bank suspects that “doubts about the sustainability of the rally are strongest among those investors most focused on fundamentals” such as hedge funds, if not pure momentum chasers like CTAs. Having sold record amounts in recent weeks – as per Goldman above – Nomura calculates that the US equity exposure of hedge funds in the aggregate is trending generally sideways, with bullishness among technical investors and bearishness among fundamentals-focused investors more or less canceling each other out.

In other words, a clash has broken out between human (fundamentally-concerned) and CTAs (momentum-chasing) traders.

So who wins? Here, Nomura is skeptical that mere momentum will be sufficient, with Takeda writing that algos they may be, but CTAs cannot go against economic fundamentals for long:

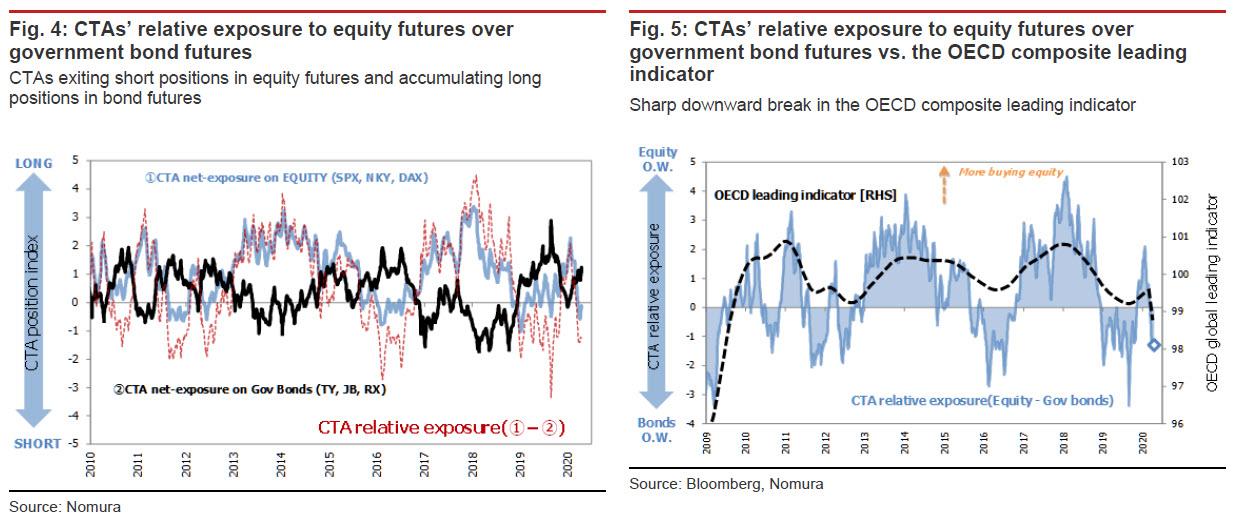

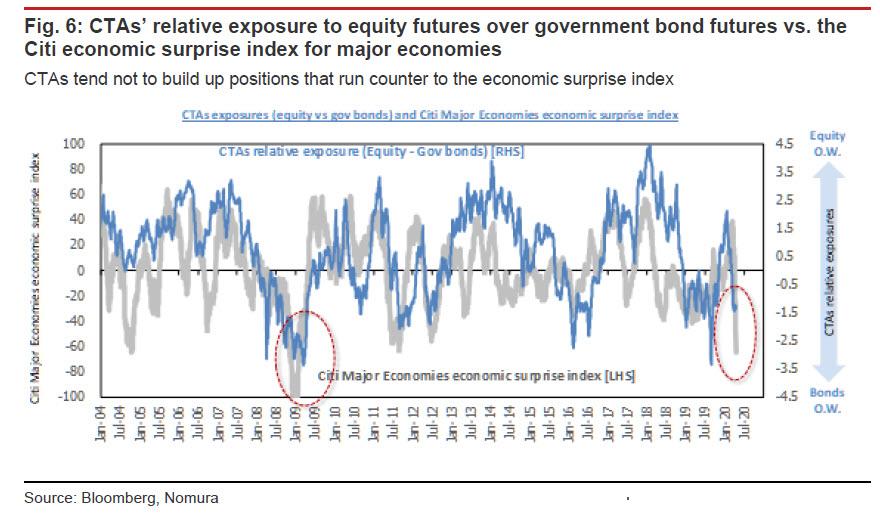

Zooming out a bit, we note that while CTAs’ trading decisions are technically driven, their trades that go against the direction of global economic momentum tend to end in failure. Looking specifically at historical trends in the relative positioning of CTAs in major equity futures (S&P 500 futures, Nikkei 225 futures, DAX futures) and major government bond futures (UST futures, JGB futures, Euro-bund futures), we find that when global economic growth momentum is collapsing (as it is now), CTAs take a more pronounced tilt towards bonds (overweighting long positions in bond futures).

One can track how this premise plays out with reference to the OECD composite leading indicator and the frequently updated Citi Economic Surprise Index for major economies. With so much uncertainty surrounding when the global economy might actually bottom out, Nomura predicts that CTAs as a group are likely to either:

- execute an allocation shift by selling equity futures and buying bond futures (on the expectation of falling stock prices and falling bond yields); or

- increase their gross exposure by continuing to buy equity futures while focusing even more intently on buying bond futures (on the expectation of rising stock prices and falling bond yields).

So who wins this man vs machine? On at least this occasion, the Japanese bank is taking the side of the humans, with Takeda warning that “expectations for a swift economic recovery could lead to a momentum crash.”

As the Nomura quant explains, the biggest risk the bank sees is that global economic growth expectations fail to pick up rapidly in a way that confounds these CTA trading scenarios. Such a “gap between reality and the expectations of trend-following investors can sometimes result in a spectacular momentum crash in equity markets and bond markets.”

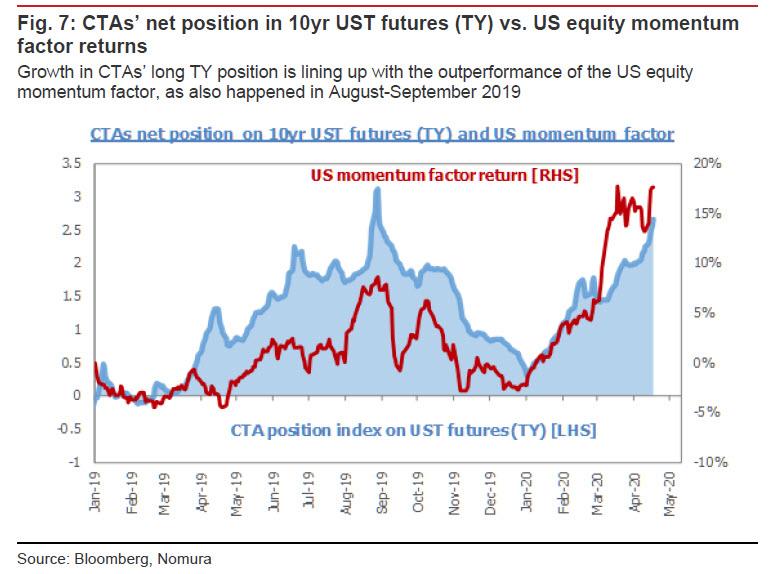

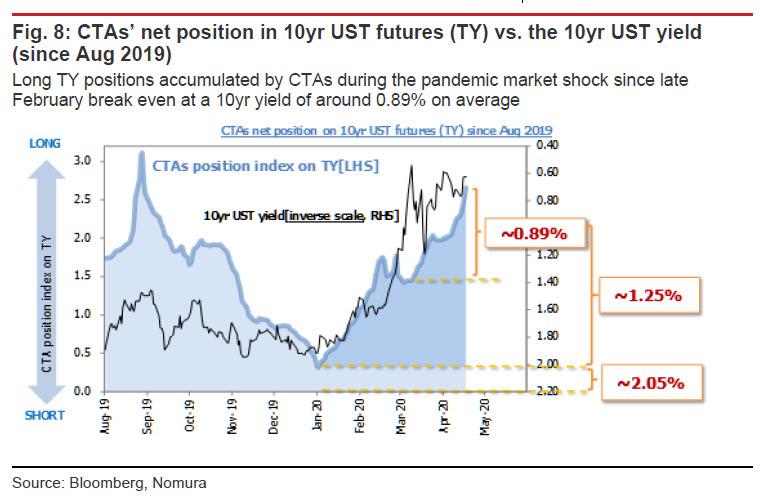

Adding to this paradoxical divergence, the outperformance of the US equity momentum factor is currently aligned with growth in CTAs’ net long position in 10yr UST futures (TY). With lower yields as the backdrop, investors have been favoring tech stocks and defensive stocks by process of elimination, causing the momentum factor to start to look overheated.

And here is the flashing red light: this alignment between the outperformance of the US equity momentum factor and growth in CTA’s net long TY position was also in evidence in August-September 2019, at the height of the US-China trade war.

Takeda concludes that “the lesson here is that when the market mood does a 180-degree about-face from pessimism to optimism—and when that optimism turns out in retrospect to have been well justified—momentum tends to crash abruptly, with CTAs dumping long TY positions (spelling a surge in US longterm yields) and the US equity momentum factor running out of steam.”

How to determine precisely when the next crash – which will be a repeat of the Aug/Sept 2019 quantastrophe – comes? Pay attention – in the coming week and beyond – to momentum positions in equity and bond markets, and “look for clues as to how realistic some market participants are being by letting themselves start to become optimistic.”

Tyler Durden

Fri, 04/17/2020 – 11:55

via ZeroHedge News https://ift.tt/2ynhOA9 Tyler Durden