Story Time 1929-1936

Submitted by Nicholas Colas of DataTrek Research

We’ll cover some upbeat earnings reports from GM, Firestone, AT&T and Texaco. The hook: they are from 1929 – 1936. Yes, every company here was profitable in the Great Depression; they cut their workforces until they could earn their dividend (basically the cost of capital back then). Unemployment was a first-order effect of that period, but these financial reports also show less-appreciated impacts: reduced adoption of productivity enhancing technologies (phones and cars) and less public ownership of stocks.

* * *

Regular readers know we have a small but growing collection of Great Depression-era annual reports issued by brand-name American companies, and those are the stars of this week’s Story Time Thursday. They offer a useful historical framework when evaluating the recent unprecedented monetary/fiscal policy responses to the COVID-19 Crisis. What you’ll see in these reports is what happens when policymakers don’t respond to an economic crisis until its effects are widespread.

#1: Firestone Tire’s annual revenues, net profits and dividends (various annual reports, 1929 – 1936, FY ending October):

- Revenues

1929: $144.6 million

1930: $120.0

1931: $113.8

1933: $75.4

1936: $135.7

- Net Profits

1929: $7.7 million

1930: $1.5

1931: $6.0

1933: $2.4

1936: $9.1

- Dividends

1929: $2.9 million

1930: $3.2

1931: $2.1

1933: $1.0

1936: $1.7

Takeaway: even in the depths of the Great Depression (1933) and after revenues had dropped by 48% from their highs just 4 years prior, Firestone posted a profit and paid a dividend. How? The only hint comes in the 1930 annual: “by readjusting our organization and reducing our expenses in every phase of our business”. That is what businesses quite rightly do when faced with economic uncertainty: reduce their workforces to protect profits and cash flows.

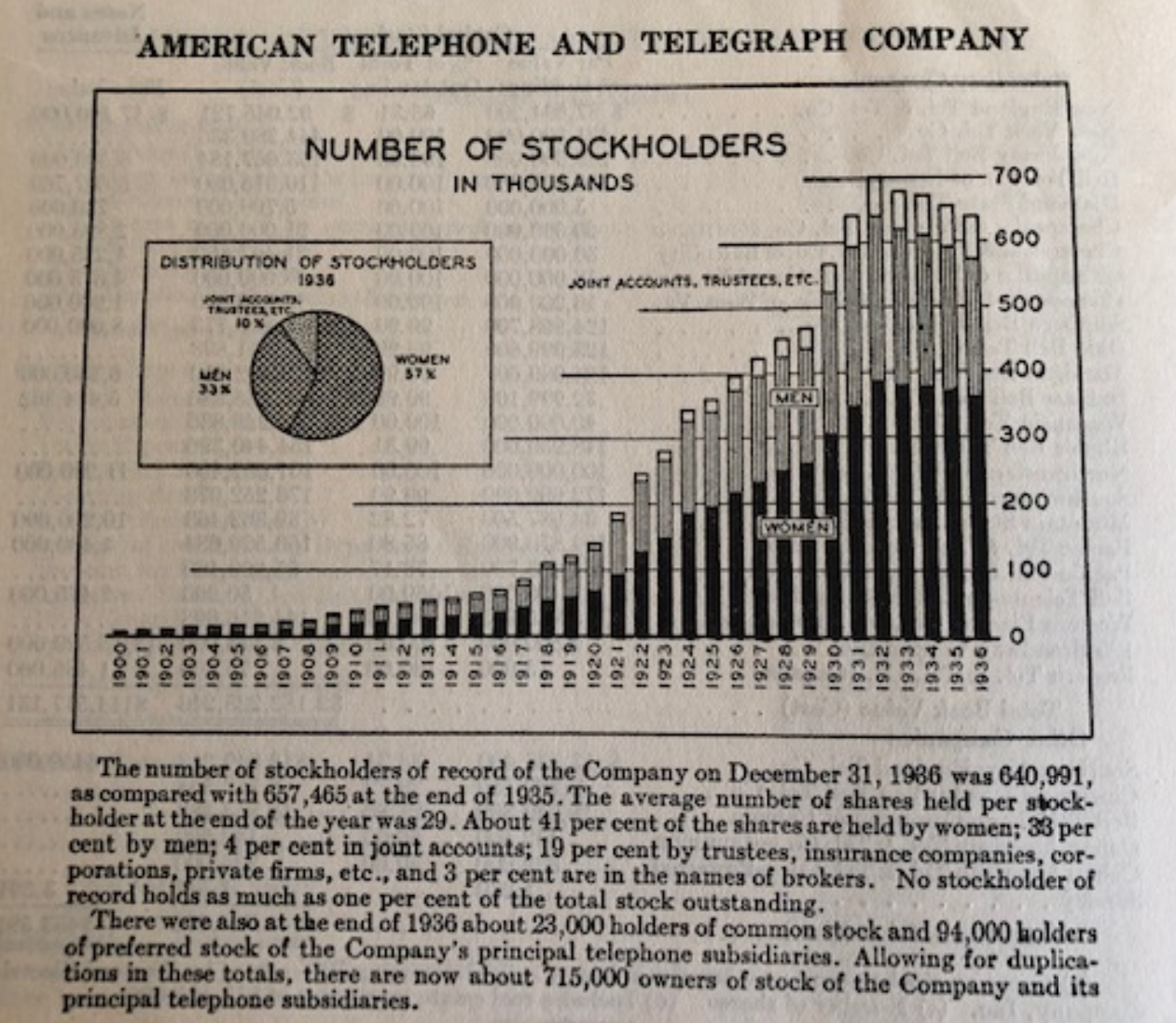

#2: Phone service company AT&T was the Internet of the 1930s, and its 1936 annual report shows the effect of the Great Depression on the adoption of what was then an important and still relatively new disruptive technology:

After 20 years of growth from 1900 to 1929 the number of telephones in America declined by 15% in just 3 years (1930 – 1933) and even when growth resumed there was a lost decade between 1926 and 1936:

And in a fascinating analysis, the 1936 AT&T annual shows the effect of the Great Depression on the de-democratization of American capitalism: about 10% fewer people owned the stock in 1936 than in 1929. Also worth noting: 41% of AT&T stock was owned by female retail investors versus 33% male ownership, with the remainder in joint or institution accounts.

Takeaway: economic depression has many second order effects, such as reversing the progress of important technological advances and reducing the involvement of the public in capital markets.

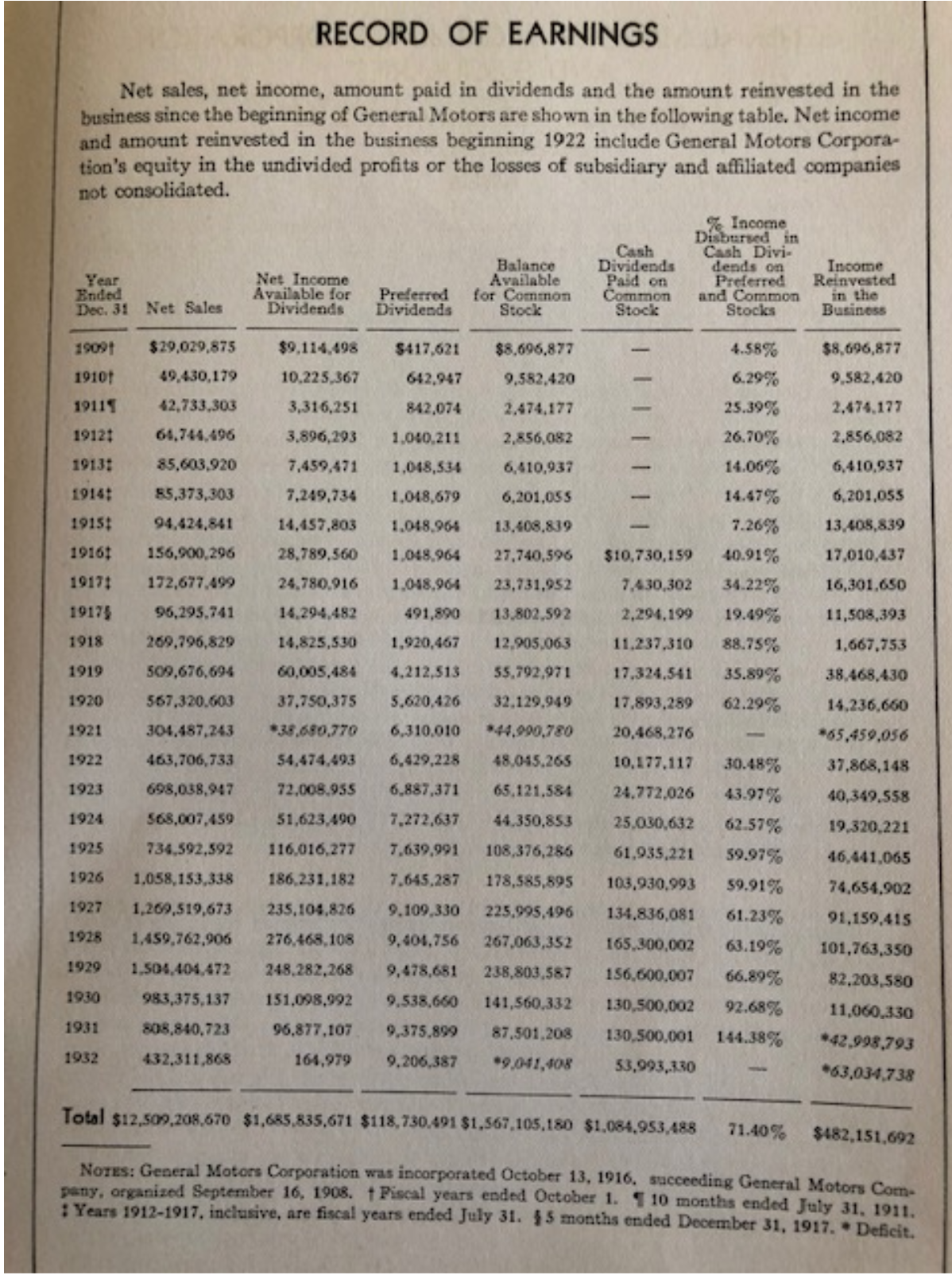

#3: General Motors was essentially the Apple of the 1920/1930s; the preeminent purveyor of a wide range of products that gave people personalized access to a wider world. Ford only went public in the 1950s, so we don’t have their numbers. But here is a table of GM’s financial results from its founding in 1909 to 1932:

Takeaway: what you see here is a combination of points #1 and #2. The Great Depression hit GM’s revenues by 71% from 1929 to 1932, which shows what happens to adoption rates for new technologies that happen to be discretionary consumer purchases. And, like Firestone, GM made money in the depths of the Depression and paid common stock dividends as well. Yes, it cost a lot of jobs to make that possible. But imagine how the US might have fared in World War II if GM and Firestone had failed in 1932…

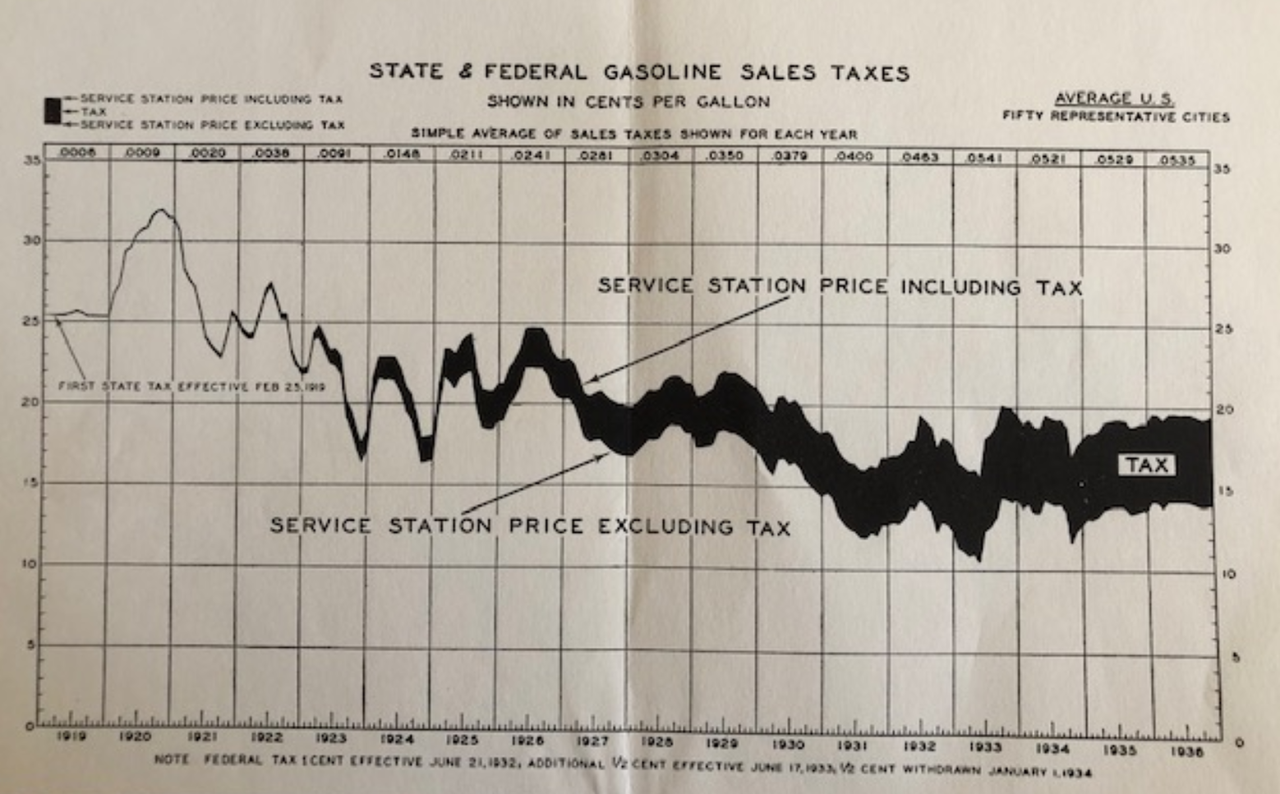

#4: As a final illustration, we turn to the 1936 annual report for The Texas Corporation (a.k.a. Texaco), which included this chart of per-gallon gasoline prices with and without taxes from 1919 to 1936:

Takeaway: in an eerie resemblance to today, pretax oil/gasoline prices per gallon fell by 50% from 1H 1926 ($0.22) to 1H 1933 ($0.11). Part of that was due to reduced demand caused by the Great Depression, especially visible in the chart from 1929 to 1933. But the other piece was the discovery of the East Texas Oil Field in October 1930 using new drilling techniques to reach reservoirs some 3,500 feet below the surface. By 1931 the “Black Giant” field was producing a staggering (even now) 900,000 barrels of oil per day.

Summing up these 4 examples into one framework about the wide-reaching consequences of serious economic contractions:

- The first order effects are easy to understand: companies do whatever it takes to survive and keep cutting employment levels until they can make a profit even in the worst of times.

- But there’s more to the story…

- The Great Depression slowed the adoption of the telephone and automobile, two important productivity enhancing technologies.

- It also reduced the population’s ownership of publicly traded capital.

- And it endangered key industrial assets that would be needed just a decade later to fight a world war.

Bottom line: deep economic contractions carry far larger societal price tags than job losses and business failures.

Tyler Durden

Fri, 04/17/2020 – 08:05

via ZeroHedge News https://ift.tt/3adfjO5 Tyler Durden