The “Best” Economy Ever? Neither Before, Nor After Coronavirus

Submitted by Joe Carson, former chief economist at Alliance Bernstein,

The strong rebound in equity prices since mid-March suggests investors are banking on a fast rebound in the economy once government eases the restrictions on work-life, travel and social and recreational gatherings. Reopening regions or sectors of the economy will undoubtedly produce a statistically powerful rebound; triggering a race among analysts to revise up growth estimates as fast as they raced to reduce them.

But “boomerang” statistics on jobs and GDP does not mean a return to the “best” economy for the simple it was not the best before. Here’s why.

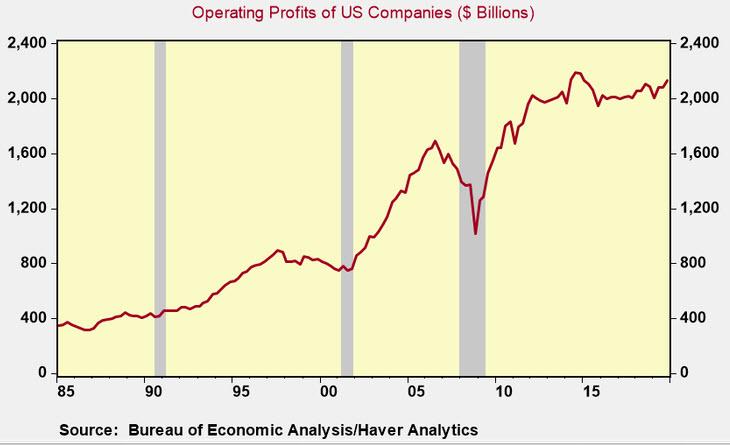

Corporate Profits: In 2019, operating profits for US companies totaled $2.075 trillion, essentially unchanged from the prior year. That flat performance represents the fifth consecutive year of no growth in corporate profits. It would be flat out wrong to characterize the economy’s recent performance as the “best” when corporate profitability has stalled for 5 consecutive years.

Even if the current recession proves to be short in time, it still will be historic in terms of the scale of decline in operating profits.

The peak to trough decline in operating profits during the Great Financial Recession was 40%. But that drop in operating profits occurred against a 3% peak to trough decline in Nominal GDP.

Currently, consensus economic forecasts point to a decline in Nominal GDP two or three times greater than what took place in 2008/09. Accordingly, investors should brace for a 60% to 70% decline in operating profits, and a long road back to pre-recession earning levels.

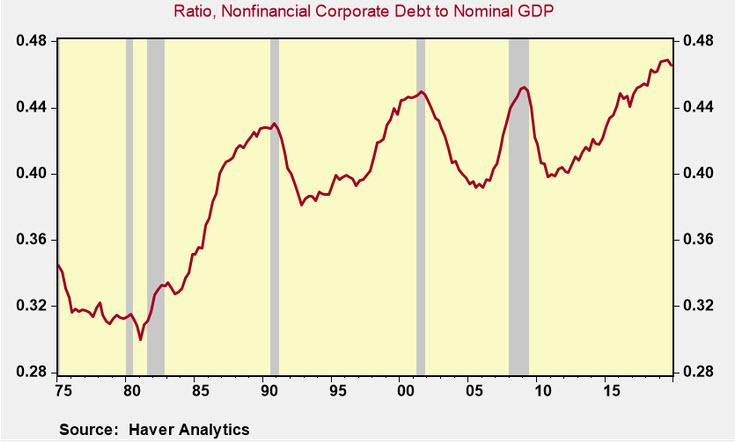

Corporate Debt: At the end of 2019, nonfinancial corporations had outstanding debt and loans of $10.1 trillion, nearly double what these firms on their balance sheet at the start of the last decade. A relatively large part of the debt binge was used for financial engineering (i.e. stock buybacks) instead of engineering for innovation and making things.

In recent weeks, commercial and industrial loans have increased nearly $500 billion as firms drew down credit lines to increase cash and liquidity levels. Also, Congress gave the federal government and the Federal Reserve the authority to initiate a new lending program for small and mid-sized companies. So the level of corporate indebtedness will continue to increase further even as the economy nosedives.

The road from recession to recovery is based on “reliquification, or the process of freeing up of cash flow by refinancing existing debt obligations for lower interest payments, longer terms or by paying down debt.

Extending more debt to companies is the exact opposite of the practices that were employed in the past to help the economy escape recession. Enabling companies to stay afloat by adding to existing debt levels might stop the economic bleeding in the short run, but it does not make the economy stronger or better. The payback will be weak growth as firms struggle with record debt levels.

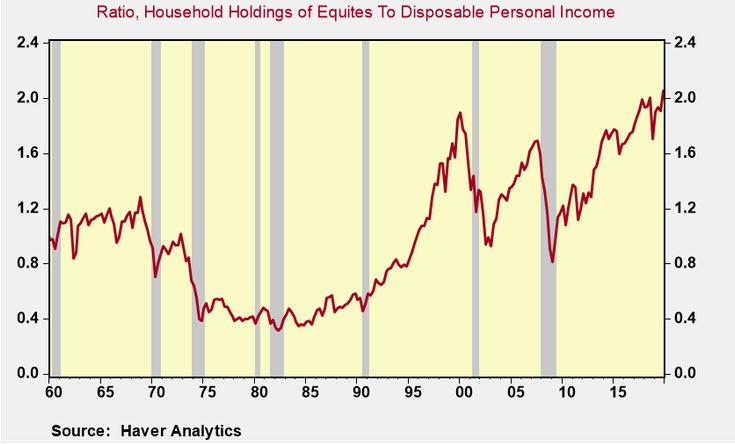

Finance vs. Economy: The last decade saw the greatest divide ever between finance and the economy. At the end of 2019, household holdings of equities stood 2 times the level of disposable personal income, an all-time high. Also, the market value of domestic companies to Nominal GDP stood at a record 1.9 times, exceeding the prior record high of 2000.

The divergence between the stock market and the real economy was fueled by easy money. To be sure, policymakers kept official rates near zero for roughly half of the record 130-month economic expansion.

Also, the cycle high of 2.37% in the federal funds rate represented the lowest nominal peak rate in the post-war period, and only for a short 6-month span in early 2019, did the fed funds exceed the core rate of consumer price inflation.

Never before in any business cycle has official rates remained below the inflation rate for almost the entire growth cycle.

In the end, monetary policy stimulated finance over the economy and in the process created an equity market that was “too big to fail”; and its fall deepens the recession and slows the recovery.

The US economy has the potential to be the “best”. But to be the “best” it needs to clean up corporate balance sheets and follow best policies and best practices.

Best policies means the capital markets fairly and freely price and allocate credit and capital. Best practices means firms focus on innovation and making things.

“Are we there yet?” Unfortunately, from a public policy and business practice perspective the US is moving in the wrong direction.

Tyler Durden

Fri, 04/17/2020 – 19:20

via ZeroHedge News https://ift.tt/3evCuGM Tyler Durden