The Market Is Now Just 5 Stocks: S&P Now More Concentrated In Top 5 Names Then Ever

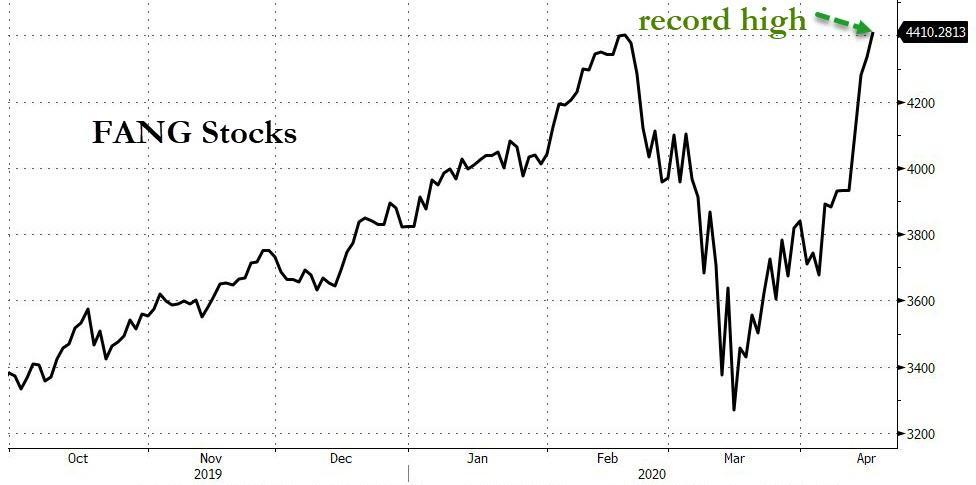

Yesterday, when we showed that the Nasdaq had turned green for the year as FANG stocks hit a new all time high…

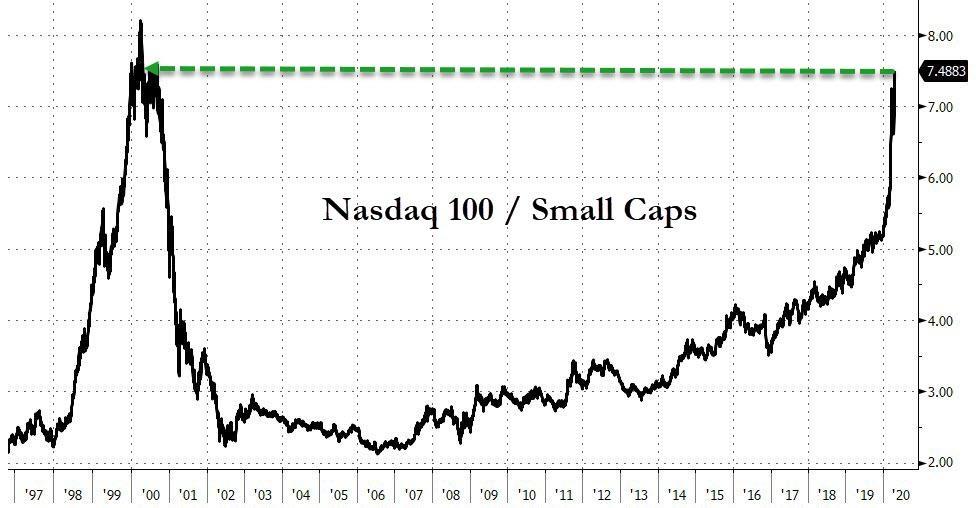

… even as small cap stocks were down 30% in 2020, we showed that the ratio of the tech (and buyback) heavy Nasdaq to the small cap (and cash flow zero) Russell had hit a level not seen since the depths of the dot com bubble..

… prompting even “veteran” retired hedge fund managers (who apparently still need a cashflow commenting on markets) to declare that tech was now in a bubble (newsflah: tech has been in a bubble for years, mostly thanks to the unprecedented amount of stock buybacks undertaken by tech names).

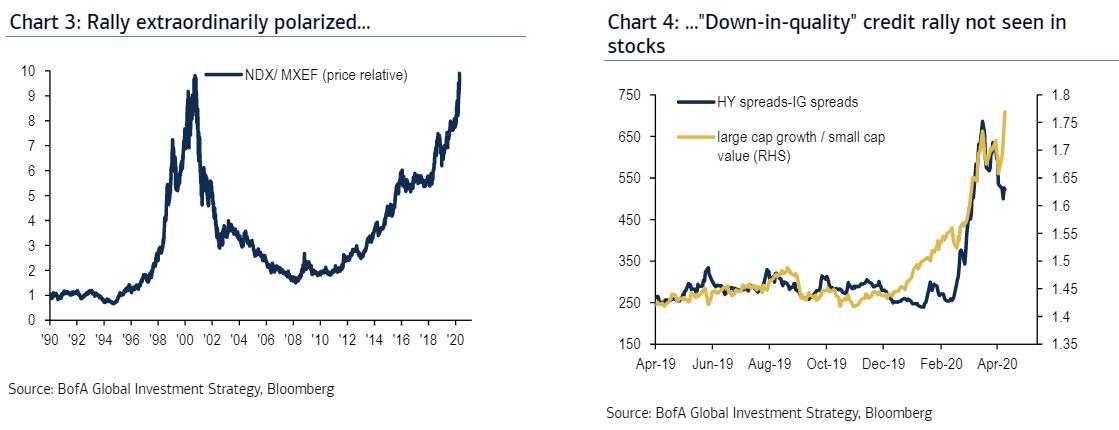

Picking up on this unprecedented dislocation in the market between the success of big names that are just getting bigger, and in the case of Amazon, set to become supreme monopolists, and the decimation of small and medium business, overnight Bank of America’s Michael Hartnett writes “The Kings, Princes & Paupers of Wall St”, noting that the rally is extraordinarily polarized and highlights the retracement from crash lows vs. Jan 1st level as follows:

- IG bonds 109% (thanks to the Fed now buying IG bonds and ETFs),

- tech stocks 95% (as tech buybacks are still active) compares with EM stocks 32% (Chart 3)

- small cap 27%

- global financials 22%

- oil 0%

- “down-in-quality” credit market theme (HY yield compresses toward IG) not replicated in stocks (large cap growth crushing small cap value – (Chart 4);

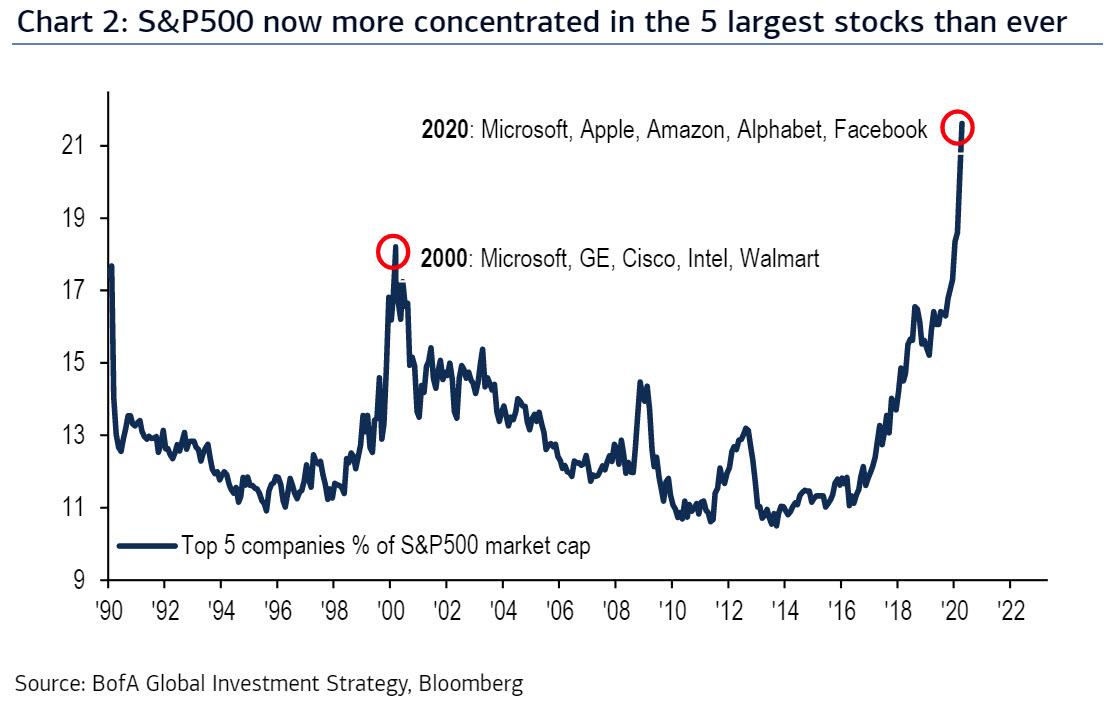

And the punchline: the S&P is now just a handful of mega stocks, because as the chart below shows the largest 5 stocks in S&P500 now account for 22% of market cap, even higher than during the dot com bubble.

Hartnett’s summary:

“Wall St split into Kings (EPS up), Princes (EPS down but can pay dividend), Paupers (EPS, dividend down).”

We would make one small change: instead of Kings, we’d use emperors, and with ad spending – which is behind the bulk of megatech revenues – crashing, the entire world will soon realize just how naked these emperors were.

Tyler Durden

Fri, 04/17/2020 – 09:45

via ZeroHedge News https://ift.tt/2z2079o Tyler Durden