“The Fed Is All The Buyers Have”: The Banks Agree Stocks Have Never Been More Expensive

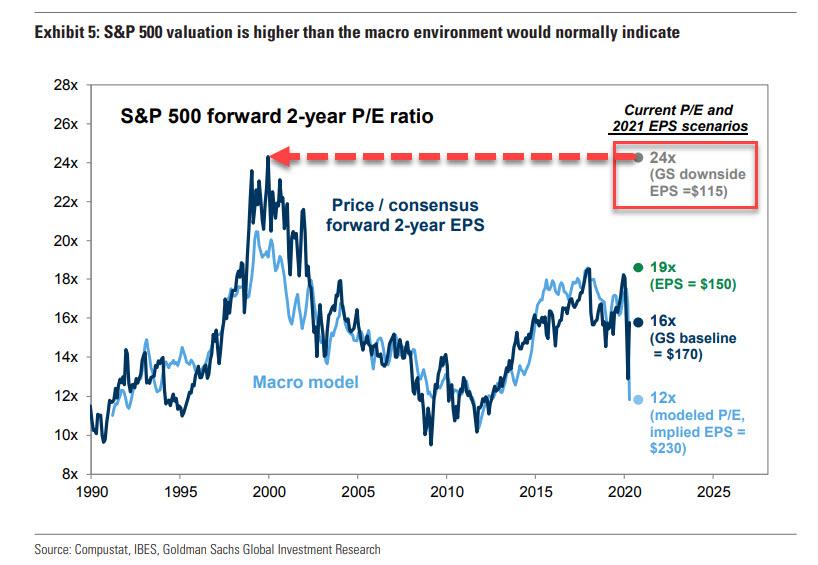

Late last week, we showed a chart from Credit Suisse which we described simply as “insanity” because it demonstrated that as the US careened into a depression, with GDP crashing and the unemployment rate soaring, between the latest Fed-driven surge in stocks and the collapse in earnings estimates, the PE multiple on the broader market had eclipsed the previous record of 19.0x set during the market’s February all time high, and had now hit a new all-time high of 19.4x. In other words, the market has never been more overvalued than it is right now.

The chart eventually made its way to Jeff Gundlach who yesterday tweeted that “U.S. GDP looks to be down 15%ish, unannualized, from its peak. SPX is presently down a similar amount from its peak. Ergo (and I over simplify to make a valid point) stocks now are back to the Feb 19th highs from a valuation perspective. “In Fed We Trust” is all the buyers have.”

U.S. GDP looks to be down 15%ish, unannualized, from its peak. SPX is presently down a similar amount from its peak. Ergo (and I over simplify to make a valid point) stocks now are back to the Feb 19th highs from a valuation perspective. “In Fed We Trust” is all the buyers have.

— Jeffrey Gundlach (@TruthGundlach) April 17, 2020

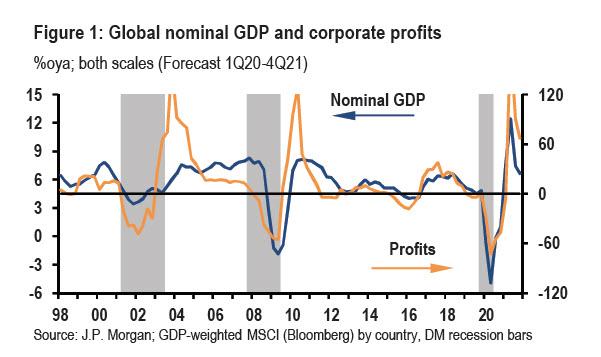

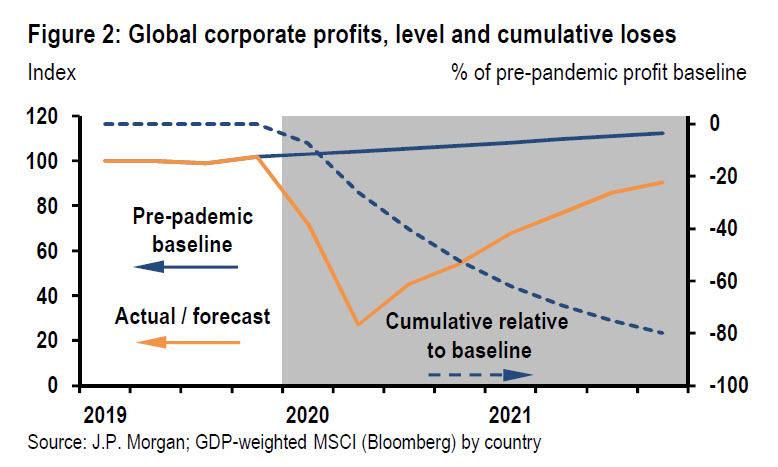

Gundlach’s math is not quite correct because as JPMorgan showed last week, the beta of corporate profits to moves in GDP is about 7x during financial crises. As a result, according to the bank’s chief economist Joseph Lipton, in the current recession in which JPM expects global GDP growth to collapse by the same 9.8%-points in Q2, the bank is applying the same profit drop beta of seven—on par with the global financial crisis– which implies a plunge in corporate profits of roughly 70% in the year through 2Q20.

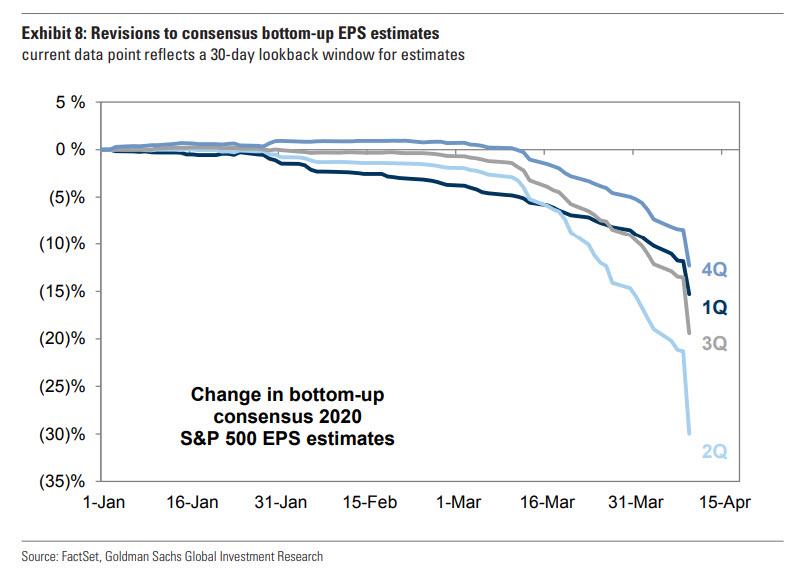

Meanwhile, with every passing day the fundamental disconnect is getting worse, because as stock prices soar (mostly due to momentum-chasing machine buying while humans sell) earnings estimates are cashing…

… with Goldman calculating that its latest bear case PE multiple (on 2021 earnings no less as nobody is looking at 2020 anymore) is now a dot com bubble-eseque 24x.

Meanwhile, crashing the bulls’ party, or rather their expectations for a V-shaped recovery, JPMorgan also cautioned that corporate profits won’t recover their pre-pandemic baseline until some time in 2022 if not 2023, which is terrible news for Wall Street strategists as it means they will now have to apply even more ridiculous forward multiples from 2023 for their optimistic recos to make any sense.

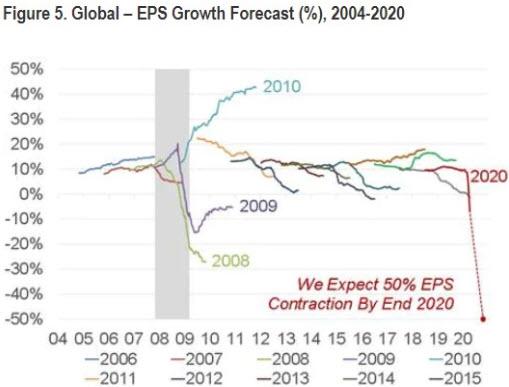

And so as Credit Suisse, JPMorgan and Goldman all point out the schizophrenia in being bullish in a time when corporate profits are set for the biggest – and longest – drop since the Great Depression, late last week two more banks joined the bandwagon with Citi warning that “equities fall the same as EPS in a recession… and reflect that equity markets are currently not reflecting the expected decline of 50% in global EPS in 2020.” Make that 70% according to JPMorgan.

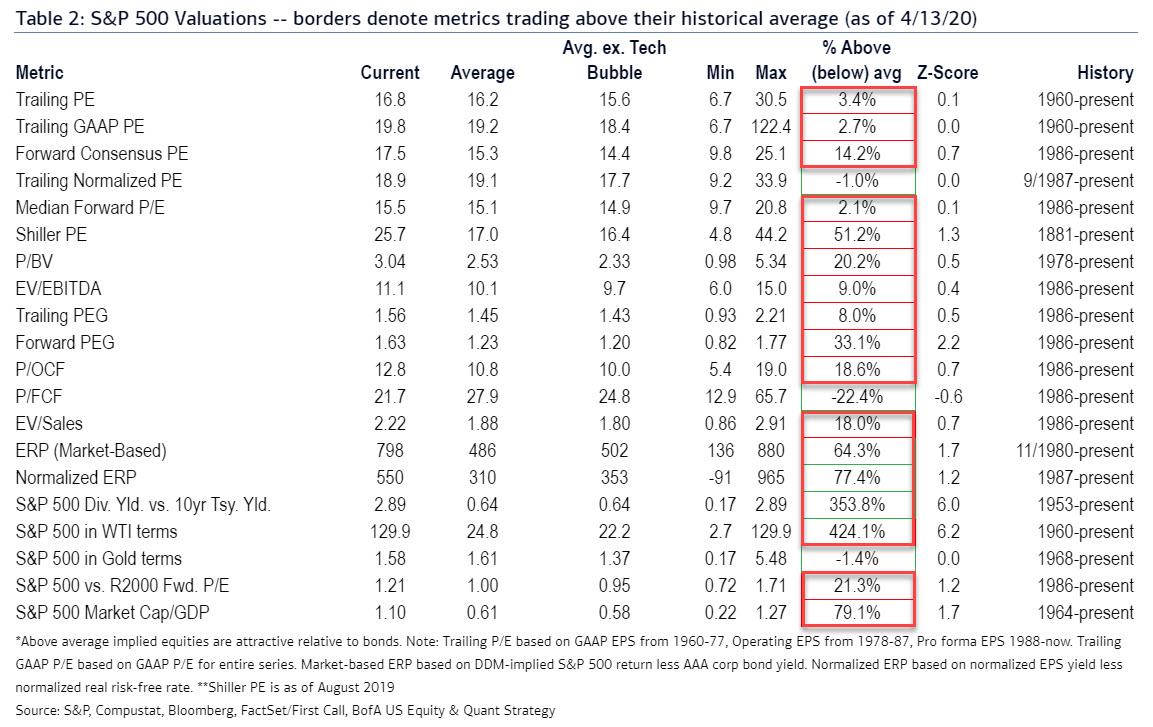

Finally, exactly two weeks after our post on the “shocking” topic of how expensive the market is right now, Bank of America’s Savita Subramanian has also done the math and concludes that as “stocks have rallied, bottom-up consensus estimates for 2020 have fallen”, which in turn has pushed the S&P 500’s forward P/E ratio from March’s low of 13.0x to 19.5x, higher than mid-Feb’s peak P/E of 18.9x.

In other words, using the bank’s reference table of 20 different valuation metrics, “we’re back to elevated multiples on most of the 20 metrics we track” with just three exceptions: lower than average Price to Free Cash Flow, cheaper relative to bonds (equity risk premia frameworks) and – drumroll – relative to gold.

The last one is especially amusing because it means that slowly but surely investors are finally realizing that the biggest winner after the current reflationary surge will not be equities but what the WSJ once dubbed “a pet rock.”

Of course, even in this unprecedented dislocation of a “market”, equity investors still have hope, which is literally is all they have: or as Gundlach puts it, “In Fed We Trust” is all the buyers have” and Citi agrees: “Central bank intervention could cap the downside.”

Better pray to those central banking gods, bulls.

Tyler Durden

Sat, 04/18/2020 – 13:30

via ZeroHedge News https://ift.tt/2ROLr40 Tyler Durden