Here’s The Next Problem: Where Do 100 Million Oil Barrels Get Delivered… And What Happens Next Month?

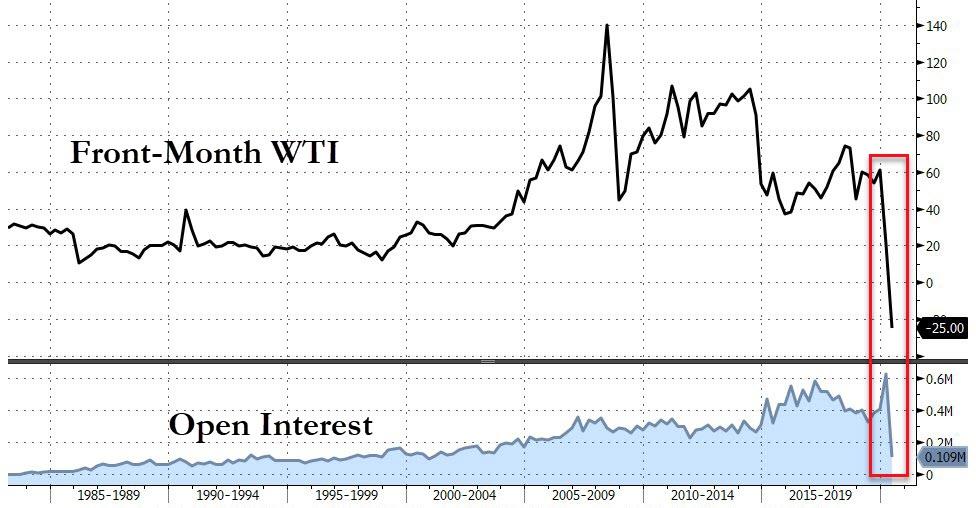

The entire financial world is watching in stunned amazement as the May WTI contract crashed as low as -$40, an unprecedented – until today – event, and one which is sparking frenzied speculation who will be oil’s “Amaranth”, the nat-gas trader which remains the best example of how futures-spread positions can go wrong.

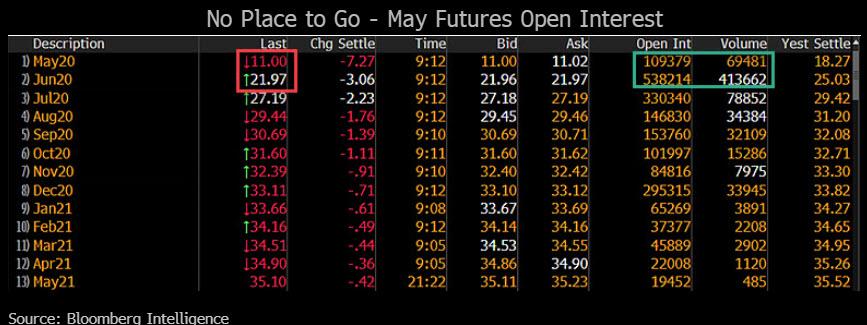

But sooner or later, investors will ask themselves the next question: where will roughly 100 million barrels of oil be delivered. That is roughly the equivalent of the outstanding May WTI open interest of some 109 thousand contracts.

As Bloomberg’s Mike McGlone writes, “the greater-than-normal level of open interest in May futures has no place to go but is likely to mark an extreme, if history is a guide.”

As of April 17, there were over 100,000 open positions in the May contract, well above the five-year average of about 60,000. What is more striking is that while the May position stops trading at 230pm tomorrow, April 21, only about 2,000 contracts are usually delivered. This time we are looking at 100,000 contracts, or about 100 million barrels of oil. The question, of course, is where does all this oil get delivered in a world where commercial storage is expected to run out as soon as next month?

And let’s say the May contract somehow finds enough space – this brings up the June contract, which is trading at around $21.51 because somehow traders believe that some magical solution will present itself in the next 4 weeks (spoiler alert: it won’t). The open interest for June is 538K contract, or the equivalent of over half a billion barrels of. While much of this will be rolled up the contago-ing curve, this still means that the world is looking at hundreds of thousands of oil barrels to be delivered next month, and the question again: where will all this oil be delivered, and what happens to the price of WTI next month?

And what about July… and August… And September? As prominent squawker Yogi Chan put it best, “Back of the fag box: Take all WTI contracts from May 2020 through to Dec 2021 (covers 93% of all OI). Average price weighted by open interest? $43.48/bbl” (editor’s note: in the UK “fag” means cigarette)

Back of the fag box: Take all WTI contracts from May 2020 through to Dec 2021 (covers 93% of all OI). Average price weighted by open interest? $43.48/bbl #oott

— Yogi Chan (@Yogi_Chan) April 20, 2020

The unfortunate answer: oil producers will have to eat the billions of dollars in foregone production even as they shut down and keep oil in the ground, suffering unprecedented losses by “selling” oil at negative prices.

To be sure, some had creative solutions, such as airplane guru and Editor in chief of the Air Current, Jon Ostrower:

I mean it’s no better or worse than handing every adult $1,200 one time.

— Jon Ostrower (@jonostrower) April 20, 2020

Which brings us to the tragic, if accurate, conclusion from the FT’s energy director: “this is a colossal economic tragedy in the making right now.”

This crash is going to destroy so many livelihoods and so many jobs. Whatever anyone thinks about the oil sector — and there many obvious reasons why the world needs to reduce oil use — this is a colossal economic tragedy in the making right now. #oott

— Derek Brower (@derek_brower) April 20, 2020

And to think all of this could have been avoided if only the Fed had some way of printing oil storage in the US.

/sarc

Tyler Durden

Mon, 04/20/2020 – 15:08

via ZeroHedge News https://ift.tt/2VNtaVW Tyler Durden