Repo Guru Zoltan Pozsar Spots The Next Crisis

Having been the first to correctly predict the Fed’s “nuclear bomb” response to the coronavirus pandemic as early as March 3 when in his 27th Global Money Notes “Covid-19 and Global Dollar Funding” he warned about the unprecedented dollar short squeeze that was set to rock global financial markets, Credit Suisse and former NY Fed repo guru Zoltan Pozsar has been one step ahead of the Fed – and virtually everyone else – when it comes to how the Fed’s monetary plumbing and liquidity operations are interwoven during times of crisis, and how to best unclog them when an black swan bat event like the global economic shutdown hits.

Which is why the Fed must have breathed a big sigh of relief when in his latest note “U.S. Dollar Libor and War Finance“, Pozsar gave the Fed’s unlimited liquidity injection over the past 4 weeks the thumbs up, saying that the “The Fed’s liquidity injections are working” pointing out that “Global dollar funding conditions have eased, and U.S. dollar Libor-OIS spreads started to tighten.”

Specifically, Pozsar lays out four reasons why he is confident that the market’s funding crisis is now over (which includes an interesting if tangential discussion on whether the Fed is sending a “Machiavellian” or “Bagehotian” message on benchmark rate reform – i.e., Libor vs SOFR – which readers can parse on their own in the attached note) and concludes that…

The machinery of war finance is in full swing and liquidity injections over the past month have stabilized funding markets and are compressing Libor-OIS spreads from the top down.

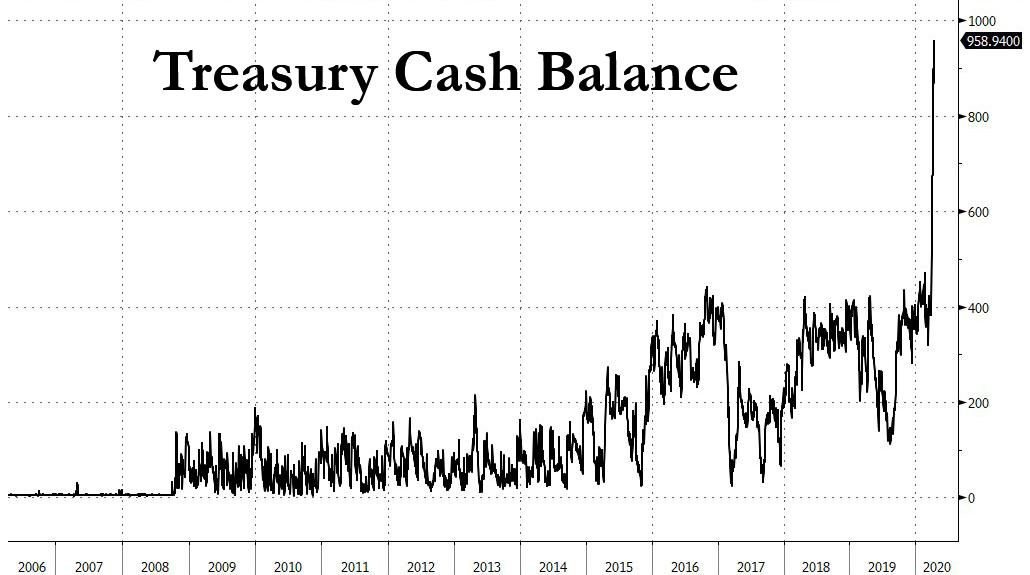

Yet despite the nuclear bomb of liquidity which appears to have fixed most of the funding conditions that snapped in the second half of March, there is one thing that Pozsar believes can still spoil the party, the same thing we discussed last week when we pointed out that in order to boost the cash balance at the Treasury to a record $960BN…

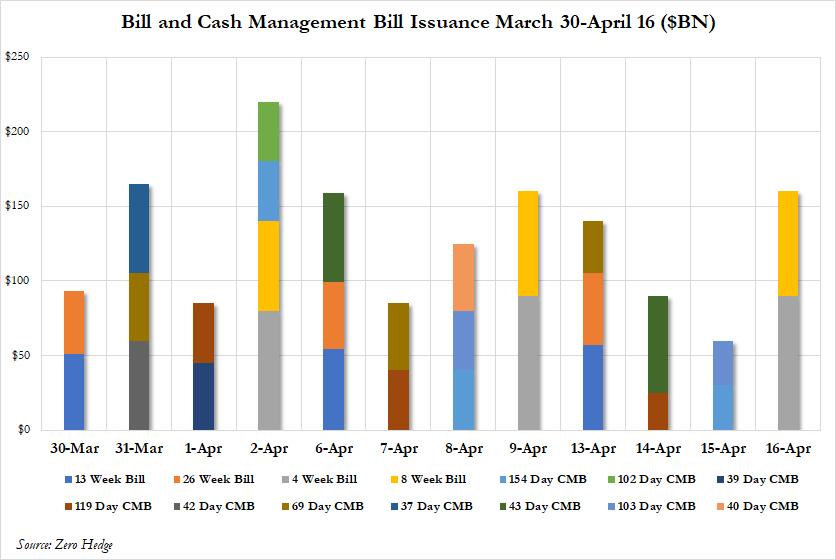

… the Treasury had unleashed an unprecedented flood of T-Bill issuance, which in the past 12 trading days has amounted to a record $1.5 trillion in gross new debt sold between T-Bills and Cash Management Bills, as shown below.

It is the chart above – the unprecedented burst in Bill supply – that Pozsar is keeping his eyes on and warning that while things may be getting better, and the Fed’s “machinery of war finance is easing unsecured funding pressures from the top down” the risk is that “bill supply can complicate this picture from the bottom up.”

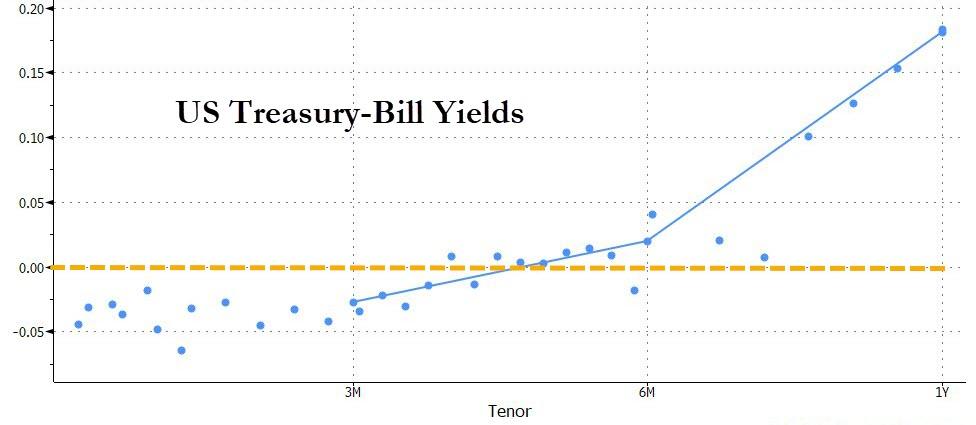

Specifically, the sudden avalanche of Bill supply – and to think less than a month ago there was such a shortage of Bills, we were seeing negative yields through three months…

… which the Treasury is using to prefund the multi-trillion fiscal stimulus (and will have to be rolled every few weeks), Bill supply last week pushed Treasury bill yields from below OIS to 20 bps above OIS. To Pozsar this spike is ominous and suggests that the market may be nearing a tipping point on the front-end. The only solution: the Fed has to launch yield curve control to contain OIS as further supply without yield curve control – and there will be a lot of future supply – could push bill yields higher, “which would risk undoing the improvement that the Fed’s liquidity and regulatory measures helped engineer”, the repo guru warns.

The immediate – and potentially dangerous – consequence of sharply higher yields is that it would offset much of the Fed’s actions and serve as a liquidity drain: according to Pozsar, “higher bill yields could pull funds away from the FX swap market as foreign central banks put their dollars into bills, not FX swaps, and as bill-OIS spreads grind more positive, they will push FX swap implied yields higher, OIS-OIS cross-currency bases more negative and that will limit how much more U.S. dollar Libor-OIS spreads can tighten from here.”

This is how the Credit Suisse strategist dissects this potential landmine:

For all the talk about the war on an invisible enemy and war finance, we haven’t heard from the Debt Management Office of the Treasury and the Fed about the need for the monetary financing of the CARES Act and further stimulus measures. The exemption of Treasuries from the leverage ratio frees up demand for supply (“limitless inventories”), but the near-term supply of bills is too much and can push bills yields higher from here, risking a reversal to the improved funding conditions the Fed worked so hard to achieve.

So what should the Fed do? Simple: since Powell has already nationalized virtually all of the long-end with unlimited QE (and one can argue has taken over the corporate bond market by purchasing IG and HY bonds), the Fed will have to go all the way, and take over the entire yield curve, fixing the front-end by pegging three month T-Bill yields at OIS rates, to wit:

The Fed has done a lot and yield curve control where they peg three month Treasury bill yields at OIS rates and is the only thing the Fed has not done yet, but soon will have to. The target range for overnight rates and the OIS curve – the bottom layer of the money market cake – are the Fed’s monetary sanctum. Everything the Fed does is priced based on variables within that sanctum: the top of the band, IOR, IOR plus a spread and OIS plus a spread.

Incidentally it is not just repo “god” Pozsar who believes the next step for the Fed is yield curve control is Deutsche Bank’s rates strategist Stephen Zeng, although where Zeng disagrees with Pozsar is that latest move by the Fed which is now just a matter of time, will keep the system in a state of artificial balance since the Fed has to be far more worried about the long-end:

As volatility and market liquidity continue to normalize, the Fed’s market functioning-oriented purchases should slow further. On the other hand, uncertainty around the extent of economic damage the virus has caused and rapidly-increasing Treasury issuance to fund the fiscal stimulus suggest the Fed will be cautious in unwinding the pace of purchases… This reduction should coincide with a very gradual and staggered reopening of the US economy in the coming months.

Beyond June, we think the objective of these purchases will pivot towards more traditional goals of supporting a more rapid rebound and ensuring that the scarring effects of this crisis are as limited as possible. With inflation stuck below target and likely to move lower, inflation expectations anchored at uncomfortably low levels, and unemployment rising sharply, the Fed has every reason to ensure that financial conditions remain exceptionally accommodative. In this context, we foresee the Fed adopting front-end yield curve control (YCC) in late Q2 or Q3 that sets caps on Treasury yields out to about three years.

But…

While YCC may be a necessary policy response, it is not sufficient since it focuses on the front-end. In the US, medium- and long-term rates are more relevant for impacting financial conditions important to business and consumer economic decisions. If implemented, front-end YCC should be paired with more traditional QE that purchases securities across the curve and keeps long-end rates contained as well.

In short, the only thing that experts agree will avoid another crisis in the bond – and funding – markets is if the Fed effectively takes over the entire yield curve, ending capital markets as we know them, and launching “price discovery” by decree. While we have no doubt that the Fed will go the length, we can’t help but remember that such terminal central planning did not have a happy ending for the USSR.

Tyler Durden

Sun, 04/19/2020 – 22:53

via ZeroHedge News https://ift.tt/2RS11vJ Tyler Durden