Futures, Oil Plunge As Crude Contagion Spreads To All Markets

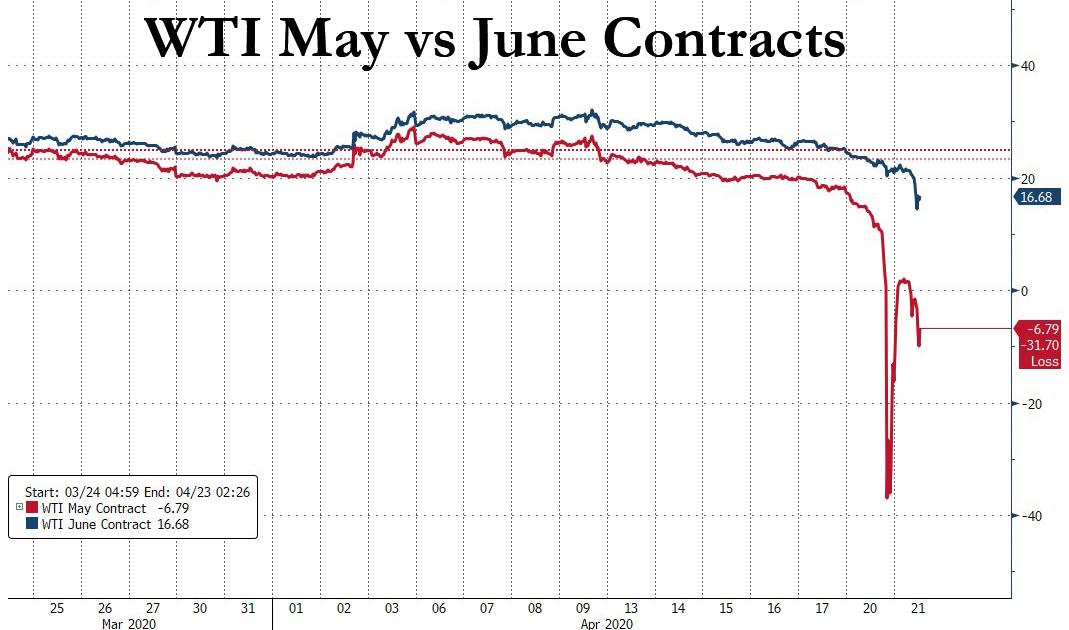

The experts said ignore the May WTI meltdown – it is irrelevant and is only confined to the deliverable contract. The experts were wrong.

Not only was the Monday May WTI meltdown not contained, with the contract still trading negative after closing down nearly $40 on Monday in their first ever sub-zero dive as traders realized Cushing was on the out of storage space, but overnight it spread to the more-active June contract which crashed almost 50% plunging to the low teens, before stabilizing down 23.5%, to $15.64 a barrel. June trading volumes were roughly 80 times those of the expiring May contract.

…. with Brent also dragged in, dropping as low as $18/barrel and last trading down $5.25, or 21% at $20.32 per barrel…

… as the world’s oil benchmark dropped below $20. And as the oil meltdown accelerated, it inflicted huge losses sweeping through markets as the world runs out of places to store unwanted crude and grapples with negative pricing.

The plunge in oil is taking place even as President Trump said late on Monday that he is looking at putting as much as 75mln bbls into SPR which would top it out and that the oil price drop is short-term in which a lot of people got caught out and was largely a financial squeeze. Furthermore, Trump suggested oil producers need to do more by the market in terms of output cuts and that the administration will either ask permission from Congress to buy oil or we will store it, while he also responded we will look at it when questioned about stopping shipments of oil from Saudi Arabia.

If the oil crash wasn’t enough, overnight we also got unconfirmed reports that North Korea’s Kim Jong Un was in critical condition (and may have contracted the coronavirus) after a surgery, which slammed Korean assets, and sent the dollar sharply higher, while hitting global stocks and S&P futures, even as traders continued to follow the impact of the ongoing coronavirus epidemic and plunging corporate earnings.

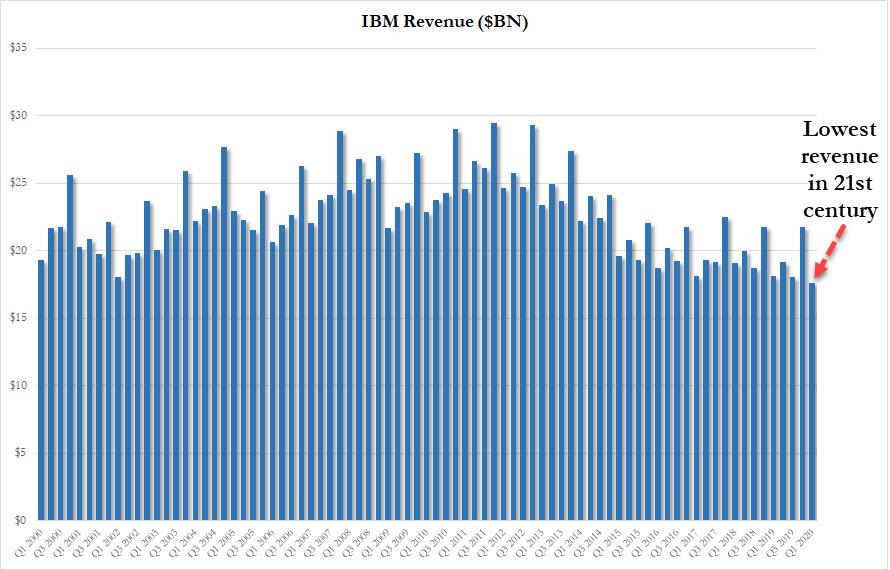

Exxon Mobil dropped 3.7% in premarket trading and Chevron slipped 4.0% as the front month May WTI contracts continued to trade below $0 on Tuesday. Other oil-related companies including Apache, Halliburton, ConocoPhillips, Schlumberger and Occidental Petroleum all tumbled between 6.3% and 11%. Coca-Cola Co provided the latest evidence of the damage wrought by the pandemic, saying its current-quarter results would take a severe hit from low demand for sodas. IBM was also sharply lower after the company reported its lowest revenue in the 21st century and withdrew guidance.

As Bloomberg writes, mystery surrounded Kim Jong Un’s health after U.S. and South Korean officials gave differing accounts of the North Korean leader’s condition. The risk of instability in the region adds to a host of market headaches, including the gut-wrenching oil slump and concerns about the outlook for the global economy.

“The uncertainty about who succeeds him in North Korea is the great unknown,” said Jeffrey Halley, senior market analyst at Oanda Asia Pacific, conjecturing about a potential worst-case scenario for Kim. “That’s what is making markets nervous.”

Meanwhile, President Donald Trump said he’ll sign an executive order temporarily suspending immigration into America as the country tries to contain the spread of the coronavirus. The news came even amid more signs that the outbreak is slowing in hard-hit areas.

In Europe, all markets and industry sectors were in the red as the Stoxx Europe 600 index declined as much as 2.1%, dropping for the first time in 4 days, with energy companies dragging on the gauge despite a sharp rebound in Germany’s ZEW index, which soared from -49.5 to +28.2, smashing expectations. In retrospect, this jump may prove to be premature.

Asian stocks also fell, led by energy and IT; all Asian markets in the region were down, with India’s S&P BSE Sensex Index dropping 3.6% and Taiwan’s Taiex Index falling 2.8%. The Topix declined 1.2%, with IBJ and Asteria falling the most. The Shanghai Composite Index retreated 0.9%, with Shangying Global and Beijing Vantone Real Estate posting the biggest slides.

In FX, the Bloomberg Dollar Spot Index advanced a second day as the dollar climbed against most major currencies, with the won and ruble tumbling and the yen edging up. amid losses in Japanese stocks while EUR/USD traded within recent ranges. The slump in Brent dragged down the Norwegian krone, as the sterling reached a near two-week low, weighed down by renewed Brexit concerns and wider unease on global markets after the rout in the U.S. oil. The kiwi fell versus all its Group- of-10 peers and NZD/USD slid as much as 1% after Reserve Bank of New Zealand Governor Adrian Orr said the central bank was open- minded on direct monetization of government debt.

In rates, the Bund and Treasury curves steepened somewhat while yields plunged, the 10Y yield sliding to the lowest since April 3, while the 5Y TSY yield plunged to an all time low.

Investors will be looking to corporate earnings for more insight on the impact of the coronavirus pandemic, with almost one-fifth of S&P 500 companies reporting this week. Looking at the day ahead, we get March existing homes sales is expected. Coca-Cola, Lockheed Martin, Philip Morris, Chipotle, and Netflix are among companies reporting earnings

Market Snapshot

- S&P 500 futures down 0.6% to 2,790.75

- STOXX Europe 600 down 1.7% to 330.00

- MXAP down 1.8% to 141.46

- MXAPJ down 2.3% to 455.77

- Nikkei down 2% to 19,280.78

- Topix down 1.2% to 1,415.89

- Hang Seng Index down 2.2% to 23,793.55

- Shanghai Composite down 0.9% to 2,827.01

- Sensex down 3.7% to 30,468.34

- Australia S&P/ASX 200 down 2.5% to 5,221.30

- Kospi down 1% to 1,879.38

- Brent futures down 21% to $20.29/bbl

- Gold spot down 0.4% to $1,688.44

- U.S. Dollar Index up 0.2% to 100.20

- German 10Y yield fell 0.9 bps to -0.457%

- Euro down 0.3% to $1.0833

- Italian 10Y yield rose 14.4 bps to 1.763%

- Spanish 10Y yield fell 1.2 bps to 0.879%

Top Overnight News from Bloomberg

- The world’s biggest independent oil storage company said that space for traders to store crude and refined fuels has all but run out as a result of the fast-expanding glut that’s been caused by Covid-19

- President Donald Trump said he’ll sign an executive order temporarily suspending immigration as the country tries to contain the spread of the coronavirus; Italy will present a plan this week to ease its rigid lockdown, joining Germany, France and Austria in pursuing a gradual return to normality as coronavirus infection rates fall and pressure mounts to reopen businesses

- Central-bank balance sheets are expanding to record levels amid their latest buying spree, raising questions about how big they can get and whether those assets can ever be sold back to markets

- More signs emerged that the coronavirus outbreak is slowing in hard-hit areas, with the U.S., Italy and U.K. showing smaller gains in new cases. China reported its sixth straight day without a fatality. Hong Kong extended social distancing measures, even as infections have dropped off

- Southern U.S. states moved to open their economies, though the nation’s top infectious disease expert warned that relaxing restrictions too soon could cause even more harm

- The U.S. is seeking details about Kim Jong Un’s health after receiving information that the North Korean leader was in critical condition after undergoing cardiovascular surgery last week, a U.S. official said. CNN had earlier reported, citing a U.S. official with direct knowledge of the matter, that Kim may be in “grave danger” after the surgery

- The Reserve Bank of Australia said it’s likely smaller and less frequent purchases of government bonds would be required if economic and market conditions continued to improve, according to minutes of its April 7 meeting

- South Korea’s exports plunged this month so far, underscoring the hit to global trade caused by lockdowns to combat the global coronavirus pandemic. Exports slid 27% during the first 20 days of April from a year earlier, the Korea Customs Service said in a statement Tuesday. Shipments to the country’s biggest trading partner, China, dropped 17%. Semiconductor sales fell 15%

- President Donald Trump said he wants to add as much as 75 million barrels of oil to the nation’s Strategic Petroleum Reserve, taking advantage of record low prices for crude, and that he’ll consider blocking imports of crude from Saudi Arabia

- President Donald Trump said he’ll sign an executive order temporarily suspending immigration into the United States as the country tries to contain the spread of the coronavirus

Asian equity markets were negative across the board following the weak handover from Wall St where sentiment was subdued. Oil markets drew a lot of attention after WTI crude futures plunged and the May contract turned negative for the first time in history, briefly resulting to losses of over 300% and lows of around USD -40/bbl. This was due to the ongoing supply glut and filling storage culminating to a lack of buying interest on a contract which is due for settlement today. Note, the more widely-traded June contract remained above USD 20/bbl throughout the chaos and the May contract gradually returned to positive territory. ASX 200 (-2.5%) weakened with focus on corporate updates including mixed quarterly production numbers from BHP which subsequently weighed on the mining giant and with Virgin Australia going into voluntary administration in an effort to recapitalize amid the government’s refusal for a bailout. Nikkei 225 (-2.0%) was pressured by the flows into the currency and the KOSPI (-1.0%) was initially among the worst hit amid uncertainty regarding the geopolitical climate for the Korean peninsula after reports that North Korea leader Kim was in grave danger following cardiovascular surgery which boosted defence stocks, although South Korea have denied the reports of Kim’s condition. Elsewhere, Hang Seng (-2.1%) and Shanghai Comp. (-0.9%) also traded lower with underperformance in Hong Kong after social distancing restrictions were extended for 14 days and after the recent sovereign rating downgrade by Fitch. Finally, 10yr JGBs were choppy with initial gains seen amid the risk averse tone and similar upside in T-notes but with price action only mild as participants also digested mixed results from the 20yr JGB auction which saw a lower b/c and wider tail in price.

Top Asian News

- Genting Plans Unprecedented Pay Cut as Virus Shuts Casinos

- Oil’s Slide Favors India’s Bonds Versus Indonesia, JPMorgan Says

- Debt Monetization Is Creeping Closer by the Day in New Zealand

- Virgin Australia Becomes First Asia Airline to Fail After Virus

Europe has latched onto the downbeat lead from the Asia-Pac session (Euro Stoxx 50 -2.1%), as oil markets continue to crater whilst stock also weighs the COVID-19 impact on large-cap earnings. US equity futures fare slightly better than its counterparts across the pond – with the prospect of another State-side stimulus package potentially providing some support. Broader sectors are lower across the board and point towards risk aversion. Energy underperforms amid the depressing performance in the crude complex, whilst the breakdown has Oil & Gas as the marked laggard, closely following by Basic Resources and Banks. In terms of individual movers, SAP (-2.3%) fell post earnings after cutting its FY total revenue guidance alongside its FCF guidance, adding to the woes for the IT sector after IBM earnings overnight. The company expects a deterioration in Q2 before gradual improvement in Q3 and Q4. PSA (-0.5%) remains subdued by its respective update in which it sees European car sales -25% and China -10% in FY20. Richemont (-3.0%) and Swatch (-2.9%) bear the brunt of Swiss watch sales slumping over 20% YY.

Top European News

- Italy Vows to Reopen as Europe Takes Steps to Ease Virus Curbs

- U.K. Takes Heart on Slowing Death Toll With Parliament Returning

- SAP Ends Co-CEO Role After Virus Brought Leadership Problem

In FX, it remains to be seen whether the Kiwi and Aussie fall prey to the phenomenon of ‘turnaround Tuesday’, but for now the tide has certainly changed markedly as RBNZ Governor Orr reiterated dovish guidance overnight and the option of more stimulus at the May policy meeting, while his RBA counterpart delivered a daunting economic outlook to compound a sharp decline in wages and the stats bureau publishing figures for March 14-April 4 revealing a 6% drop in employment. In response, Nzd/Usd is back below 0.6000 and Aud/Usd is under 0.6300 again, while the Aud/Nzd cross pivots 1.0500. For the record, RBA minutes did not really impact even though scaling back QE was mentioned if conditions improve. Elsewhere, Loonie losses are accumulating almost in lock-step with oil prices, as WTI and Brent lose grip of Usd12 and Usd19/brl handles respectively in the June contracts after Monday’s May capitulation, with Usd/Cad up through 1.4200 and eyeing 1.4250 ahead of Canadian retail sales data.

- USD/JPY – The Yen is marginally eclipsing the Dollar as safe-haven currency of choice amidst renewed risk-off positioning and the ongoing rout in crude markets, as Usd/Jpy edges towards 107.00 and the DXY tests resistance above 100.00 around 100.300 again that has been rejected a couple of times in recent sessions.

- NOK/GBP/SEK/CHF/EUR – No shock that the Norwegian Krona, Russian Rouble and Mexican Peso are all underperforming alongside oil, but broader risk asset contagion is also weighing heavily on the likes of the Swedish Crown, British Pound and even Swiss Franc. Indeed, better than expected jobs data and a wider trade surplus have been largely ignored, while the Euro has only derived partial encouragement from the latest German ZEW survey showing some signs of improvement in sentiment to counter the steep deterioration in current conditions. Eur/Nok has been up above 11.5900, Usd/Rub as high as 77.2400+, Usd/Mxn over 24.3000, while Eur/Sek straddles 10.9000, Cable gives up another big figure at 1.2400 and breaches the 21 DMA (1.2357), Usd/Chf rebounds from sub-0.9700 to circa 0.9715 and Eur/Usd rotates either side of 1.0850.

- EM – Contrasting fortunes for the Zar and Hkd as the Rand weakens on more SA financial strain given a missed loan payment by the Land and Agricultural Development Bank, while the HKMA has sold Hong Dollars to maintain the peg for the first time in over 4 years despite yesterday’s ratings downgrade by Fitch.

In commodites, WTI and Brent June contracts are posting unprecedented losses. Attention remains on the oil market since yesterday WTI May crude futures plunged to negative territory for the first time in history, briefly resulting to losses of over 300% and lows of around USD -40/bbl. This was sparked by the ongoing supply glut and filling storage culminating to a lack of buying interest on the contract which is due for expiry later today. The volatile price action followed through to today’s trade with WTI June contracts -42% at one point, and Brent down over 25% – with the former dipping below USD 12/bbl, to trigger a 2-minute circuit breaker and the latter residing sub-20/bbl. Russia’s Kremlin emerged amid the volatile action and downplayed the moves in the oil market, stating that its speculation sparked the movements. Kremlin also stated talks between OPEC+ members can be set up if needed; Moscow has all reserves it needs to offset weak oil prices. Meanwhile yesterday, WSJ citing sources noted that Saudi is mulling applying the agreed-upon oil cuts as soon as possible instead of waiting until May 1st. Elsewhere, today will see the second official Texas Railroad Commission (RRC) meeting, where the Texas regulatory agency is expected today to provide more colour on its stance regarding potential oil production curtailment in the state. However, the RRC is reportedly unlikely to vote on a plan to mandate oil production cuts for Texas at the Tuesday meeting, according to Energy Intel citing sources. As a reminder, the meeting last week saw disagreement on whether cuts should be implemented or not, with larger producers mostly arguing for market-driven declines, and smaller players supportive of cuts. Elsewhere, spot gold trades relatively flat and meanders just south of USD 1700/oz. Copper prices meanwhile track sentiment and the downside in stocks, with the red metal now below USD 2.25/lb.

US Event Calendar

- 10am: Existing Home Sales, est. 5.25m, prior 5.77m

- 10am: Existing Home Sales MoM, est. -9.01%, prior 6.5%

DB’s Jim Reid concludes the overnight wrap

One of the great things about working through several cycles is that you can recycle old research. Yesterday we updated and republished a chart (originally from 2010) looking at the biggest bailouts in history. Back then we highlighted how ever increasing debt had meant the bailout currency had needed to be inflated perhaps 10 fold in the GFC relative to the past. 10 years and even more debt later and we’ve perhaps had to inflate the bailout currency by an additional 10 times. While we have sympathy for current policy makers given the nature of this shock, the reason the numbers are so big today is due to a 20-30 year “bailout first, ask questions later” approach which has left the world with ever higher debt. See the short note here for more. I look forward to republishing it in another 10 years.

Also a reminder of our April investor survey results ( link here ) from yesterday where we showed the usual market related answers plus people’s views on WFH and when the world will be back to normal post covid-19. We also asked whether people were eating, drinking and exercising more or less during the lockdown.

Yesterday I talked about how I had a gushing flow of water in my garage after a stopcock failed. If you want an image of what it looked like picture one of those movies where you see someone successfully striking oil. However given the current price of oil this leak is potentially more profitable than had we actually struck oil in our back garden. Indeed yesterday this was the main theme in markets as we saw one of the more remarkable moments in financial history and that is a deeply negative oil price – that is paying someone to take delivery. The May contract for WTI, which started the day at $17.85, traded at -$39.55 at one point and in negative territory for a total of about six hours before popping back to $1.43 this morning. This move is all about supply and demand. American energy users and refiners do not have the storage capacity given all that is going on.

This decimation comes ahead of today’s contract expiration, a culmination of sorts for an asset that’s been under immense pressure all year, with WTI and Brent having already lost nearly two-thirds of their value in Q1. According to our colleague Michael Hsueh, the fact that June is currently still trading $21 per barrel should not be seen as a guarantee that this sort of price action could not happen again upon June’s expiry if demand hasn’t increased over the next 2 months. Even prior to the move lower on WTI, lower quality runs of crude were near to or in negative territory, with Wyoming Asphalt Sour – a landlocked stream with higher associated costs than WTI – traded at negative 19 cents a barrel last month.

The moves for oil had knock-on effects in equity markets. By the close the S&P 500 had fallen -1.79% with the Energy industry group a relatively measured -3.30% given the carnage in May WTI. Every sector in the S&P 500 ended the day lower though as the large index moves continue. Yesterday’s move means that the index has only had 3 days under 1% in either direction since the start of March. In Europe the STOXX 600 managed to pare back its losses to record a +0.70% gain, putting the index in a technical bull market, up +20.04% since the March lows. It closed before the US sunk back towards the lows for the session at the final bell.

After the bell IBM announced earnings at $1.84 per share, compared to consensus of $1.81, but posted lower revenues on the quarter compared to a year ago. Also the firm pulled its year-long profit guidance on concerns that the virus outbreak makes it hard for the company to roll out its cloud computing transition. Today the main earnings highlights are from The Coca-Cola Company, Netflix, Philip Morris International, Lockheed Martin and Texas Instruments.

Before we get to that though there’s a couple of overnight stories to report. The first came from CNN who reported that the US is monitoring the health of North Korean leader Kim Jong Un after receiving information that he may be in “grave danger” following cardiovascular surgery last week. Yonhap reported that South Korea has denied the news. Meanwhile, US House Speaker Pelosi has said that the negotiations on an emergency stimulus package of as much as $500bn are “down to the fine print.” She added that the Senate can vote on the measure today and then it can move to the House on Wednesday for vote. The legislation would add funds to the tapped-out Paycheck Protection Program for small businesses and would also provide money for coronavirus testing and overwhelmed hospitals. Staying with the US, President Trump has said that he’ll sign an executive order temporarily suspending immigration as the country fights off the spread of the virus. No further details were mentioned.

Asian markets are following Wall Street’s lead this morning with the Nikkei (-2.17%), Hang Seng (-2.29%), Shanghai Comp (-1.35%), ASX (-1.83%) and Kospi (-1.68%) all down. In FX, the New Zealand dollar has weakened -0.66% after RBNZ Governor Adrian Orr said that he was open to the idea of directly monetizing sovereign debt or buying bonds straight from the government. He also said that the central bank would assess the need for additional stimulus at its May review. Elsewhere, futures on the S&P 500 are down -0.60% while yields on 10y USTs are down –1bp to 0.597%.

Back to yesterday, there was further pressure on European sovereign bonds ahead of Thursday’s pivotal European Council videoconference, with spreads widening across the continent to their highest level in over a month. The spread of yields on 10yr Italian debt over bunds ended the session up +12.2bps at 239bps, while those on Spanish (+5.0bps), Portuguese (+6.0bps) and even French (+1.6bps) debt also widened to one-month highs. So keep an eye out for any further widening of spreads over the next couple of days going into that meeting, and whether the calls for joint debt issuance manage to get any more traction. Assuming not how will they fudge the rescue packages.

On similar lines, we did get some news yesterday from Bloomberg, who reported that the idea of an EU-wide bad bank that we mentioned yesterday had run into resistance from Germany. According to the report, they’re resistant to the idea that they and other northern countries would have to see their taxpayers on the hook for losses accumulated elsewhere, which pretty much echoes the objections made to the idea of ‘coronabonds’.

It was a different story over in the US, where 10yr Treasury yields fell -3.6bps. On the subject of US debt, our economists put out a note yesterday where they forecast that debt-to-GDP ratio is likely to rise to 100% this year, a level not seen since the mid-1940s. Under their base case, the ratio will rise to nearly 125% by the end of the decade, with the possibility of even steeper increases if the pandemic lasted longer than anticipated. In reading through their piece it echoes a lot of what we said in last year’s long term study in that you can control the rise in debt/GDP if you can successfully keep yields notably below nominal GDP. Obviously that won’t happen this year but will likely in the years ahead if the economy gets back to some normality and the Fed control yields. The alternative scenario of yields mean reverting back to their long-term trend is a scary prospect for debt sustainability. Link here.

There wasn’t much in the way of economic data, though we did get the Chicago Fed’s National Activity index, which fell to -4.19 in March (vs. -3.00 expected), its lowest level since January 2009. Meanwhile in Hong Kong, the unemployment rate rose to 4.2% in the January-to-March period, its highest level in over 9 years, while the Spanish central bank predicted that country’s economy could contract by between 6.8% and 12.4% this year.

To the day ahead now, and data releases include UK employment data for February, the German ZEW survey for April, Canada’s retail sales for February, and US existing home sales for March. From central banks, the ECB’s Stournaras will speak, while earnings releases out include The Coca-Cola Company, Netflix, Philip Morris International, Lockheed Martin and Texas Instruments.

Tyler Durden

Tue, 04/21/2020 – 08:24

via ZeroHedge News https://ift.tt/3cDEpHc Tyler Durden