Netflix Adds Record 15.77MM Paid Subs, Crushing Estimates But Offers Disappointing Outlook

While recent earnings reports from streaming giant Netflix have been a mixed bag, missing badly three quarters ago when US subs declined and forecasting the first annual drop this decade, then smashing expectations two quarters ago, and finally last quarter when it beat on new subs but disappointing in its guidance, none of that mattered today when the company reported earnings for its first “post Corona” quarter, when the only thing investors cared about was not whether the company would beat or miss expectations, but rather if Netflix, whose stock price has soared in the past month, is really a pandemic-proof company?

As Bloomberg notes, the company is riding a wave of optimism, its stock soaring 50% in the past month, with investors pushing the shares to new highs and analysts seeing people download its app in record numbers. And while there’s no doubt that viewership has surged during the Covid-19 lockdowns in the U.S. and much of the world, there are complications: the virus has brought TV and film production to a halt, a situation that may only get more dire for Netflix as the months wear on.

The world’s largest paid streaming service is also facing more intense and cutthroat (or rather cut-price) competition than ever. Comcast’s Peacock platform began its rollout this month, along with the short-form video service Quibi. And AT&T Inc.’s big bet on streaming, HBO Max, debuts in May, while Disney+ has already reportedly hit 50 million subs.

So was this that unleashes a new growth trajectory for Netflix? Judging by the company’s blockbuster report, the answer – and the reason why stocks are surging after hours – is a resounding yes.

Here is what the company reported:

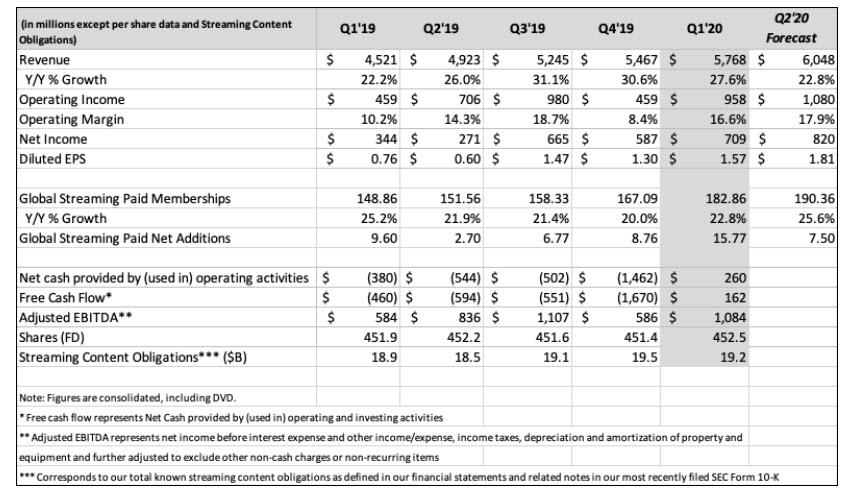

- Q1 revenue $5.768BN; beating the estimate of $5.74 billion (range $5.36 billion to $5.89 billion)

- Q1 GAAP EPS of $1.57, missing the estimate $1.64 (range $1.20 to $1.74)

In short, bit of a mixed bag, but the number everyone is focusing on after hours and the reason why the stock is soaring is the company’s blockbuster addition in net subs:

- Q1 streaming paid net change 15.77MM, smashing the estimate +8.47 million new adds and more than double the company’s own forecast of 7.00 million.

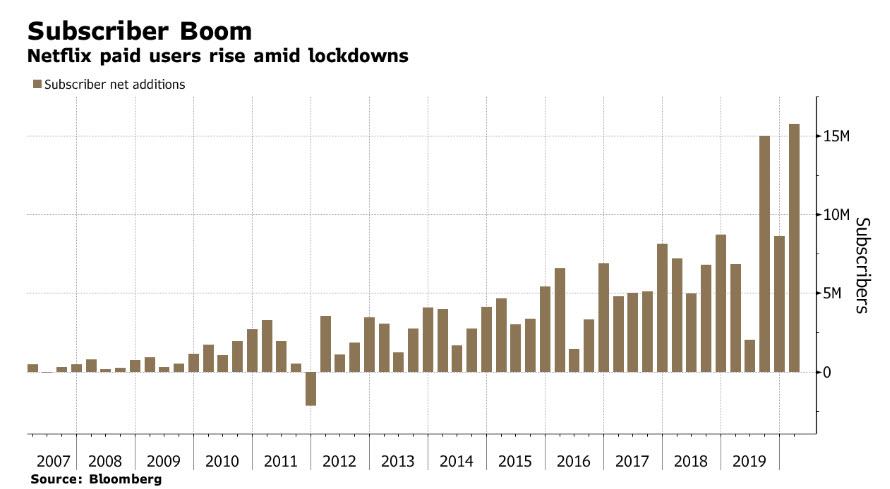

The corona-quarter hardly needs to be highlighted in the chart below:

“With lockdown orders in many countries starting in March, many more households joined Netflix to enjoy entertainment,” Netflix said, adding that Netflix subscriber growth in the first two months of the year was “similar to the prior two years.”

Then things took off in March with the global virus lockdown. Netflix doesn’t expect this kind of growth to continue with Q3 and Q4 net additions lower than last year, in part because there won’t be new seasons of “Stranger Things” and “Money Heist.”

And summarized:

Or maybe just call it the Tiger King quarter. As Bloomberg points out, it should surprise no one that’s spent any time online in recent weeks that Netflix’s “Tiger King” was a smash hit. The weird docuseries about a zookeeper that is now in prison for attempted murder attracted 64 million viewers. That’s still far behind the Mark Wahlberg film “Spenser Confidential,” which garnered 85 million viewers.

In any event, the forced lockdowns were all that matters, and Netflix admitted as much saying it was seeing “temporarily higher viewing and increased membership growth” during the lockdown, but that’s being “offset by a sharply stronger U.S. dollar, depressing our international revenue, resulting in revenue-as-forecast.”

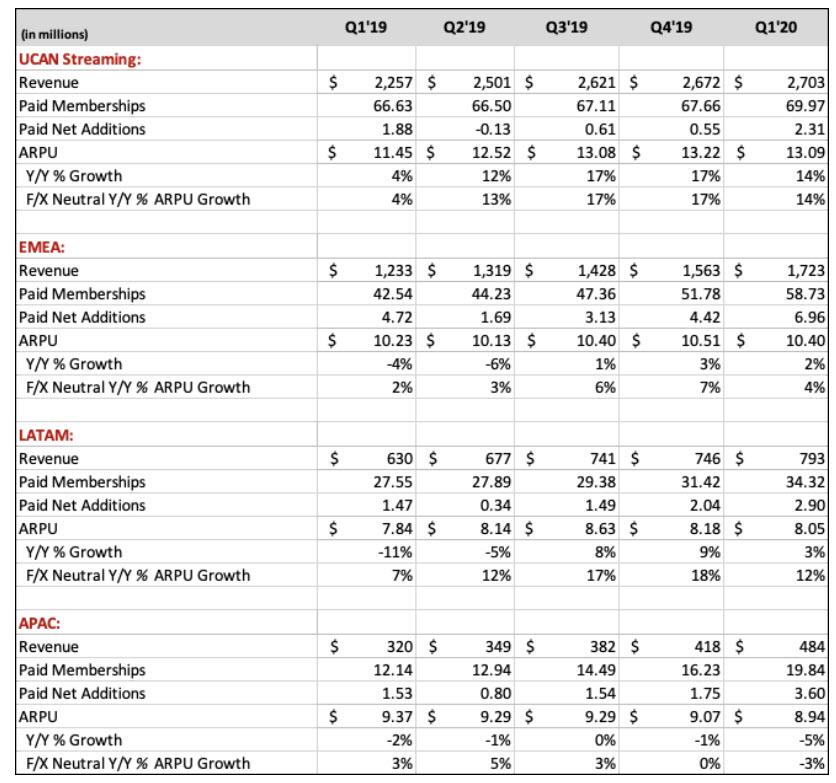

But how is it possible to blow out your own subscriber forecast yet revenue barely beats? The company explains that despite paid net additions that were higher than forecast, “revenue was in-line with our guidance due to the appreciation in the US dollar vs. other currencies. Excluding a -$115m impact from F/X, streaming ARPU grew 8% year over year.”

Meanwhile, operating margin of 16.6% (vs. 10.2% in the prior year quarter) was lower than its 18.0% forecast as the company incurred $218m in incremental content costs due to paused productions and hardship fund commitments (a 3.8 percentage point impact to operating margin).

Some more headlines, courtesy of Bloomberg:

- Q1 streaming content obligations $19.2 billion, -1.5% q/q

- Q1 UCAN streaming paid net change +2.31 million vs. +550,000 q/q

- Q1 EMEA streaming paid net change +6.96 million, +57% q/q

- Q1 LATAM streaming paid net change +2.90 million, +42% q/q

- Q1 APAC streaming paid net change +3.60 million vs. +1.75 million q/q

- Q1 operating margin 16.6% vs. 8.40% q/q

Looking ahead the company expected a drop in the coronavirus surge, and expected 7.5MM subs in Q2, a roughly 50% decline from the current quarter. Specifically, Netflix expects viewing to decline and subscriber growth to decelerate as home confinement ends, “which we hope is soon.”

Additionally, Netflix expected the following:

- Q2 revenue of $6.05BN, above the estimate $5.96 billion

- Q2 GAAP EPS of $1.81, above the estimate of $1.55

- The company hired 2,000 agents to boost customer support levels

Summarized:

To summarize the coronavirus impact on the company (via BBG):

- Subscriber growth accelerated due to home confinement.

- International revenue will be less than forecast due to the dollar rising sharply.

- Due to the production shutdown, some cash spending on content will be delayed, improving free cash flow.

As Bloomberg Intelligence Senior Tech Analyst Geetha Ranganathan notes: “a strong 2Q outlook lends credence to our view that Covid-19 will create tailwinds for Netflix, accelerating the shift away from linear TV. The record 15.77 million additions in 1Q blew past guidance and came in almost 85% higher than consensus estimates.”

Commenting on the quarter, Reed Hastings said that “in our 20+ year history, we have never seen a future more uncertain or unsettling. The coronavirus has reached every corner of the world and, in the absence of a widespread treatment or vaccine, no one knows how or when this terrible crisis will end. What’s clear is the escalating human cost in terms of lost lives and lost jobs, with tens of millions of people now out of work.”

With cinemas closed, Netflix said it was taking the opportunity to acquire titles that might not have otherwise gone straight to streaming. It said it recently bought Paramount Pictures’s “The Lovebirds” and Legendary Pictures’s “Enola Holmes.”

While Netflix has tried to focus more on original content in recent years, making sure there’s enough on the platform to fulfill demand will be important to retain its subscribers, according to Bloomberg. A tricky thing to do when most Hollywood productions are shut down because of the virus.

In terms of its content organization, Netflix said its daily top-10 most-watched films and series lists will be a regular feature, available in almost 100 countries. Some more content notes from the letter to shareholders:

As people shelter at home, our hope is that we can help make that experience more bearable by providing a diverse range of high quality content for our members. While our productions are largely paused around the world, we benefit from a large pipeline of content that was either complete and ready for launch or in post-production when filming stopped.

For Q2, we’re looking forward to releasing all of our originally planned shows and films (with some language dubbing impacts on a few titles). We’re also finding ways to bolster our programming this year – including the recent acquisition of Paramount’s and Media Rights Capital’s The Lovebirds, a comedy starring Issa Rae and Kumail Nanjiani, for Q2’20 and Legendary Pictures’ Enola Holmes starring Millie Bobby Brown, Helena Bonham Carter, Henry Cavill, and Sam Claflin, for Q3 ‘20. So, while we’re certainly impacted by the global production pause, we expect to continue to be able to provide a terrific variety of new titles throughout 2020 and 2021.

Our Q1 slate highlighted the variety of content that people enjoy en masse all over the world on Netflix: scripted English language series like Ozark season 3 (a projected 29m member households will have chosen to watch this season in its first four weeks), the riveting docu-series Tiger King: Murder, Mayhem and Madness (64m), our breakthrough unscripted dating show Love is Blind (30m), original film Spenser Confidential (85m), and season four of the Spanish language hit La Casa de Papel, aka Money Heist (a projected 65m), which debuted in early April.

In Q2, we are looking forward to the launch of Space Force, our new original comedy series created by Greg Daniels (The Office) and Steve Carell, starring Carell, John Malkovich and Lisa Kudrow. We just launched our latest buzzy unscripted series Too Hot to Handle, #BlackAF from Kenya Barris and, outside the US, the Michael Jordan documentary The Last Dance, which we co-produced with ESPN (launching on Netflix in the US on July 19). We will also premiere Hollywood from Ryan Murphy, and, later this week, Extraction, a large scale action film starring Chris Hemsworth and directed by Sam Hargrave, who was the stunt coordinator and choreographer on films like Avengers: Endgame, Avengers: Infinity War, Deadpool 2, and Captain America: Civil War.

* * *

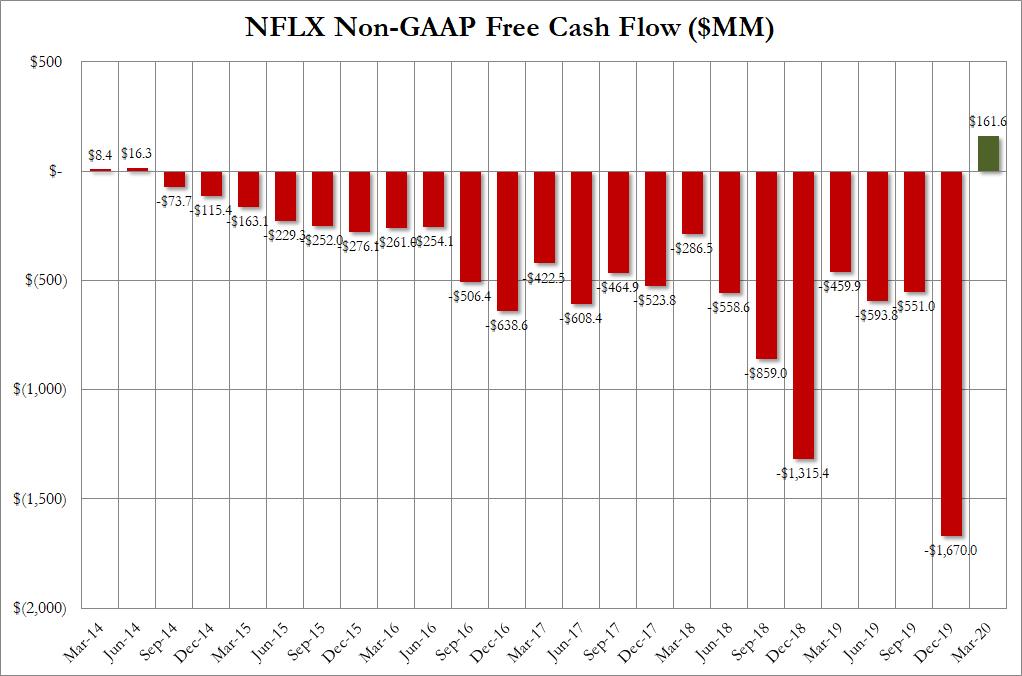

What is perhaps most remarkable was the dramatic reversal in Netflix cashflow: net cash used in Q1 operating activities was +$260 million vs. -$380 million in the prior year period. Free cash flow totaled +$162 million compared with -$460 million in the year ago quarter.

As the company stated last quarter, our FCF profile is beginning to improve due to growing operating margin and profits and “as it digests its big move into the production of Netflix originals (which requires more cash upfront vs. later-window content) that started five years ago.”

Or perhaps there is less here than meets the eye: as Netflix admits, with its productions currently paused, this will shift out some cash spending on content to future years. As a result, the company now expecting 2020 FCF of -$1 billion or better (compared with our prior 2020 expectation of -$2.5 billion and -$3.3 billion actual in 2019). This dynamic may result in more lumpiness in its path to sustained FCF profitability. However, there has been no material change to its overall time table to reach consistent annual positive FCF and we believe that 2019 will still represent the peak in our annual FCF deficit.

The company ended the quarter with cash of $5.2 billion, while its $750m unsecured credit facility remains undrawn. Combined with improved FCF outlook for 2020, the company has more than 12 months of liquidity and “substantial financial flexibility.”

And while the company’s surge in Q1 subs was enough to initially send the stock sharply higher, perhaps as a result of the company’s cautious Q2 guidance where it sees a drop of 50% in new subs, the stock is virtually unchanged after hours.

Tyler Durden

Tue, 04/21/2020 – 16:22

via ZeroHedge News https://ift.tt/2XUMPpy Tyler Durden