“A Recipe For Disaster” – WTI Holds Huge Gains Despite Inventory Surge

More crude chaos overnight (with AsiaPac oil ETFs trading at “crazy premiums” and Asian oil futures tumbling) has been over-ruled this morning as long-squeezes have morphed into a short-squeeze after Trump ordered the US Navy to “shoot down and destroy any and all Iranian gunboats if they harass our ships at sea”, sending June WTI soaring 40% to $16 before fading modestly into the official inventory data from DOE.

“There’s no way you can predict [it] right now,” Michael Cuggino, portfolio manager at Pacific Heights Asset Management LLC, said on Bloomberg TV.

“It’s virtually impossible until we have more visibility with respect to how to world comes out of the coronavirus on the other side.”

Still, we suspect inventories will be a catalyst for the next leg in these chaotic paper oil markets…

API

-

Crude +13.226mm (+13.8mm exp)

-

Cushing +4.913mm (+14mm exp)

-

Gasoline +3.435mm (+4.4mm exp)

-

Distillates +7.369mm (+3.9mm exp)

DOE

-

Crude +15.022mm (+13.8mm exp)

-

Cushing +4.776mm (+14mm exp)

-

Gasoline +1.017mm (+4.4mm exp)

-

Distillates +7.8765mm (+3.9mm exp)

This is the 13th weekly rise in crude inventories…

Source: Bloomberg

Crude stocks soared to their highest since May 2017 (this is the highest level of crude inventory for this time of year ever aside from 2017)…

Source: Bloomberg

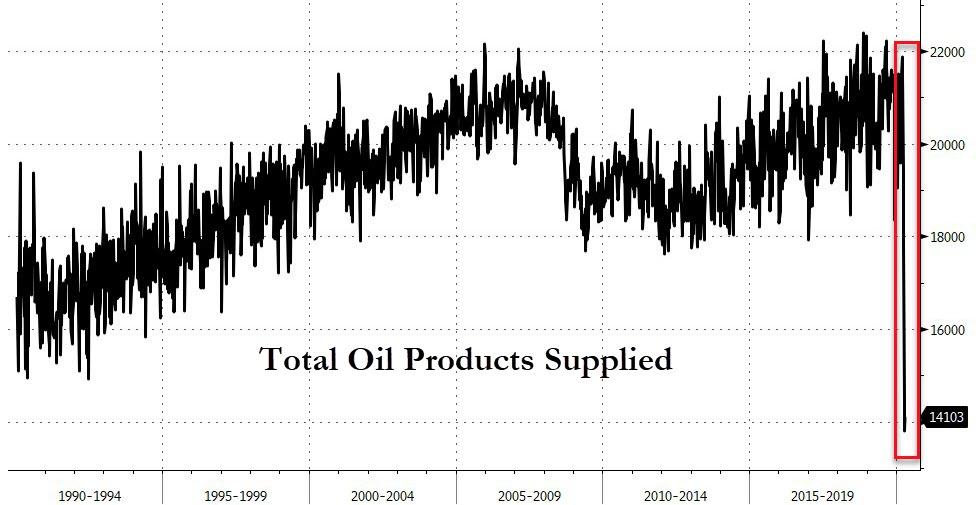

Bloomberg Intelligence energy analyst Fernando Valle warns that the roll of WTI contracts showed that all remaining storage at Cushing is booked, even if not yet full… but demand has collapsed…

Source: Bloomberg

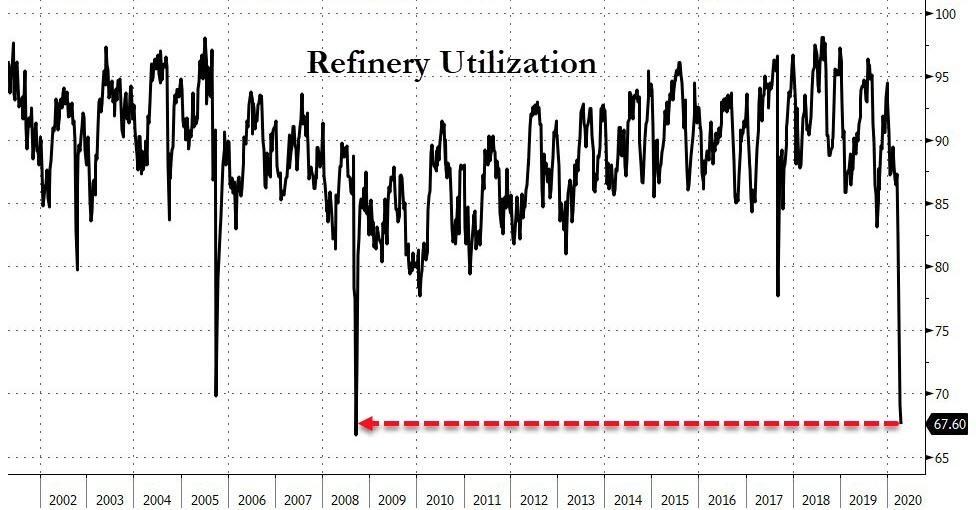

Refineries slowed to 67% of utilization last in the previous week, the lowest since 2008.

As Bloomberg Intelligence senior energy analyst Vince Piazza notes, “U.S. crude storage capacity has about three months to go before it’s filled, as demand falls faster than production is declining.”

Following a collapse in US oil rig counts, US oil production is fading back to its lowest since June 2019…

Source: Bloomberg

The possibility of negative prices has sent a shockwave through the ETF industry. Should the price of the futures they hold fall below zero, ETFs could go “lights out”, Charlie McElligott, a cross-asset macro strategist at Nomura Securities, warned on Tuesday, but June WTI lifted very modestly after the inventory print.

Pierre Andurand, a hedge fund manager who has successfully bet on lower oil prices in recent months, warned that oil ETF investors faced the possibility of being “completely wiped out.”

“Anything that invests in the front two months WTI is a recipe for disaster,” he told Bloomberg TV.

In case you wondered who was/is buying all this oil… it’s easy – Millennial bagholders…

“It is possible that the price of June 2020 contracts will drop to zero or a negative value,” Samsung Asset Management said in its filing. “In the worst-case scenario, the Net Asset Value of the Sub-Fund may drop to zero and investors may suffer a total loss of their investments in the Sub-Fund.

Tyler Durden

Wed, 04/22/2020 – 10:36

via ZeroHedge News https://ift.tt/2VwXMfL Tyler Durden