One Of Them Is Wrong: Kolanovic Sees Record S&P In First Half Of 2021, Billionaire Paul Singer Sees 50% Crash

Today was a remarkable day in more ways than just the ongoing triple-digit sigma rout in oil: today was perhaps the first day in years when Marko Kolanovic issued one of his traditionally super-bullish reports on a major market downtick, as opposed to its usual dissemination day: when the market was soaring.

So what did the JPM quant who now moonlights as JPM’s in-house virologist (just don’t tell MW Kim who actually is one) had to say to cheer up the bulls and lift the spirits of all those who followed to his July 2019 “once in a decade opportunity” trade reco to buy value stocks and sell low vol/defensive stocks which as shown below did not quite work out as expected?

Nothing really that exciting: just his latest iteration of buy stuff and watch it go up because the Fed’s got your back, which is not only boring at this point but if Marko keeps repeating that all that matters is the Fed’s backstop of stock prices, he will talk himself right out of a job because who needs strategists and quant experts in a centrally-planned world where stocks go up and down by decree?

For those who want to hear the same old story retold yet again, this is what Kolanovic had to say:

After the Fed introduced the first wave of monetary easing, we expressed our view that the S&P 500 will reach its previous highs in the second half of 2021. This was based on our analysis of the pandemic and market structure (flows, positioning, and liquidity).

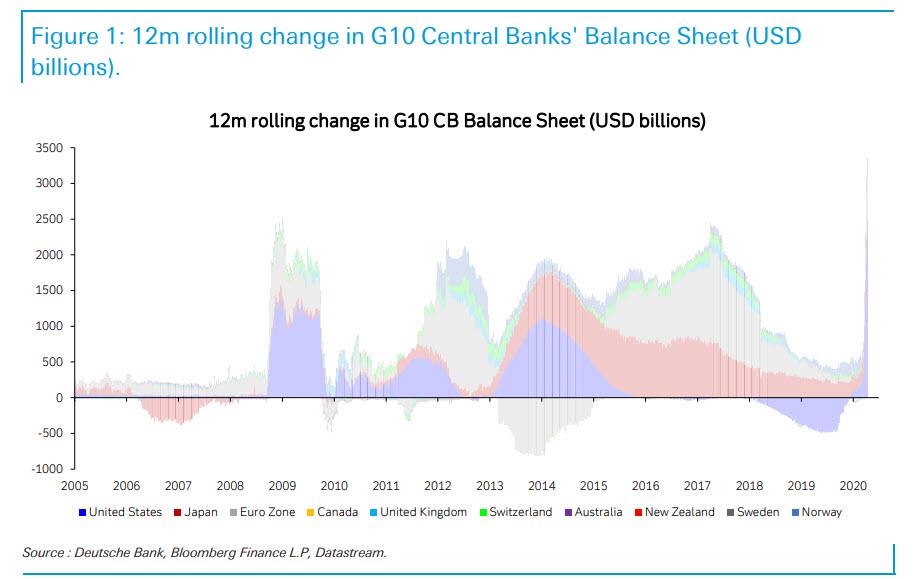

… what he really meant is that this was based on his analysis of the tsunami of liquidity, which amounts to an annualized $23.4 trillion and which was unleashed by central banks as shown in the chart below…

… but back to Marko, who apparently thinks that somehow the Fed announcing it would buy IG and junk bonds wasn’t a clear message to investors.

Following the second wave of monetary measures, which included a backstop for certain credit assets, we shifted our forecast that the previous highs are likely to happen in the first half of 2021.

At this point, just like Goldman and Morgan Stanley, Kolanovic found himself scrambling to explain how stocks will soar in the next 8 months even with earnings expected to plunge by 30% or more. Here things get funny: unlike Morgan Stanley and Goldman which both rely on that “other” valuation methodology of the Equity Risk Premium – since neither can use forward PE multiples to justify their bullishness – Kolanovic decided to go full first year corp fin analysts and… DCF the entire market!

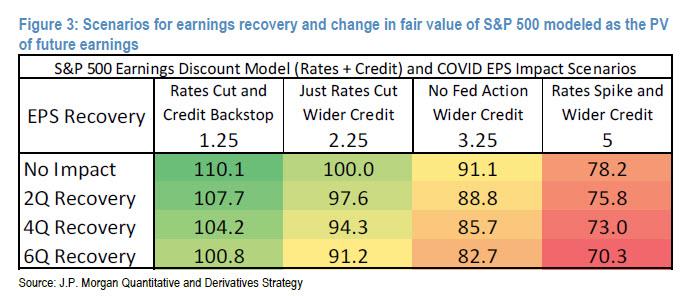

We will now model the valuation of the S&P 500 via a discounted earnings model. To arrive at a valuation, we look at the various scenarios for the earnings decline and recovery due to the pandemic, and then quantify the impact of the central bank reduction of interest rates and credit spreads – i.e., the earnings discounting rate.

We will show that for the S&P 500, the combined suppression of the risk free rate and credit spreads by the Fed likely has a bigger positive impact on equity valuation, compared with the negative impact of the temporary earnings loss. The reason is that by reducing the discounting rate, present value is increased by ‘adding more’ (i.e., discounting less) of future earnings relative to near-term earnings loss. This would not be true in a high interest rate environment or for companies with high credit spreads (as the ‘back end’ of earnings are already heavily discounted relative to nearterm earnings). It would also not be true in countries that cannot effectively reduce sovereign risk or credit spreads (e.g., non-reserve currency, or high external deficits). For this reason, we believe this model applies only to US, investment-grade companies.

Once again, Kolanovic has outdone himself: instead of using the ERP which at least has some credibility, the quant has decided to stake his entire credibility on a model that even first year ibanking associates mock at every opportunity for the simple reason that a DCF is nothing more than any attempt to demonstrate just how familiar one is with the goalseek function in excel. Undaunted by the glaringly obvious desire to desperately achieve a specific “valuation” outcome, the Croat continues:

Next we calculated the present value of earnings by using the applicable discounting rate after two waves of Fed monetary actions. Currently, the discounting rate has been suppressed by 100bps, which is a result of the combined reduction of risk free rates and reduction of credit spreads via credit asset purchases. This has reduced the discounting rate from ~225bps to ~125bps in our model. Given the massive suppression of the discounting rate, the present value of future earnings in all 3 earnings impact scenarios is above the pre-crisis level. This indicates that the S&P 500 should attain previous all-time highs if the monetary measures are sustained.

There is a whole lot more words in there, but the bottom line is that “the combined suppression of the risk free rate and credit spreads by the Fed likely has a bigger positive impact on equity valuation, compared with the negative impact of the temporary earnings loss. Given the massive suppression of the discounting rate, the present value of future earnings in all three earnings impact scenarios is above the pre-crisis level. This indicates that the S&P 500 should attain previous all-time highs if the monetary measures are sustained.”

And there you go: all you need to kickstart your valuations to pre-corona crisis levels when your cash flows crater to half their normal level (or less) is to use a discount rate that is drastically below normal levels, and – boom magic, you justify (i.e., goalseek) the value you were looking for all along… just like every “intro to corp fin” class will teach you. Marko even put in a (neatly color-coded for those confused) chart summarizing all the goalseeked scenarios:

But what happens if the crisis escalates and profits/cash flows plunge further, or turn outright negative? Fear not, as Marko will have a solution for that too – it’s called a negative discount rate.

And that’s how you cover every base.

Just three problems.

- First, stocks are now below where they closed 2017. In that period of almost two and a half years, Kolanovic has been bullish the entire time, and yet unlike his employer which has the biggest balance sheet of any bank in the US, the dramatic drawdowns that individual investors suffered during the Q4 2018 crash and then again in March, would have stopped out virtually anyone who listened to Kolanovic (especially on that whole value vs low vol disaster), who is always ready to point out how bullish he was in the past when stocks are rising, yet has never once told his clients to get out stocks, not before the Q4 2018 bear market and certainly not before the March crash which was more violent than the 2008 financial crisis and led to widespread liquidations across the board, especially among JPM clients. Oh yes, one will also never hear Marko discuss his “once in a decade” trade reco (see above) that left anyone who put it on devastated.

- Second, while we marvel at Marko’s perpetual bullishness, Wall Street strategists gain more respect by occasionally reversing their outlook – and ideally timing the market in the process – something Marko’s colleague at Morgan Stanley, has been far more successful at doing, and in fact just yesterday, Wilson turned bearish again after going long at the end of March, saying “stocks are now overbought” and warning that a “correction will begin soon.” Maybe Wilson just needs to “DCF” the S&P with a lower discount rate and he will turn bullish again?

- Third, the shtick of pretending one is doing “analysis” when one is merely giving lip service to Powell and hoping the Fed will bail markets out again is getting tiresome, and not just for ideological reasons, or even “analyzing” oneself out of a job as there is no need for strategists in a centrally-planned market, but because as SocGen’s Andrew Lapthorne explained on Monday, “time and time again, investors have demonstrated their willingness to buy equities in the knowledge/hope that central banks, and the FED specifically, had their back.” Just like Marko. And yet, as Lapthorne warns “there is zero evidence historically that markets can go up on a sustained basis whilst profits continue to slump. Equity markets may have bounced but investors still seem to be positioning themselves for a drop.”

We realize that all of the above is moot: having been promoted from “mere” quant, if one of the most influential on the street, to a far more prominent, client-facing role one where it is his duty to inspire confidence a la Abby Joseph Cohen (and to have a buyer when JPM itself is selling) what Marko says now has far less practical significance for actual trading than what he used to say just 3 or 4 years ago, when his calls actually moved markets. Now it’s all part of just helping mold the bullish narrative.

No, if we wanted to know what will happen to the market, we would go to someone who not only has skin in the game but also decades of reputation at risk behind his every statement. Someone like billionaire investor and Elliott Management founder, Paul Singer, who in his latest letter to clients has a distinctly different view on what happens next than Kolanovic: in his latter, instead of begging the Fed to bail him out after foolishly having called for more upside, or DCFing non-existant cash flows (at a negative discount rate?), Singer instead approaches the biggest question of our generation from the perspective of a truly impartial outsider who warns that far from new all time highs in 2021, the real crash has yet to happen, to wit:

there is no way of telling whether the minus 36% stock market waterfall decline is “enough,” [ZH: what, not even if you DCS the stock market?] and whether the subsequent sharp rally signals “fini” to the crash (the decline was sharp enough, with several days comparable to the 1929 crash, to justify the “crash” label). Since the actual economic downturn is exceeding in depth and impact – and probably will exceed in length – the 2008 experience, our gut tells us that a 50% or deeper decline from the February top might be the ultimate path of global stock markets.

Demonstrating just why he manages over $30 billion, the next part in Singer’s letter explains precisely why he doesn’t bother with DCFs, or trying to convince someone he is correct, but merely with prudent risk management in a time when everything is falling apart:

… public policy has been marshalled with all its strength to do battle with a resumption of the market decline. Our job, and style, is not to pick tops and bottoms with precision (actually, not to pick them at all), but to have a portfolio that can make some money in normal times and keep it when the music stops for any reason, the timing of which is always a surprise even if you keep a sharp eye on the disc jockey.

And here is something else that makes for a brilliant investor: honesty.

… currently, despite the massive stimulus moves around the world and the unimaginably large new rounds of money printing, there is substantial uncertainty about the future viability of a large range of businesses. Which businesses will eventually emerge stronger than ever, which will come back more or less as they were, and which will require very substantial changes to their business model in order to maintain some profitability (or even to survive)? It is very difficult to make a careful and realistic assessment of the timing and shape of the restoration of the global economy, the future financial condition of the companies whose securities appear to be bargains and the possible further downside of those securities. We are currently in the process of sorting through it.

Nope. No DCFs here, or amateur epidemiological attempts to justify a 400 point S&P surge by “analyzing” that sunshine in the summer is bullish as it will kill the virus and so stocks will soar. Instead what we get is the kind of incisive criticism of the party responsible for everything that is wrong in modern capital markets, that we have grown to admire from Singer. We have included the must read conclusion from Singer’s letter below, although we urge readers to find the full thing and read it – it’s truly inspirational and will quickly answer the question posed by the title of this article.

Should it be a surprise that stocks go straight up and then crash straight down? Which part of “record prices, record valuations, record leverage, record derivatives trading and record complexity” should investors be excused from understanding? Any outright long investor who is not waking up in the middle of the night sweating and worrying whether there will be a next leg of the bear market (despite the desperate and gigantic policy moves) is either Cool Hand Luke or oblivious.

We are not in the business of calling market turns. Why did most managers, economists, strategists and policymakers miss it? Certainly as the virus was getting underway, advisors should have been incorporating it into their thinking. Certainly as the global economy started shutting down, advisors should not have been upgrading their recession probability forecasts “from 20% to 25%” and modestly downgrading their Chinese growth forecasts “from 6.1% to 5.6%.” Maybe investors DIDN’T miss it. Maybe they actually thought that no matter what happens, the authorities want stocks to go up, and that is all you need to know.

The central bankers, particularly at the Fed, should be ashamed of themselves for fostering that belief, and for allowing the policy mix to be so skewed toward free and (overly) plentiful money. The solution is now pouring unlimited money into the boiling cauldron. MMT has come along just in time to justify everything. Not in productive ways, not in the building of useful infrastructure, not doing a better job of educating our workforce so we can grow like crazy, but just to save the screwed-up system that we have, just to hold things together. Helicopter money has made the job of active investing harder, and the suppression of interest rates by central bankers lowers the forward rates of return for everyone. You might say, “But it has enhanced the to-date rate of return.” We would retort, “That is true, but despite the artificially enhanced to-date rates of return in bonds and stocks, net debt has skyrocketed, pension plans are universally underfunded and developed world infrastructure is oriented toward political pet projects and is inadequate to support needed economic growth going forward.”

Tyler Durden

Wed, 04/22/2020 – 07:05

via ZeroHedge News https://ift.tt/34XCJpm Tyler Durden