BOJ To Launch Unlimited QE, Double Corporate Bond Purchases

One day after the ECB announced that it – just like the Fed – would purchases fallen angle junk bonds, the BOJ, afraid it would be left behind in the global race to crush one’s currency, is reportedly preparing to abandon its 80 trillion yen a year purchase limit for JGBs and will replace it with unlimited QE – also just like what the Fed unveiled exactly one month ago – when it meets for its next policy meeting on Monday, the Nikkei reports.

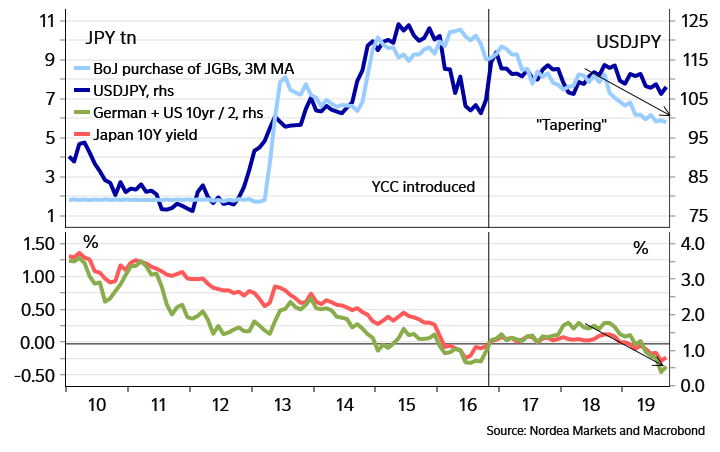

Additionally, the BOJ is also set to double purchase targets for CP and corporate bonds, while keeping its Yield Curve Control in place, targeting the 10-year JGB at around 0% and maintaining negative rate at -0.1%.

While we wish Kuroda the best of luck in overtaking the Fed and ECB in nationalizing the market, we will remind the central banker that it is not an issue of monetization demand, but rather supply, that has kept Japan’s QE in check, with the annual amount of bonds purchased by the central bank declining consistently every year as there are simply not enough bonds available in the open market for the central bank to buy, and is also one of the reasons why Japan has been urged by various entities to boost its fiscal stimulus to provide the BOJ with the “helicopter money” ammo it so desperately needs to keep the Japanese economy running.

Following the news, the USD/JPY spiked around 40 pips to 107.85 now that the BOJ is clearly doing what it can to crush the yen…

… while US Treasury 10-year yields tumbled back below 0.61%, 1bp richer on the day, as traders are starting to contemplate that the next BOJ move may be to buy US debt.

Tyler Durden

Thu, 04/23/2020 – 10:00

via ZeroHedge News https://ift.tt/3eJQw7I Tyler Durden