Stocks Inexplicably Close Red After Economy Loses Millions More Jobs

The headline banner may be a little misleading:

-

The Good – Stocks are up (all it took was a few trillion dollars)? Oil is up (all it took was threats of war)?

-

The Bad – COVID cases are up, COVID deaths are up (and Gilead’s drug is a dud)…

-

The Ugly – Over 26 million Americans have now filed for unemployment benefits in the last 5 weeks, PMI…

A three-way-standoff between ugly real economic data, ongoing global lockdowns, and The Fed’s “whatever it takes” asset liftathon…

For the fifth week in a row, The Dow managed gains on the back of simply unprecedented surge in joblessness BUT the S&P 500 and Nasdaq DID NOT!!…

-

3/26 – 3.31mm jobless, S&P +6.24%, Dow +6.38%

-

4/02 – 6.87mm jobless, S&P +2.28%, Dow +2.24%

-

4/09 – 6.62mm jobless, S&P +1.45%, Dow +1.21%

-

4/16 – 5.24mm jobless, S&P +0.58%, Dow +0.12%

-

4/23 – 4.43mm jobless, S&P -0.04%, Dow +0.18%

As LPL’s Ryan Detrick noted “So stocks have never dropped when more than 3 million people apply for unemployment. That is crazy.”

Nasdaq and the S&P were unable to hold the early gains that were lost after the Gilead headlines.

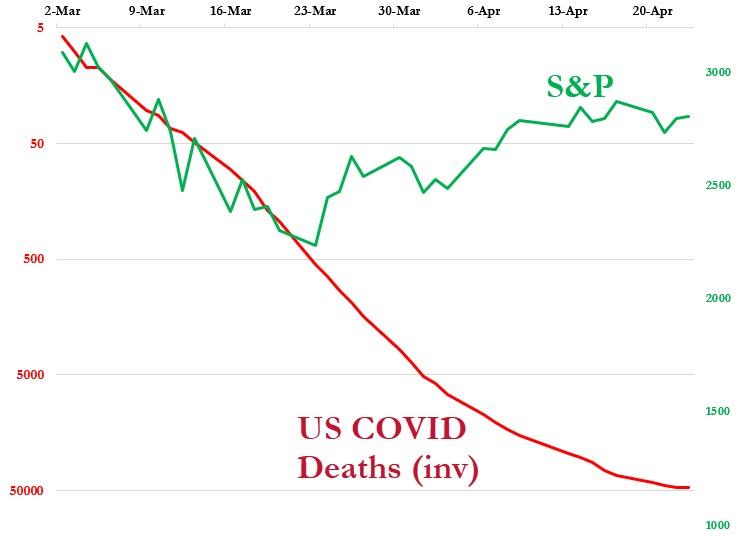

Crazy indeed Ryan and the US’ COVID cases and deaths continues to rise – so ignore that too…

oh and Gilead’s stock price has erased all of its gains from last week as its Remdesivir drug proved to be a dud… but stocks are hopeful…

So, in its worst precedent yet, bad news – the absolute worst – is good news? Because it means fiscal and monetary idiocy will go all the way to ’11’ – even if it’s not already there.

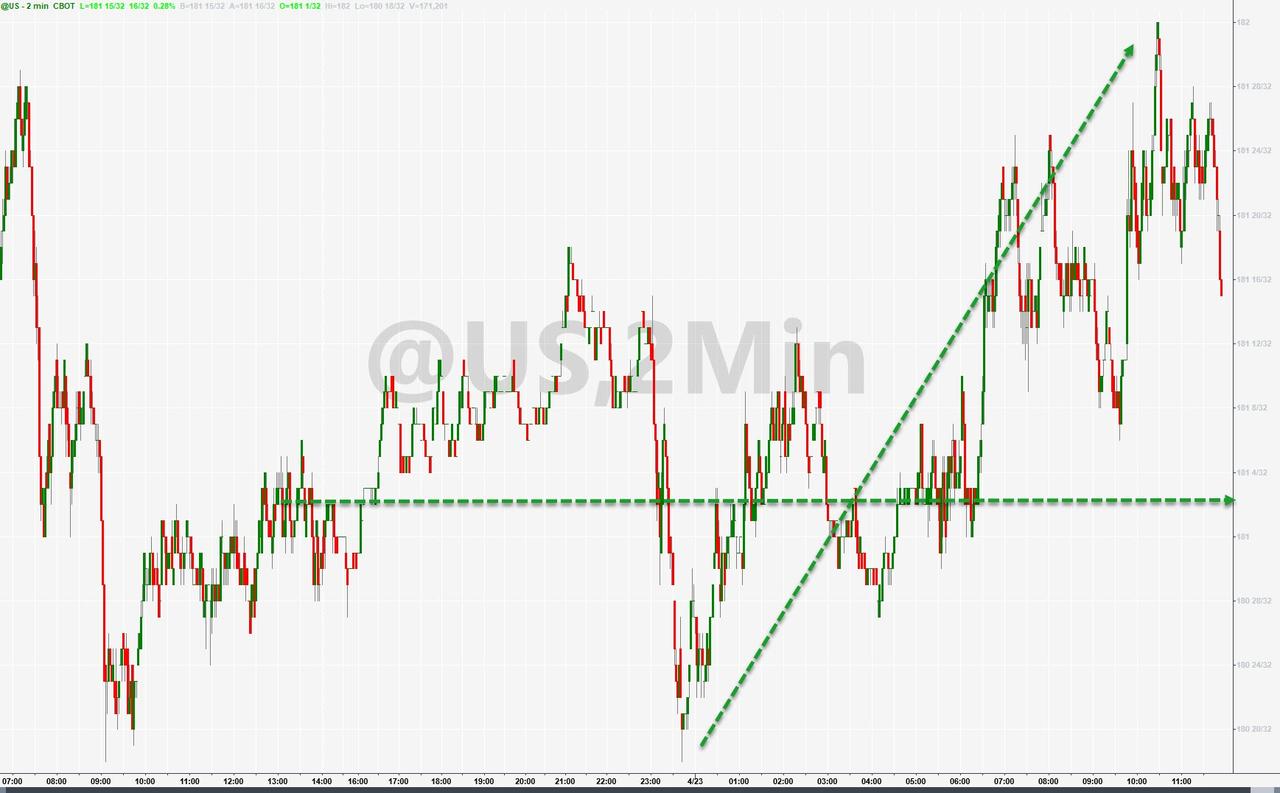

But safe-havens were bid with bonds (price) rising…

Gold rallying…

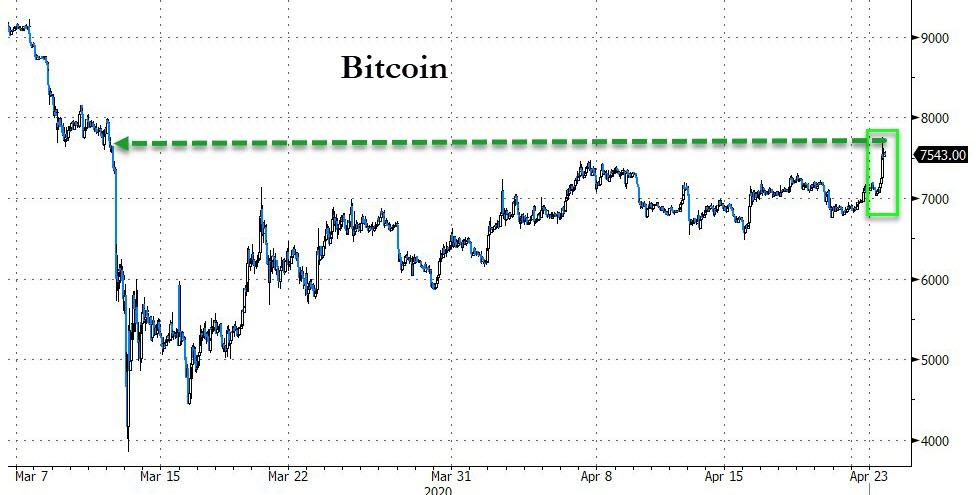

And Bitcoin bouncing back…

Source: Bloomberg

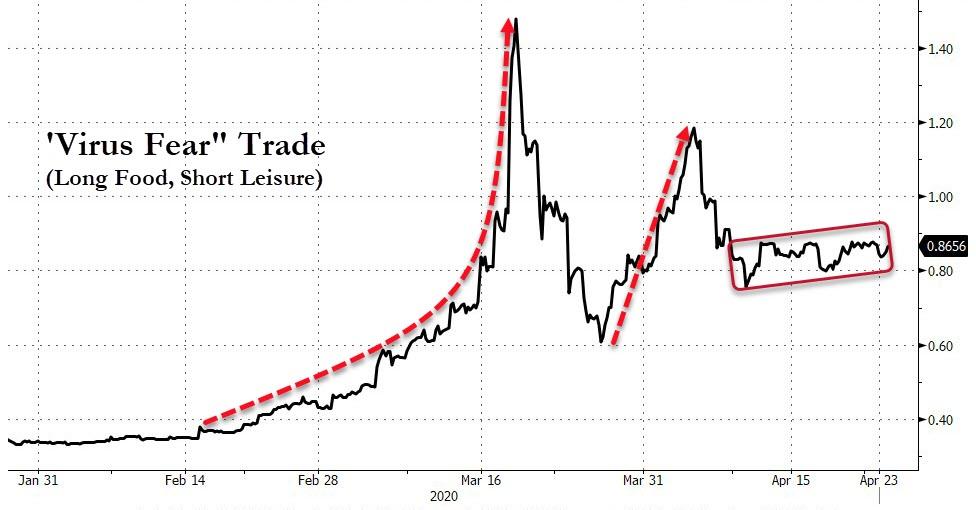

Notably the “Virus Fear” trade has been flat for almost two weeks – even as the broad market has lifted…

Source: Bloomberg

The Dow manage to scramble back up to its 50% retrace level once again… and fail…

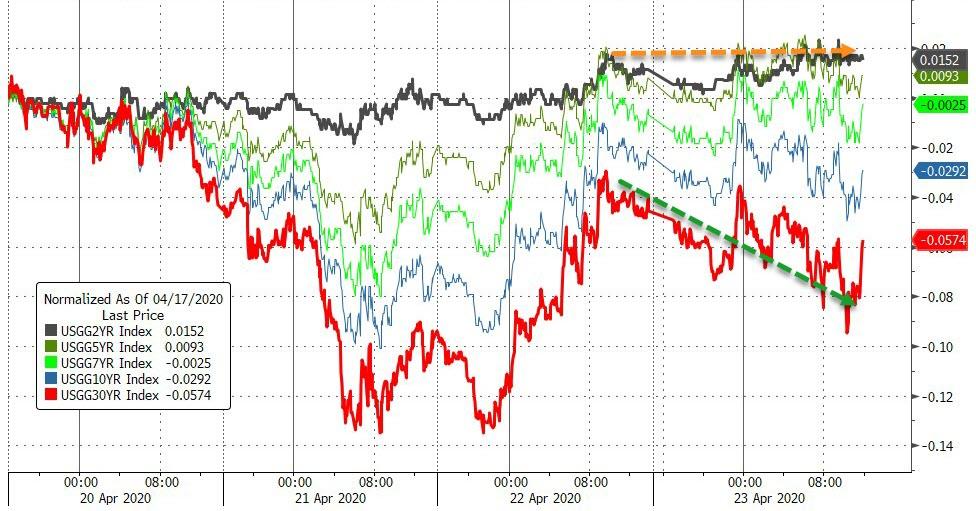

The long-end of the bond curve saw yields drop today as the short-end was flat…

Source: Bloomberg

Big divergence today between HY (down) and IG (up) bond prices…

Source: Bloomberg

The Dollar rallied for the 4th day in a row after Europe closed…

Source: Bloomberg

The Brazilian real collapsed to 5.5/USD – a record low…

Source: Bloomberg

The entire crypto-space was bid today with Ethereum leading the charge…

Source: Bloomberg

Oil futures (June WTI) rallied once again (as did USO modestly) but as the chart below shows, the muppets still don’t get it…

Source: Bloomberg

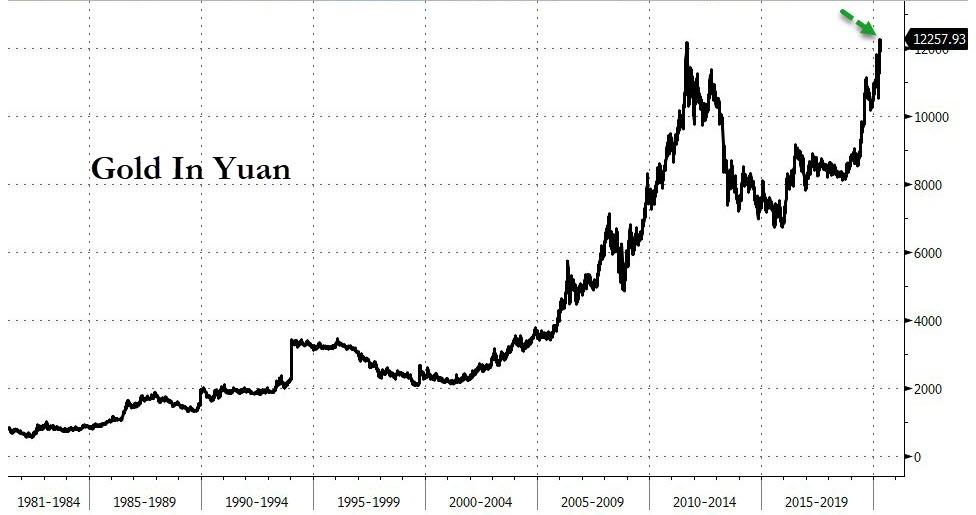

Finally, we note that Gold surged to a new record high against Yuan…

Source: Bloomberg

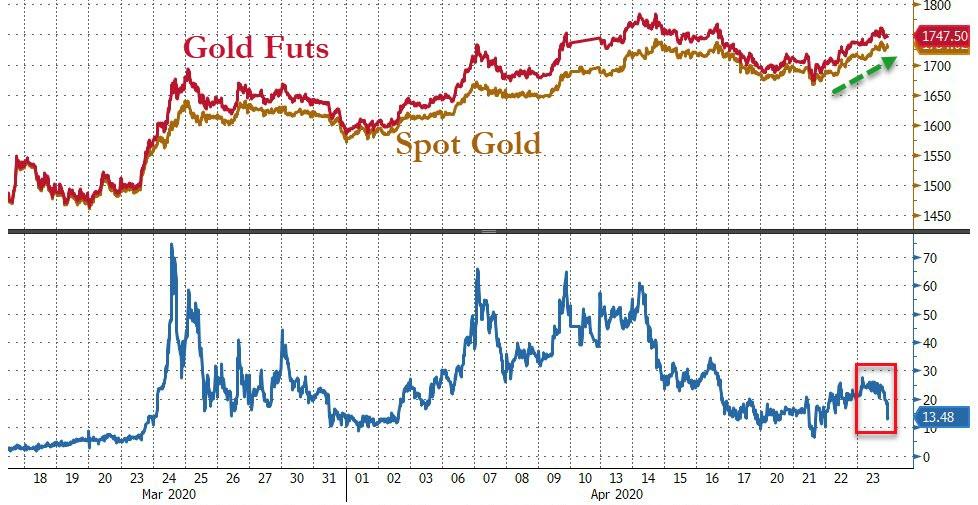

And while physical and paper gold were bid, the futures premium over spot compressed today…

Source: Bloomberg

You have to laugh… global stocks know something that the global economy doesn’t…

Source: Bloomberg

Tyler Durden

Thu, 04/23/2020 – 16:02

via ZeroHedge News https://ift.tt/34Z4Pkl Tyler Durden