What Rebound? Hedge Funds Have Been Selling For 8 Of Past 9 Days As “Global HF Heavyweights Remain Bearish”

Today’s market rebound was impressive, but after the first major sell-off in some time on Monday and Tuesday, it was not impressive enough for Nomura’s quant Masanari Takada who writes that what is going on in the market – i.e., the unprecedented arrival of negative WTI crude oil futures prices which seems to have dealt a blow to investor confidence – looks like the sort of shakeout from long positions that he has been expecting and “at almost precisely the timing we had expected.”

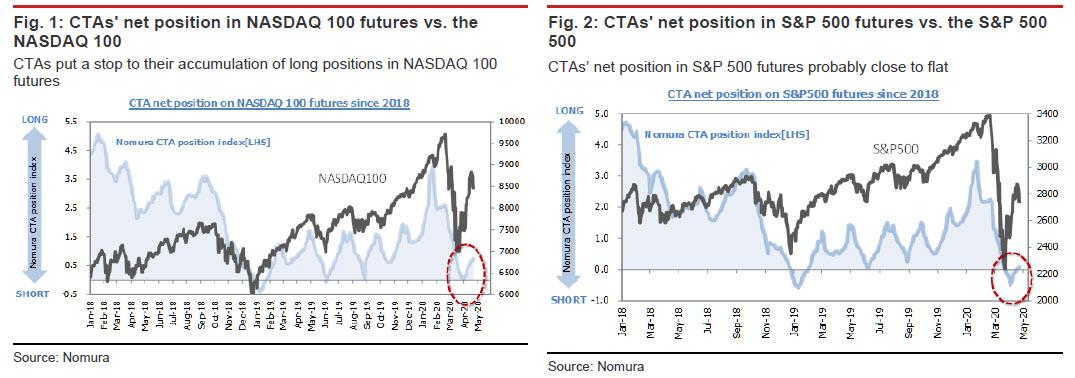

But while a gut feeling is one thing, a tangible reversal is something far more notable, and according to the Nomura quant, “it appears that CTAs have put a stop to their accumulation of long positions in NASDAQ 100 futures” and as a result, a key concern is whether the NASDAQ 100 manages to hold the line at around 8,180 that Nomura estimates is the average entry point for CTAs’ net buying of futures since the beginning of April.

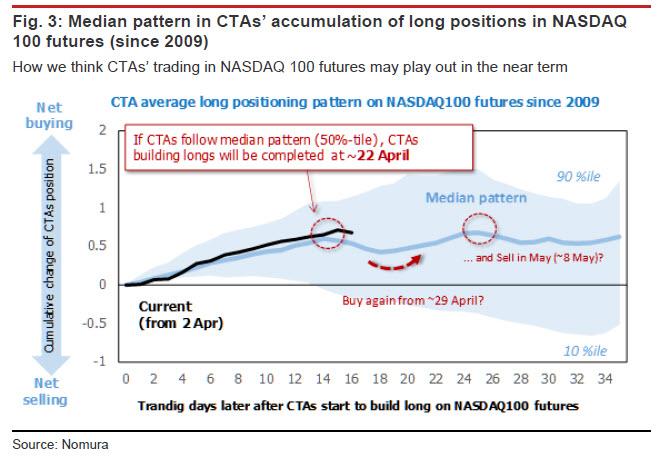

In terms of technical patterns, CTAs may take another stab at chasing the market up starting around 29 April, provided that the index stays above this line. However, if such an upside attempt were to fail to squeeze some investors out of shorts or convince others to stake out fresh longs, Takada expects the buying pressure generated by these CTAs on their own in the US equity market to fizzle out on or around 8 May: “This would imply a need to brace for selling in tune with the “sell in May” adage.”

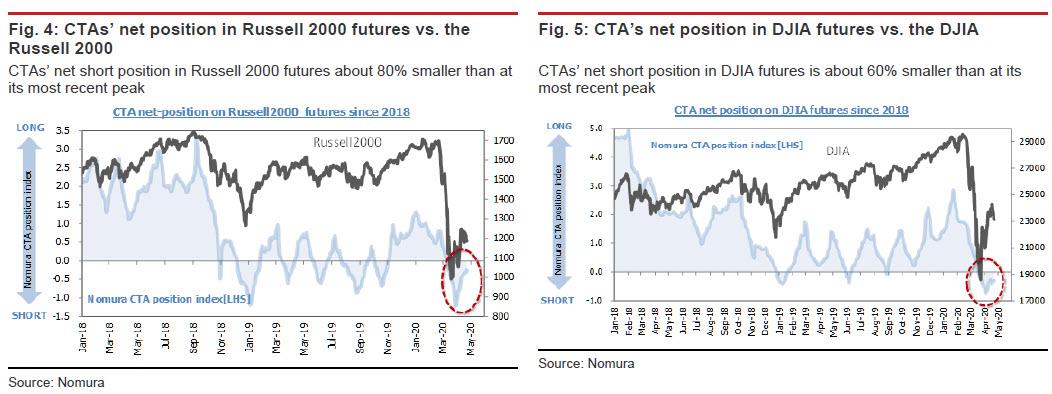

Recent reversal in the Nasdaq aside, CTAs still have outstanding net short positions in Russell 2000 futures and DJIA futures. However, their net short position in Russell 2000 futures is now 80% smaller than it was at its most recent peak, while their net short position in DJIA futures is similarly about 60% smaller than it was at its peak. So “what we are seeing now looks like a pause after a period of concentrated short-covering.”

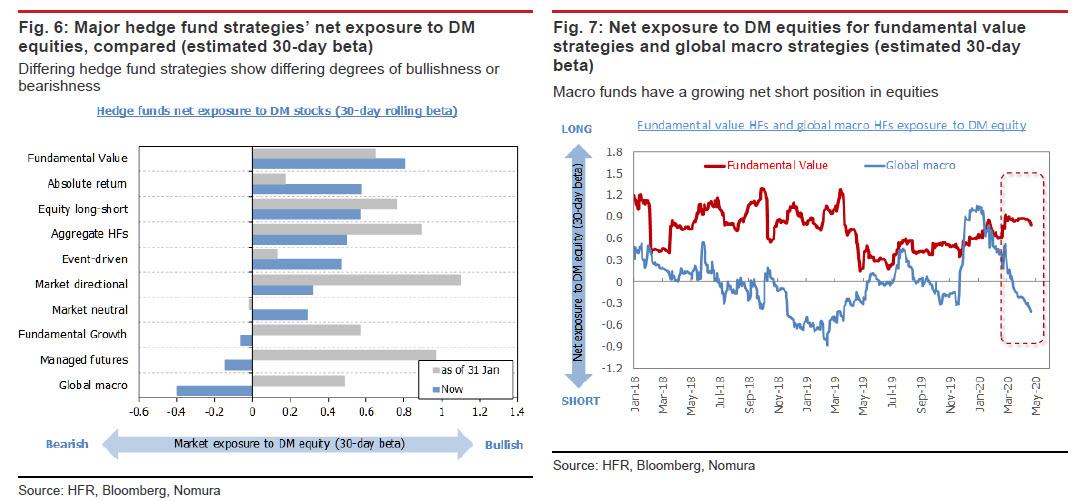

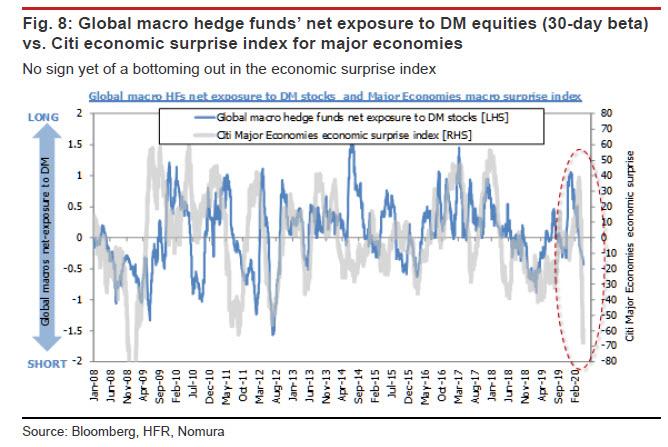

One notable observation, and a continuation of a trend we discussed late last week when we discussed that “Record Human Hedge Fund Selling Meets Furious Robot CTAs Buying“, is that unlike CTAs, global macro hedge funds – i.e., those controlled by humans – appear to be targeting further downside in DM equities. Indeed, as Takada writes overnight, “that the risk-off mood arrived just when historical patterns suggested it might lends further support to the idea that the buying of DM equities in April thus far has been powered by CTAs and other short-term trend-followers along with fundamental value hedge funds and other such perma-contrarians. Meanwhile, the funds looking least interested in buying have been those that focus mostly on fundamentals.”

Most interesting, and yet another indication that humans are not buying this rally at all – literally – is that according to Nomura, “the global heavyweights among macro hedge funds are still bearish on equities” and their trades targeting the downside are snuffing out early attempts by some investors to feel out the upside. “We suspect that global macro hedge funds will remain bearish until there is some reason to believe that DM economies are on their way to finding a floor”, according to Nomura.

Of course, investors could quickly become more optimistic before economic indicators have had a chance to bottom out. Should that happen, global macro hedge funds might have to make an emergency rush for the exits from their short trades.

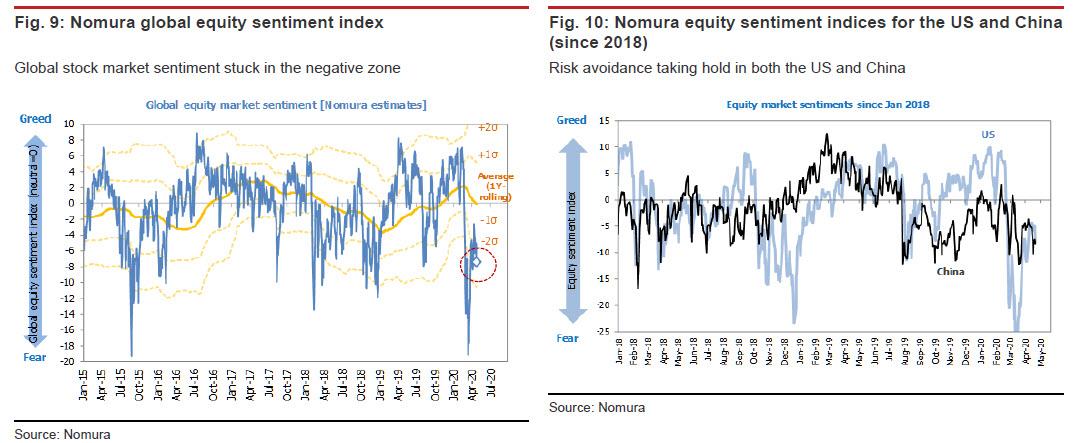

However, with equity sentiment stubbornly parked in negative territory, Nomura’s impression is that there is not much impetus among global macro hedge funds to rethink their current strategies just now.

All of this helps explain why as Morgan Stanley’s quants write, long/short hedge funds have sold longs for 8 of the past 9 days, and “were net sellers of equities again on Tues with selling led by L/S funds who were adding to shorts, and also selling on the long side.” As a result, net exposures fell further, down another 2% to 38%– a level which represents a near record low, or 2nd %-tile, over the last 12M and the 1st %-tile since 2010.

In other words, the ongoing war between human and machine investors wages with the former expecting the worst, while robots – who are obviously immune to the wu flu – understandably eager to push stocks back to all time highs.

Tyler Durden

Wed, 04/22/2020 – 20:25

via ZeroHedge News https://ift.tt/3cEutNL Tyler Durden