Unprecedented Pace Of Corporate Debt Issuance Has Crippled Corporate Fundamentals

When the Fed breached a monetary taboo even Ben Bernanke did not violate when Jerome Powell announced last month he would buy investment grade bonds, it was clear that the Fed’s only solution to avoiding the bursting of the corporate debt bubble was to make it even bigger. And sure enough, the Fed’s explicit backstop of the bond market has meant the supply of IG bonds has set a record pace in 2020. According to Morgan Stanley, IG supply has totaled $693 billion through mid-April, up a staggering 63% y/y…

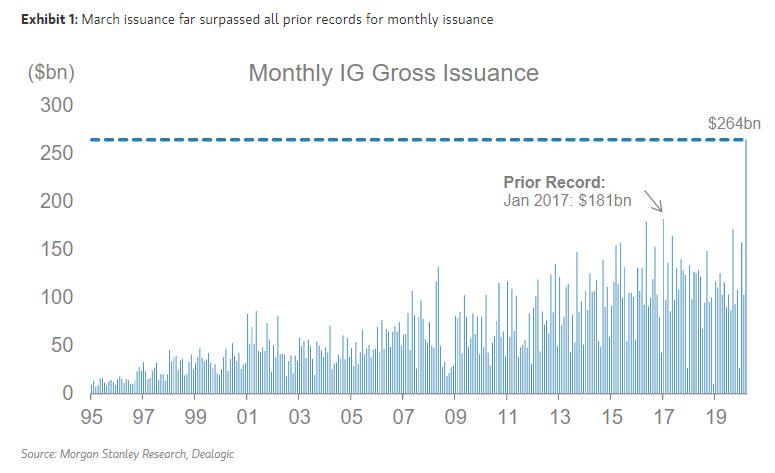

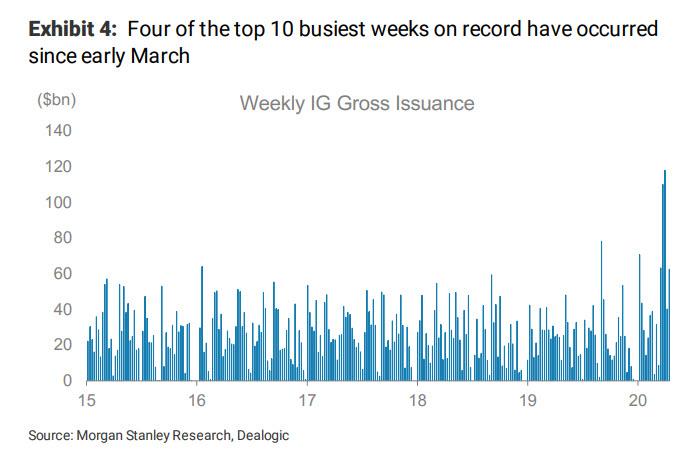

… with $435 billion pricing since the beginning of March alone. March supply set an all-time record at $264 billion, breaking the prior record by over $80 billion and a further $170 billion in the first half of April. To put that in perspective, the March total surpasses the prior record for the busiest month (January 2017) by over $80 billion. Issuance just in the first half of April already ranks in the top five busiest months on record. Four of the top 10 busiest weeks on record have occurred since the beginning of March, with the week of March 30 ranking as the busiest ever, at $118 billion of issuance.

All to say that this was truly an unprecedented pace. Year-to-date through April 17, total supply of $693 billion is tracking 63% ahead of last year.

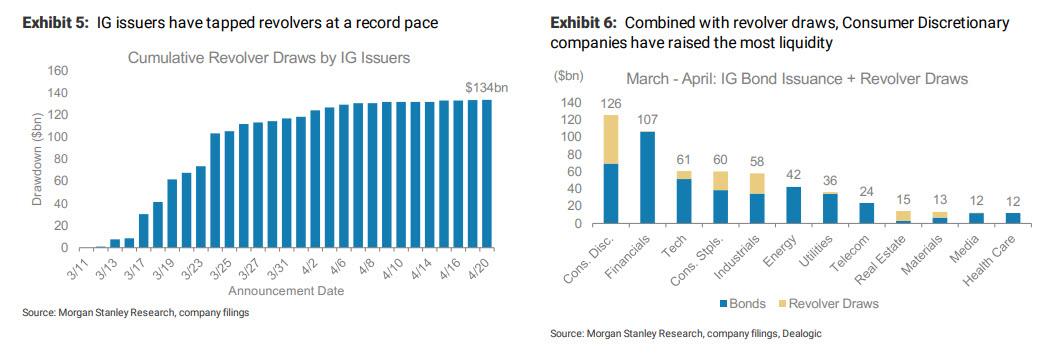

And confirming what we said a month ago in “Bond Market Tears In Two“, issuance has been heavily skewed toward high-quality issuers, with issuance rated “A” making up 57% of supply from the beginning of March onwards, for obvious reasons: these are the bonds that will find a willing buyer in the Fed via Blackrock’s purchases of the LQD ETF. Drilling down, consumer Discretionary companies have raised the most new debt financing when combined with revolver draws.

Of course, the Fed’s enabling of this epic bond bubble burst would have been impossible without the coronavirus crisis: the pandemic has produced an unprecedented market shock, with issuers experiencing an extremely sharp drop in earnings, without clarity on when the economy will begin to recover. Indeed, IG issuers have tapped financing wherever possible, including drawing on revolvers. Through April 20, IG issuers had tapped $134 billion in revolvers, putting combined bond issuance and revolver draws at $568 billion since the beginning of March.

And while trends in the use of those proceeds point to companies using debt issuance to shore up liquidity, the IG issuance momentum has been so powerful, companies have been using corporate bonds to refi some of the revolver draws in recent weeks, as we reported last week.

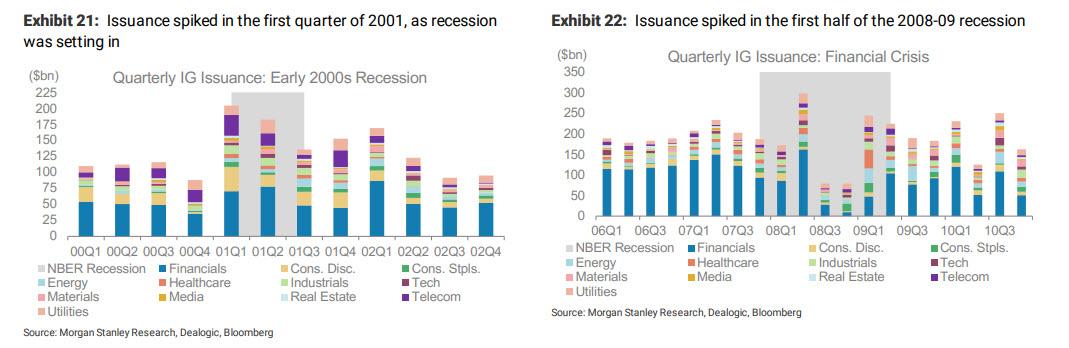

So while it is obvious by now that the Fed’s actions have triggered a tidal wave of new corporate debt issuance, one which will make the corporate sector scream for a bailout during the next, even bigger crisis, and the Fed will gladly bend over backwards yet again, what is perhaps more interesting is the fact that IG issuance tends to spike before or right at the

start of a recession, according to Morgan Stanley.

Looking at the period right before the early 2000s recession, trailing three-month issuance spiked in the same quarter that the recession started (1Q01). Similarly, issuance rose in the first-half of the recession surrounding the global financial crisis (peaking in 2Q08). As shown in the next two charts, in both instances issuance from “problem” sectors rose – Telecom in the early 2000s and Financials during the crisis. In the early 2000s recession, Consumer Discretionary issuance also rose sharply in the first quarter. However, in both cases, issuance did slow meaningfully from the peak for the remainder of the downturn, before returning to a more normal run-rate as the economy recovered.

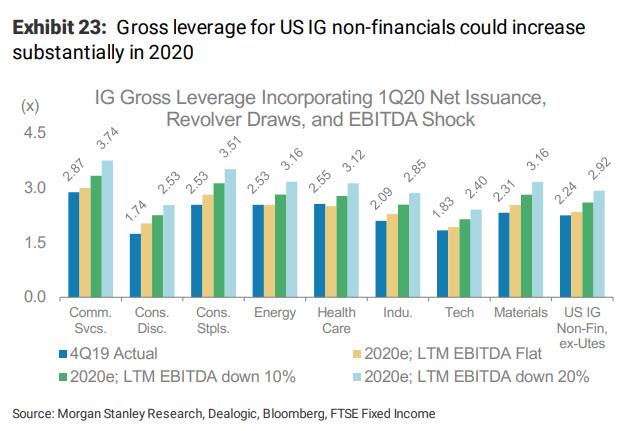

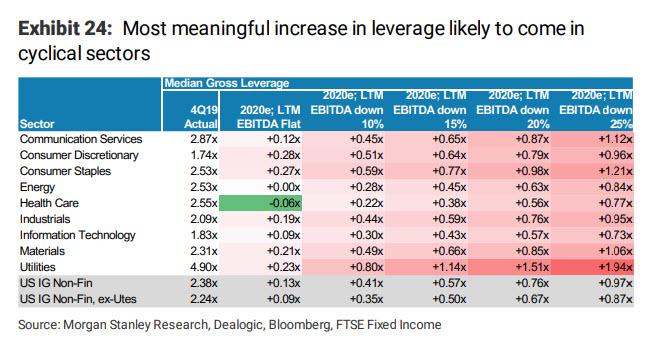

All of which leads us to the last question: what impact will all this issuance have on corporate fundamentals? Net of maturities, calls,and tenders, Morgan Stanley estimates net bond issuance for 2020 YTD to be about $400 billion. Including the draws that IG issuers have made on their revolvers, net issuance rises to ~$535 billion. To estimate how this level of issuance could impact leverage, the bank then takes its usual subset of US, non-financial companies in the IG index with publicly available data,and extrapolate from 4Q19 fundamentals. Across this subset of ~375 companies, net issuance has totaled about $314 billion when including revolver draws. These issuers had median leverage of 2.38x at the end of 2019.

Assuming flat EBITDA, the increase in debt alone could push gross leverage +0.13x higher. However, a severe shock to the EBITDA of these companies is now assured. As such, incorporating shocks to LTM EBITDA of 10-25% shows leverage could increase by +0.41x, to nearly 1.0x year. Overall, these results suggest that leverage peaks during or after a recession when earnings fall.

In summary, leverage is likely to rise across sectors.

The Consumer sectors could see the largest increase in leverage, followed by Materials and Industrials sectors. Health Care is the least impacted sector, with significantly less net issuance YTD than the others.

And so, as companies flood the market with new debt, they plant the seeds of their own overlevered demise, because while the Fed has made it frightfully easy for IG corporations to issue an unprecedented amount of debt, by doing so it has merely doomed even the most solid credits to a painful day of reckoning, one where they will have more net debt than ever, effectively assuring another avalanche of downgrades – many straight to junk – either in the current crisis, should its duration persist beyond worst case estimates, or in the next one, when the Fed will have no choice but to buy all the outstanding corporate debt.

Tyler Durden

Sat, 04/25/2020 – 23:33

via ZeroHedge News https://ift.tt/3bznwgV Tyler Durden