Blistering Demand For 5Y Auction Leads To Record Low Yield, Dealer Takedown

The US deficit is expected to soar to a record $3+ trillion this years… and Treasury buyers have no problem with buying all the bonds that will be needed to fund it.

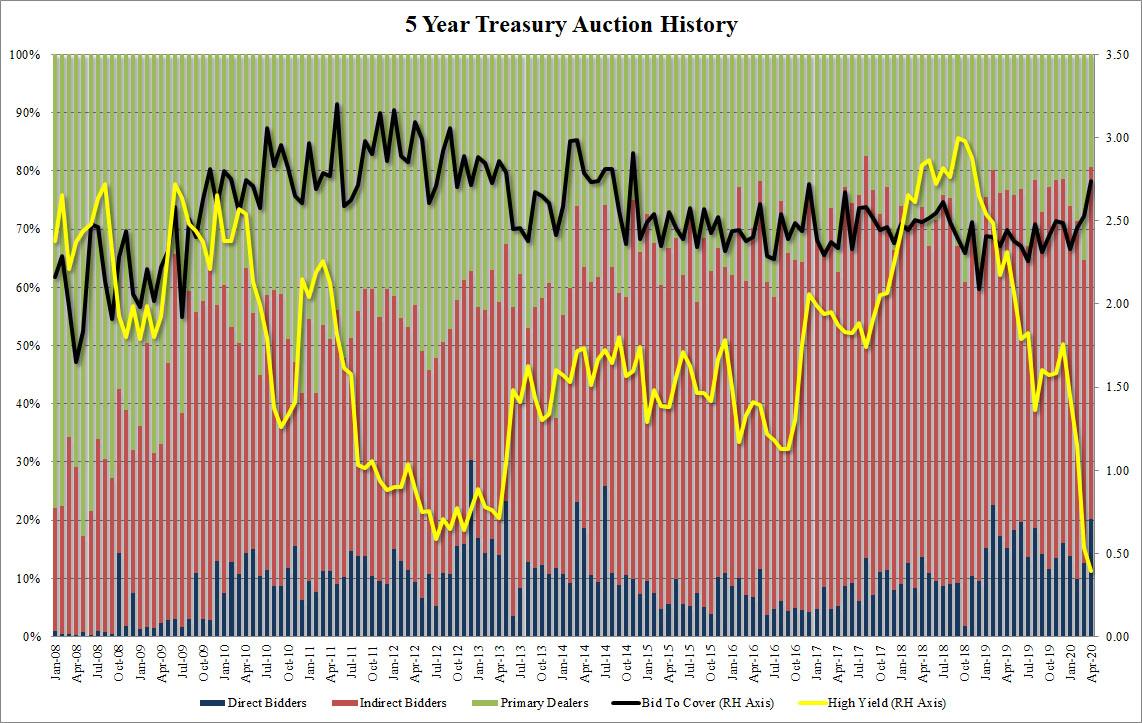

Just over an hour after tremendous demand met the Treasury’s sale of $42BN in 2Y paper as documented earlier, moments ago the Treasury’s sale of $43BN in 5 year paper was no less spectacular, with the yield not only tumbling to an all time low of 0.394%, far below the 0.535% in March now that negative rates are just a matter of time for the Fed, but also stopping 0.7bps through the When Issued.

While the Bid to Cover also jumped, it was not nearly as impressive the 2Y’s surge, if still a solid rebound to 2.74, far above the 2.53 in March and the highest since Nov 2014.

The internals were also solid, with Indirects taking down 60.4%, or well above the 52.1% in March, and Directs soared to 20.2%, the highest since February 2019. That left Dealers holding just 19.4% of the auction, the lowest on record.

And so, between tremendous demand for both 2Y and 5Y Treasurys, we wonder just what Lloyd Blankfein – who can’t figure out why anyone would buy US debt at prevailing rates when there are tens of trillions in deficit spending to be funded in coming years – is thinking.

Tyler Durden

Mon, 04/27/2020 – 13:30

via ZeroHedge News https://ift.tt/2S8ANFu Tyler Durden