A Violent “Slingshot” Higher: CTAs Flip From -69% Short To +100% Long On Close Above 2901

As BMO noted earlier today, when looking at the ongoing daily low-volume levitation in stocks, “there is a real risk the optimism is getting ahead of itself and equities are vulnerable to disappointment with the results of the reopening.” For now, however, the path of least resistance – and arguably the max pain trade – remains higher, due to the pent up optimism from the gradual reopening of the global economy (similar to the perpetual hope that was Trump’s Phase 1 trade deal with China for much of 2019) and as Nomura’s Charlie McElligott writes this morning, the global stock market “is breathing an ongoing sigh of relief with rolling lockdown unwinds/reopening plan releases around the globe: in the past 72 hrs, Italy, Spain, Belgium, France, Switzerland, Norway and Germany have updated details on relaxation of restrictions; in the U.S., Ohio, Mississippi, Colorado, Hawaii and New York all began announcing initial “easing” steps of stay-at-home orders.” All of this is contributing to a buoyant risk-asset move – with EU Banks and Autos again rallying powerfully = further pain-trade for these crowded “Cyclical” shorts – while the prior multi-month FTQ bid in US Dollar is incrementally “leaking” out with another large down day in DXY, as we noted in our market wrap.

As also noted previously, earlier in the session we saw WTI Crude and Gold powerfully hit with WTI front futures smashed yet again on more June contract selling from ETFs and Index products headlines as now S&P GSCI is also rolling from June to July in a race to the death vs USO and the negative feedback loop thereafter, but as McElligott points out, “this new escalation of the US Dollar weakness actually caused Commodities rally off lows—before CL1 now again under pressure as US traders get back to work.”

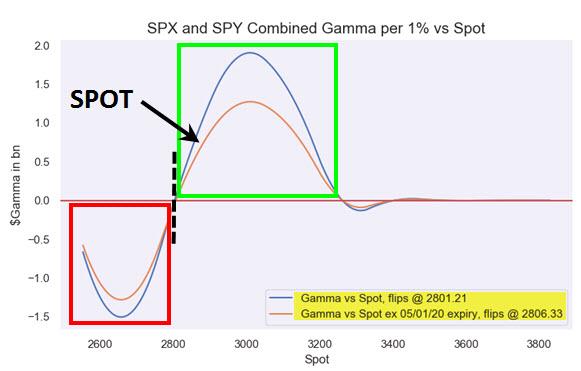

Meanwhile, with stocks now solidly in “positive gamma” territory…

… the Nomura strategist notes “the return of heavy overwriter (vol selling) flows in US Equities, a trend that has accelerated in recent weeks, and has helped normalize US Equities single name- and index- Vols”, and now, with the VIX curve term-structure too normalizing yesterday from the multi-month inversion in the front-end (i.e. again upwardly-sloping), Charlie believes that “it is likely that the return of systematic roll-down participants will further escalate the repricing / compression of Vol even lower.”

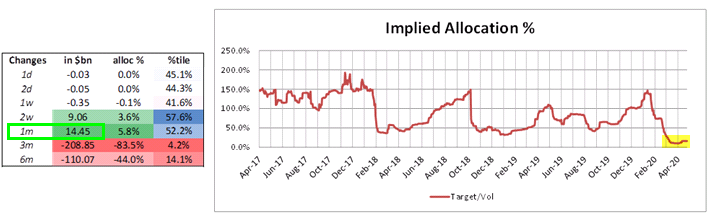

Focusing on the last point of normalizing/compressing Vol, something which McElligott has previously called a “Crash DOWN, Crash UP” cycle, he points out that “it matters as a second-order slingshot in dictating a mechanical RE-LEVERAGING across the Vol Target universe into re-establishing or growing their Equities positions.”

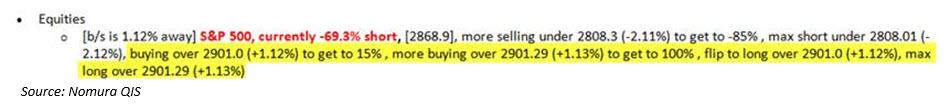

There is no clearer example of this than today’s Nomura QIS CTA Model, which estimates that the CTA position in S&P 500 futs would flip from “-69% Short” to a “+100% Long” on the close above 2901 (right on top of spot), with Charlie adding “that anecdotally on these days where the model indicates a “flip” potential, said buying to cover and go long is likely already part of the flow creating the current move (ES1 +1.2%)“

This CTA reversal would come in conjunction with Nomura’s analysis of Vol Control funds, as we estimate an incremental “re-buy” of +$14.5B of US Equities off the lows over the past 1m for these mechanical products.

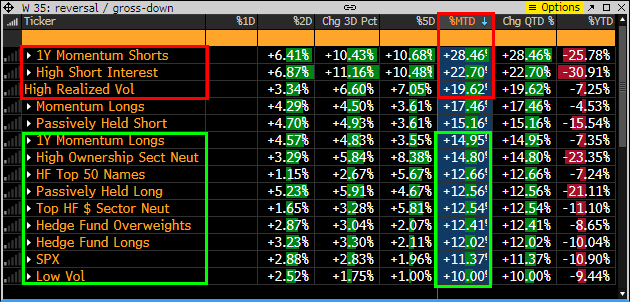

One place where this equity “slingshot” hurts the most is the “pain” for the shorts with Cyclical Equities where yesterday was yet another performance bleeder, as US shorts again significantly outperforming longs as we noted in our Monday EOD wrap, thus Charlie’s “1Y Price Momentum” factor market neutral strategy was again hammered -2.8% yesterday and now -13.5% MTD—particularly boosted by the “bear-steepening” in UST curves as a macro catalyst (which was fueled by not just the +++ risk-asset move and well-subscribed UST front-end issuance, but also the $24B of new US high-grade paper brought yday).

Why are shorts getting steamrolled? As the Nomura strategist explains, the extreme positioning/crowding resulting from the Covid flight to safety into the “Everything Duration” / “Slow-flation” barbell longs (Secular Growth and MinVol / Defensives), in conjunction with the seasonality of the “April Momentum Reversal,” the rolling “whatever it takes” moments for both Central Banks and Governments, as well as Equities’ ability to pull-forward good news (i.e. COVID-19 curve flattening, reopening plans) “all made for this painful set-up in the folks’ short-books—exactly as laid-out in my March 31st note “WATCH YOUR CYCLICAL-BETA SHORTS INTO APRIL’S “MOMENTUM REVERSAL” SEASONALITY, “PEAK COVID” PULL-FORWARD, MONPOL EASING AND FISCAL STIMULUS.”

Tyler Durden

Tue, 04/28/2020 – 09:49

via ZeroHedge News https://ift.tt/3bN21cq Tyler Durden