US Home Prices Surged In February, But…

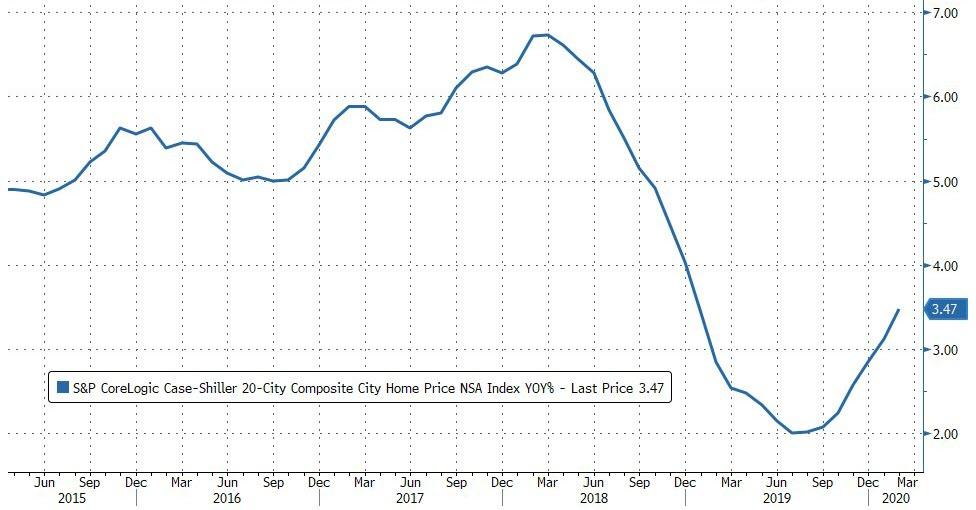

After a slight disappointment in January, analysts expected US home price growth to relatively stable… but instead it re-surged – rising 3.47% YoY (for the 20-City Composite) – the best YoY gain since Dec 2018.

Source: Bloomberg

Phoenix, Seattle, Tampa, Charlotte reported highest year-over-year gains among 20 cities surveyed, but…

“Importantly, today’s report covers real estate transactions closed during the month of February, and shows no signs of any adverse effect from the governmental suppression of economic activity in response to the COVID-19 pandemic,” Craig J. Lazzara, global head of index investment strategy at S&P Dow Jones Indices, said in a statement.

“As much of the U.S. economy was shuttered in March, next month’s data may begin to reflect the impact of these policies on the housing market.”

But, of course, this data – as always with Case-Shiller – lags dramatically and since February, a lot has happened. So the question is – what happens next for home prices?

Source: Bloomberg

With all the smoothing in the index, we suspect not a lot, but under the surface of plunging sales, plunging homebuyer and homebuilder sentiment, and soaring mortgage deferrals, nothing good is coming soon in the US housing markets.

Tyler Durden

Tue, 04/28/2020 – 09:02

via ZeroHedge News https://ift.tt/3bG495T Tyler Durden