China’s ‘Belt And Road’ Partners Beg Beijing For Bilateral Bailouts

China’s cash-strapped partners in their “Belt and Road” (BRI) global development project have been begging Beijing for debt relief amid the coronavirus pandemic, according to the Financial Times.

And according to Chinese policy advisers, the Xi regime is considering several options – including suspending interest payments on loans from the country’s financial institutions. That said, outright debt forgiveness is unlikely.

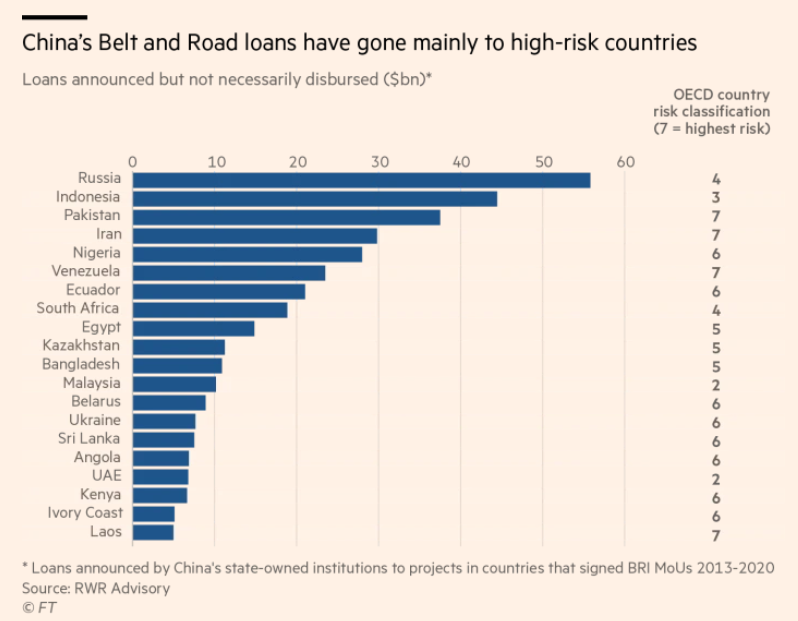

According to Washington-based consultancy RWR Advisory, Chinese financial institutions have lent an estimated $461bn for BRI projects since 2013 – making it the largest development initiative in the world.

“We understand a lot of countries are looking to renegotiate loan terms,” said one researcher at China Development Bank, which spearheads hundreds of billions of dollars in BRI projects globally along with the Export-Import Bank of China.

“But it takes time to strike a new deal and we cannot even travel abroad right now. The BRI loans are not foreign aid. We need to at least recoup principal and a moderate interest,” said the researcher on condition of anonymity.

“It is OK for 20 per cent of our portfolio projects to have problems,” they added, “But we can’t tolerate half of them going under. We might consider extending loans and giving interest relief. But in general our loans are issued according to market principles.”

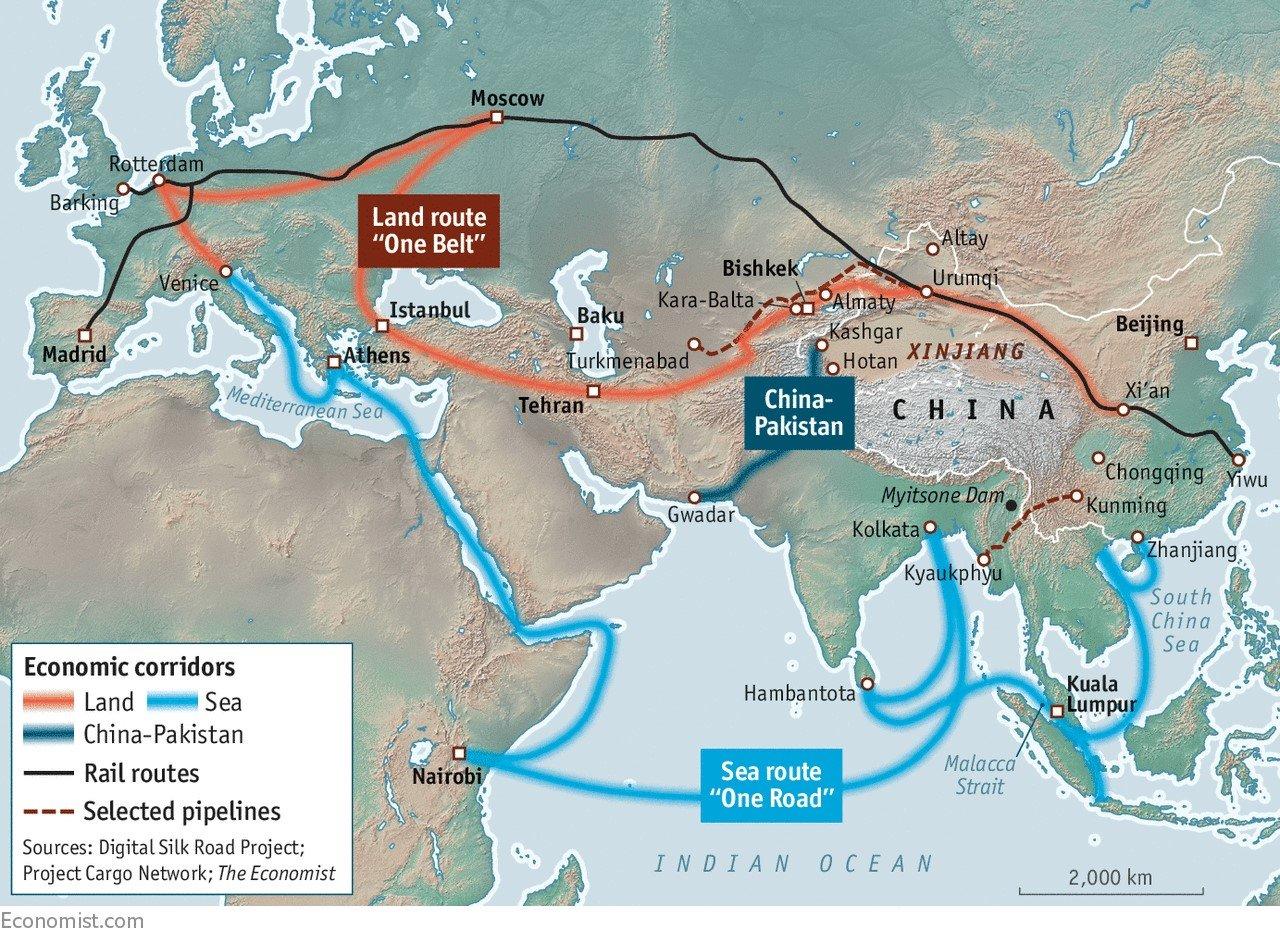

The BRI, which was launched in 2013 as the signature foreign policy initiative of President Xi Jinping, is aimed at building infrastructure and boosting China’s influence around the world. Most of the 138 countries that have officially signed up to the BRI are developing nations, many with the weakest credit ratings in the world. -Financial Times

In particular, BRI partners in several African nations – which have received approximately $143bn in BRI loans between 2000 and 2017 – are understood to have applied for debt relief.

A policy adviser to the Chinese government, who declined to be identified, said that Beijing’s preferred option in dealing with national requests for debt relief would be to “suspend interest payments” on loans.

However, some borrowers with “good market order” may be allowed to reschedule their loans. Forgiving debt permanently would be a “last option”, the adviser said. -Financial Times

Earlier this month China agreed to freeze bilateral loan repayments for low-income countries until the end of the year, agreeing to a G20 initiative which covered “all official bilateral creditors,” including lending from Chinese policy banks.

That said, diplomats say that the process of sifting through which loans from various countries would be eligible, while negotiations are being undertaken with China on a bilateral basis. According to the FT, China consequently has a ton of leverage.

According to researcher Mei Guanqun of the Beijing think-tank China Center for International Economic Exchanges, China has yet to solidify plans for dealing with the mounting debt-relief requests.

“But there are a few rules of thumb,” he said. “First, China’s commercial banks like [Bank of China] and [Industrial and Commercial Bank of China] are unlikely to forgive loans because they are under pressure from Beijing to meet financial targets.”

“Second, China Development Bank and China ExIm Bank may provide sovereign loan relief to countries that are friendly with us,” added Mei. “We may cut interest rates by a few percentage points or have it removed. We could also reduce principal payment by a moderate amount. The idea is to keep borrowers from going under, which may undermine our interest.”

According to Andrew Davenport, COO of RWR Advisory, Beijing is concerned that BRI will be interpreted to have resulted in “predatory economic behavior” by which China will be able to claim valuable assets as collateral when countries can’t pay their debts.

“The narrative certainly matters and indeed they seem to worry about it,” said Davenport. “If they can persuade people not to always be looking at what mischief Beijing is up to but rather to see the ‘goodness’ on offer, that’s a winning formula for China.“

Tyler Durden

Fri, 05/01/2020 – 01:10

via ZeroHedge News https://ift.tt/2YtK1Qu Tyler Durden