Exxon Reports First Quarterly Loss In 32 Years

The energy industry is truly reeling.

One day after Shell unexpectedly cut its dividend for the first time since WWII, supermajor Exxon Mobil reported its first quarterly loss in 32 years amid a glut of oil, a global recession, and a pandemic that has forced billions of people to stay indoors instead of driving, destroying petroleum demand.

The company reported a $610 million loss for the quarter ending March 31, equivalent to a 14c loss per share in 1Q versus earnings per share estimates of around 55c Y/Y. First-quarter results are a reminder that the worst has yet to come, as lockdowns only began around mid-month, so the quarter only captured about 15 days or so of demand destruction.

Here are some of the highlights from the 1Q earnings report:

- 1Q production 4,046 mboe/d, +1.6% y/y, estimate 3,943 (Bloomberg Consensus)

- 1Q capital expenditure $7.14 billion, +3.7% y/y

- 1Q production 9,396 mmcfe/d, -5.3% y/y, estimate 8,633

- 1Q chemical prime product sales 6,237 kt, -7.9% y/y

- 1Q downstream petroleum product sales 5,287 kbd, -2.4% y/y

- 1Q cash flow from operations and asset sales $6.36 billion, -25% y/y

- 1Q refinery throughput 4,060 mb/d, +4.5% y/y

Exxon also announced it is “reducing 2020 capital spending by 30 percent and cash operating expenses by 15 percent. Capex is now expected to be approximately $23 billion for the year, down from the previously announced guidance of $33 billion.”

“COVID-19 has significantly impacted near-term demand, resulting in oversupplied markets and unprecedented pressure on commodity prices and margins,” said Darren W. Woods, chairman and chief executive officer.

“While we manage through these challenging times, we are not losing sight of the long-term fundamentals that drive our business. Economic activity will return, and populations and standards of living will increase, which will in turn drive demand for our products and a recovery of the industry.”

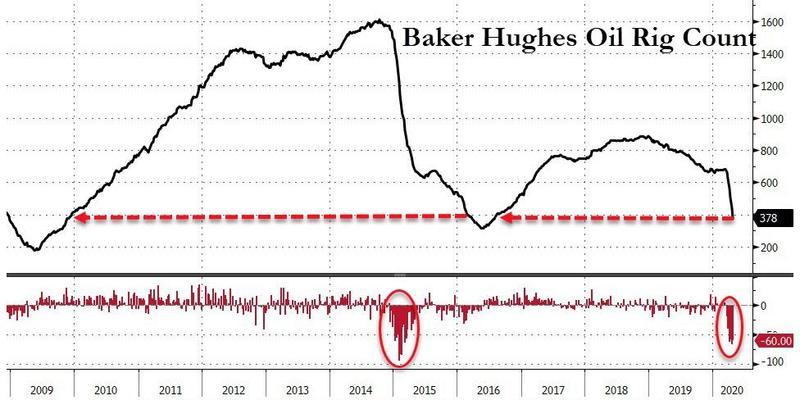

We have noted in the last several weeks that a bankruptcy wave in the oil and gas complex has begun. Producers have slashed spending amid collapsing energy demand. The economic downturn has destroyed tens of billions of dollars in value for shale companies, rigs are being taken offline, and thousands of jobs eliminated.

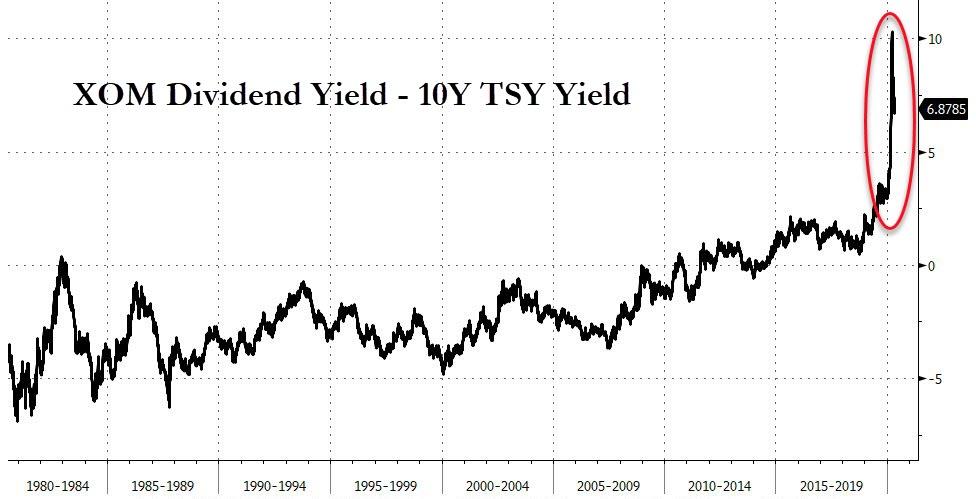

While it did not follow in Shell’s footsteps and cut its dividend, Exxon kept its dividend unchanged for the first time in 13 years earlier this week. The current dividend yield is near its absolute record highs.

But on a relative basis the yield is an extreme outlier…

Exxon shares are widely unchanged after the earnings announcement. Shares doubled over the last 27 sessions from mid-March despite deteriorating fundamentals, mostly the result of a technical bounce after a halving in share price was seen from early January to mid-March.

Tyler Durden

Fri, 05/01/2020 – 08:18

via ZeroHedge News https://ift.tt/35mCTXA Tyler Durden