Here Is Hugh Hendry’s 3-Step Plan To Save The World From Financial Collapse

It’s official: despite still technically retired in St Barts where he is a “luxury real-estate, mentor, advisor, paddle-surfer” according to his twitter profile, last week’s markets tweetstorm appears to have awoken if not the investing, then at least the analytical “primal urge” in the Scottish investor, who ran the Eclectica macro hedge fund for 15 years until he shuttered it in September 2017 (his farewell letter can be found is here) disgusted with how broken and impossible to navigate capital markets had become as a result of central bank intervention.

And in case it wasn’t clear that after a three year hiatus Hendry suddenly finds himself having much more to say, late on Friday the macro investor followed up last week’s “inaugural” commentary with another massive tweetstorm (Hugh: it may be easier to just write a blog post or alternatively, send it here and we will post it), spanning hundreds of tweets, discussing – in far more whimsical, if typically Hendrian terms – what is arguably the most important concept: when does money printing become inflationary (i.e., the catalyst that will make David Einhorn’s long-term forecast correct).

But first, as a reminder last Friday, Hugh Hendry reverted to his investor roots, discussing the fate of gold and the dollar in the helicopter money regime, what it would take for the S&P to hit 10,000, whether the entire VIX regime is now inverted due to central bank backstops, and asks the “two key questions”: are we transcending from a bull market in fear to a bull market in WTF!? And will QE infinity differ from its previous vintages by driving risk asset volatility levels higher??

Over on hughhendryofficial pic.twitter.com/WW4ByuNQRg

— Hugh Hendry Eclectica (@hendry_hugh) April 29, 2020

Hendry also touches on an old favorite topic, namely hyperinflation, a thesis which he thinks “needs stock prices to fall further and vol to rise in the conventional manner.” But his most topical observation is what are the core criteria that will allow MMT – i.e., that fusion of the Fed and Treasury known as “helicopter money”…

you can print as many dollars as you damn well please, as long as the yield curve doesn’t steepen and the dollar doesn’t rally precipitously…you’re good to go and MMT is dope.

… as the alternative is game over. As usual, his stream of consciousness answers, right or wrong, were fascinating and could be read in their entirety here.

Fast forward one week later when we got “part two” from the Scottish investor – perhaps best known for his 2010 full-frontal assault on Jeffrey Sachs and the immortal words “I recommend you panic“, when Hendry explained accurately why the current central planning takeover would lead to much more pain in the future…

“Let’s purge this system of its rottenness. Let’s take on a recession. It’s going to be tough, people are gonna lose their jobs. They are going to lose their jobs anyway. We can spread this over 20 years, or we can get rid of it over 3 years.

… something which was clearly correct now that we are 10 years through Hendry’s 20 year forecast, and as we can observe in real time, to keep the system from imploding due to the accumulated “rottenness”, the Fed was forced to inject and backstop a record $12 trillion in just a few short weeks.

Below is the full stream of twitter consciousness which as expected is just as disjointed, as it is insightful, and every bit the Hugh Hendry we had grown to admire (and periodically criticize, especially after his odd “conversion” phase) over the past decade.

In it, Hendry – and this is our best attempt at actually grasping what he is trying to say – proposes a 3 Step mechanism for fixing the broken world, one which revolves around the following i) undoing capital limitations that would enable banks to lend much more aggressively while phasing away concerns about “moral hazard” and the great bank bailout of 2008; ii) end negative rates and force positive rates across the globe; and iii) “reintroduce central bank Window Guidance” giving banks a quota for their loan book and a targeted growth rate.

Now, we don’t necessarily agree with Hendry’s proposal – after all there is now so much debt in the world that artificially hiking rates far above r-star (which according to Deutsche Bank is now -1% in the US so one can imagine what it is in Europe and Japan) would lead to an immediate and catastrophic collapse in bond prices. On the other hand with central banks now monetizing virtually all securities, and bond markets no longer signaling anything, one would not have an incentive to sell bonds even if yields were to spike – since central banks would backstop everything. And so, in a perverted way Hendry’s proposal may actually work.

On the other hand, and we will discuss this later, there also needs to be loan demand instead of just supply. And the fact that the government’s PPP program is not based on loans at all but forgiveable grants, is precisely what there has been over $600BN in demand for the Paycheck Protection Program. If these funding facilities were structured as plain vanillla loans at slightly punitive rates (to invoke Bagehot), there would be virtually no demand and none of the money the government and Fed had created would flow through to the economy.

Long story, short, for there to be loan demand in the future, loans may all have to be structured as grants, which is possible for a government that can just print money but is impossible for banks which obviously can only take so many loan losses.

In any case, the reality is that the current status quo is also completely unsustainable – as the recent bailout of everything has shown – and so it may be that trying anything would be better than merely enforcing the same broken policies that have led the entire world to the edge of hyper(deflationary/inflationary) collapse.

And with that, without further ado, here is Hugh Hendry’s 3-step plan to save the world, as tweeted late on a Friday night..

We’ve never seen the phenomenon of simultaneously higher equity prices and a shift higher in the VIX curve without a state of hyperinflation; except at the start of Abenomics for 1-2 months in 2012 and maybe now…

But it’s a HUGE ask to imagine that April’s moves in VIX and SPX, allied to promises of further gigantic central bank printing, will prove a precursor to runaway inflation. But heck, let’s give it a go…

Crudely put, it seems more likely that this 2020 helicopter money is simply filling the great landfill dump left behind by the furloughing of the global labour market this year; that the CBs have replaced the normal monetisation that would emanate from an active labour force.

What might deliver a tipping point – where bank printing outweighs every other factor and we experience runaway prices? Clue: the answer is always in what I don’t write.

I’m going to attempt this thought exercise tonight

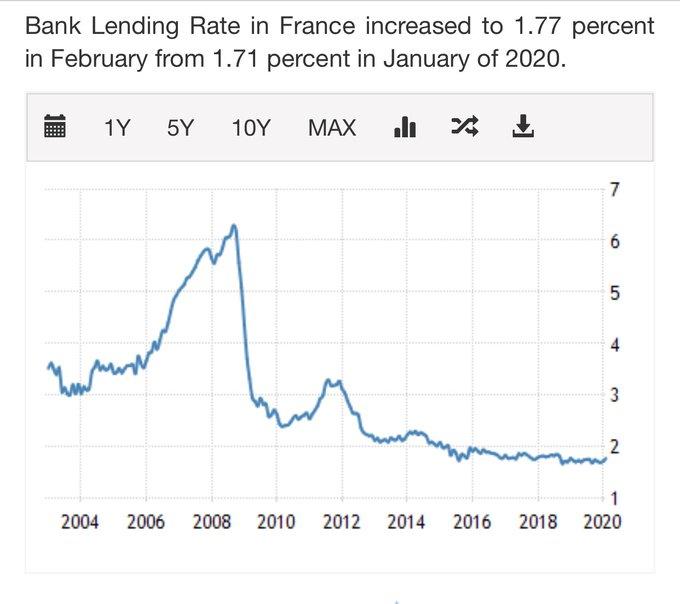

But first, let’s look at the abysmal chart of French bank lending

If you have the 50y data series, please share. But it kind of looks like a GOLD/SPX chart from the 1990s. Right? Hey to a man with a hammer, everything looks like a nail

Loans were expanding @ < 2pc p.a. before the pandemic. Looking forward, I think they are going to take off; or rather, this is an absolute requisite if we are to stave of the march to serfdom and prevent political extremists attaining the highest offices of government

But having lost so much precious time dithering, we may have to experience runaway prices as the quid pro quo. Hey! Shit happens. I really can’t imagine a scenario where a Hank Reardon saves the day. Can You?

Ok hold that thought! Cause first we got to remember that before this calamity, Macron, decided to shake up France’s overly generous state pension system. Quelle bêtise.

Imagine, we’ve had a 50y cycle that allocated more and more of the economic spoils to creditors and a FRENCH President just announced an attack on the proletariat. Hold on! Wait a minute? It’s like handing the DJ a cassette player…

But then this is the country that elected the ultra-leftie Mitterrand as President of the First Republique and he invited the Communist Party to join his government at the beginning of this cycle in 1981. I mean 1931 and the guy is a forward-thinking master of the universe but 1981 with the proletariat in it’s ascendancy and downtrodden creditors having retreated to the ghettos? It’s like a bully who can only find his courage in a crowd.

As contrarian signals go the French are a perfect indicator of where we are in the 50y cycle of wealth redistribution. The last adopter surely must always be the President of the Republique. Right? After 50y of this we all know that you only fight when the economy is set to boom.

The global dream of an endless arc of rising economic prosperity is in jeopardy and this is no longer happening. Since the GFC, our Wesley Mouch type policymakers have consistently “mouched” their way through the manual of how to remedy an economy made vulnerable from a shock

It didn’t have to be like this.

The valedictory sound of “mission complete” first sounded along this bureaucratic blunder-path to radicalism when, and for good reason, they bought private debts at way above face value through regimes such as TARP I & II

Normally a sure-fire thing way to restore vitality to a devastated post-shock economy. Helpful. Relevant. On point. Courageous. I loved this!

But no bank-boom; no huge lift in GDP.

Again, and for good, sound reasons, they declared, “mission complete”, when they really went for it and loaded up on radicalism and opted to return huge flows of money to the private sector. Subterfuge for sure but QE enabled the banks to make significant profits – the classic market cornering -where your independent, some might say lawless, central bank buys with the objective of creating a Hunt Brothers’ Bubble in Treasuries where private banks invest heavily.

Controversial to many for sure but no complaints from me. I give them an A+ for this exemplary move. But bank boom? Explosive GDP growth? Nada…So 2 textbook steps forward but little payback. What gives?

They have been undone by a collective failure to grasp the principle that GDP growth rates are determined by the momentum, the mojo, the VELOCITY, if you will, that only comes from an expansion of private sector bank balance sheets.

And hence my deliberate omission from earlier. Changes in money supply equal changes in central bank plus commercial bank assets. But moral hazard busted this equation…

In the frenzy of fear and recriminations that was 2008-9, centrist parties whimsically determined that as taxpayers were not responsible for the GFC (really?) then they – the State – did not have a mandate to foot the recovery bill. Caution: Ideology Alert!

As a consequence, it became preordained that all of the rise in the money supply had to come from the expansion in public or central bank balance sheets. A great depression averted but at the cost of economic dynamism. Bash them banks all you want but no loan growth begets no loan growth begets a fossilising economy were GDP can’t grow nowhere near damn fast enough to right ‘em wrongs.

Japan anyone?

All the central bank money printing in the world isn’t going to generate runaway prices if private sector banks are not expanding credit!!

So what has to happen?

It is not difficult to nudge the economy back into action. Ideology brought us here. Drop the dogma and we recover. Heck there’s even a manual residing somewhere in every government treasury department that explains exactly how to do it. Otherwise, appoint HughHendryOfficial to advise your sovereign Treasury and I promise that my team and I will generate “dynamic” GDP growth. Just tell me the number you desire cause I’m your supplier.

Step I: First things first, on the first day of my appointment, I’m going to ditch this moral hazard nonsense and rescind the longest suicide note in economic history a.k.a., Basel III: International Regulatory Framework for Bank Supervision.

Let me read directly from the macro manual. Rule no.1 clearly stipulates that accounting changes should be introduced to improve bank profitability which will beget more capital strength and more risk appetite; vigorous loan growth will ensue. I scream, you scream, we all need ice-cream! These bozos implemented the reverse!!!

However, it’s just possible that the legacy of the pandemic a.k.a the phantom menace, may allow scope to reverse this idiotic regulation; let’s hope so.

Step II, I’m going to reverse negative official interest rates in Europe and Japan. I’m not smart enough to understand everything. But I watch, listen and I try to improve. And those voices in my head keep telling me that those neg rates are counter-productive. How else do you explain the disparate performance of US banks vs. their Japanese and European cousins? Can someone chart and share this please? So I’m gonna raise rates folks; Volker, anybody?

Shorn of ideology deflation can be averted.

But to return to the future we most likely have to visit the past. To conceive of this, I want you to try the following mental exercise. Think of a glossy Steve Jobs, promo video showcasing not the latest iphone but instead the economic milestones of the last 50 years.

Volker raising rates to tame inflation, quantitative restriction of the money supply, independent CBs, less powerful unions, liberalisation of the capital account, no unemployment, rising profits, risk taking, entrepreneurship, dynamic economies, the liberation of billions from the tyranny of state planning…

Done that? OK, now I want you to replay that same movie but only in reverse, and in slow motion, with interest rates being cut to negative, with market rates determined by the public sector, with the loss of CB independence, with quantitative expansions of the money supply. With less and less risk taking and lower rates of prosperity, less technology breakthroughs, less free markets and more government-set prices. An economy where everyone is on the payroll of the State.

It’s a dirty business but who ya gonna call? If it’s HughHendryOfficial then…

Step III will see us quietly, and without pomp or ceremony, reintroduce central bank Window Guidance whereby commercial banks will be given a quota for their loan book and a targeted growth rate.

The Princes of the Yen describes this technique well. The political imperative in Japan in the late 1980s was to stoke a domestic boom to deflect international pressure from the US regarding the Japanese trade surplus. Japan’s commercial banks grew their risk assets by 15pc pa between 1986 and 1989 and everything boomed.

Normally the circuit breaker is you and me. It’s we who work out the unsustainable nature of a fiat directed bank loan expansion. It is we who see the tower of riskier and riskier loans and its power to generate reflexively even riskier loans and huge unproductive investment.

Because, You & Me, we see things differently. It is us who head to the exit first and that’s why it’s You & Me who are going to live forever!

Sorry, I digress, where were we? The ensuing currency crisis. It usually puts a brake on the expansion. However, Japan, with a capital account of more than $200bn, rivalling the firepower of the IMF at the time, had no currency crisis; you want to pick a fight with a monster?

The hammer when it fell was simply an ideological change by the policymakers. Revolted by “les noveaux riches” and with a titanic battle of egos raging between MoF and the BoJ, policymakers chose to reverse their loan program. And, lacking a bid, risk assets crashed. It wasn’t about super sky high equity valuations. It was simply a change in bureaucratic ideology…damn dogmas.

Anyway, put me in charge of the ECB and I’ll deliver 3pc GDP growth across the continent by 2023ish; it will be easy. I’ll raise official policy rates, abolish Basel III and by re-introducing window guidance, I can command that European banks expand their balance sheets by 10pc.

Failure will be punishable by loss of quota. You wanna misbehave?

Not convinced? I hear you: the macro community are going to see a bozzo like me coming from miles away. Rapid private sector bank lending, riskier and riskier lending, debt fuelled asset purchases, bubbles – the €uro will plummet, and my German paymasters will kick me out.

Or will they? Is it inevitable that the €uro crashes under this scenario? I don’t think so because the U.S. Treasury has my back. Bitch!

Remember they promised to stop at nothing to prevent a sharp deflationary rise in the external value of the $. And so, like my brethren at the BoJ, so many years ago, I think I‘ve got job security. Just don’t re-introduce moral-hazard cause I’m the guy who’s gonna take you higher

I know you think this is fanciful, and for sure I won’t argue, but hear me out just a little longer. I promise I’m nearing the end. Let’s talk about me. Like the film, The Truman Show, I’m an investor living inside my investment. Weird, huh?

To the un-initiated, my Vol @ the End of the World Trade is to own client financed, one-of-a-kind, real estate on the tiny island of St Barts, funded by €uro matched, fixed, 20-year money at 2 or less percent. Recently my phone has never stopped ringing. It’s my French bank; they called to ask whether I wanted to defer my payments for 6 months? Those friendly officials from the French government are keen to help-out. God bless them…of course, I accepted their generosity.

Last week, same thing. It transpired that officials from the Treasury had put their heads together and come up with another great idea. They could propose an interest-only 5y loan equivalent to 20pc of my outstanding debt. Is that something I might be interested in? You sure bet!

The political centre ground is collapsing under a systematic ideological failure to forgive the banks. The malaise of the banking sector is preventing the cyclical propensity of GDP to rebound and deliver prosperity to the many.

Centrists must resolve their own moral hazard or face extinction. Make Banks Great (again)! Give me a call at hughhendryofficial

Or we’re destined to remain trapped in the serfdom of perpetual deflation

So there you have it:

dd

d

d

d

Tyler Durden

Sat, 05/02/2020 – 16:45

via ZeroHedge News https://ift.tt/3d6r5LZ Tyler Durden