“The Dam Has Burst”: Why David Einhorn Thinks The Coronavirus Shock Will Lead To Soaring Inflation

One of the bizarre aspects of the global depression resulting from the coordinated shutdown of most world economies due to the coronavius pandemic, is that we have experience a collapse in both aggregate supply and demand which, almost absurdly, has kept equilibrium prices relatively unchanged (except in the infamous case of oil where due to storage space limitations, the prompt WTI contract traded as far negative as -$40 on April 20. As a result, the biggest challenge facing economists is deciding if what comes next after the coronavirus pandemic is conquered, is inflation – as trillions in central bank and government stimulus lead to a far faster rebound in demand, or if the early surge in supply overwhelms demand and leads to a deflationary crash similar to what was seen in oil.

While the majority of economists and strategists, even contrarian types, are confident what comes next is even more deflation – and why not according to 10Y breakevens there will barely be any inflation for the next decade…

… one financial luminary who disagrees is David Einhorn who, when not feuding with Elon Musk on an almost daily basis now, believes that the economic shock from the coronavirus will turn out to be inflationary as he explains in his latest letter to investors.

But before we get into the gist of it, first we lay out his take on where we are now, and how we got here, namely the events leading to the global corona crisis, and the official response:

A global pandemic. It’s just sad. It’s sad seeing people get sick. Some recover, others do not. It is sad to mourn friends who have passed, and sadder still for their families who are not able to say goodbye at the hospital or hold a proper funeral. It is sad seeing people lose their jobs or live with the uncertainty that they soon may. Some jobs will come back, but others won’t. As hard as it has been watching the virus cut a swath of suffering through our hometown of New York, we can only imagine how much worse it must be in countries that do not have a viable choice to shut down their economies to limit the spread of the disease.

Our leaders are faced with a menu of only bad options: allow the disease to spread, or ruin the economy. There is a continuum of trade-offs. On balance, the decision in the U.S. has been to slow the spread of the disease at the expense of the economy, but to try to socialize as much of the cost as possible. We don’t have an economic crisis because of the health crisis; the economic crisis is a product of how we have chosen to react to the pandemic. In the last crisis, we socialized the financial sector risk by bailing out the banks that were deemed too big to fail. The result from that intervention was more than a decade-long recovery, fueled by increasing financial leverage, with the expectation that the government would ultimately assume the risks. And the authorities did so confidently; in June 2017, then Fed Chair Yellen declared that she didn’t believe there would be another financial crisis “in our lifetimes.” We found it cringe-worthy when she said it.

We were told that the emergency measures were temporary. After a decade of easy monetary policy, the Fed, under Chairman Powell, delicately began to unwind some of the emergency measures. Wall Street responded to Chairman Powell’s first courageous steps negatively and President Trump criticized him vociferously.

President Trump is a businessman, and in business, the best credit gets the lowest interest rate. President Trump translated that principle to the sovereign debt market: in President Trump’s view, if the U.S. is the best credit, it should have the lowest rates. The President misapprehends how government debt works. High real interest rates are the sign of a strong economy. They reflect attractive investment opportunities that can earn attractive returns Zero (or negative) real interest rates reflect a weak economy with poor investment opportunities, and difficulty servicing its debts.

In late 2018, Chairman Powell caved to the pressure: he did not have the Volcker-like stomach to absorb blame for the economic slowdown that might have followed a normalization of monetary policy. Instead, he went back to Jelly Donut monetary policy, where the sugar rush drove a final burst of a stock market rally, which lasted until the pandemic – an exogenous event.

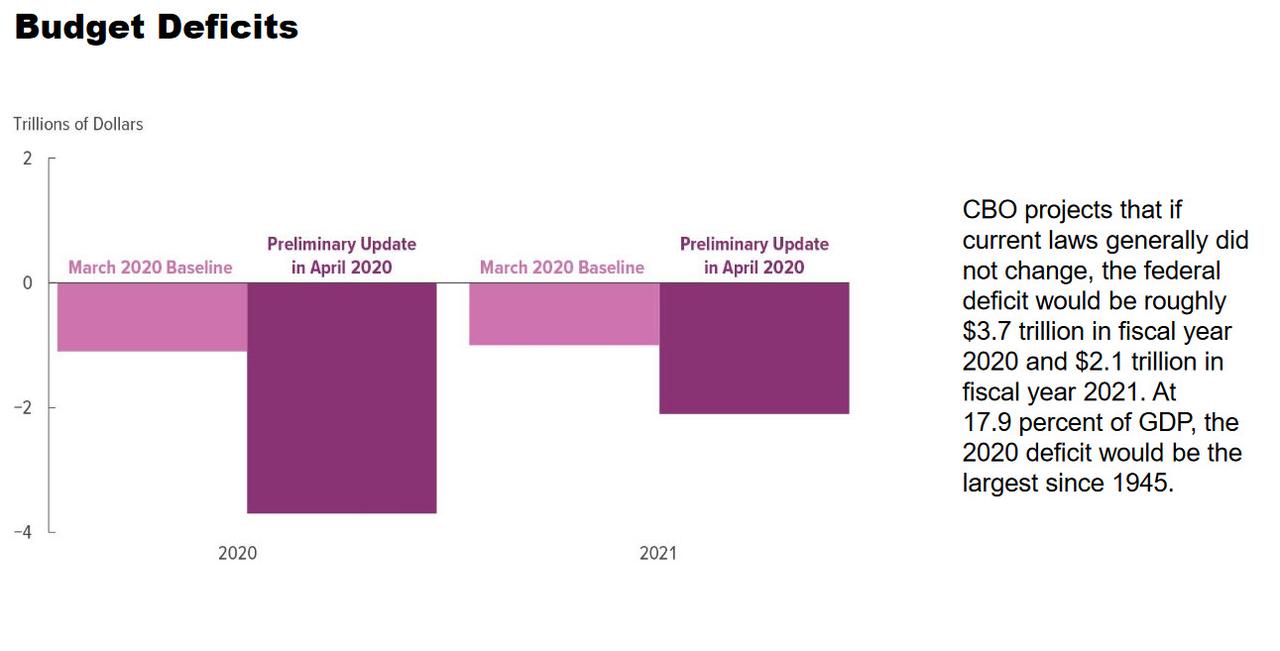

Even prior to this crisis, our leaders had reached bipartisan agreement that deficits do not matter. The only real debate had become who to tax and how much to spend. The arguments are generally politically-motivated: tax the other party’s constituents while cutting taxes for your own constituents, and spend money to benefit your own constituents, while trying to withhold money from the other party’s constituents. The outcome of this dynamic has amounted to both guns and butter – and low taxes. Pre-crisis, the Congressional Budget Office (CBO) projected a 2020 deficit of $1 trillion, or 4.6% of GDP, despite record low unemployment. Cyclically adjusted, this very loose fiscal policy matched the Jelly Donut monetary policy.

The pandemic is not anyone’s fault (outside of China). And it stands to reason that policymakers are now doing “whatever it takes” to shelter the population from both the health and economic fallout. Since it’s been agreed that deficits don’t matter, there really is no limit. Debts will be forborne or forgiven and money will shower from the sky. Similarly, monetary policy is in all-out crisis mode. Whatever the traditional rules were, each week we see new evidence that they were made to be broken. Creditors will be protected from losses and money will be printed in whatever quantities are needed to support the fiscal needs.

President Truman once quipped, “It’s a recession when your neighbor loses his job; it’s a depression when you lose yours.” Every business is “essential” for the people who work there. Pausing the economy except for government-determined “essential” businesses has caused a recession/depression.

Having laid out where we are, Einhorn next takes a stab at what happens next. And since Einhorn has for years warned about the dire terminal consequences of what he dubbed the “jelly donut” policy a decade ago, it is hardly a surprise that he expects recent events to only accelerate the coming inflationary climax:

The economy is now faced with simultaneous supply and demand shocks. There is much debate as to whether the shocks are inflationary or deflationary. The deflationists point to the loss of income and the collapsing price of oil. The problem with using oil as a proxy for inflation is that the price of oil is suffering mostly from a demand shock, while the supply of oil is unaffected. Oil wells continue to flow, while demand for transportation has collapsed. Oil is not alone. For any good or service where the supply isn’t cut to the lower demand, prices will fall.

Even so, in a broader sense, we believe the economic shock will turn out to be inflationary. People (and businesses) who aren’t working are no longer supplying goods or services. The social response of replacing most or all of the lost income sustains demand (or, if temporarily hoarded as savings, creates pent-up demand). Although both supply and demand are falling, supply is falling more.

The CBO now projects that the budget deficit will be 18% of GDP in 2020 and over 10% in 2021. This takes into account the estimated effects of all pandemic-related legislation enacted through April 24, but not the effect of any potential further stimulus.

The year “2020” could come to stand for a 20% deficit and 20% unemployment. The country is consuming more than it is producing – our combined private plus public savings rate is negative. The private sector cannot finance this level of government spending without further crowding out private sector investments and driving up interest rates. Historically, the U.S. has turned to its trade partners, particularly China, to finance its debts.

However, China’s economy is already under pressure. Here in the U.S., there is widespread discussion of reducing our dependence on Chinese supply chains, and the chorus of voices blaming China for the pandemic is growing louder. The lawsuits have already started, and it wouldn’t shock us if President Trump were to suggest using the debt we owe the Chinese to make restitution. All told, it is unlikely the Chinese will finance U.S. government deficits on this go-round.

These large deficits can only be financed by the Fed through the creation of new money.

Which brings us to the punchline: inflation is coming next, gradually at first – just like bankruptcy to loosely quote Hemingway – then suddenly:

The inflation is unlikely to appear immediately. Opportunistic price-gouging on toilet paper, hand sanitizer, milk, rice and potatoes is not a signal of broad inflation. However, a country that consumes much more than it produces, financed by ongoing money creation, will have more money chasing fewer goods and services. Once the initial shock wears off and the recovery begins, the inflation will begin to show up – and it probably won’t be limited to the share prices of money-losing “story” stocks.

The deflationists point to Japan as the obvious counter-example. However, Japan never ran these kinds of annual deficits, never had a large negative public plus private national savings rate, and never grew its money supply this quickly.

Now that the political fiscal dam has burst, the authorities have no incentive to slow the support. Stimulus packages 1, 2 and 3 will likely be followed by 4, 5, 6… The Fed will create money (and attempt to suppress interest rates) to support the economy.

Making matters worse, inflation from monetizing global debt and deficit will be a global phenomenon.

The U.S. is not alone – it’s a global pandemic and a global response. We expect inflation on a global basis. We expect policymakers to target and applaud mid-single digit inflation, which, combined with interest rate suppression, will be the only way to outgrow the mounting debts.

Incidentally, Einhorn is not alone in expecting inflation. One month ago, Morgan Stanley’s Michael Wilson flipped from bear to bull for the very same reason; and just like Einhorn, Wilson predicts that the coming inflation trend “will be slow at first and then accelerate quickly.”

We believe inflationary pressures may be building more than appreciated given the massive targeted fiscal stimulus, in conjunction with other ongoing trends in populism, nationalism, de-globalization and a worldwide pushback to the US dollar as the only reserve currency.

As these inflationary pressures become more apparent, we suspect nominal and real interest rates can rise more than the consensus believes as market participants begin to demand a greater term premium. A materially weaker US dollar would accentuate such a new trend. As is usual with new trends that go against the consensus, they tend to be slow at first and then accelerate quickly, which is why it’s imperative to be thinking about them before they happen.

So then what happens then as things “get tricky” and inflation accelerates further? That’s when it will be the turn of one particular asset class to shine: gold.

It might get tricky a few years from now if inflation accelerates further. The Fed has demonstrated it doesn’t have the stomach to slow the economy by reigning in policy. We believe the implied negative real interest rates are bullish for gold and for unlevered real assets with pricing power (home prices will rise, while leveraged commercial real estate will fall from lack of demand).

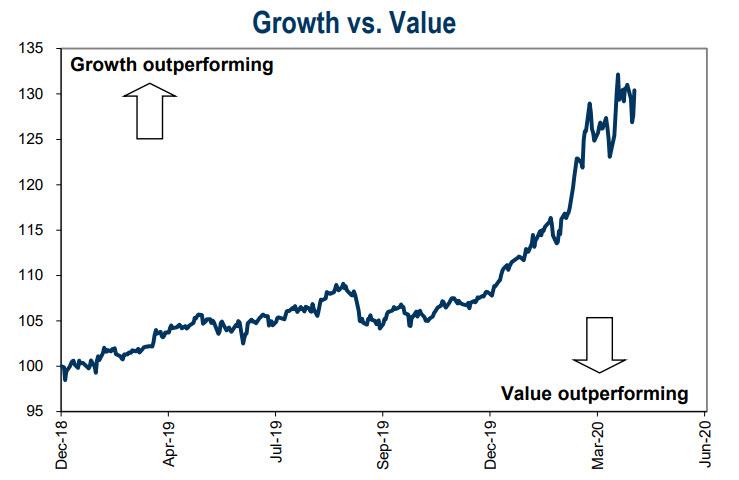

What does this mean for Greenlight’s portfolio – which as we will show in a subsequent post have had a rather tough time at it in recent years – and Einhorn’s steadfast bet on value stocks while shorting growth, “story” names?

We have been asked many times what will cause the pendulum to shift. According to Mr. Lapthorne, cheap value stocks, not growth stocks, have historically led us out of a recession. If true, then a reversal should materialize, and we believe our performance is likely to turn. There is a decent chance that our gold-backed fund will have an even stronger result.

Whether or not the inflation point is here remains to be seen, but one thing is certain: the divergence between value and growth has never been greater.

For those who believe that it’s time for Einhorn’s fate to finally change and for the former hedge fund wunderkind to strike it out of the park, we have good news – Greenlight is now accepting new capital.

For most of the last 20 years, our funds have been closed for new investment. Over the past few years, we’ve had redemptions and the Partnerships have become smaller. A year ago, we opened for new investment, but made no real attempt to market the Partnerships. That is about to change. We think it’s a good time to invest in Greenlight. We know it will take a strong stomach to overlook our recent performance, and we recognize that some of you may need to see proof of a turn first. That said, we have not felt as optimistic about the opportunity set ahead of us since the depths of the 2008 financial crisis.

Tyler Durden

Sat, 05/02/2020 – 15:55

via ZeroHedge News https://ift.tt/3feWUnN Tyler Durden