Platts: 6 Commodity Charts To Watch This Week

Via S&P Global Platts Insight blog,

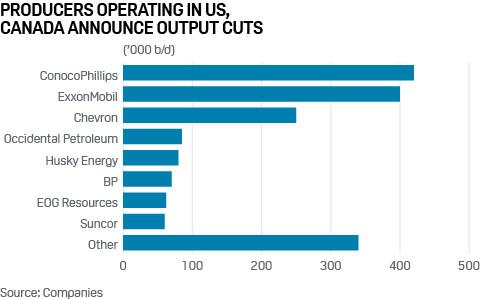

Oil producers in North America have announced vast cuts in output, led by ConocoPhillips, ExxonMobil and Chevron. Plus, contrasting gas market signals from both sides of the Atlantic, Brazilian corn exports under pressure and more, in S&P Global Platts editors’ pick of key trends in energy and commodities this week.

1. North American crude output set to decline in reaction to low oil prices…

What’s happening? Global oil companies have announced production cuts of roughly 4 million b/d in response to a collapse in prices. Of that total, around 1.8 million b/d has been announced by producers focused in the US and Canada, with ConocoPhillips, ExxonMobil and Chevron leading the way. Production cuts could even be higher, as only some of the dozens of companies announcing spending cuts have detailed their output plans.

What’s next? Crude futures have found some support from the cuts, but the NYMEX front-month contract is still lingering below $20/b. The market will likely need to see more cuts to push prices substantially higher, whether from oil companies, or from OPEC and its allies, which have pledged cuts totaling 9.7 million b/d for May and June.

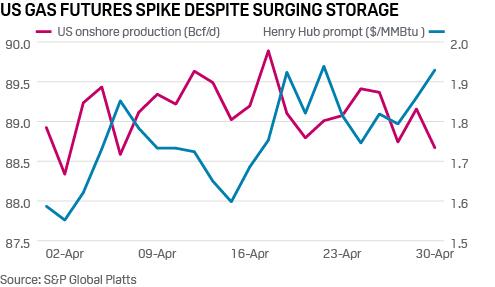

2. Falling rig count, bearish crude support US gas prices…

What’s happening? Despite US natural gas in storage sitting nearly 20% above the five-year average with hefty builds on the horizon likely, Henry Hub futures continue to strengthen as the prompt month approaches the $2/MMBtu mark. As US states discuss plans to begin easing restrictions related to the coronavirus pandemic, demand may see some upside throughout May, cutting into the storage surplus.

What’s next? Weak oil prices and declining rig counts also present a bullish risk to prices at Henry Hub for the second half of the year. Associated gas production is already showing declines. Total US production has averaged 92 Bcf/d the past 10 days, 300 MMcf/d below the April 1 through 20 average. The Bakken and DJ Basin lead US fields in recent declines, at 300 MMcfd/d and 150 Mcf/d, respectively.

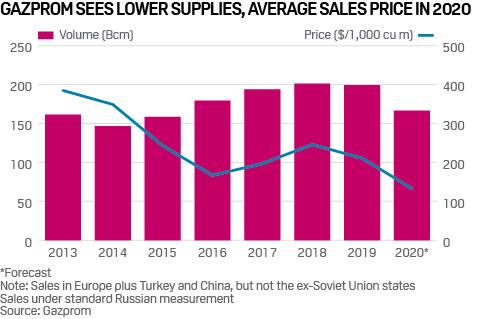

3. … as gas glut sees Gazprom slash exports, sales price outlook

What’s happening? Russia’s Gazprom expects its gas exports to its main international markets to total 166.6 Bcm in 2020, which would mark a 17% reduction compared to last year. The forecast is the first Gazprom has given for 2020 and reflects the extreme shift in European gas market dynamics since the turn of the year. Gazprom has also signaled an expected realized gas price for 2020 as a whole of just $133/1,000 cu m, which would be a 37% decline year on year.

What’s next? Europe has witnessed sharp falls in gas demand due to the mild winter, high storage stocks and the economic impact of the coronavirus, reducing demand for Russian pipeline gas. Limited gas storage injection demand and continuing economic turmoil caused by the virus means a recovery for Russian sales in Europe may be problematic.

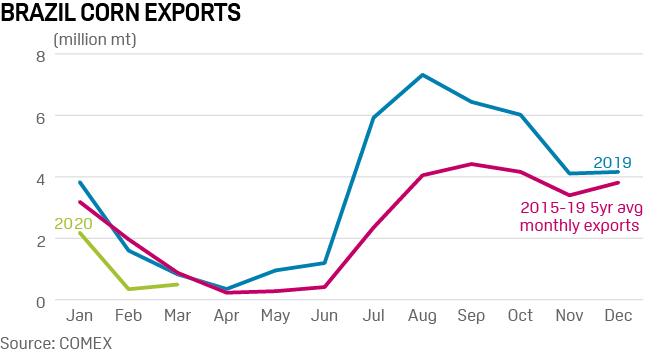

4. Brazil sees sluggish corn export pace amid mounting virus concerns

What’s happening? Brazil’s corn shipments have been significantly lower in 2020, after exporting a record quantity last year. Between January-March, Brazil exported 3 million mt of corn, down 56.5% from the same period last year. Depleted corn stocks, strong local demand, and high export prices have restricted exports in this new marketing season from Brazil.

What’s next? The National Food Supply Company has forecast Brazil’s corn export to reach 34.5 million mt in 2019-20, down 17.3% from the previous marketing season. However, experts doubt Brazilian corn exports will hit this level, as coronavirus-related restrictions are likely to bring down demand from the livestock and ethanol sectors. Concerns also remain as the pace of Brazil’s confirmed coronavirus cases keep surging. Moreover, in the US the collapse of ethanol demand in and the expectation of higher planted areas for corn this season mean the market is likely to be flooded with cheap corn.

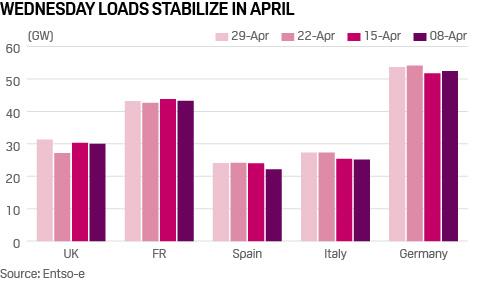

5. European power demand stable as first signs of recovery emerge

What’s happening? UK electricity demand was trending up in late April and into May as chilly, unsettled weather swept in from the Atlantic, pushing mid-week demand up over 10% on week. This followed modest demand recoveries in both Spain and Italy earlier in April, these due to partial lifting of coronavirus lockdowns. System data for both Germany and France, meanwhile, showed stabilization of demand levels through April after the massive drops seen in March.

What’s next? The following weeks should see further incremental easing of lockdowns in European power markets, prompting a phased resumption in commercial and industrial activity. It is impossible to say when or even if the drastic declines seen to date will be erased. After the 2008 credit crunch, electricity demand bounced back to varying degrees in most markets, but never fully recovered to pre-crunch levels. This was in large part for positive reasons – as economies recovered, new investment drove down the energy intensity of equipment. It remains to be seen whether social distancing will have a similar constraining influence on recovering demand.

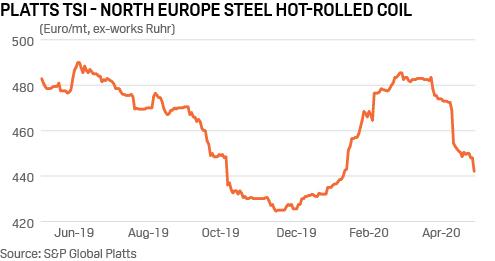

6. Steel demand slump, plant restarts raise specter of protectionism

What’s happening? Steel hot rolled coil prices are again under downwards pressure in Europe as coronavirus-related curbs have hit consumption, halting a recovery glimpsed early in 2020 after a slump in November amid global oversupply. Since March, Europe has seem an estimated 80% fall in steel demand from the automotive industry and 40% in construction.

What’s next? As some mills return to production after virus-related stoppages, price pressure is likely to increase, particularly as Chinese, Iranian and Russian mills are becoming more active in steel export markets. Protectionism is likely to rise: industry sources have reported the European Commission is now accelerating a review of its steel imports safeguards review, following a request from European steelmakers’ association Eurofer and the European Steel Tube Association (ESTA) for a 75% reduction in import quotas for Q2-Q3.

Tyler Durden

Mon, 05/04/2020 – 15:10

via ZeroHedge News https://ift.tt/2yjYhB0 Tyler Durden