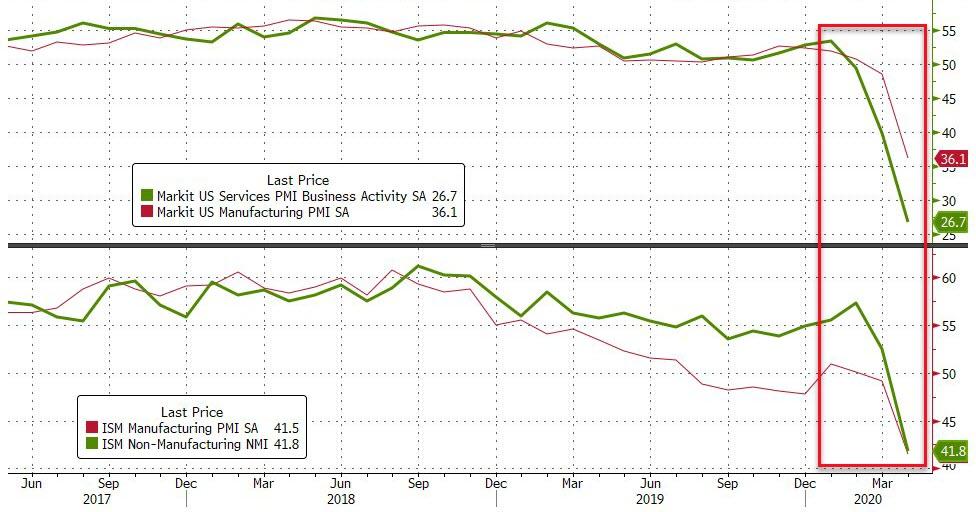

ISM/PMI Surveys Signal Q1 Collapse In US GDP “Will Be Dwarfed By What’s To Come”

ISM’s data continues to lag Markit’s (due to the utter farce of supplier delivery reversals not being factored as a devastatingly bad thing in the former).

-

Markit Manufacturing 36.1 (record low)

-

Markit Services 26.7 (record low)

-

ISM Manufacturing 41.5 (not record low due to supplier delivery times)

-

ISM Services 41.8 (lowest since April 2009 – finally caught down to reality)

Finally ISM Services caught down to reality, somewhat, in April…

Source: Bloomberg

Measures of business activity, new orders and employment all fell to record lows last month in figures going back to 1997, according to survey data from the Institute for Supply Management on Tuesday. The industries in ISM’s report represent about 90% of the economy.

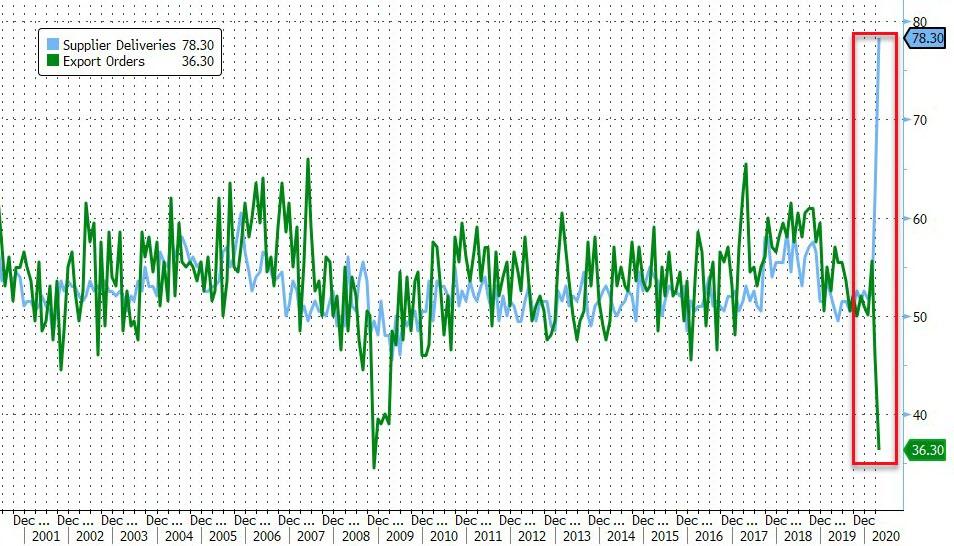

And the ISM Services print is way better than it should because of this shitshow!!

Source: Bloomberg

The composite gauge reflects a surge in the supplier-delivery index to a record 78.3, indicating longer lead times.

While that usually indicates strains from elevated demand, the deliveries index now reflects virus-related disruptions in supply lines and business closures.

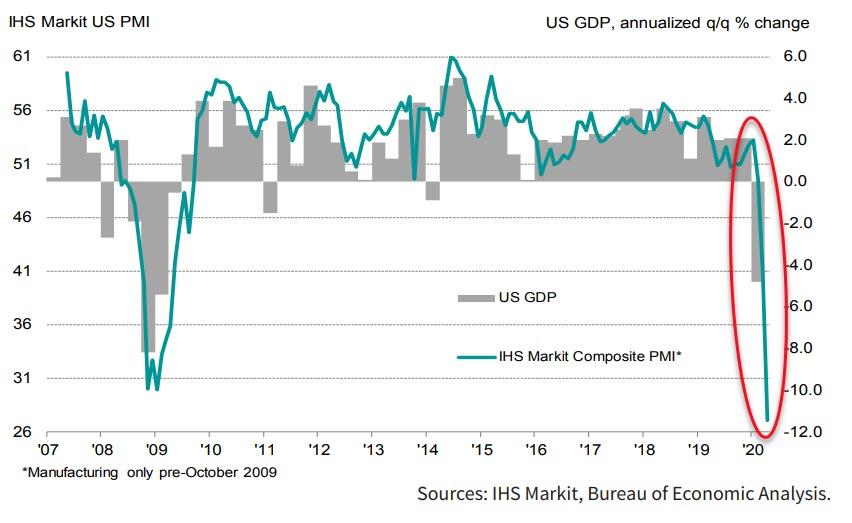

The IHS Markit Composite PMI Output Index dropped significantly from 40.9 in March to 27.0 at the start of the second quarter. The overall decline was driven by historic downturns in both the manufacturing and service sectors following the escalation of the COVID-19 outbreak, and signals dramatic further worsening in GDP…

“The slump in the business survey indicators to all-time lows in April indicates how the 4.8% rate of economic decline seen in the first quarter will likely be dwarfed by what’s to come in the second quarter. “

Commenting on the latest survey results, Chris Williamson, Chief Business Economist at IHS Markit, said:

“Measures to fight the COVID-19 outbreak mean vast swathes of the service sector has been especially hard hit by travel restrictions and social distancing, with temporary company closures and dramatically reduced demand resulting in an overall drop in activity of even greater magnitude than seen during the height of global financial crisis.

“With hope, infections rates have peaked and the economic downturn should start to ease as virus-related restrictions are lifted. However, while manufacturing may see a rebound in production as increasing numbers of factories are allowed to re-open, prospects look bleaker for many parts of the services economy, especially where businesses rely on travel, social gatherings or close contact with customers. Businesses such as airlines, bars, restaurants, cinemas, sports arenas and other recreational activities will likely be at the back of the line in terms of being able to re-open to anything like previous capacity levels, meaning the recovery will be long and slow.”

And finally, spot the odd one out!

Source: Bloomberg

Seems like China has this whole fake fucking data thing sorted out.

Tyler Durden

Tue, 05/05/2020 – 10:05

via ZeroHedge News https://ift.tt/2YDvLVA Tyler Durden