Lyft Soars After Smashing Expectations, But An Ugly Future Awaits

Back at the start of February, just before the world shut down due to the Wu Flu, Uber delighted investors when it predicted that it would (somehow) reach profitability one year ahead of schedule, a move which its main competitor Lyft failed to copy, and the market punished its stock accordingly. Just three months later, Uber may have changed its mind, considering it just announced 3,700 layoffs – hardly the confidence boosting corporate activity from a company hoping to turn profitable- with the news spooking Lyft investors who pushed its stock as much as 5% lower ahead of earnings.

But was it warranted? One look at LYFT earnings suggests that perhaps this time around it is Uber – with its much more international operations – that is hurting far more, because in a surprise to most LYFT easily surpassed some investors’ worst expectations Wednesday when it not only beat expectations, but pushed closer to profitability and reported moderate growth of the ride-hailing business in a quarter marred by the effects of the coronavirus pandemic.

The San Francisco-based ridehailing company reported Q1 revenue of $956MM, a 23% increase from the $776MM a year ago, and smashing expectations of $829.6MM; the resulting adjusted loss of $97.4MM, down 20% Q/Q, was roughly half the expected loss of $179.6MM.

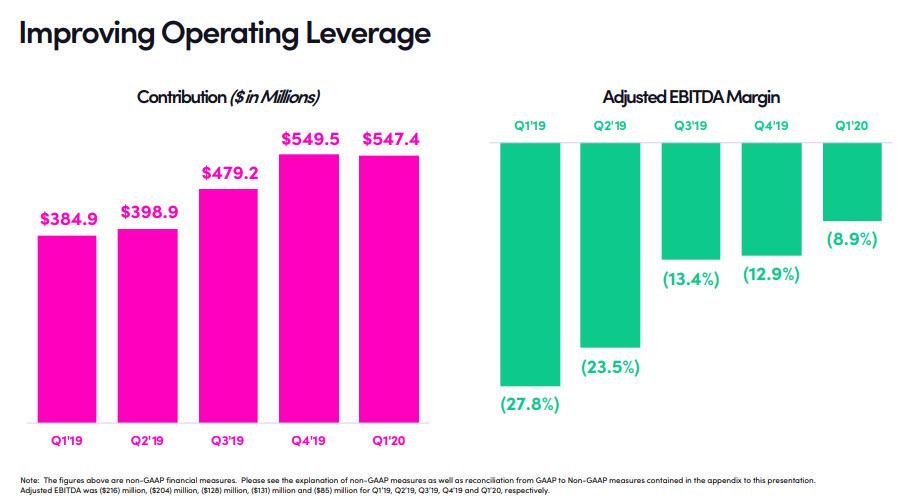

Adjusted EBITDA came in at negative ($85.2MM), down 35% Q/Q and far better than the ($201.2MM) EBITDA expected, a -9% Adj EBITDA margin compared to -28% a year ago, a 19% improvement Y/Y.

Also of note, LYFT’s contribution margin improved substantially by 7% to 57% from a year ago.

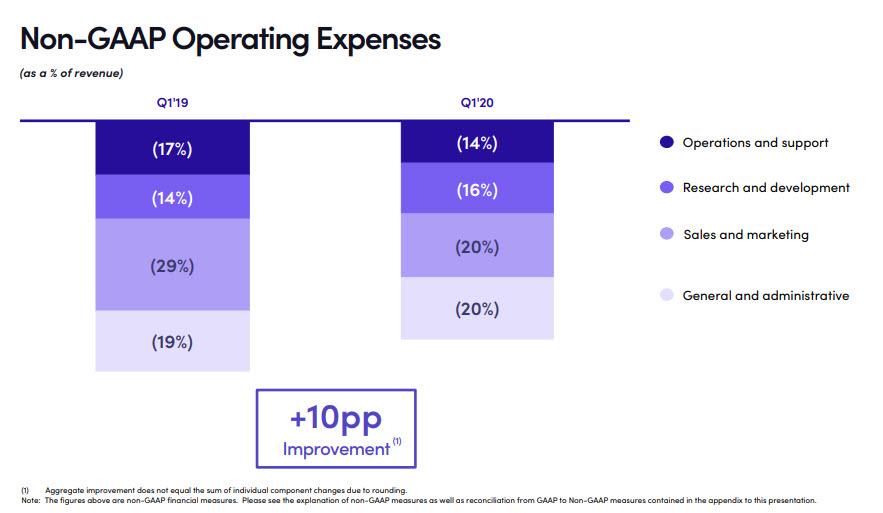

However, while LYFT clearly streamling its income statement by cutting operating expenses…

… the coronavirus clearly hit Lyft’s growth machine, and the company, which as Bloomberg notes is accustomed to growth rates of more than 50% a quarter, said adjusted sales climbed 23% from last year.

Indeed, LYFT’s Q1 active riders of 21.2 million, an increase of +3.5% y/y, were well below the 22.7 million estimates, even as the revenue per active rider rose by 19% y/y to $45.06.

Looking at liquidity, the company reported $597.9MM in cash and cash equivalents, and a total $2.7BN including short-term investments.

A couple of caveats: as noted above, Lyft only operates in the U.S. and Canada, which were largely spared from the virus until March, which means that LYFT’s results were only affected for about a week or two at the end of March, when the governments issued guidance saying people should significantly curb travel. Transportation businesses, including Lyft’s, were jolted. Last month, Lyft pulled its 2020 forecast and said it would reduce its workforce by 17%, furlough another 5% and slice salaries for everyone left.

Brian Roberts, LYFT’s CFO said in a statement Wednesday that the company would cut spending for the year beyond its previous expectations by about $300 million. “In these uncertain times, we are building on that progress by taking decisive action to reduce costs and further improve our operating efficiency,” he said.

Lyft was dealt another major setback this week when California sued the company and its larger rival, Uber Technologies Inc., claiming they’re in violation of a law that went into effect this year that makes many contract workers eligible for employee benefits. Although the companies are seeking to overturn the law through a ballot measure in November, investors were unsettled by the suit. Lyft’s stock was down 2.1% at the close of trading Wednesday.

None of this mattered after hours, when a furious short squeeze coupled with the stronger than expected results delighted investors; alas, the earnings merely reflected the solid performance in January and February while the far uglier new normal has yet to be quantified. For now the stock is up 10% in kneejerk reaction, but the early euphoria will soon reverse as investors realize that it will take years for things to get back to normal.

Tyler Durden

Wed, 05/06/2020 – 16:28

via ZeroHedge News https://ift.tt/3do9L5k Tyler Durden