What’s Really Driving Market Performance: A Look At Return Decomposition

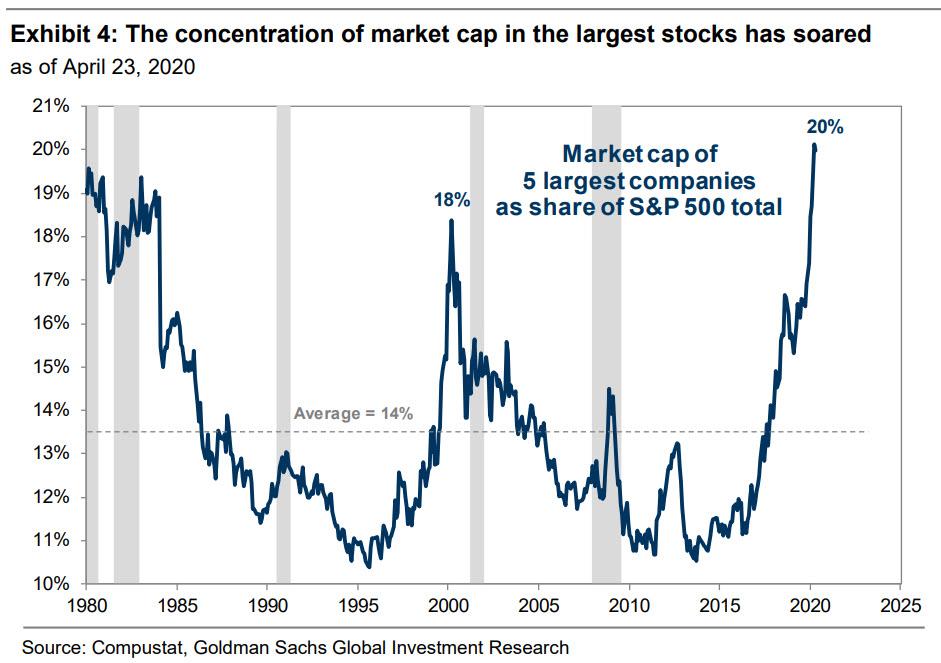

Now that it is common knowledge that “The Market is Now Just Five Stocks” as we first put it over a month ago, with Goldman clarifying that the five largest S&P 500 stocks – MSFT, AAPL, AMZN, GOOGL, FB – accounted for 20% of index market cap, the highest concentration on record…

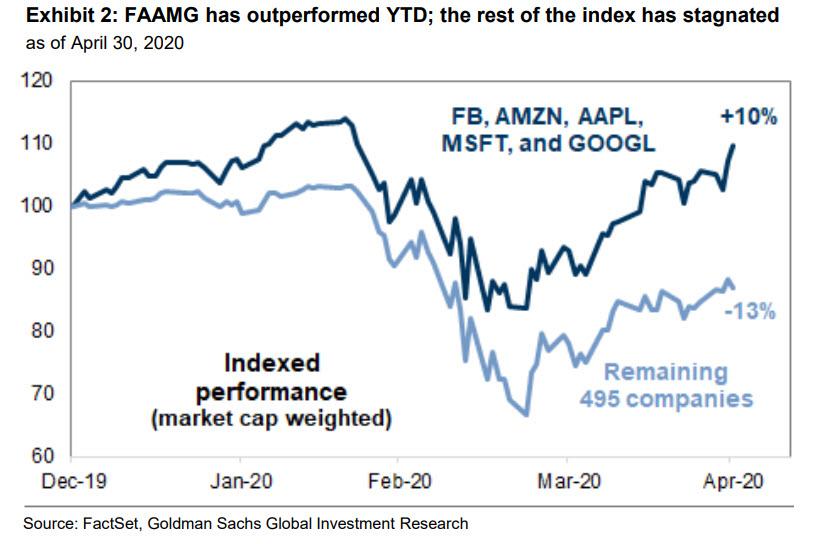

… which has led to a fascinating market divergence in which the 5 biggest stocks are up 10% YTD while the remaining 495 S&P500 companies are lower by a collective 13%…

… Credit Suisse’s equity strategist Jonathan Golub decided to drill down some more, and as he writes in a Tuesday morning note, looking at the ever wider disconnect between fundamentals and returns, he “found this month’s return decomposition particularly useful.”

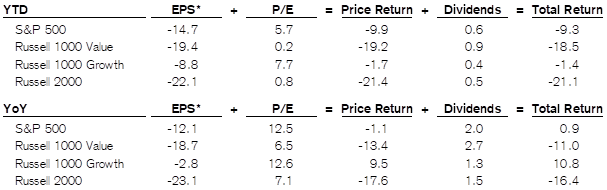

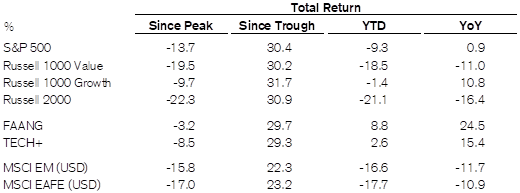

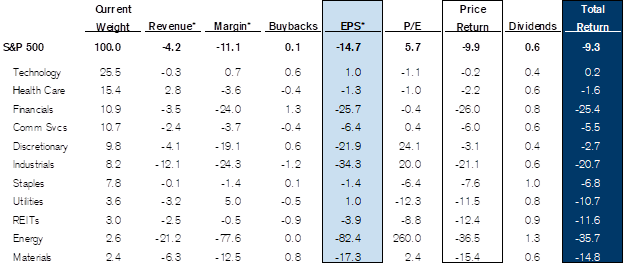

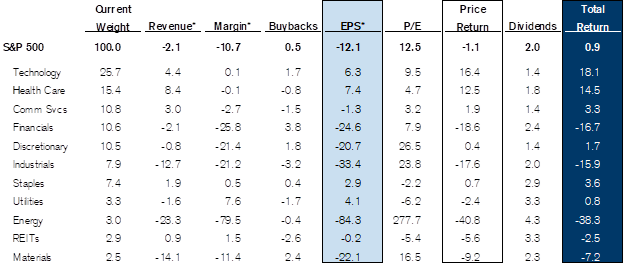

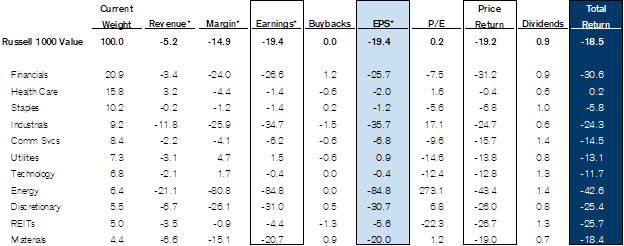

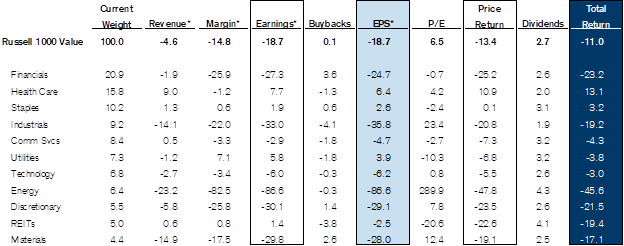

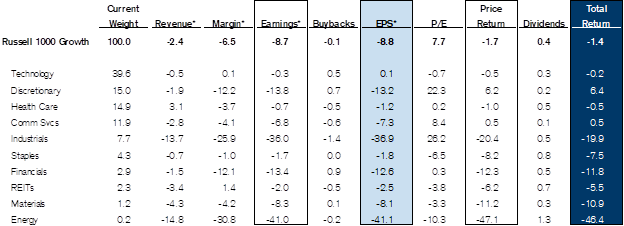

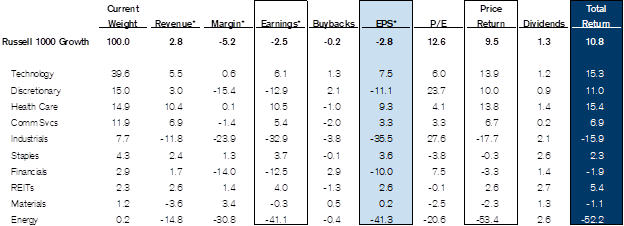

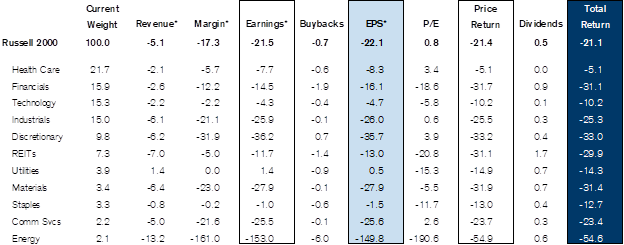

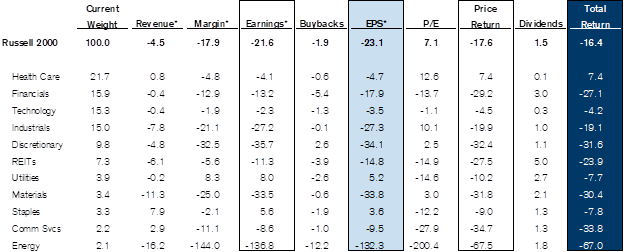

As Golub explains, the analysis breaks down performance into its key components (revenues, margins, multiples, buybacks) for the S&P 500, Russell 1000 Value and Growth, and Russell 2000. It also contains lists of those stocks that have had the largest positive and negative impact on each benchmark. And as the strategist further notes, in a time when momentum is all that matters as fundamentals are now irrelevant, he receives “more special requests on this work than anything else we publish.”

So without further ado, here is the Credit Suisse Return Decomposition Summary:

Total Returns

S&P 500 Return Decomposition – YTD

S&P 500 Return Decomposition – YoY

Russell 1000 Value Return Decomposition – YTD

Russell 1000 Value Return Decomposition – YoY

Russell 1000 Growth Return Decomposition – YTD

Russell 1000 Growth Return Decomposition – YoY

Russell 2000 Return Decomposition – YTD

Russell 2000 Return Decomposition – YoY

Tyler Durden

Tue, 05/05/2020 – 22:04

via ZeroHedge News https://ift.tt/2YFdt6m Tyler Durden