2Y Yields Hit New Record Low As Market Pushes NIRP Bets Amid Powell Silence

The Fed has a major problem…

Futures markets are signaling, with increasing zeal, negative US interest rates as soon as November 2020…

In fact, as the chart above shows, Fed Fund Futures are pricing in a stunning negative 42bps rate in December 2020.

This collapse at the short-end has dragged 2Y rates to new record lows…

As Wrightson ICAP economist Lou Crandall warned in a note today, the longer the Fed is perceived to tolerate negative quotes in the futures market, “the more widespread the conviction that overnight rates will indeed turn negative will become.”

And if that expectation becomes “deeply entrenched,” the cost of disappointing the market later this year will increase.

Crandall notes that it is possible that the FOMC minutes on May 20 will “shoot down any market expectations of negative rates, but the minutes rarely give unequivocal guidance about future policy decisions”

FOMC members have said they don’t feel negative interest rates will be an appropriate policy for the U.S. in this cycle, “but the Fed has also repeatedly been forced to change its views on other policy implementation questions over the past year or two”

Negative overnight rates “are extremely unlikely to materialize,” though betting against unexpectedly aggressive Fed policy actions hasn’t been a winning strategy in recent months

Critically, Crandall concludes, The Fed needs to regain control of the overnight rate narrative, within the constraint of continuing to project an extremely supportive policy stance.

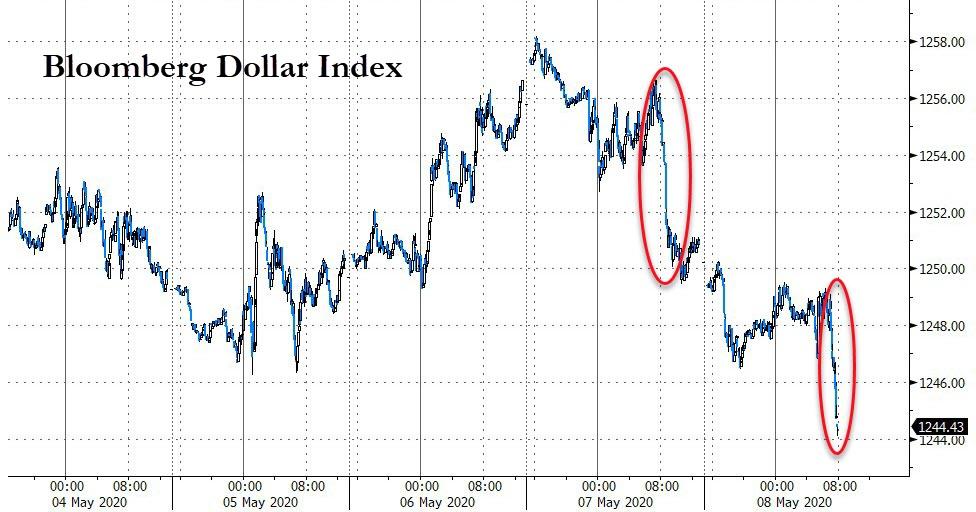

Finally, we note that as the negative-rate expectations have accelerated, so the dollar has accelerated lower…

This abrupt selling of the dollar perhaps reflects Deustche Bank’s recent scary conclusion: despite everything the Fed has done – which includes trillions in explicit liquidity injections and implicit funding backstops – not only does the Fed need to do more, but it would in fact have to cut rates to negative to offset pent up market imbalances.

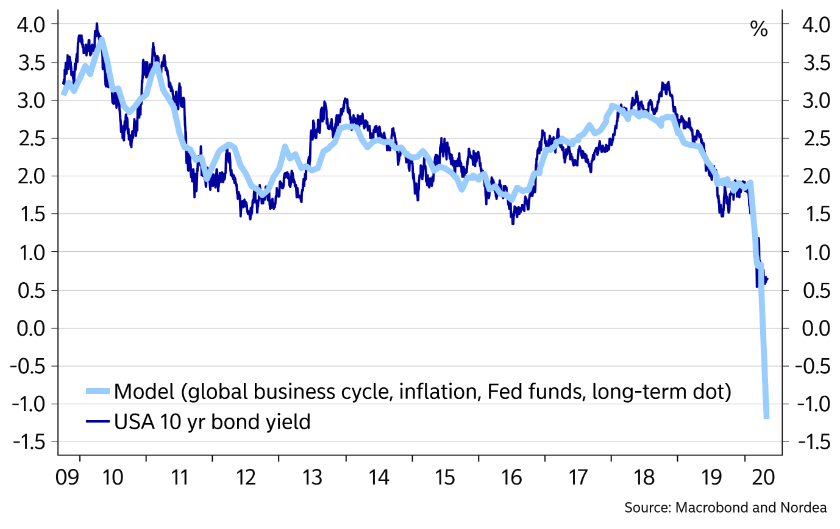

Deutsche Bank wasn’t alone in its dire assessment: in a report published today Nordea’s FX strategist Andreas Steno Larsen went even further than the German Bank, writing that according to the bank’s model, “negative long USD yields could be the name of the game” and references the following chart correlating 10Y Treasurys with its implied yield which uses inputs from the global business cycle, inflation, Fed Funds, and the Fed’s long-term dot. In other words, not just the short-end will go red: the entire curve will soon be negative.

The wheels of the narrative were already moving earlier this week, when Ken Rogoff wrote a Project Syndicate piece titled “The Case for Deeply Negative Interest Rates” in which he wrote “imagine that, rather than shoring up markets solely via guarantees, the Fed could push most short-term interest rates across the economy to near or below zero. Europe and Japan already have tiptoed into negative rate territory. Suppose central banks pushed back against today’s flight into government debt by going further, cutting short-term policy rates to, say, -3% or lower.“

Well, Ken, It would be absolutely devastating not only for what’s left of savers but the banking sector and by implication – since banks control everything in the US – the rest of the US economy. But we are delighted to sit back and watch as you conduct your final experiment.

Tyler Durden

Fri, 05/08/2020 – 11:16

via ZeroHedge News https://ift.tt/2WCs1RE Tyler Durden