Companies Are Far More Terrified Than They Were In 2008

After aggregating data from Q1 conference calls, one thing appears to be clear: companies are far more scared now than they were during the global financial crisis.

Those were the findings of a new study by the Federal Reserve, which used a “machine-reading program” to look through more than 600 earnings calls that took place last month, during the middle of the ongoing global pandemic.

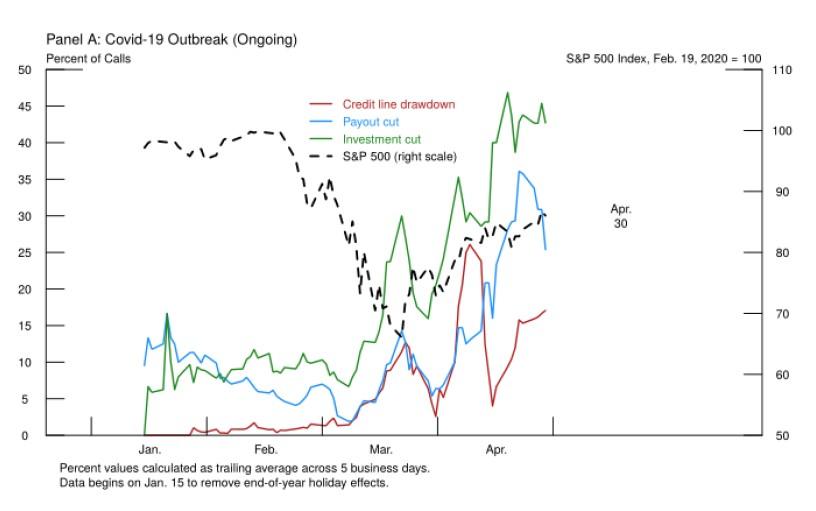

According to the study, 42% of American non-financial companies are talking about reining in spending/investments, 27% are discussing equity payouts and 17% are talking about drawing down their lines of credit. This compares to 25%, 11% and 7% for these figures, respectively, during the worst point of the 2008 recession. The paper states:

We find that actions consistent with financial concerns spiked dramatically in April 2020. The share of firms drawing down on credit lines, cutting equity payout, or cutting investment was 17, 27, and 42 percent, more than 6.5 standard deviations from their mean values of 2, 5, and 10 percent. For comparison, during the peak of the 2008-2009 financial crises these numbers peaked at 7, 11, and 25 percent.

Economists Andrew Y. Chen and Jie Yang pieced together the data by looking at the number of times senior company officials used key words and phrases, according to Bloomberg.

The paper continues:

“The dramatic increase in the share of firms taking these actions indicates that financing concerns amid the Covid-19 outbreak are even more severe than they were in 2008.”

The Fed estimates that sentiment won’t normalize for another year. We think that’s an optimistic assertion, especially because the rate at which things “normalize” (if they even dare to call it that) depends heavily on treatment and vaccine options for Covid-19.

Regardless, the results of the study make it clear how big of an impact the pandemic and ensuing economic shutdown have had on corporations across the country. At the same time, unemployment and corporate bankruptcies are far outpacing numbers from the 2008 recession, even with the government’s massive stimulus plan.

And despite the S&P 500 being up more than 25% since march.

Tyler Durden

Fri, 05/08/2020 – 08:30

via ZeroHedge News https://ift.tt/2YOxyan Tyler Durden