Futures Jump Ahead Of Worst Unemployment Report In US History

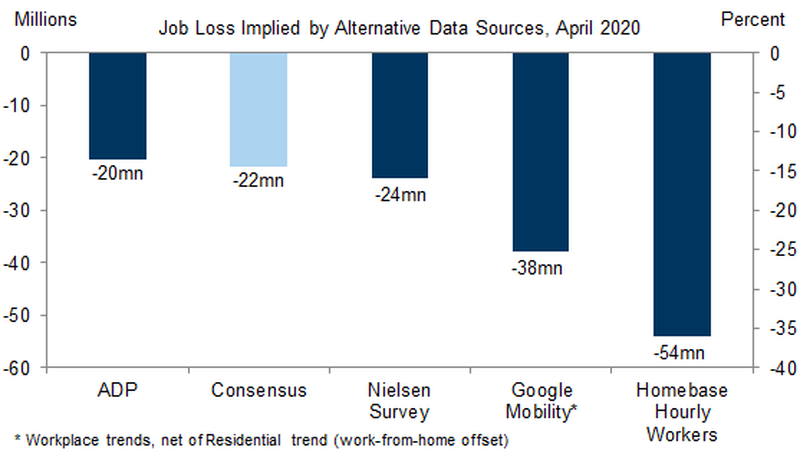

The US is about to report that it lost some 22 million (according to consensus) jobs in April, and potentially as much as 54 million, with the unemployment rate soaring in what will easily be the worst unemployment report in US history…

… but futures continued their Thursday levitation alongside all other global markets because, rising above 2,900 and for the second day in a row hitting session highs after fresh hope for a US-China Phase 1 trade deal, as reports that China and the U.S. had a constructive phone call on trade added optimism over the reopening plans of major economies, outweighing concerns over the damage caused by the virus outbreak, even as many speculate that reopenings will simply lead to a second and potentially worse wave of infections.

After Trump rattled investors last week by threatening new tariffs against China, Beijing said on Friday that both sides agreed to improve the atmosphere for the implementation of a Phase 1 trade deal. Chinese Vice Premier Liu He, US Treasury Secretary Mnuchin and USTR Lighthizer spoke over the phone and agreed to keep communications, strengthen cooperation and vowed efforts to implement the phase 1 deal. The sides reportedly agreed to work together to create beneficial environment for carrying out trade deal, while they agreed good progress was made to make deal a success and that both sides fully expect obligations to be met. Subsequently, a Chinese Gov’t Adviser, on the US-China phone call, suggested that the fact that “the dialogue has now gone straight to ministerial level may indicate the problem is quite severe”, via SCMP.

The strategically timed news came just hours before the U.S. economy is expected to announce it lost a staggering 22 million jobs in April, in what would be the steepest plunge in payrolls since the Great Depression.

But with several states reopening businesses this month, financial markets have so far ignored all data underlining the business damage inflicted in April and have pinned their hopes on a revival in supply chains and consumer spending, with expectations of a sharp V-shaped recovery. Wall Street ended higher on Thursday with the Nasdaq recouping all its losses for 2020, powered by a clutch of upbeat earnings and gains for tech stocks that have proven largely resilient in the broader selloff.

Meanwhile, with the S&P 500 still about 15% below its record high and investors still fearing a deep depression due to the outbreak, on Thursday, financial markets began pricing in a negative U.S. interest rate environment for the first time ever.

Among early US equity movers, Disney rose 2.6% as tickets for the earliest days of Shanghai Disneyland’s re-opening in China sold out rapidly. Uber Technologies jumped 7.3% as the company said its ride service bookings slowly recovered in recent weeks and that it expects a coronavirus-related slowdown will delay the goal of becoming profitable by a matter of quarters, not years.

In Europe, construction and industrial goods stocks pulled the Euro Stoxx Index higher while U.K. markets were closed for a holiday. Europe’s largest engineering company Siemens rose after publishing a sales forecast that investors viewed as better than feared amid the industrial malaise caused by pandemic.

Earlier in the session, Asian stocks gained, led by industrials and energy, after falling in the last session. Most markets in the region were up, with Japan’s Topix Index gaining 2.2% and India’s S&P BSE Sensex Index rising 1.1%, while Jakarta Composite dropped 0.2%. The Topix gained 2.2%, with Oizumi and DD HD rising the most. Nomura posted a surprise quarterly loss, failing to capitalize on wild market swings. The Shanghai Composite Index rose 0.8%, with Dalian Energas Gas-System and Anhui Tongfeng Electronics posting the biggest advances.

“Earnings estimates have yet to fall as much as we think they will, making global equities vulnerable to a near-term correction,” wrote strategist Peter Berezin and colleagues in a BCA Research note. “Nevertheless, the spread between earnings yields and bond yields is wide enough to justify a modest overweight to stocks on a 12-month horizon.”

Needless to say, all eyes today will be on the U.S. jobs report (previewed here), which is forecast to show employers slashed about 22 million from payrolls in April, nearly a decade of job gains in a single month. Equities have so far managed to weather miserable economic data as well as a string of poor earnings reports as investors bet on a swift recovery, but the strong rebound in risk assets has left others questioning whether further gains are warranted.

US Treasury yields dipped in Asian trading with two-year Treasury yields slipping to a fresh record amid market bets policy makers could adopt negative rates, while Italy’s bond-yield spread narrowed before Moodys announces an update on Italy’s sovereign rating (expected to be kept unchanged). The dollar nudged lower and

In FX, the Bloomberg Dollar Spot Index fell a second day after dovish rhetoric from Federal Reserve officials fueled talk that the central bank will cut its policy rate below zero; gold advanced. The euro was little changed against the greenback while the yen edged lower on commercial dollar demand ahead of the weekend; the Japanese currency is still on track for a fifth straight weekly advance against the dollar, the longest winning streak since July 2012. The New Zealand and Australian dollars led Group-of-10 currency gains on the pickup in risk sentiment; the Aussie was also supported after Australia announced a three-phase plan to reopen the economy by July.

In commodities, oil headed for its first back-to-back weekly gain since February as output cuts from the biggest producers and a nascent recovery in demand began to rebalance a market awash with crude. Gold trader slightly higher after surging yesterday amid NIRP panic.

Market Snapshot

- S&P 500 futures up 0.8% to 2,903.50

- STOXX Europe 600 up 0.5% to 339.71

- MXAP up 1.6% to 146.29

- MXAPJ up 1.1% to 470.11

- Nikkei up 2.6% to 20,179.09

- Topix up 2.2% to 1,458.28

- Hang Seng Index up 1% to 24,230.17

- Shanghai Composite up 0.8% to 2,895.34

- Sensex up 1.2% to 31,829.52

- Australia S&P/ASX 200 up 0.5% to 5,391.08

- Kospi up 0.9% to 1,945.82

- German 10Y yield fell 1.9 bps to -0.564%

- Euro down 0.07% to $1.0826

- Brent Futures up 0.9% to $29.71/bbl

- Italian 10Y yield fell 5.6 bps to 1.744%

- Spanish 10Y yield fell 5.5 bps to 0.766%

- Brent Futures up 0.9% to $29.71/bbl

- Gold spot up 0.2% to $1,718.81

- U.S. Dollar Index down 0.05% to 99.84

Top Overnight News from Bloomberg

- Boris Johnson’s government tried to damp expectations that the U.K.’s coronavirus lockdown will be significantly rolled back as top scientists warned the country’s infection rate has crept upward in recent days

- Australia’s central bank said household spending is likely to slump about 15% in response to the lockdown to stem the spread of the coronavirus

- Japanese households cut monthly spending by the most in five years as the coronavirus started to spread more quickly in the weeks before the government called a state of emergency

- Investors increased liquidations of positions in equity funds, with the U.S. seeing the most outflows, Citigroup said in a note, citing data from EPFR Global for the week ended May 6

- The torrent of cash into U.S. prime funds continues to support declines in money market rates. The funds racked up a fifth straight weekly inflow of $15.5 billion — making $60 billion in total over the streak– according to data Thursday from the Investment Company Institute. That’s helping pare the $140 billion cash exodus in March

- The critical ruling by Germany’s constitutional court over the European Central Bank’s bond-buying program poses a threat to the future of the common currency, according to Wolfgang Schaeuble, the country’s former finance minister.

Asian equity markets were higher across the board and US equity futures extended on gains overnight in which the Emini S&P and Mini Dow futures breached the 2900 and 24000 milestones respectively as global sentiment was underpinned amid renewed dialogue between US-China trade negotiators, whilst Fed Fund Rate futures began to price in negative rates for the US from December. ASX 200 (+0.5%) and Nikkei 225 (+2.6%) were positive as they take impetus from their Wall St peers and with risk appetite spurred by loosening of coronavirus-related restrictions after Australia’s cabinet agreed to relax some of its social distancing measures in a 3-step phase and with Japan touting the early lifting of the state of emergency in some regions, while Japan is also said to mull additional measures including proposal to subsidize rents for small businesses for up to 6 months. Hang Seng (+1.0%) and Shanghai Comp. (+0.8%) joined in on the upbeat tone as Hong Kong reopens its bars and other venues from today, and due to the easing of trade tensions following a conference call between USTR Lighthizer, Treasury Secretary Mnuchin and China Vice Premier Liu He in which the sides agreed to work together to create a beneficial environment for carrying out the trade deal and to strengthen cooperation on the macro economy. Finally, 10yr JGBs initially tracked upside in T-notes as US yields declined amid the pricing of future negative rates although the price action in JGBs was relatively tepid and the gains were later reversed following the 10yr inflation indexed bond auction which saw attracted weaker prices despite the amount sold just being half of the previous auction.

Top Asian News

- China Stocks Top Key Technical Level on Trade, Policy Optimism

- Billionaire Birla’s Novelis to Slash Spending as Demand Dries Up

- India’s Top Airline to Put Some Staff on Leave Without Pay

- Fancl Jumps Most on Record as Direct Sales Help It Beat Peers

European stocks see modest gains [Euro Stoxx 50 +0.8%] after a positive APAC handover – with sentiment supported by Fed Fund futures pricing negative rates from December, alongside the developments in the US-China trade saga in which the two sides vowed efforts to implement the Phase One deal. European bourses see a broad-based performance, whilst the FTSE 100 is closed on account of UK’s Early May Bank Holiday. Sectors in Europe are mostly in the green, with the exception of Financials amid a rebound in bonds. Industrials outperform on the prospect of factories and other industrial operations resuming post-lockdown. In terms of individual movers; ING (+4%) rose some 6% at the open on the back of lower than expected loan-loss provisions. Siemens (+5%) are higher despite dismal earnings as the group moves to accelerate its cost-savings programme to deal with the impacts of the virus. On the flip side, Rheinmetall (-3.0%) holds onto losses as the group warned of a significant negative impact in Q2 earnings.

Top European News

- EU Rifts Spook Foreign Investors to Question Its Future

- Siemens Scraps 2020 Guidance With Industrial Slump Ongoing

- U.K. Starts Developing Second App to Trace Virus Spread, FT Says

- ING Profit Resilient as Bank Keeps Tight Rein on Provisions

In FX, the DXY is back below the psychological 100.000 level and some distance down from its new early May high (100.400) within a narrow 99.880-627 range amidst widespread Greenback declines vs major and EM counterparts. Nerves ahead of the monthly US jobs data may be weighing on the Buck alongside buoyant risk sentiment after a seemingly constructive call between the US and China on the Phase 1 trade deal that is keeping the YUAN off recent lows and offsetting some COVID-19 economic headwinds. However, the looming payrolls number and unemployment rate are widely expected to highlight the adverse impact of measures taken to mitigate the fallout, while markets are starting to price in or hedge for even lower short term rates in response to even worse contagion from the pandemic in the months to come and this is also weighing on the Dollar.

- NZD/AUD – The Kiwi is flying high again, and back on the 0.6100 handle awaiting lift-off from lockdown, but also benefiting from favourable cross-flows as the Aussie reflects on the latest RBA SOMP that essentially repeated the policy meeting assessment and guidance, though also reiterated that QE can be scaled up again if necessary. Aud/Usd is holding above 0.6500 after fading into 0.6550, while Aud/Nzd has pulled back under 1.0650 from around 1.0686 awaiting next week’s RBNZ policy convene and Aussie labour market report.

- GBP – Not quite zero to hero, but the early signs are looking considerably better for Sterling after a far from super Thursday, with Cable retesting 1.2400 compared to deep sub-1.2300 levels yesterday and Eur/Gbp pivoting 0.8750 on UK May/VE Bank holiday. No specific or new catalyst for the Pound’s rebound, so the recovery looks more technical and positional ahead of the weekend and Sunday’s update from PM Johnson on plans to remove coronavirus restrictions.

- CAD/CHF/EUR – All firmer against the Greenback, as the Loonie extends well beyond 1.4000 to 1.3925 in the run up to Canadian and US jobs data, the Franc pares losses towards 0.9700 and Euro forms a firmer base above 1.0800 following its fall to a fresh multi-week trough. However, the single currency looks somewhat hampered by hefty option expiry interest at 1.0850 (1.9 bn) having attempted a breach earlier.

- JPY – The G10 laggard, albeit marginally, with the Yen boxed in from 106.23-46 vs its US peer in wake of 2 efforts to clear 106.00, but no success before the return of Japanese participants from Golden Week.

In commodities, WTI and Brent front month futures continue to track sentiment higher, with the benchmarks underpinned on US-China trade optimism, and with the outlook for the complex less dire – reflected by Saudi’s OSP increases yesterday for most oil grades into most of the regions for June. Aside from that, fresh fundamental news-flow has been light. WTI and Brent meander around mid-range, with the former’s June contract having printed an intraday band of USD 23.26-25/bbl whilst the latter clocked a parameter of USD 29.43-30.66/bbl thus far. Elsewhere, spot gold remains steady within a tight USD 1712-1720/oz range ahead of a detrimental US labour market report. Copper prices move higher in tandem with sentiment and amid the prospect of economies returning from lockdown – the red metal briefly topped its recent high at USD 2.4150/lb. Finally, Shanghai iron ore and steel futures posted weekly gains of over 2.5% each on a rosier demand outlook.

US Event calendar

- 8:30am: Change in Nonfarm Payrolls, est. -22m, prior -701,000;

- Change in Private Payrolls, est. -21.9m, prior -713,000

- Change in Manufact. Payrolls, est. -2.5m, prior -18,000

- 8:30am: Unemployment Rate, est. 16.0%, prior 4.4%

- 8:30am: Average Hourly Earnings MoM, est. 0.5%, prior 0.4%; Average Hourly Earnings YoY, est. 3.3%, prior 3.1%

- 8:30am: Average Weekly Hours All Employees, est. 33.5, prior 34.2;

- 10am: Wholesale Inventories MoM, est. -1.0%, prior -1.0%; Wholesale Trade Sales MoM, est. -3.0%, prior -0.8%

Tyler Durden

Fri, 05/08/2020 – 07:52

via ZeroHedge News https://ift.tt/2L7xYAC Tyler Durden