Commercial Real Estate Is Crashing In Europe: Offices Obliterated, Retail Routed

Authored by Wolf Richter for WolfStreet.com,

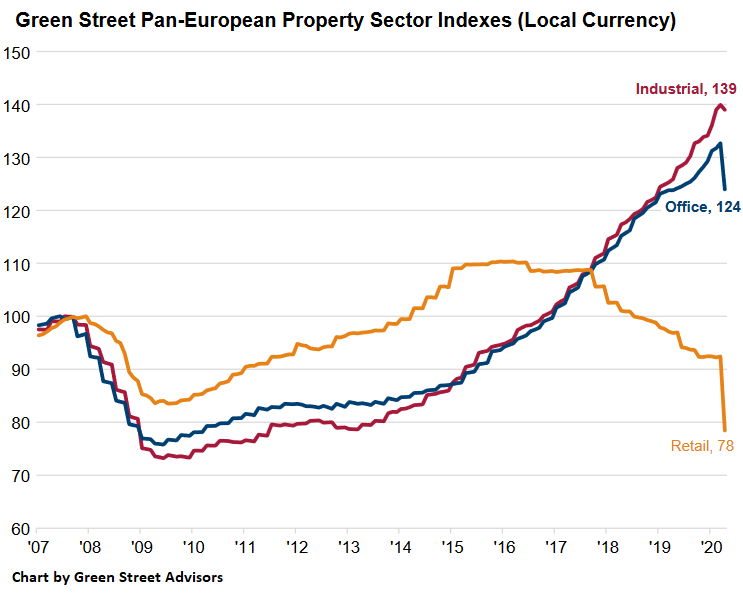

Over the past few years, the various sectors of commercial real estate have split into different trajectories, with some property types, such as industrial and office, rising to new highs, and with retail properties dropping further and further. Then came the issues surrounding Covid-19 and the lockdowns.

The trajectories suddenly turned into the same direction: down for all, but to different degrees, some sectors barely ticking down and other sectors dropping more sharply. And retail properties plunged.

Here is a first taste of the dynamics in Europe, where the lockdowns started earlier than in the US – in Italy, local lockdowns started on February 21, nearly a month before the first local lockdown in the US, the San Francisco Bay Area.

Retail properties have long been suffering from the structural shift of where retail spending takes place, the shift from brick-and-mortar stores to ecommerce. This shift had been relentlessly progressing over the years. But in March and April, it exploded higher as brick-and-mortar stores were shut down and ecommerce operations boomed.

Tenants of retail properties are now having trouble paying rent, or are unwilling to pay rent, as their stores are closed. Some of them will go out of business altogether; others will attempt to stay in business but renegotiate their leases. This whole dynamic has accelerated, as many future years of more or less gradual change are now being distilled into a few months. It has thrown the retail property sector into turmoil.

According to the Green Street Pan-European Commercial Property Price Index, which tracks prices of retail properties in the 25 most liquid real estate markets in Europe, all three sub-indices dropped in April, from March. But prices of retail properties plunged during the month:

-

Retail properties: -15.1%

-

Office properties: -6.6%

-

Industrial properties -0.7%,

“Wide bid-ask spread points to lower values” going forward, the report by Green Street Advisors notes.

The indices for office and industrial properties came off their all-time highs in March. But the all-time high of the retail index was the plateau period of mid-2015 to early 2016. Since then, the retail property index has plunged 29% (chart via Green Street Advisors, click to enlarge):

The report notes:

“The commercial real estate transaction market has largely come to a standstill as buyers and sellers adjust their underwriting expectations and try to agree on a fair price,” the Green Street report notes.

“During periods of wide bid-ask spreads, asset values often move closer to the bid than the ask. There is little to no investor demand in the retail sector and waning investor demand for sub-prime office buildings today.

“However, high-quality office and most industrial assets are still likely to trade at punchy capital values per square meter.”

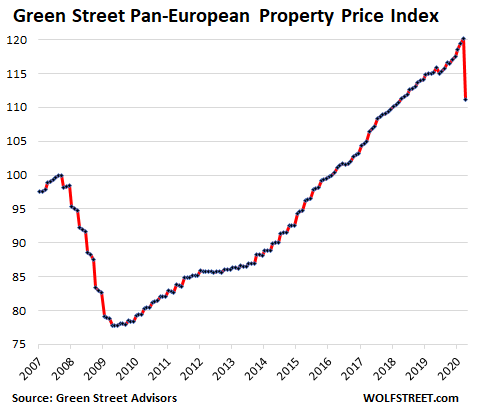

The overall Green Street Pan-European CPPI, which is an average of the retail, office, industrial sectors, dropped 7.5% in April from March and is down 3.4% over the past 12 months:

Each index was set at 100 for the month of its pre-Global-Financial-Crisis peak in 2007. According to Green Street, prices are tracked in local currency. The indices capture the prices at which commercial real estate transactions are currently being negotiated and contracted, which makes the index very timely.

Much like the retail sector of commercial real estate, the office sector also faces new structural challenges going forward as work-from-home strategies have been successfully rolled out during the pandemic, and companies and service providers now see that it is a functional and manageable alternative with high productivity for many jobs.

This too is playing out worldwide.

And this – much like the acceleration of ecommerce – is one of many structural shifts coming out of this crisis.

* * *

Tyler Durden

Sun, 05/10/2020 – 09:20

via ZeroHedge News https://ift.tt/2zrNip0 Tyler Durden