A New Reality: Pandemic-Induced Layoffs May Be Permanent

A new report from the University of Chicago found that pandemic-induced layoffs will result in permanent job loss, which shreds the Wall Street narrative of how many of these lost jobs will return once lockdowns are lifted. As if the Wall Street consensus has a damn clue about the job situation in the back half of the year.

The U.S. economy lost 20.5 million jobs in April, and the unemployment rate spiked to 14.7%. Optimism on Wall Street last Friday ramped stocks higher as Wall Street cheered more than 18 million of those jobs lost were considered temporary reductions and were likely to come back once restrictions were lifted quickly.

However, a recent working paper from the school’s Becker Friedman Institute for Research in Economics discovered there were only three new hires for every ten layoffs caused by virus-related shutdowns. The authors — Jose Maria Barrero, Nick Bloom, and Steven J. Davis estimated that 42% of the layoffs seen over the last several months would result in permanent job loss:

“Drawing on our survey evidence and historical evidence of how layoffs relate to recalls, we estimate that 42 percent of recent pandemic-induced layoffs will result in permanent job loss. If the pandemic and partial economic shutdown linger for many months, or if pandemics with serious health consequences and high mortality rates become a recurring phenomenon, there will be profound, long-term consequences for the reallocation of jobs, workers, and capital across firms and locations,” the authors wrote.

The report went on to say that virus-related shutdowns have devastated the U.S. economy with nearly 28 million people filed for new claims for unemployment benefits over the six weeks ending April 25. It said at an annualized rate, the U.S. economy is expected to contract 4.8% in 1Q20 and 25% in 2Q20.

The authors quoted a recent Wall Street Journal piece that noted, “The coronavirus pandemic is forcing the fastest reallocation of labor since World War II, with companies and governments mobilizing an army of idled workers into new activities that are urgently needed.” In other words, the pandemic has created a “major reallocation shock.” As for anecdotal evidence, the report said the new hirings by Walmart, Amazon, and Instacart are evidence of this.

They went onto say that “historically, creation responses to major reallocation shocks lag the destruction responses by a year or more,” adding that, “we anticipate a drawn-out economic recovery from the COVID-19 shock, even if the pandemic is largely controlled within a few months.”

The authors said several economic forces will delay creation response. They said government intervention can prolong the creation response, slowing the recovery.

“In this regard, we discuss four aspects of U.S. policy that can retard creation responses to the pandemic-induced reallocation shock: Unemployment benefit levels that exceed earnings for many American workers under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, policies that subsidize employee retention irrespective of the employer’s longer term outlook, occupational licensing restrictions the impede mobility across occupations and states, and regulations that inhibit business formation and expansion,” they wrote.

“If we are correct that many of the lost jobs are gone for good, there are important implications for policy,” the report said.

What this report suggests is that Wall Street’s optimism about a V-shaped recovery this year is absolutely wrong and the recovery may not be seen until 2021 or beyond.

A former Federal Reserve economist, Claudia Sahm, who is now director of macroeconomic policy at the Washington Center for Equitable Growth, has also shared similar remarks that some furloughed workers will have trouble finding jobs.

“For a lot of those furloughed workers, a non-trivial number will have no job to go back to, because the company they worked for will have failed or will need fewer workers than they used to,” Sahm said.

Since aggregate demand collapsed, and will likely not revert to 2019 levels for several years, factories are shuttering their doors across the country, resulting in permanent job loss. Here are several closings:

“Factory furloughs across the U.S. are becoming permanent closings, a sign of the heavy damage the coronavirus pandemic and shutdowns are exerting on the industrial economy.

Makers of dishware in North Carolina, furniture foam in Oregon and cutting boards in Michigan are among the companies closing factories in recent weeks. Caterpillar Inc. said it is considering closing plants in Germany, boat-and-motorcycle-maker Polaris Inc. plans to close a plant in Syracuse, Ind., and tire maker Goodyear Tire & Rubber Co. GT plans to close a plant in Gadsden, Ala.

Those factory shutdowns will further erode an industrial workforce that has been shrinking as a share of the overall U.S. economy for decades. While manufacturing output last year surpassed a previous peak from 2007, factory employment never returned to levels reached before the financial crisis,” The Wall Street Journal reports.

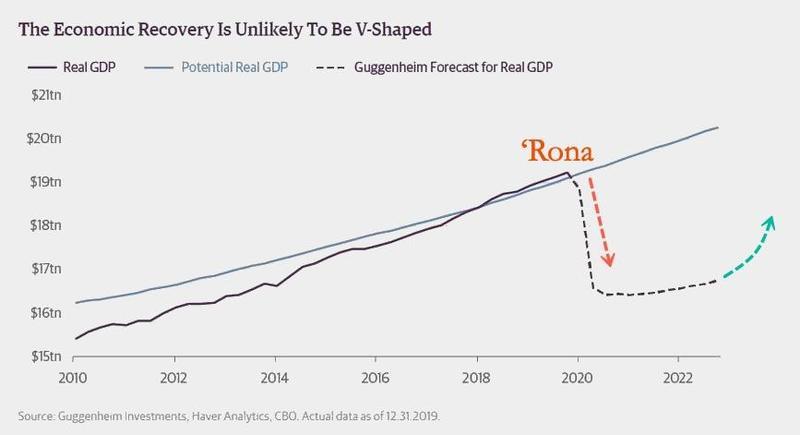

Scott Minerd, CIO Guggenheim Investments, believes it could take upwards of “four years” for a recovery to take place adding that “to think that the economy is going to reaccelerate in the third quarter in a V-shaped recovery to the level where the gross domestic product (GDP) was before the pandemic is unrealistic.”

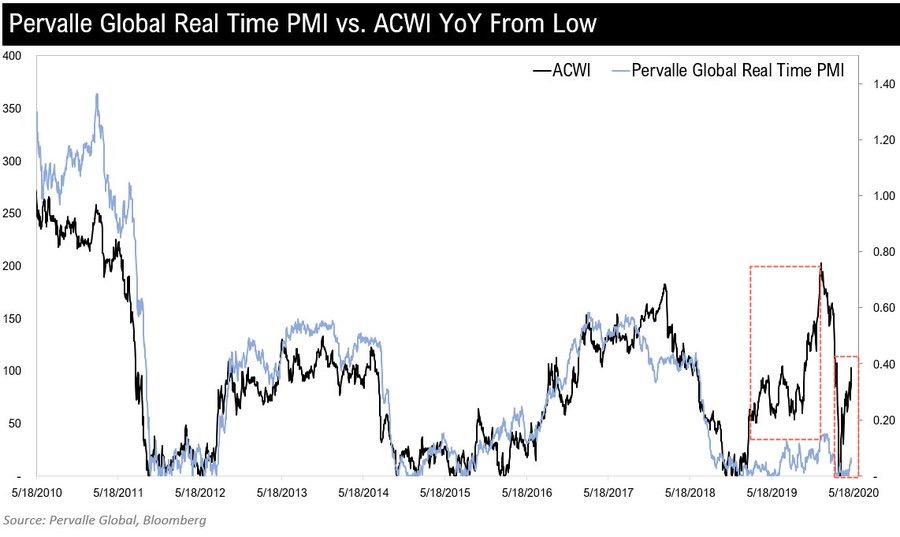

Teddy Vallee, Founder & CIO of Pervalle Global, recently tweeted, “Global equities for the second time in a year price in a growth rebound that our Real-Time PMI model does not confirm.”

And here we are, the Wall Street consensus is pricing in a V-shaped recovery this year that will likely not happen.

Tyler Durden

Mon, 05/11/2020 – 14:23

via ZeroHedge News https://ift.tt/2yMrK6I Tyler Durden