How Brokerage-App “Game-ification” Enticed A Generation Of Lemmings To Day-Trade This Market

Millennial retail traders who have been piling into retail brokerage accounts over the past few months, desperate to capitalize on what many fear might be their last chance to buy stocks on the cheap.

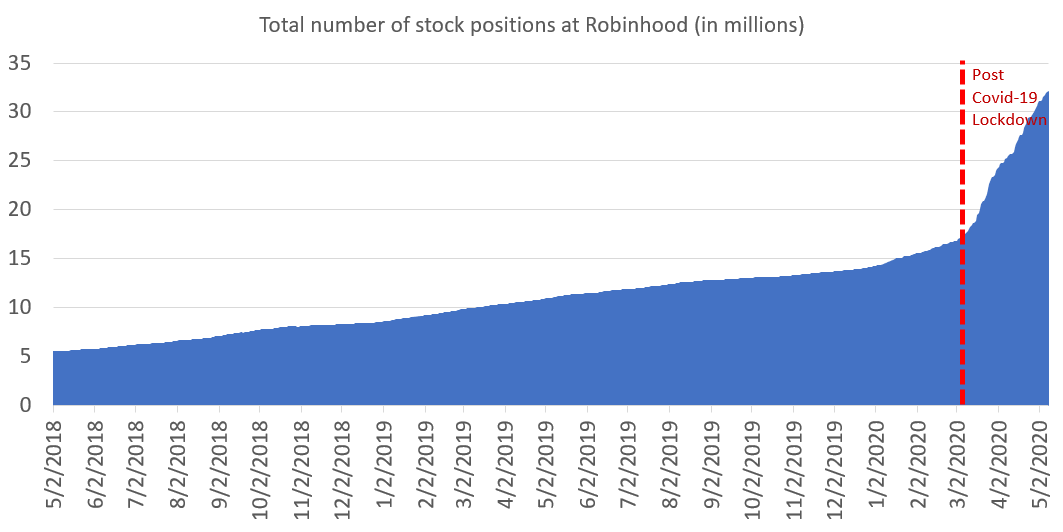

Stock positioning at free brokerage app Robinhood has become increasingly stretched since the beginning of the year…

…as 3 million new customers (almost 10x the number of new customers at one of its traditional rivals) have signed up. More and more, social media activity, traffic on financial news websites and other indicators have shown more young people are experimenting with the time-honored practice of “buying the dip”. As one FT columnist claimed (somewhat incredulously, we might add) their 13-year-old child recently asked if they could open a Robin Hood account for the purposes of above-mentioned dip buying.

Millennials and their younger “Gen Z” peers are in some ways perfectly positioned for the age of remote work and simpler living. They are digital natives who live and breathe streaming, social media, ecommerce and such. They are well-positioned to sell themselves to employers and start businesses in the new and much more digital era. And they’ll need to, because they are more exposed to long-term decreases in earning power than any other group. Economic research shows that when you start your working career during a period of high unemployment and compressed wages, you never recoup the losses fully. Zoomers, as they may now be called, will be at increased risk for poverty and retirement insecurity. Which may be why some are frantically trying to play the stock market. I was slightly suspicious when my 13-year-old son asked me if he could open a brokerage account last week because “Mom, you want to buy the dip!” (um, no, not this one — see my latest column on that score).

Unfortunately, while people seem to always be talking about how young people need to learn a better grasp of basic financial management – from how to save, to what percentage of one’s income should be spent on housing, and what percentage should be saved etc.- this, as the author concedes, is hardly an example of sound financial planning.

Apps like TD Ameritrade and Charles Schwab have cut trading fees to zero. So why continue trading with Robinhood? Well, as the FT explained in another horrifying recent trend piece, Robinhood is leading the charge into the “gameification” of stock trading.

Essentially, Robinhood is taking the logic that resulted in the creation of CNBC – that is, tacitly encouraging (some might say ‘conning’) ‘normal people’ to play the market like casino – to its logical end point.

To wit, Zoomers might think they’re getting a bargain right now, but as the chart below shows, they’re not.

And as recent market action would suggest, now that the millennials are nearly exhausted, these “gameified” apps have supplied what is essentially an entire generation of lemmings lining up to get eaten by the sharks. Hence, the author’s reason for writing a column that was tantamount to a warning.

My fear – we are about to see Zoomers lose both their earnings potential in labour markets and, now, their shirts in the stock market. Yet more fodder for generational political wars over a shrinking pie.

Any Zoomers reading this who thought the last few sessions might be a good time to buy: delete Robinhood or live to regret it.

Tyler Durden

Mon, 05/11/2020 – 16:40

via ZeroHedge News https://ift.tt/35XAnYo Tyler Durden