Record Big 30Y Treasury Auction Tails Amid Mediocre Demand

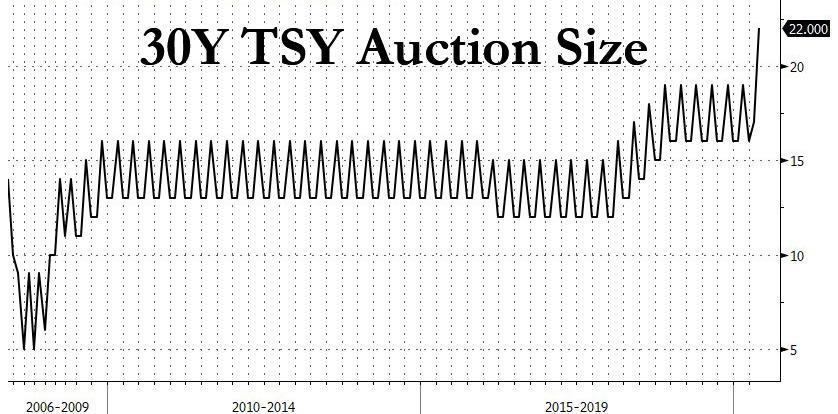

A week of record sized refunding treasury auctions has concluded with today’s sale of $22 billion in 30Y paper, which as we discussed last week, was the largest auction of this tenor in history.

However, unlike the 3Y and 10Y auctions which priced earlier this week, and ahead of next week’s inaugural 20Y issuance, today’s 30Y sale left much to be desired, especially as bonds rallied into the 1pm deadline.

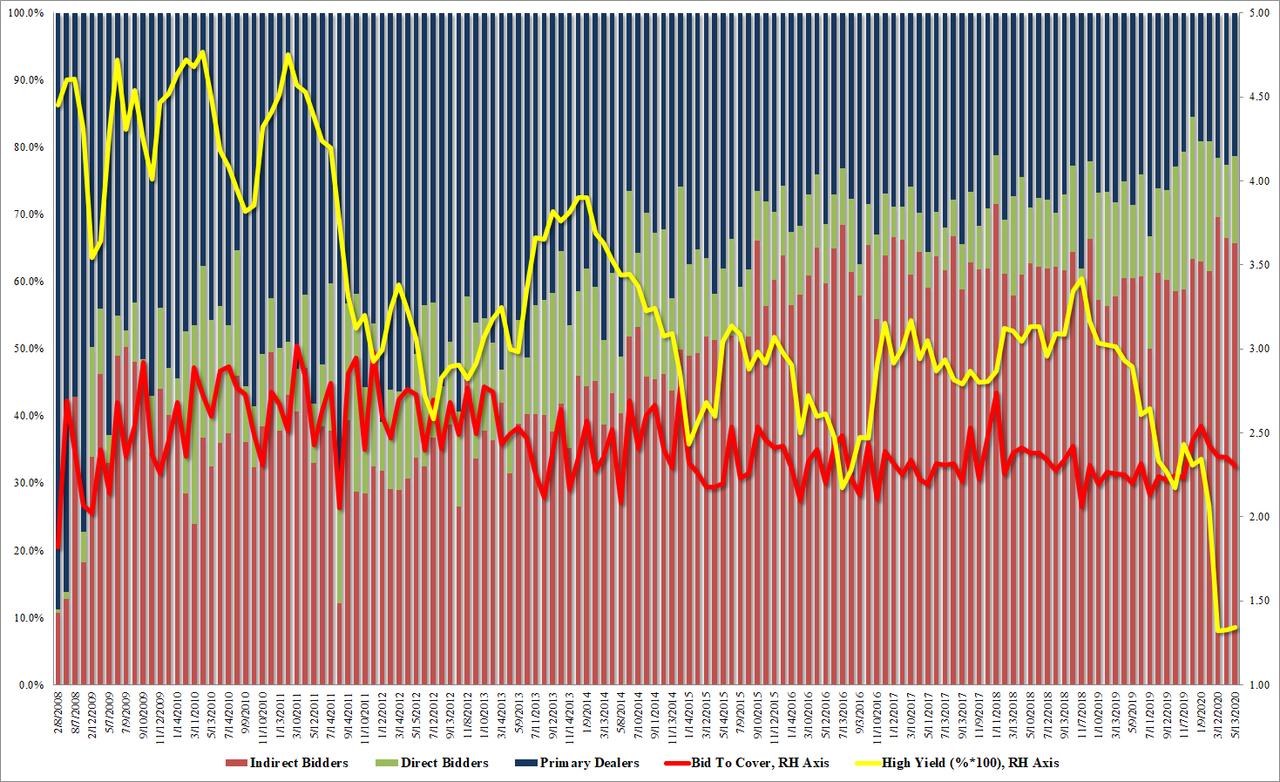

Pricing at a high yield of 1.342%, it just barely missed out on being a record low yield after last month’s 1.325%. It also tailed the When Issued 1.334% by 0.8bps.

The Bid to Cover also disappointed, coming in at 2.301, the lowest since October of 2019 and well below the 2.40% six auction average.

The internals were mediocre, with Indirects taking down 65.7%, the lowest since February although just above the recent average of 63.8%, and with Directs taking 12.9% it left Dealers holding on to 21.4%.

And while the auction was clearly far weaker than this week’s previous two, much may have to do with today’s slide in yields which saw the entire curve dip and the 30Y was 5bps lower. Also, despite today’s mediocre reception, another record refunding has now been digested by the market and the results are certainly encouraging to the Treasury. The problem: there are trillions more to come, much of which will be targeting the long-end. One wonders just how much more paper Mnuchin can ram down investor throats before an auction does not go quite as well…

Tyler Durden

Wed, 05/13/2020 – 13:21

via ZeroHedge News https://ift.tt/2y3Wgsw Tyler Durden