Companies Call The Market Top With Most Stock Sales In Eight Years

Tyler Durden

Thu, 05/14/2020 – 19:25

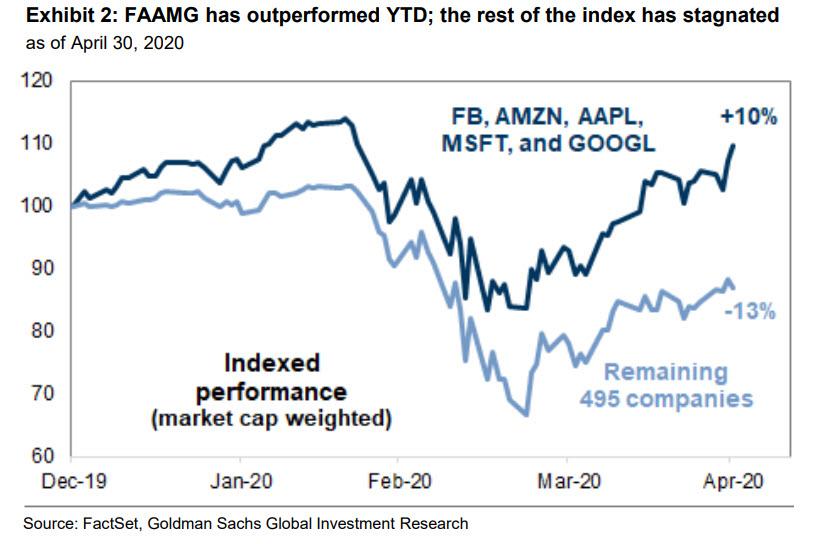

If one asks companies why the market, by which we of course mean just the top 5 tech names that now comprise “the market”…

… has soared 30% in the past two months, the most likely response is a blank stare: after all nearly 30% of companies have pulled guidance as nobody has any idea what is coming. Not even the Fed in fact: in an interview with MNI, St Louis Fed president James Bullard said the Fed may not have enough clarity on the economy by its June meeting to offer a quarterly forecast.

One thing companies do know, echoing recent similar observations from both Stanley Druckenmiller and David Tepper, is that stocks have run up too far, too fast. And, as a result, CEOs, CFOs and Treasurers are all taking advantage of the tidal wave of liquidity that has propelled many shares back to all time record levels, and are selling stock at a furious pace not seen in almost a decade.

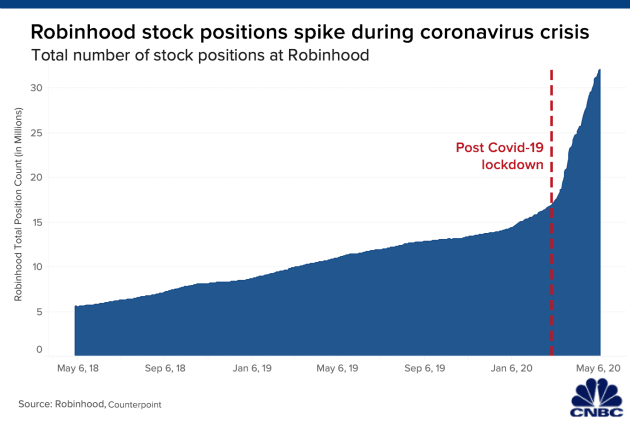

According to Bloomberg calculations, public companies have raised more cash in the past three days – from selling shares – than in any week in eight years. Buyers have been undaunted by warnings from either Fed Chair Jerome Powell, who cautioned about unprecedented downside risk to the U.S. economy, from Goldman Sachs which we first reported said stocks could drop nearly 20% in the next three months, or by investing titans who say this is the most overbought market in history. No, these are retail investors who know better than even corporate management…

… and riding a momentum wave unlike any in recent history, are buying everything companies have to sell.

And while these same amateur traders will point to the strength in equity financing is a promising sign for the broader economy (what they really mean is that Fed backstops actually do work), the reality is that a burst of corporate selling is about as bearish as it gets, as the investors who know their own assets and growth potential best are rushing to sell their stock to a greater fool. Luckily, there is more than enough of those in the US retail investing population.

“Now’s the time to act. The rally is extremely fragile,” said Michael Purves, CEO of Tallbacken Capital Advisors, who spent 12 years advising companies on mergers and capital-raising. “When you’re a CFO or a board director of a company in a capital intensive industry, you raise money so that you don’t lose your job. That’s 100% the right thing to do now.“

Sadly for all those greater, perhaps greatest fools, who bought the shares the rally is now ending, because despite a modest short covering rally on Thursday, the market has double-topped out, unable to rise above 2,950 and is now sliding despite trillions and trillions in central bank liquidity.

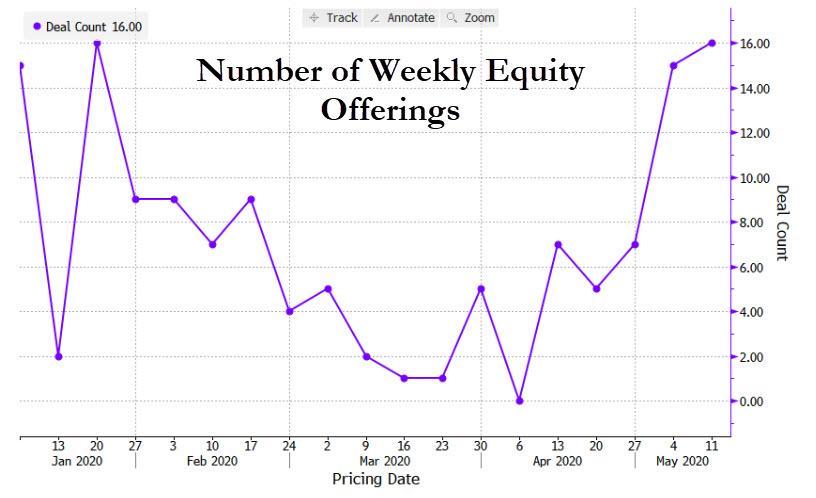

Of course, every short-squeeze in the broader market will be promptly used by companies to sell even more shares. Just int the past three days, investment banks have conducted 16 secondary offerings on U.S. exchanges since Monday in stocks such as Zillow, Equinix, MyoKardia, YETI Holdings, and Q2 Holdings Inc. And according to Bloomberg, through Wednesday that already made for the busiest week of 2020.

In fact, in just the first three days of the week, companies raised more than $17 billion from investors, the most since 2012, thanks largely to PNC Financial Services Group Inc. selling $12.1 billion of its BlackRock shares in the second-largest offering since 2009.

As Bloomberg summarized, “a scarcity of deals during the market’s March meltdown has turned into a geyser after equities recovered and issuers released their first earnings reports since the new coronavirus pushed investors away from risk.”

Since March 1, share sales by public companies and top holders have raised about $35 billion, with this week’s activity comprising half of that volume. Equity-linked offerings are also on the rise, raising $11 billion in the last two weeks – nearly double their haul from the second half of April.

Yet what is even more bizarre is that traders are rewarding these massive at times dilutions (because who cares about such things as shares outstanding at a time of central planning) by bidding their stocks up by an average of 5% from their offering prices even as the Nasdaq has suffered a 2.2% decline in recent days.

”If your stock has done well, you might do a secondary offering here because you know there’s going to be an opportunity to deploy that,” said Jerry Braakman, chief investment officer of First American Trust, in Santa Ana, California, which manages about $1.8 billion. “When people are looking at this current environment, cash is king and equity is a long-term holding.” Because of course equity is a “long-term holding” during a depression when the only liquidity out there is thanks to central banks.

There is just one problem: while it’s safe to say the situation now in the market defies historical comparison, Bloomberg points out that “the record for stocks after big surges in share sales isn’t encouraging” and usually results in broad market selling, something which the companies know too well, and is precisely why there is a firehose of equity offerings now before the window closes. Consider that monthly proceeds from secondary offerings have surpassed $30 billion on only three occasions since 2010. Three months after those spikes, the S&P 500 was trading lower every time (and on most occasions required either small or large Fed bailouts to keep the party going).

Proceeds from this month’s U.S. stock offerings have surpassed $24 billion so far, but are almost assured to cross $30 billion in the next two weeks.

via ZeroHedge News https://ift.tt/2WX3ln1 Tyler Durden