COVID-America: 84,136 Dead, 36 Million Jobless, Nasdaq +30%

Tyler Durden

Thu, 05/14/2020 – 08:34

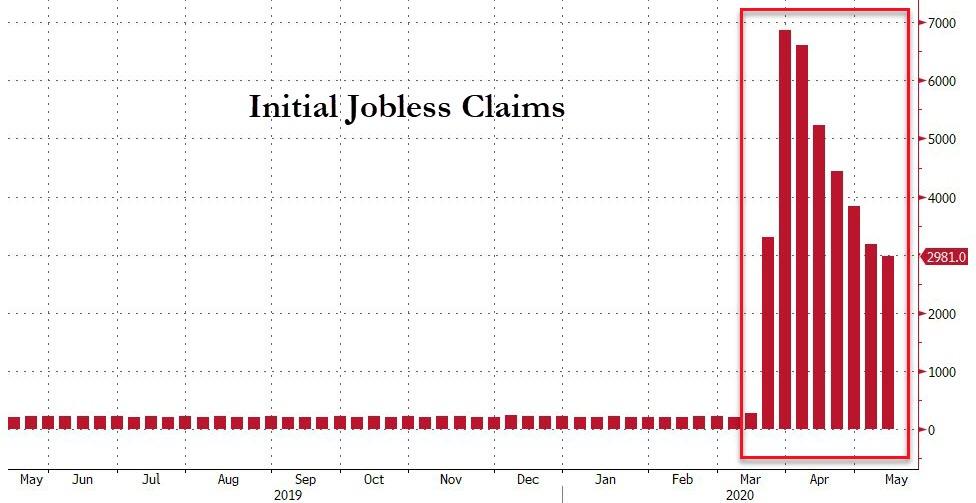

The string of unprecedentedly huge spikes in jobless claims continues. In the last week 2.98 million Americans filed for unemployment benefits for the first time (notably worse than the 2.50 million expected).

Source: Bloomberg

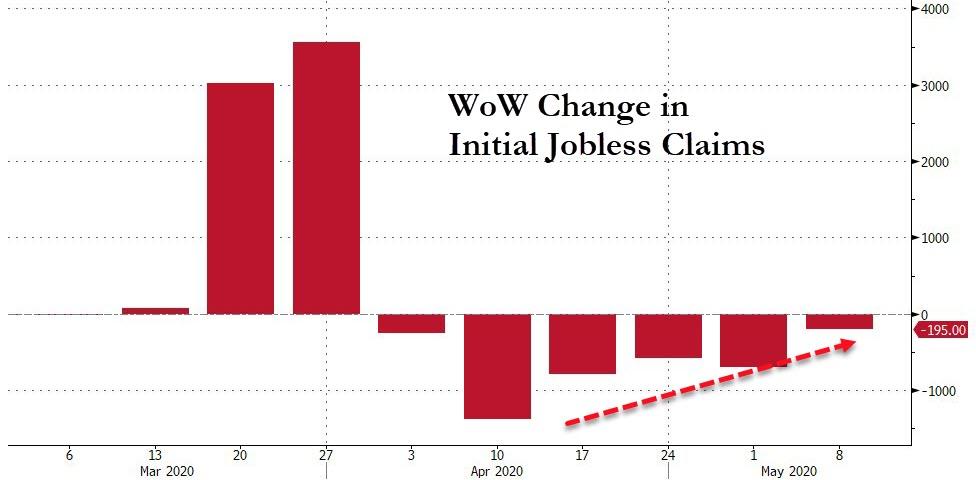

The small difference WoW suggests a second wave of unemployment is hitting…

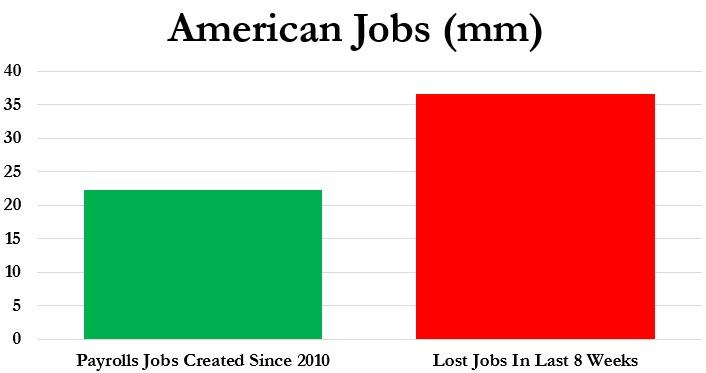

That brings the eight-week total to 36.47 million, which is massively worse than the prior worst eight-week period in the last 50-plus years.

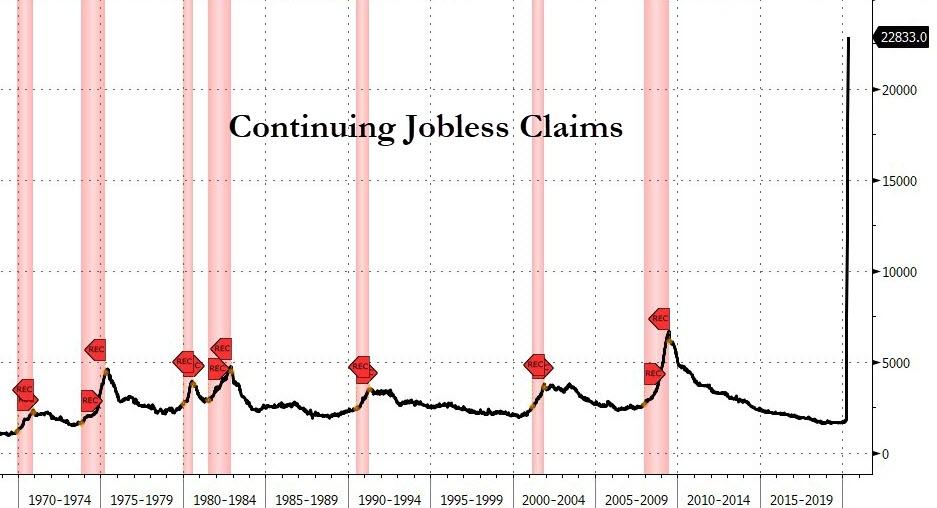

And of course, last week’s “initial” claims and this week’s “continuing” claims… the highest level of continuing claims ever

Source: Bloomberg

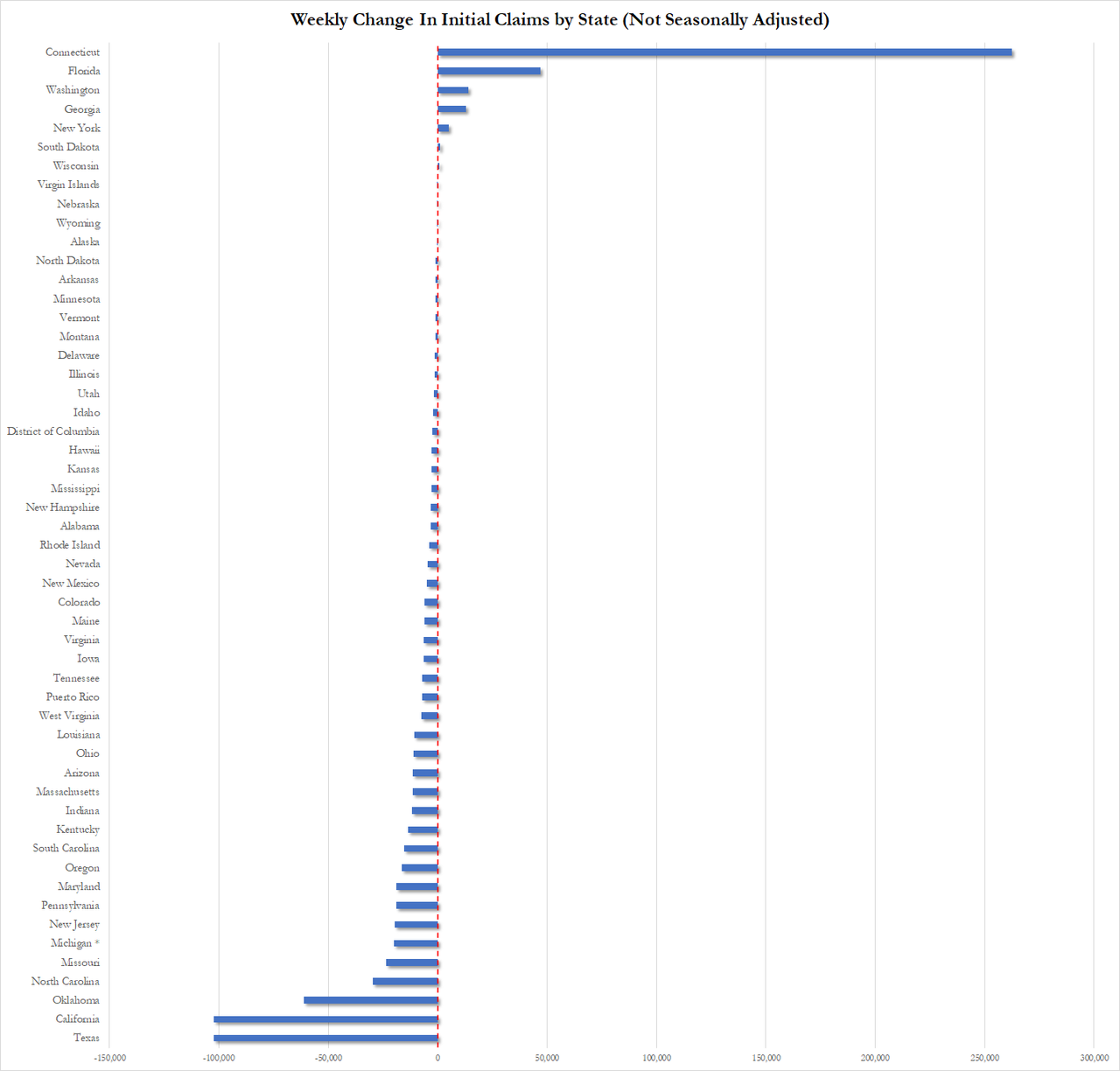

Connecticut saw a massive surge in initial jobless claims last week (we suspect this is more systems catch up than a sudden resurgence)…

And as we noted previously, what is most disturbing is that in the last eight weeks, far more Americans have filed for unemployment than jobs gained during the last decade since the end of the Great Recession… (22.13 million gained in a decade, 36.47 million lost in 8 weeks)

Worse still, the final numbers will likely be hurt even more due to the bailout itself: as a reminder, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, passed on March 27, could contribute to new records being reached in coming weeks as it increases eligibility for jobless claims to self-employed and gig workers, extends the maximum number of weeks that one can receive benefits, and provides an additional $600 per week until July 31. A recent WSJ article noted that this has created incentives for some businesses to temporarily furlough their employees, knowing that they will be covered financially as the economy is shutdown. Meanwhile, those making below $50k will generally be made whole and possibly be better off on unemployment benefits.

As Mises’ Robert Aro noted earlier in the week, the stimulus packages being handed out across this world provide us with an opportunity to document the anticapitalist process as it unfolds in real time, keeping in mind that when these inflation schemes fail, it will likely be blamed on capitalism.

The combination of increasing the money supply in order to pay people not to produce goods or services has consequences that not a lot of people are talking about.

It flies in the face of the free market and is as nonsensical as a negative interest rate. A loan that is forgivable is unconventional to say the least, because a loan is normally defined as an amount borrowed that is expected to be paid back with interest. When a loan is given on a first-come-first-served basis for the purpose of paying people not to work and is forgivable because it’s guaranteed by the United States government, we shouldn’t call it a loan.

It may be called socialism, maybe interventionism, and some may still prefer the term statism; but one thing is certain when it comes to the Paycheck Protection Program: it’s not capitalism!

Welfare cliffs are of course not the only reason so many capable Americans languish in partial dependency on government assistance. Dreadful government schools in poor areas and systematic obstacles to getting a job, such as minimum wage laws and occupational licensing laws, are also to blame. But the perverse incentives of America’s welfare system really hurt, and the CARES Act may have been a serious tipping point.

But, hey, there’s good news… well optimistic headlines as Treasury Secretary Steven Mnuchin said he anticipates most of the economy will restart by the end of August.

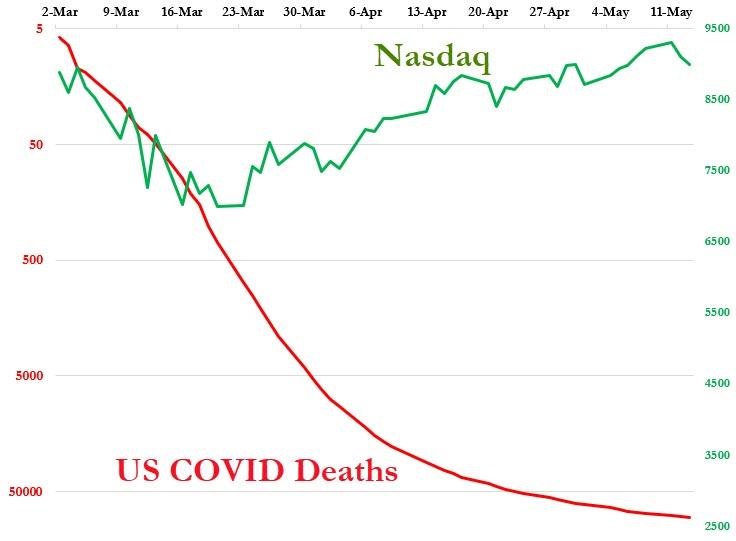

Finally, it is notable, we have lost 314 jobs for every confirmed US death from COVID-19 (784,136).

Was it worth it? Well of course it was – US equity markets are roaring higher (though the last 3 days reality may be starting to set in again)…

via ZeroHedge News https://ift.tt/3cB8YOk Tyler Durden