Key Events This Week: Things Quiet Down

Tyler Durden

Mon, 05/18/2020 – 09:10

After several weeks of economic, political and corporate earnings, things finally quiet down this week as Q1 earnings season comes to an end with a handful of retailers (at least the ones that aren’t bankrupt yet) set to report. The main data release this week will be the flash PMIs for May from around the world on Thursday and Friday, according to DB’s Jim Reid. The consensus is expecting services in Europe to bounce from low teens to the mid-twenties area and manufacturing to go up a few points in the thirties. The PMIs are diffusion indices, with respondents simply saying whether things are better or worse than the previous month so they are a little difficult to calibrate to growth at such extreme levels of activity but they will be a big curiosity nonetheless.

There’s a raft of central bank events this week, including a number from the Fed. The highlights are likely to be the two sets of remarks from Fed Chair Powell that we mentioned above. Aside from that, there’ll also be remarks to digest from Vice Chair Clarida and New York Fed President Williams on Thursday, as well as other regional Fed Presidents throughout the week. Finally on the Fed, it’ll be worth keeping an eye out for the release of the minutes from April’s meeting on Wednesday. On Friday, the ECB will also be publishing their account of the most recent monetary policy meeting.

Earnings season continues to wind down over the week ahead, with over 90% of the S&P 500 companies having now reported. This week will only see a further 22 companies from the S&P 500 and 30 from the STOXX 600 announce earnings. In terms of the highlights, today we’ll hear from Ryanair, Lufthansa and Panasonic. Then tomorrow we have Walmart and Home Depot, before Wednesday sees Lowe’s, Target and Experian report. On Thursday, there’s Nvidia, Medtronic, Intuit, TJX and Hewlett Packard Enterprise, and finally on Friday there’s Deere & Company and Alibaba.

Finally on Friday, the National People’s Congress will open in China. The central government is expected to unveil more fiscal measures, aimed at supporting households and encouraging consumption. Another thing that will be interesting to see is whether a numerical GDP target for this year is made, since Bloomberg reported previously that one option that could be done instead is to have a description of the GDP goal.

Below, courtesy of Deutsche Bank, is a day-by-day calendar of events:

Monday

- Data: Japan preliminary Q1 GDP, March tertiary industry index, China April new home prices, US May NAHB housing market index

- Central Banks: Remarks from the Fed’s Bostic, ECB’s Hernandez de Cos and the BoE’s Tenreyro

- Earnings: SoftBank, Ryanair, Lufthansa, Panasonic

Tuesday

- Data: Japan March capacity utilisation, final March industrial production, UK March unemployment, employment, average weekly earnings, EU27 April new car registrations, Germany May ZEW survey, US April housing starts, building permits

- Central Banks: Remarks from Fed Chair Powell, the Fed’s Rosengren, Kashkari and the ECB’s Lane, Bank Indonesia monetary policy decision, Reserve Bank of Australia release minutes from May policy meeting

- Earnings: Walmart, Home Depot

Wednesday

- Data: Japan March core machine orders, UK April CPI, Euro Area March current account balance, Euro Area final April CPI, US weekly MBA mortgage applications, Canada April CPI, Euro Area advance May consumer confidence

- Central Banks: FOMC release meeting minutes, remarks from BoE’s Bailey, Broadbent, Cunliffe and Haskel, Fed’s Bullard and Bank of Canada’s Lane

- Earnings: Lowe’s, Target, Experian

Thursday

- Data: Manufacturing, services and composite PMIs from Australia, Japan, UK and US, Japan April trade balance, US May Philadelphia Fed business outlook survey, weekly initial jobless claims, April leading index, existing home sales

- Central Banks: Remarks from Fed Chair Powell, Vice Chair Clarida and New York Fed President Williams, monetary policy decisions from the Central Bank of Turkey and South African Reserve Bank

- Earnings: Nvidia, Medtronic, Intuit, TJX, Hewlett Packard Enterprise

Friday

- Data: Manufacturing, services and composite PMIs from France, Germany and the Euro Area, Japan April nationwide CPI, nationwide department store sales, UK April retail sales, public sector net borrowing, Canada March retail sales

- Central Banks: ECB releases account of monetary policy meeting

- Earnings: Deere & Company, Alibaba

- Politics: China’s National People’s Congress begins

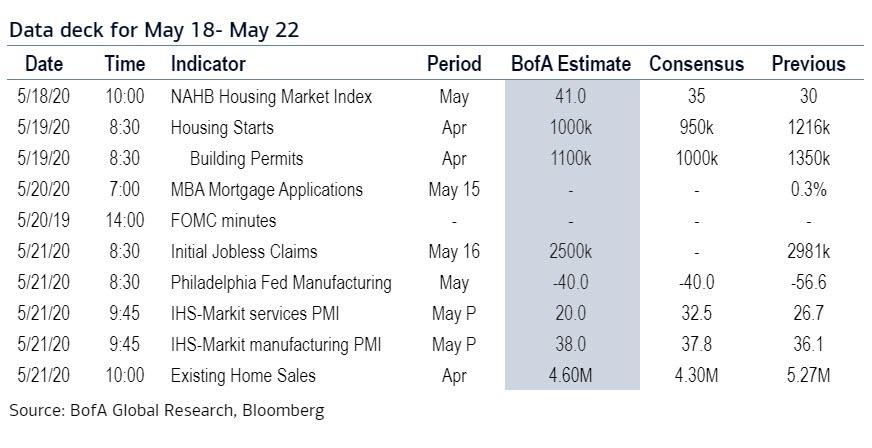

Key highlights via BofA:

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the Philly Fed manufacturing index and the jobless claims report on Thursday. In addition, minutes from the April FOMC meeting will be released on Wednesday. There are several scheduled speaking engagements from Fed officials this week, including Chair Powell on Tuesday and Thursday, and New York Fed President Williams and Vice Chair Clarida on Thursday.

Monday, May 18

- 10:00 AM NAHB housing market index, May (consensus 34, last 30)

- 02:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will take part in a virtual discussion about the economy and the coronavirus hosted by the Nashville Chamber of Commerce. Audience Q&A is expected.

Tuesday, May 19

- 08:30 AM Housing starts, April (GS -26.0%, consensus -24.1%, last -22.3%); Building permits, April (consensus -25.9%, last -6.8%); We estimate housing starts declined by 26.0% in April due to coronavirus-related declines in construction activity.

- 10:00 AM Fed Chair Powell appears before the Senate Banking Committee: Fed Chair Jerome Powell will testify alongside Treasury Secretary Steven Mnuchin on the Quarterly CARES Act report to Congress before the Senate Banking Committee. Prepared text is expected.

- 10:00 AM Minneapolis Fed President Kashkari (FOMC voter) speaks: Minneapolis Fed President Neel Kashkari will discuss the economy in a virtual town hall hosted by General Mills.

- 02:00 PM Boston Fed President Eric Rosengren (FOMC non-voter) speaks: Boston Fed President Eric Rosengren will discuss the impact of the coronavirus on the New England economy and the actions taken by the Fed in response in a virtual talk hosted by the New England Council.

Wednesday, May 20

- 10:00 AM Atlanta Fed President Raphael Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak on the Fed’s response to the coronavirus in a webinar with the JAXUSA Partnership.

- 12:00 PM St. Louis Fed President James Bullard (FOMC non-voter) speaks: St. Louis Fed President James Bullard will take part in a virtual discussion on the coronavirus and the economy hosted by the Missouri Growth Association.

- 02:00 PM Minutes from the April 28-29 FOMC meeting: At its March meeting, the FOMC left the target range for the policy rate unchanged at 0-0.25%, as widely expected. The FOMC did not make changes to IOER, the forward guidance, the asset purchase plan, or the credit facilities. In the minutes, we will look for further discussion of the economic outlook and the Fed’s toolkit.

Thursday, May 21

- 08:30 AM Philadelphia Fed manufacturing index, May (GS -35.0, consensus -40.0, last -56.6): We estimate that the Philadelphia Fed manufacturing index increased by 21.1pt to -35.0 in May.

- 08:30 AM Initial jobless claims, week ended May 16 (GS 2,500k, consensus 2,425k, last 2,981k): Continuing jobless claims, week ended May 9 (consensus 23,500k, last 22,833k); We estimate initial jobless claims declined but remain elevated at 2,500k in the week ended May 16

- 09:45 AM Markit Flash US manufacturing PMI, May preliminary (consensus 38.0, last 36.1): Markit Flash US services PMI, May preliminary (consensus 32.3, last 26.7)

- 10:00 AM Existing home sales, April (GS -21.0%, consensus -18.4%, last -8.5%): After falling by 8.5% in March, we estimate that existing home sales fell another 21.0% in April. Existing home sales are an input into the brokers’ commissions component of residential investment in the GDP report.

- 10:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will take part in a webinar video conference hosted by the Buffalo Niagara Partnership, CenterState CEO, and the Greater Rochester Chamber of Commerce. Prepared text and audience Q&A are expected.

- 01:00 PM Fed Vice Chair Clarida (FOMC voter) speaks: Fed Vice Chair Richard Clarida will take part in an online discussion on the US economy and monetary policy hosted by the New York Association for Business Economics. Prepared text and a moderated Q&A are expected.

- 02:30 PM Fed Chair Powell (FOMC voter) speaks: Fed Chair Jerome Powell will make opening remarks at a virtual Fed Listens event on how the coronavirus is affecting US communities. Fed Governor Lael Brainard will moderate the discussion.

Friday, May 22

- There are no major economic data releases scheduled today.

Source: Deutsche Bank, Goldman, BofA

via ZeroHedge News https://ift.tt/36bZwOQ Tyler Durden