Platts: 5 Commodity Charts To Watch This Week

Tyler Durden

Mon, 05/18/2020 – 14:59

Via S&P Global Platts Insight blog,

The US oil production slowdown, China’s domestic gasoline pricing policy, and power market outlooks on both sides of the Atlantic feature in this week’s pick of commodity market trends from S&P Global Platts editors.

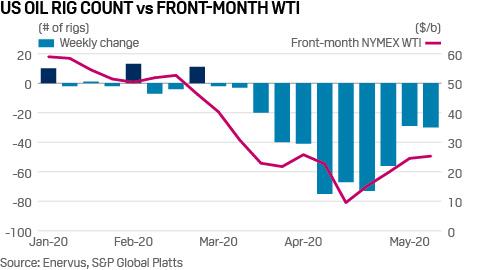

1. US rig count declines slow as WTI rebounds…

What’s happening? Since oil prices plunged in mid-March, upstream producers have cut their capital budgets and sharply curtailed drilling activity, resulting in a collapse in rig counts. But oil rig count declines have slowed in recent weeks as WTI futures have climbed back into the mid $20/b range.

What’s next? Total US crude output averaged at 11.6 million b/d in the week ending March 9, down 1.5 million b/d from its mid-March peak and the weakest since December 2018. Crude output declines have accelerated, with weekly output falling by 300,000 b/d in the week to May 8, up from 200,000 b/d the week prior, and around 100,000 b/d for most of April. This trend is likely to face headwinds as rig declines slow.

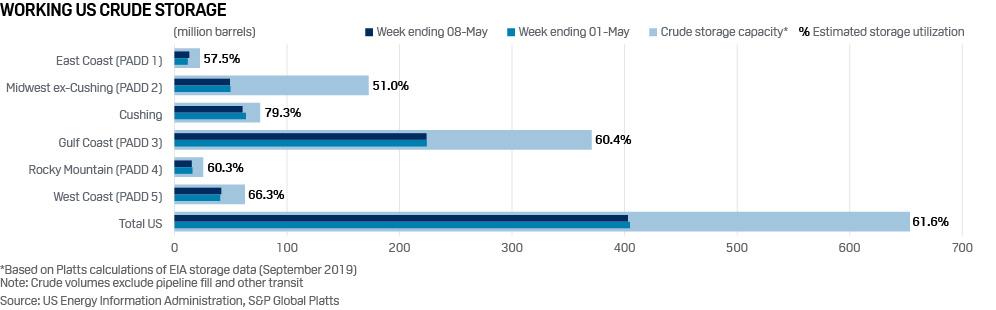

2. … and crude storage race pauses after drive to shut in production

What’s happening? As the global pandemic killed global crude demand, there was a race to turn off the production taps in US shale before crude storage volumes could hit their capacities, especially in the benchmark storage hub of Cushing, Oklahoma. But, with Cushing 80% full and largely contracted out, commercial crude inventory levels actually dipped slightly for the week of May 8, according to the latest EIA report on Wednesday.

What’s next? The brief pause on the rush to fill up crude storage means more crude is sitting in floating storage offshore or being exported. And even though refinery utilizations remain low, producers have largely succeeded in shutting in wells in response to the global demand collapse. Still, crude storage volumes are expected to keep rising moving forward and the weekly inventory report will remain a key barometer to watch.

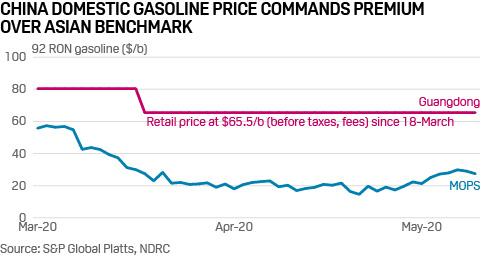

3. China cautious on gasoline pricing policy as economy slows

What’s Happening? It has been widely expected that some of the top Chinese policymakers and politicians may propose to remove or lower the floor prices set for various oil products during the annual “two sessions” starting from May 21, in order to lower consumer cost burden during the global economic slowdown, according to industry officials and market sources. The “two sessions” are the plenary session of the National People’s Congress, or NPC, and the annual session of the National Committee of the Chinese People’s Political Consultative Conference, or CPPCC.

What’s Next? China is unlikely to remove the current retail fuel price floor mechanism, as this could jeopardize Beijing’s push for green energy. “We will see some proposals about the floor price mechanism, but cutting retail fuel prices will encourage more oil consumption, which is not in line with China’s long term green energy development target,” a senior government official said. State-run and independent refiners would breathe a sigh of relief if the price floor mechanism remains, as they have benefited from high domestic refining margins in recent months. In Guangdong province, 10 ppm 92 RON gasoline retail price has been set at Yuan 6,900/mt or $65.5/b, unchanged since March 18. In contrast, S&P Global Platts assessed the Mean of Platts Singapore 10 ppm 92 RON gasoline at $27.09/b so far this month.

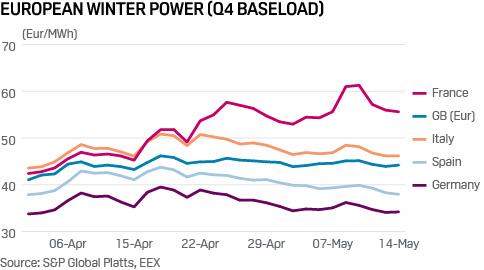

4. EU power market jumpy on drip-drip of EDF nuclear guidance

What’s happening? French Q4 2020 power prices climbed over 40% after EDF slashed its 2020 nuclear output target in April, but some of these gains were lost last week as Q4 availability improved in the latest maintenance adjustments, and EDF management hinted the current maintenance schedule was not set in stone, with winter supply security of overriding importance.

What’s next: Almost anything EDF says about nuclear is market moving and sure enough, the generator’s May 14 comment that its dire winter reactor availability outlook was “cautious” sliced around 12% off the fourth quarter French power contract. Traders must be exhausted by the eternal vigilance required as EDF pumps out daily updates on reactor availability, but there is no let-up in view. This is partly because of other hard-to-predict outcomes relating to the easing of lockdowns and the timing of new interconnection projects between France, the UK and Italy. The 2-GW IFA2 link between the UK and France remains on course for Q3 testing, potentially doubling trading capacity and easing supply concerns – if schedules hold together.

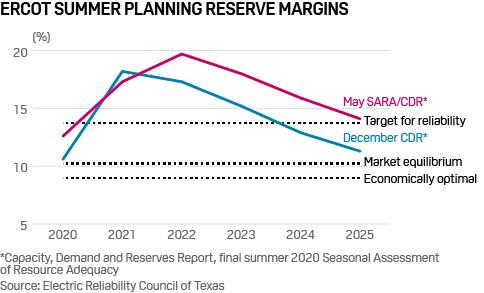

5. Texas power market’s reserve margin grows, but record peakload forecast

What’s happening? The Electric Reliability Council of Texas (ERCOT), which manages the power market for about 90% of Texas load, has increased the estimate for its summer 2020 reserve margin – resources in excess of forecast peakload – to 12.6% from December’s forecast of 10.6%. Factoring the coronavirus pandemic’s power demand reducing effects, ERCOT cut its summer peakload forecast by 1.5 GW, but still expects to hit a new record of 75.2 GW, up from last August’s 74.8 GW.

What’s next? A recent change in the Operating Reserve Demand Curve (ORDC), which ERCOT uses to enhance pricing during supply scarcity, may more than counteract the price-suppressing effect of demand reductions tied to the pandemic. The change is designed to have the ORDC price adder deployed more often at higher levels. Uncertainty about the pandemic’s longer-term effects prompted ERCOT to not revise its forecasts for 2021 and beyond.

via ZeroHedge News https://ift.tt/36b71Wi Tyler Durden