World’s Largest Contract Chipmaker Halts Deliveries To Huawei As New US Sanctions Bite

Tyler Durden

Mon, 05/18/2020 – 09:25

The Commerce Department’s decision to tighten restrictions on Huawei announced a few days ago are already throwing a wrench in Huawei’s supply chain, a sign that the US is no longer playing around, and is going all-in on bringing the Chinese telecom giant with strong links to the PLA to its knees.

As we reported on Friday, the Trump Administration reportedly blocked a shipment of American-made semiconductors that was headed to Huawei, eliciting a flurry of retaliatory threats, as Beijing via the mainland press promised to target Boeing, Apple and Qualcomm. Despite the seeming escalation in the US trade and tech wars with China, White House economic advisor Kevin Hassett told CNBC Monday morning that the ‘Phase 1’ trade deal appears to still be intact.

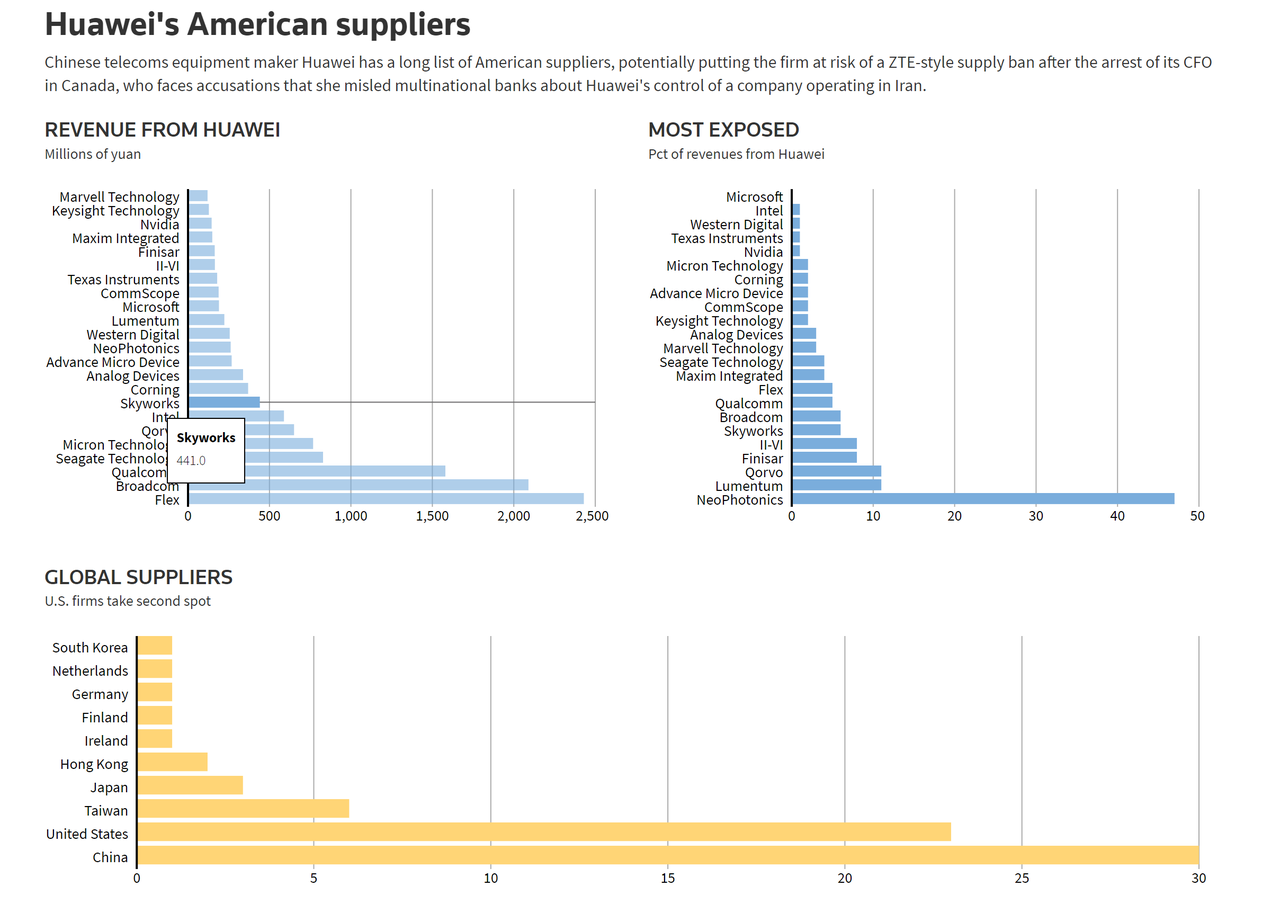

Despite years of aggressive intellectual technology theft coordinated by the Chinese government, Huawei remains surprisingly dependent on products and technology produced by American companies.

When the Commerce Department added Huawei to the national “entities list” – effectively a “blacklist” requiring US companies to seek permission from Commerce to do business with Huawei – it essentially caveated the decision to hell, leaving in loopholes that allowed large American chip companies to continue shipping to Huawei (which, in addition to its telecoms infrastructure business, is also the second-largest maker of smartphone handsets)

However, the latest restrictions unveiled by the Commerce Department late last week and over the weekend will “narrowly and strategically” target a loophole that allows US companies to produce chips overseas with American technology to get around the restrictions. This will no longer be allowed, as even foreign companies that depend on US products will be forced to comply. In response, other global chipmakers are refusing to ship certain products to Huawei. This group includes the world’s biggest contract chipmaker, Taiwan Semiconductor Manufacturing Co, a

According to Nikkei Asian Review reported published Monday morning, TSMC has halted new orders from Huawei in response to tighter US export controls. Prior to the new declaration, some companies evaded existing US sanctions by producing semiconductor chips overseas, using American technology, then selling them directly to Huawei.

From here on out, any company that continues this practice risks being sanctioned by the Treasury Department, sanctions that could restrict their access to the dollar-based financial system, or even ban them entirely, leaving them in the same predicament faced by Iranian companies.

“TSMC has stopped taking new orders from Huawei after the new rule change was announced to fully comply with the latest export control regulation,” a person familiar with the situation said. “But those already in production and those orders which TSMC took before the new ban are not impacted and could continue to proceed if those chips could be shipped before mid-September.”

[…]

“It’s a difficult decision for TSMC as Huawei is the company’s No. 2 customer, but the chipmaker has to follow the U.S. rules,” another person familiar with the matter said.

The Chinese 5G pioneer relies on TSMC for chips that power its smartphones, and TSMC has long been viewed as a “lifeline” for Huawei in the face of US sanctions.

Huawei, the world’s biggest telecom equipment maker and second biggest smartphone maker, relies heavily on TSMC to manufacture its advanced chip designs – including all of the mobile processors used in Huawei’s flagship smartphones. The Taiwanese company, which also produces artificial intelligence processors and networking chips for Huawei, has been viewed as a vital lifeline for the Chinese company in its efforts to resist U.S. pressure since Washington placed it on a trade blacklist last May.

This relationship with Huawei, however, has put the Taiwanese company in the crossfire of Washington-Beijing tensions.

The tighter U.S. controls were announced the

However, TSMC shares tumbled during Asian trade on Monday as investors fretted about how these sanctions would impact the relationship between TSMC and its second-biggest customer (after Apple).

One trade lawyer who spoke to Nikkei explained that virtually every contract chip maker outside the US will need to apply for a license from the US to ship to Huawei, unless they meet certain criteria showing American-made components in a given product fall below a given threshold.

Harry Clark, a Washington-based trade law expert and managing director of U.S. law firm Orrick, said that chip contract manufacturers outside the U.S. will have to apply for license for any shipments that do not meet the above criteria. Violating such laws, he added, could leave a company “exposed to substantial penalties” imposed by the regulators.

Huawei has of course been preparing for another crackdown since the trade war between the world’s two largest economies started, and those preparations were stepped up after the US government targeted Huawei and its fellow Chinese telecoms giant ZTE.

Huawei has been preparing for such a move by the U.S. since the end of last year, including stockpiling more than a year’s worth of networking equipment-related chips, especially for its crucial telecom equipment and carrier business, sources told Nikkei Asian Review.

The company has also explored a wide range of other options, including asking European chipmaker STMicroelectronics, a longtime supplier, to co-design chips, Nikkei reported earlier. However, those efforts may not immediately solve all of its vital chip supply issues, which are critical for Huawei to continue rolling out world-class technologies, analysts said.

China’s Department of Commerce on Sunday said it “strongly objects to the new export controls and warned such restrictions would pose a huge threat to the global supply chain. If Washington doesn’t reverse the action, Beijing warned it would face retaliation.

One analyst at Jeffries Equity Research wrote that if the US is successful, the pressure could help “quash China’s 5G ambitions” – the White House’s ultimate goal – though that would come with its own set of repercussions…

“The proposed legislation likely aims to stop Huawei’s tech progress and quash China’s 5G ambitions,” Jefferies Equity Research analysts said in a research note. “We expect China to retaliate if this materializes. The risk of a ‘super’ cold war is mounting.”

…including mounting risk of a “super cold war” as the two economies continue with a decoupling that has been rapidly accelerated by the coronavirus.

via ZeroHedge News https://ift.tt/3bFbgdR Tyler Durden