Fearing An Imminent Top, Companies Flood The Market With Stock For Sale After The Close

Tyler Durden

Mon, 05/18/2020 – 20:25

Last week was remarkable for the capital markets, not because the S&P did something crazy (it actually suffered its biggest weekly drop in months) but because the companies that comprise it appeared to make a collective decision that after its 30% rebound from the March 23 lows, that was as good as it gets and proceeded to flood the market with follow-on and secondary equity offerings.

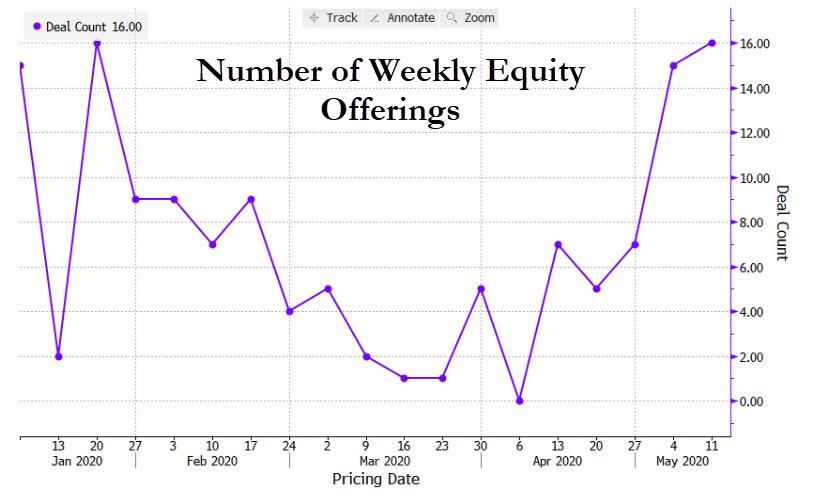

As we reported before, in just the first three days of the week, public companies raised more cash from selling shares than in any week in eight years. According to Bloomberg calculations, investment banks conducted no less than 16 secondary offerings on U.S. exchanges in the Monday thru Wednesday interval in stocks such as Zillow, Equinix, MyoKardia, YETI Holdings, and Q2 Holdings Inc. Over that three-day interval, companies raised more than $17 billion from investors, the most since 2012, thanks largely to PNC selling $12.1 billion of its BlackRock shares in the second-largest offering since 2009. That made for the busiest week of 2020.

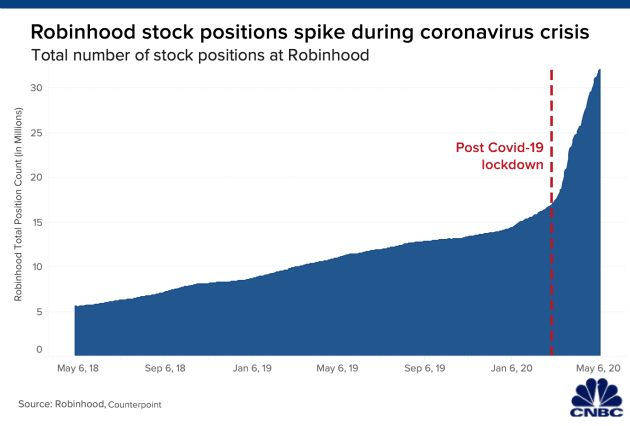

Buyers – mostly retail investors – have been undaunted by warnings from either Fed Chair Jerome Powell, who cautioned about unprecedented downside risk to the economy, from Goldman Sachs which we first reported said stocks could drop nearly 20% in the next three months, or by investing titans who say this is the most overbought market in history. No, these are retail investors who know better than even corporate management…

“Now’s the time to act. The rally is extremely fragile,” said Michael Purves, CEO of Tallbacken Capital Advisors, who spent 12 years advising companies on mergers and capital-raising. “When you’re a CFO or a board director of a company in a capital intensive industry, you raise money so that you don’t lose your job. That’s 100% the right thing to do now.”

More importantly, you raise money when you think the top is in so you don’t leave any on the table. Like now… because after last week’s torrid pace of equity offerings, at least thirteen equity offerings launched after the market closed Monday, the busiest evening of 2020 for such deals, as stocks that surged during the Covid-19 crisis thanks to a frenzy of retail buying, are now tapping the same retail investors for more cash, and follow on last week’s furious offering that raised more cash than in any week in eight years.

That said, unlike some prior share sales from distressed sectors, Bloomberg notes that almost all of Monday’s deals came from stocks that outperformed since the coronavirus began rattling U.S. markets in late February. Of the thirteen secondary offerings launched so far, all but two have outperformed the Nasdaq Composite Index since March 1.

Moderna for example, launched the largest of three stock offerings since going public in 2018 after Monday’s 20% rally capped off a more than 300% gain this year on very hasty speculation that the company’s Phase 1 trial which included 8 participants, was supposedly successful when it was, at best, noise. Fastly also sold shares after rising 69% since May 6, when it boosted its 2020 revenue forecast due to stay-at-home measures.

Below is a summary of the post-market launches of secondary offerings:

Avantor (AVTR) 45m shares, trades May 21

- Bookrunners: Goldman Sachs, JPMorgan

- Shares -7.0% post-market

- Seller: Holders

Bellerophon (BLPH) Shares offered at $13 each

- Bookrunner: Jefferies

- Shares -15% post-market

- Seller: Company

Cable One (CABO) $400m of shares, trades May 20

- Bookrunners: JPMorgan, BoFA, Wells Fargo

- Shares little changed post-market

- Seller: Company

Carvana (CVNA) 5m shares at $93-$96

- Bookrunners: Citi, Wells Fargo

- Shares -4.8% post-market

- Seller: Company

Clovis Oncology (CLVS) $85m of shares at $8.05-$8.50

- Bookrunners: JPMorgan, BofA

- Shares -6.9% post-market

- Seller: Company

Fastly (FSLY) 6m shares, trades May 21

- Bookrunners: Morgan Stanley, Citi, BofA, Credit Suisse, William Blair, Raymond James, Baird, Oppenheimer, Stifel, Craig- Hallum, DA Davidson

- Shares -1.7% post-market

- Seller: Company

Gamida Cell (GMDA) Shares offered at $4.50-$5.00

- Bookrunners: Piper Sandler, Evercore Group, JMP

- Shares -13% post-market

- Seller: Company

Gossamer Bio (GOSS) Shares offered at $13.25- $13.75

- Bookrunners: BofA, SVB Leerink

- Shares -11% post- market

- Seller: Company

Houlihan Lokey (HLI) 3m shares at $63.50- $64.00

- Bookrunners: Goldman Sachs

- Shares -0.8% post-market

- Seller: Company

Hexo (HEXO) No terms

- Bookrunner: Canaccord

- Shares -12% post-market

- Seller: Company

Krystal Biotech (KRYS) Shares offered at $55-$56

- Bookrunners: Cowen, Evercore

- Shares -1.2% post- market

- Seller: Company

Moderna (MRNA) $1.25b of shares at $75.00- $77.50

- Bookrunner: Morgan Stanley

- Shares -3.2% post-market

- Seller: Company

RealPage (RP) $300m of shares, trades May 20

- Bookrunners: Goldman Sachs, BofA Securities, Wells Fargo

- Shares -3.2% post- market

- Seller: company

- Notes: Also offering $300m of convertible bonds

Source: Bloomberg

via ZeroHedge News https://ift.tt/2ZhZsM3 Tyler Durden