FOMC Minutes Show Fed Officials Mull Forward-Guidance To Battle “Tremendous Human Hardship”, Hint At Yield Curve Control

Tyler Durden

Wed, 05/20/2020 – 14:18

Since the somewhat snoozeworthy April 29th FOMC statement (more of whatever it takes… forever… and it’s going to be bad), The Fed has issued its semi-annual “risks” report, warning very clearly of elevated asset valuations. But that hasn’t stopped “investors” buying stocks and selling bonds…

Gold (and silver) also rallied as the dollar leaked lower since the relatively dovish (if its possible to get any more dovish) statement.

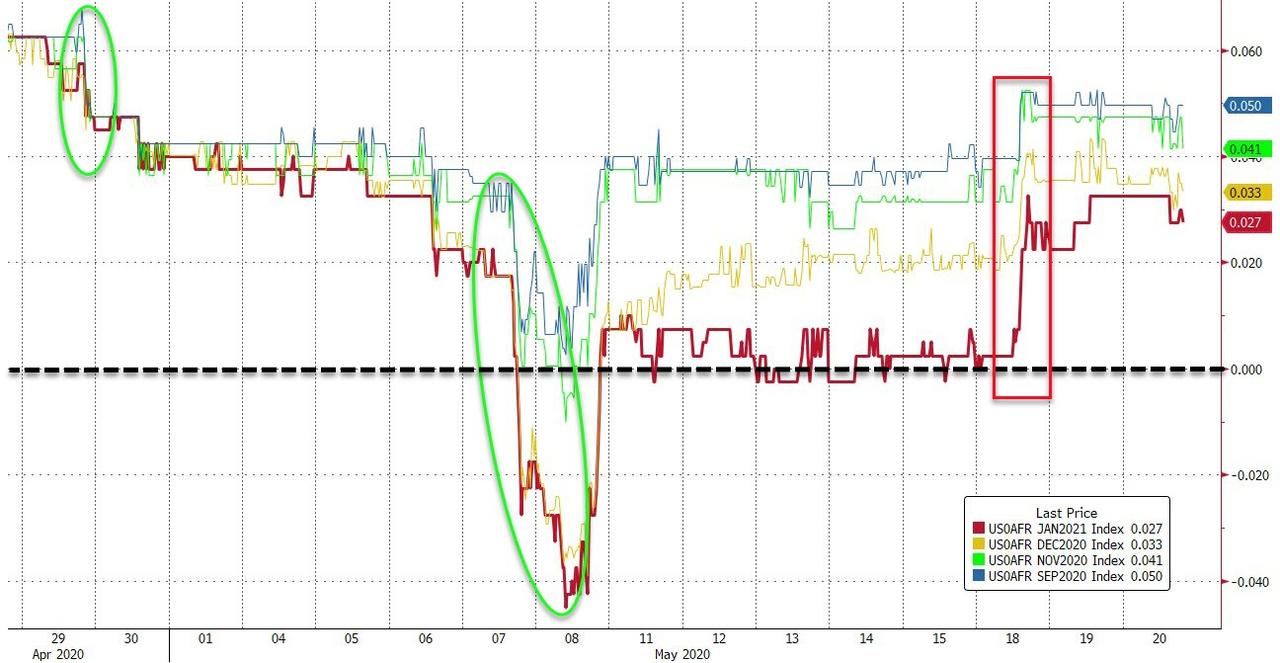

And despite The Fed’s desperate efforts to talk down the possibility of negative rates, expectations for such rates have increased since the last FOMC…

Source: Bloomberg

Realistically, given that the minutes follow a presentation on Tuesday from Chair Powell and also many officials have spoken on the record in public since the meeting, the room for new developments is small.

In fact, as Joseph Trevisani, Senior Analyst at FXStreet, argues, “discussions in the edited minutes may seem somewhat out of date as the national conversation in the almost three weeks since the meeting has rapidly moved from the revelations of the economic debacle to the apparent success of several states in reopening parts of their economies and considerations about the criteria for opening the others.”

Additionally, The Fed took the historic step of beginning purchases of ETFs invested in corporate bonds on May 12, so any discussion of that at the April meeting could be informative; and that has happened as The Fed has already wound its unlimited bond-buying program down to $6 billion of daily Treasury purchases, from a peak of $75 billion in mid-March.

Of course, we don’t truly expect any mention of the increasingly difficult-to-rationalize dichotomy between improving financial conditions (as a result of the Fed and the U.S. government’s massive stimulus) and the ongoing pain in the real economy; but it would be nice to see some rational thinking at the table. As Julian Emanuel, BTIG’s chief equity and derivatives strategist, warned, “The Fed’s Bigger Boat cannot substitute for the consumer’s need to feel safe enough to send kids to college, eat in restaurants, or get on an airplane.”

But, the minutes really focused on Federal Reserve officials’ growing distress at the economic implications of the coronavirus pandemic last month, which sent unemployment soaring and froze swaths of commercial activity.

On the virus’ impact:

“Participants noted that the coronavirus outbreak was causing tremendous human and economic hardship across the United States and around the world. The virus and the measures taken to protect public health were inducing sharp declines in economic activity and a surge in job losses. “

On outcome-dependent forward guidance…

“For example, the Committee could adopt outcome-based forward guidance that would specify macroeconomic outcomes – such as a certain level of the unemployment rate or of the inflation rate – that must be achieved before the Committee would consider raising the target range for the federal funds rate.”

Others favored basing forward guidance on a timeline:

“The Committee could also consider date-based forward guidance that would indicate that the target range could be raised only after a specified amount of time had elapsed. These participants noted that such explicit forms of forward guidance could help ensure that the public’s expectations regarding the future conduct of monetary policy continued to reflect the Committee’s intentions.”

Additionally, Fed officials “raised concerns that banks could come under greater stress.”

Participants were concerned that banks could come under greater stress, particularly if adverse scenarios for the spread of the pandemic and economic activity were realized, and so this sector should be monitored carefully. Participants saw risks to banks and some other financial institutions as exacerbated by high levels of indebtedness among nonfinancial corporations that prevailed before the pandemic; this indebtedness increased these firms’ risk of insolvency.

And raised questions on limiting dividends…

“A number of participants emphasized that regulators should encourage banks to prepare for possible downside scenarios by further limiting payouts to shareholders, thereby preserving loss-absorbing capital.

Indeed, historical loss models might understate losses in this context. A few participants stressed that the activities of some non-bank financial institutions presented vulnerabilities to the financial system that could worsen in the event of a protracted economic downturn and that these institutions and activities should be monitored closely.”

But the highlight appears to be the discussion that “forward guidance could be more explicit” in the context of “capping” yields at short-to-medium term maturities, i.e. imposing Yield Curve Control which the US had in the late 1940s (see the Fed-Treasury accord), which Japan has of course popularized in recent years, and which Zoltan Pozsar said is coming sooner or later:

“A few participants also noted that the balance sheet could be used to reinforce the Committee’s forward guidance regarding the path of the federal funds rate through Federal Reserve purchases of Treasury securities on a scale necessary to keep Treasury yields at short-to medium-term maturities capped at specified levels for a period of time. “

Notably no mention of negative yields.

* * *

Full Minutes below:

Fomc Minutes 20200429 by Zerohedge on Scribd

* * *

Powell simply promises to keep busy…

via ZeroHedge News https://ift.tt/3e55LHb Tyler Durden