Despite Soft Survey Data Rebound In May, PMI Signals 37% Collapse In US GDP

Tyler Durden

Thu, 05/21/2020 – 09:53

Since its record collapse in April, US economic data has surprised to the upside (admittedly against depression-esque expectations) and stocks have soared as if the pandemic never happened. This has sparked a renaissance in economists’ expectations that Markit’s soft survey data (after Europe’s rebound) will also rebound today in preliminary May data.

-

Markit US Manufacturing 39.8 (40.0 exp vs 36.1 prior)

-

Markit US Services 36.9 (32.5 exp vs 26.7 prior)

Source: Bloomberg

Although the overall contraction in new business eased in May, it was still the second-steepest in the series history. Firms continued to report significant decreases in client demand as customers further postponed the placement of orders.

Service sector and manufacturing firms registered the second-sharpest reductions in new orders since the global financial crisis. Foreign client demand remained especially muted, with new export orders decreasing substantially and at only a slightly reduced rate compared to April as lockdowns associated with the virus pandemic persisted across key export markets.

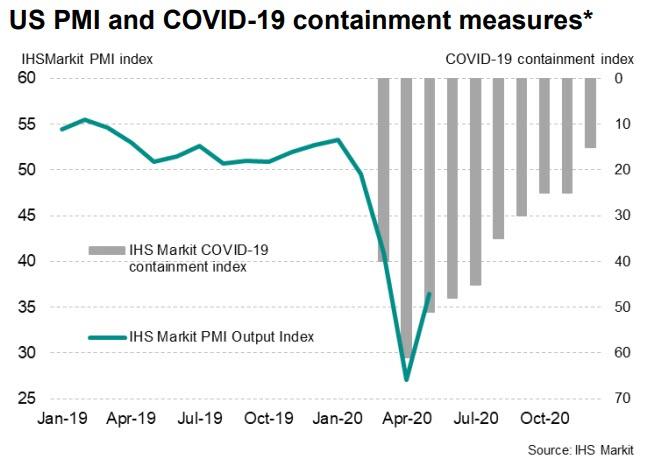

Adjusted for seasonal factors, the IHS Markit Flash U.S. Composite PMI Output Index posted 36.4 in May, up from 27.0 in April, but nonetheless indicating the second-sharpest decline in business activity since the series began in late-2009.

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at IHS Markit, said:

“The severe drop in business activity in May comes on the heels of a record downturn in April, adding to signs that GDP is set to suffer an unprecedented decline in the second quarter.

“Encouragement comes from the survey indicating that the rate of economic collapse seems to have peaked in April. In the absence of a second wave of COVID-19 infections, the decline should moderate further in coming months as measures taken to contain the coronavirus are steadily lifted.

“However, the sheer scale of the current downturn and associated job losses, and the fact that some restrictions will need to stay in place until an effective treatment or vaccine are found, highlights how a full recovery is unlikely to be swift.

Finally, Williamson comments on GDP:

“We anticipate that GDP will decline at an annualised rate of around 37% in the second quarter…”

and, according to Markit’s newly introduced COVID-19 containment index (based on information relating to issues such as closures of schools, non-essential shops and restaurants, as well as restrictions on public gatherings, internal mobility and external borders – We also forecast how these are expected to change in coming months, based primarily on government announcements. A reading of 100 means severe restrictions while a reading of zero indicate no restrictions)… “it will take the economy two years to regain the prepandemic peak.”

“ Businesses remained pessimistic towards the outlook for output over the coming year as the pandemic’s impact was extended. Although some became more confident of a pick-up in the later stages of the year, helping lift the survey’s future expectations index from April’s all-time low, others noted it would take a long time for conditions to normalise. “

Hope springs eternal.

via ZeroHedge News https://ift.tt/2ASesXb Tyler Durden