“Feeding Fednzy”: Powell To Announce $2.5 Billion In Bond ETF Purchases Today

Tyler Durden

Thu, 05/21/2020 – 15:38

One week ago we reported that after avoiding the capital markets for weeks, the Federal Reserve finally started waving corporate bond ETFs in, and as of May 13 owned $305 million in corporate bond ETFs under the Corporate Credit Facility, i.e., the corporate bond ETF buying program.

With the Fed set to provide its latest weekly balance sheet update at 4:30pm today, some are curious how many more bond ETFs (i.e., LQD and HYG) the Fed purchased in the past week to make sure stocks can only go up as companies use the mispriced bond market to issue even more bonds (up to $1 trillion YTD at last check) and repurchase their stock, if much more quietly.

According to BofA’s credit strategist Hans Mikkelsen, the Fed has continued buying at roughly that average daily pace and the bank’s expectation is that the Fed will report holding around $2.5bn of corporate bond ETFs as of Tuesday this week.

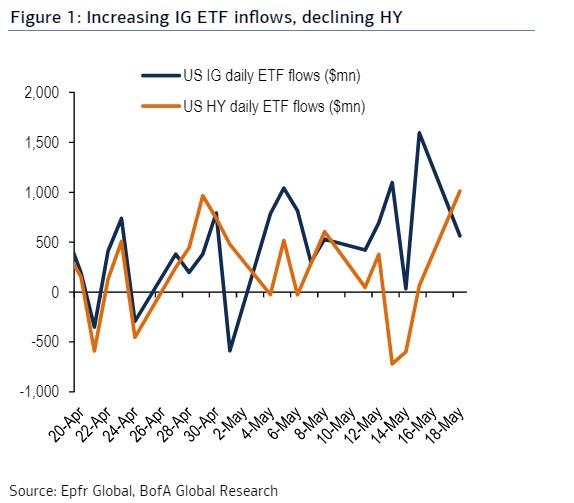

Looking at daily IG ETF inflows they have risen to about $780bn after the Fed began buying from $360bn the prior period. Meanwhile, HY ETF inflows actually declined.

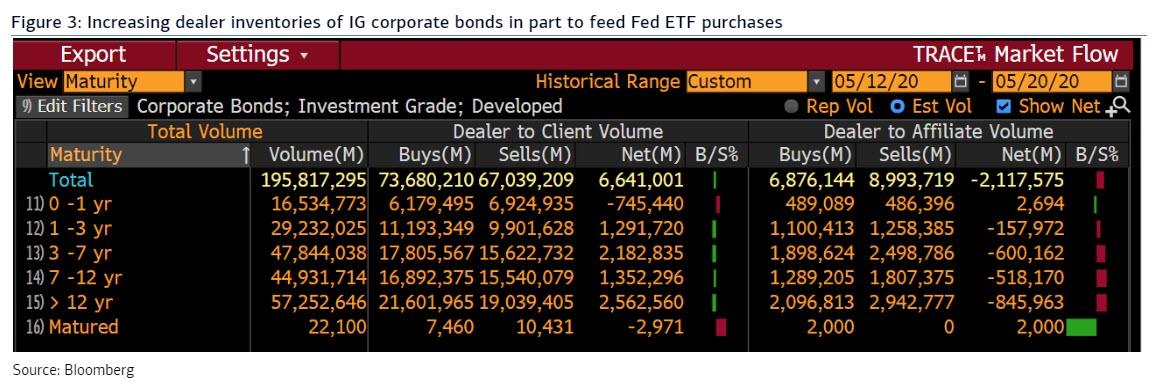

Trace data shows an estimated $5.3bn increase in dealer inventories after the Fed began buying ETFs, no doubt in part artificial because ETF creations are unreported and thus not subtracted from Trace…

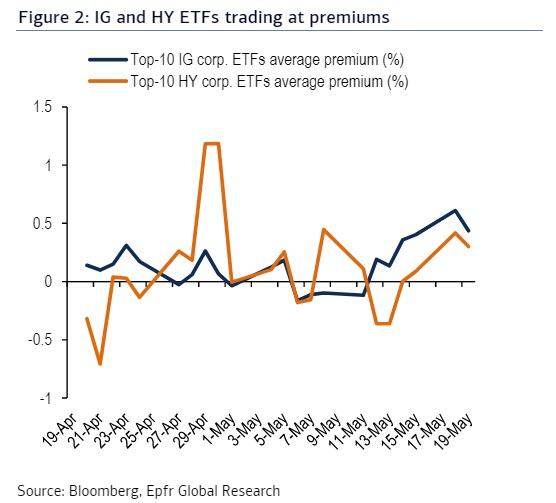

… when dealers feed the Fed. IG and HY ETFs are trading at 0.44% and 0.30% premiums, respectively, on average, suggesting some limitations on specific ETFs the Fed can buy.

In short: the Fed likely purchased $2.5 billion in bond ETFs in the past week, once again steamrolling over even the faintest pretense that price discovery remains in a market where the perpetually high LQD and JNK prices mean companies can and will issue trillions in debt which they will promptly turn around and use to fund even more buybacks, as the Fed now fully owns the final bubble, the one where Soviet-style central planning is on full display.

via ZeroHedge News https://ift.tt/2ZwjYZP Tyler Durden