How Retail Investors Took Over The Stock Market

Tyler Durden

Thu, 05/21/2020 – 11:50

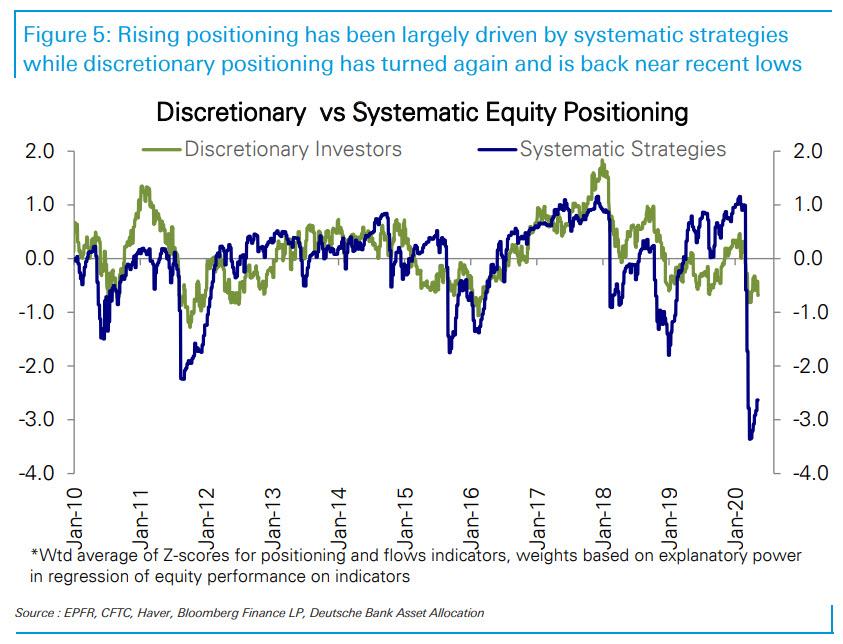

Two weeks ago, we showed a bizarre breakdown of the main market participants during the latest market meltup/massive short squeeze phase: whereas institutional, hedge fund, CTA, quant and other institutional and systematic funds were refusing to chase the rally…

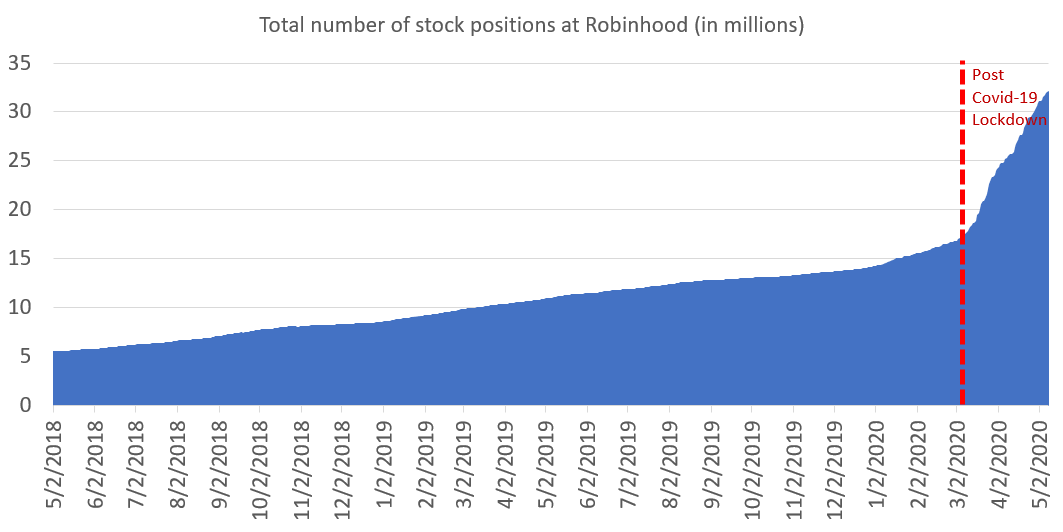

… retail investors were not only all-in but had literally doubled down since the Covid lockdown.

But how? And where were they getting the money from to chase stocks with such reckless abandon.

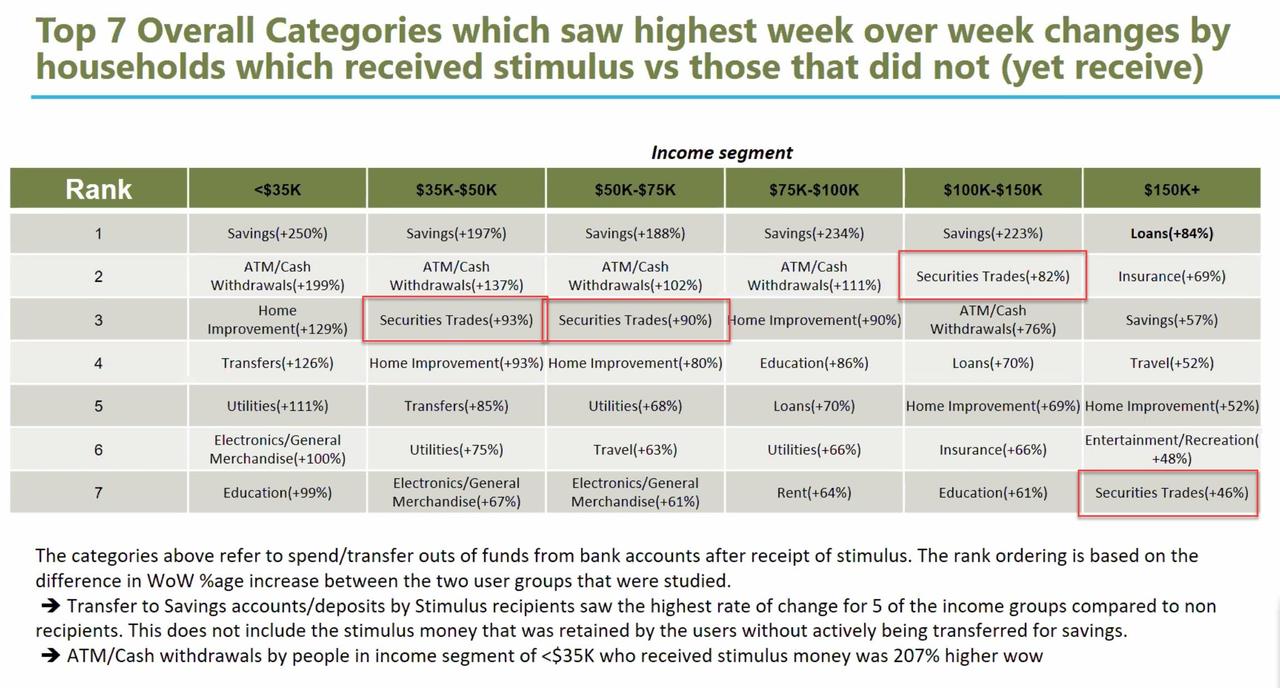

We now know the answer: according to credit card data analytics company Yodlee, after putting some money into savings and withdrawing cash (confirming some of those nascent rumors about ATM runs in March), the third most popular activity for most income segments was “securities trades” – i.e., buying stocks – especially among the pure middle class, those making between $35K and $75K.

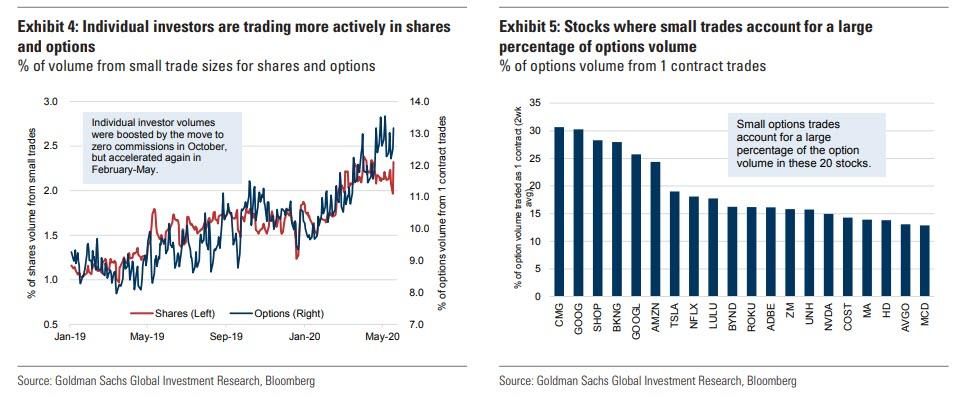

Meanwhile, separate data from Goldman only confirms the surge of small trades, i.e., retail participation, in the past three months.

A few months ago, in response to inbound client inquiries about the participation of individual investors in the share and options market, Goldman started tracking the percentage of volume that is driven by trades of small size as a proxy for assessing the percentage of activity attributable to individual investors.

We monitor the percentage of volume that is attributable to trades of $2,000 or less in the largest 100 stocks. In single stock options, we monitor the percentage of volume that occurs in 1 contract (1 contract provides optionality on 100 shares) for the 50 stocks with the most liquid options.

Not surprisingly, according to Goldman strategists, the proportion of volume driven by small trades over the past three months, in both the shares and options market, has been rising rapidly, with the most significant increase in percentage of volume driven by small trades occurred in February, before the broad decline in liquidity, but has remained at an elevated level.

This data supports the view that individual investor active trading is playing an increased role in market volatility, particularly in select stocks. In the shares market, 2.3% of all volume is made up of trades for $2,000 or less. The increase in small trades has been even more notable in the options market, where 13% of all trades are for 1 contract.

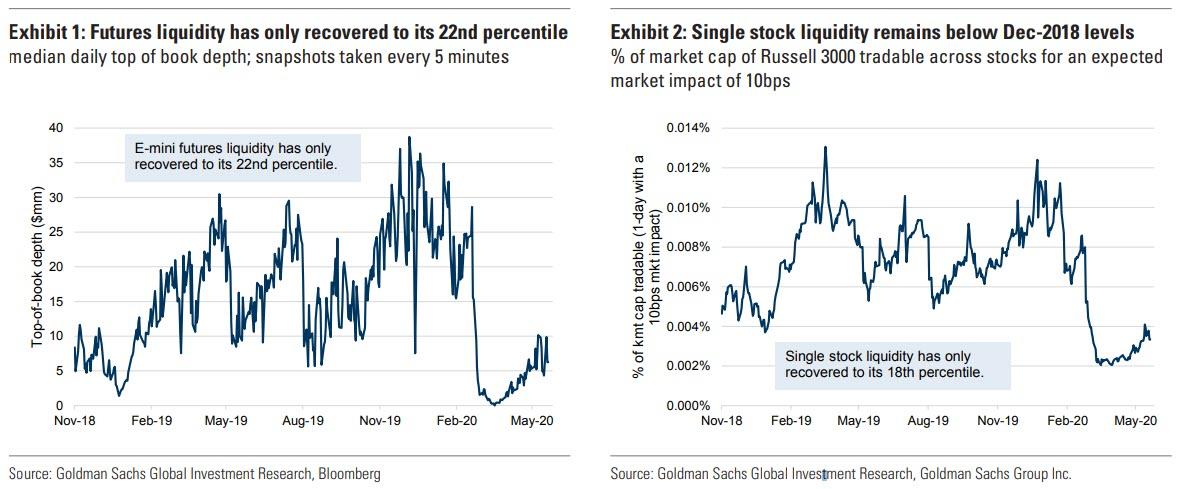

But wait, if individual investors who barely register in the grand scheme of the market, have enough of an impact to move not only single names but entire indexes, that would mean that liquidity in the broader market is non-existent. And that’s precisely the case because as Goldman notes, futures liquidity has only recovered to its 22nd percentile, while single-stock liquidity remains below Dec-2018 levels.

In other words, with most other investor classes sitting this one out and thus making sure market liquidity remains dismal, retail investors – who have been chasing upward momentum in the past three months as they flooded their $0-trade cost online discount brokers with trades – basically took over the market, which also explains why this particular bear market rally from the March 23 low to 3,000 has been especially hated by institutions.

via ZeroHedge News https://ift.tt/2Tt4rWF Tyler Durden