Japan Exports Worst Since Financial Crisis; Korea Early May Export Data Just As Dire

Tyler Durden

Wed, 05/20/2020 – 21:43

If any traders, or frankly anyone out there, still cares about fundamental economic data, there was little to celebrate this evening, when Japan reported another round of dismal trade numbers, with Imports plunging 7.2% in April, worse than the -5.0% drop in March but slightly better than expected. However, it was Japan’s exports – that key benchmark for the BOJ whose goal of keep the yen weaker is not only to support stocks but also to facilitate exports – that was the highlight, with the April number plunged by 21.9%, double the previous month’s -11.7% drop and the biggest plunge since the financial crisis.

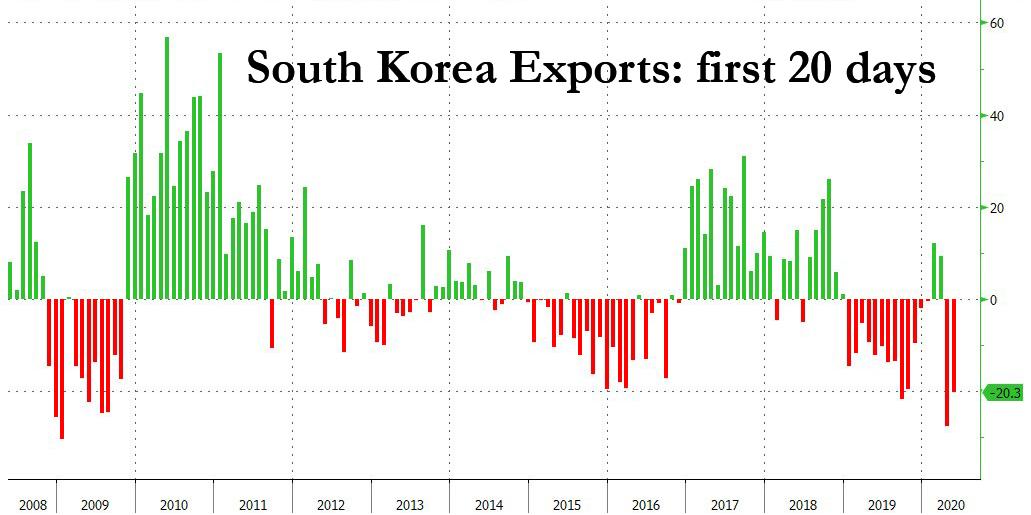

But if Japan’s number was dismal, at least it was expected. What was more concerning was the latest Korean export number for the first 20 days of May, which some had expected to see a solid rebound in light of the so-called reopening observed this month. Well, it did not happen, and while the May number wasn’t quite as bad as the near-record plunge in April when exports plunged by 26.9% in the first 20 days, the -20.3% Y/Y drop in May – off an already depressed 2019 number – showed that any hopes for a solid global recovery taking hold have been painfully premature.

To be sure, there was a tiny silver lining, as semiconductor exports rose 13.4% in contrast to a 15% decline in the same period of April. According to Bloomberg “this supports optimism for an economic turnaround and equities’ rally” and is “likely to give investors fresh reasons to look at the tech sector in Korea and abroad” although we disagree.

As noted in recent weeks, just like during the trade war in much of 2019, the reason for a sharp pick up in semiconductor trade has been fear that China’s tech sector will soon be locked out of US supply chains – as the recent Huawei news confirmed – and as such any jump in S.Korean semi exports is simply frontloading of demand now ahead of more crackdowns on the Chinese tech space in the future, when Huawei et al may find themselves completely locked out from US suppliers, which in turn explains why as Bloomberg reported earlier, China is planning to invest $1 trillion in its semiconductor industry to if not overtake the US in technology, at least become self-sufficient and not rely on US semi production.

via ZeroHedge News https://ift.tt/2XaoWbK Tyler Durden