S&P Futures Jump, Global Markets Rise In Holiday-Muted Session

Tyler Durden

Mon, 05/25/2020 – 08:16

US equity futures jumped in thin holiday volume, rising alongside European and Asian markets, and are now less than 20 points away from 3,000 having put the key resistance level of 2,950 in the rearview mirror, as investors cheered the reopening of more economies while ignoring the rapid deterioration in US-China relations which has put the fate of Hong Kong on the line. The dollar was flat despite the weakest yuan fixing in 12 years, while oil recovered modest overnight losses.

MSCI’s gauge of world stocks gained 0.32%. The pan-European STOXX 600 index climbed 0.8%, with European markets green across the board, after a survey showed German business morale rebounded in May, boosting optimism around economic re-openings, although caution prompted the dollar to snap a rare losing streak.

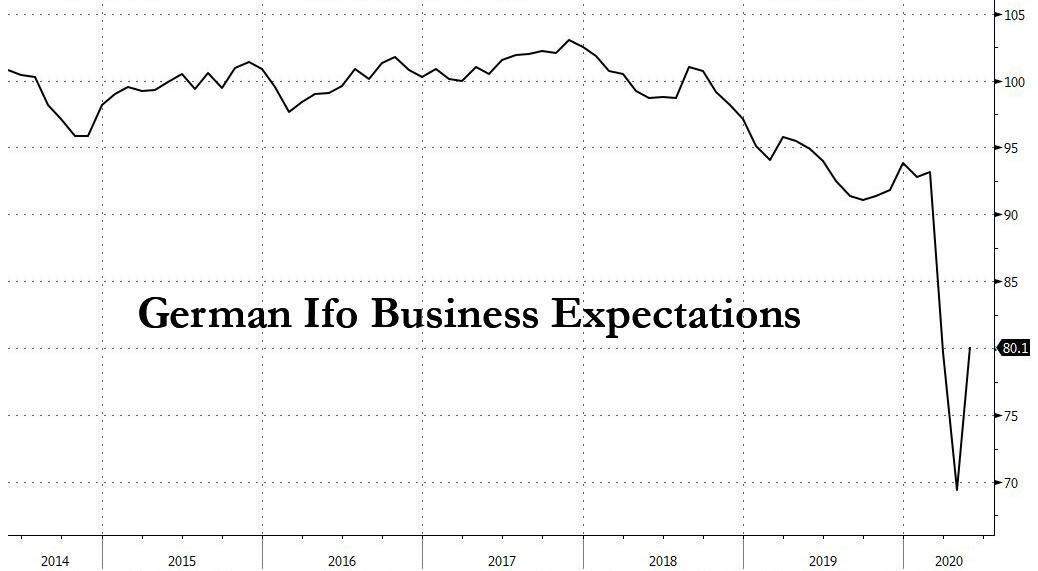

With nervous investors wary of adding to their equity holdings over concerns on what a post-lockdown world would look like, Germany’s Ifo institute survey for May gave some relief. Its expectations index rebounded strongly to 80.1, from 69.4 last month, beating expectations of 75.0, while the business climate index rose to 79.5 from a downwardly revised 74.2 in April, also higher than forecast, and fueling optimism about the outlook of Europe’s biggest economy after a drop in the first quarter.

“Today’s Ifo index echoes more real-time signals that economic and social activity has started to pick up significantly since the first lifting of the lockdown measures in late April,” ING economists said in a note. “In short, the low point of the slump should now be behind us and there even is the chance for a short-lived strong rebound in the coming months.”

Construction and healthcare shares led a broad advance in the Euro Stoxx Index, with Bayer AG jumping almost 9% after Bloomberg reported it reached agreements to resolve some cancer lawsuits over its Roundup weedkiller.

In Asia, the MSCI’s index of Asia-Pacific shares outside Japan was 0.3% higher on thin volume, as stocks gained led by industrials and health care, after falling in the last session. Hong Kong shares inched higher after Friday’s slump, following police clashes at the weekend with protesters marching against China’s move to crack down on dissent. All markets in the region were up, with Australia’s S&P/ASX 200 gaining 2.2% and Japan’s Topix Index rising 1.7%. The Topix gained 1.7%, with W-Scope and Showcase Inc/Japan rising the most. The Shanghai Composite Index rose 0.1%, with Danhua Chemical Technology and Beijing Sanyuan Foods posting the biggest advances

Contracts on all three major US indexes also rose, but with markets in Singapore, Britain and the United States closed for public holidays on Monday, market moves were relatively small and held within well-worn ranges. Emini futures gained 1%.

Volumes may be light with holidays in the U.S., U.K. and Singapore. Treasuries weren’t trading, and futures on the 10-year note were little changed. Elsewhere, bond markets were stable with Italy’s 10-year yield at 1.60%, just off six-week lows hit on Friday, and safe-haven German 10-year yields down 1 basis point at -0.50%.

In FX, China set its daily yuan reference rate at the weakest level since 2008 after the increasing acrimony drove the currency to a seven-month low on Friday. A benchmark of emerging-market stocks headed for its first rise in three sessions.

The bullishness in the stock markets contrasted with caution in currency markets, where the dollar ended a rare weekly loss to rise to a one-week high against its rivals in early trading, but has since given up much of the gains. The dollar gained after China’s move to impose a new security law on Hong Kong heightened concerns about the stability of the city and global trade prospects.

Traders were rattled on Friday when Beijing announced details of the security legislation, which critics see as a turning point for the territory. Sino-U.S. ties have worsened since the coronavirus outbreak, with the administrations of President Donald Trump and President Xi Jinping trading barbs over the pandemic, including accusations of cover-ups and lack of transparency.

“One big threat to the recovery in markets is the escalating war of words between the U.S. and China,” said Shane Oliver, head of investment strategy at AMP Capital Investors Ltd. in Sydney. Separately, “the main focus will likely remain on continuing evidence that the number of new Covid-19 cases is slowing in developed countries, progress towards medical solutions, the reopening of economies and signs that economic activity is picking up.”

“Rising tensions between the U.S. and China around Hong Kong, trade policy and who is responsible for the 2020 economic dislocation are threatening to end the post March-trough rally,” said Perpetual analyst Matthew Sherwood.

While fresh turmoil in Hong Kong is threatening to damage an already souring Sino-U.S. relationship, investors are looking to the reopening of economies from Japan to Australia and the U.S. to provide impetus to global stock markets, which have already priced in a successful reopening and then some.

In commodities, WTI rose 32 cents, or 1%, to $33.57 a barrel. Brent crude was up 9 cents, or 0.20% higher, at 35.14.

Top Overnight News

- China’s Foreign Minister warned the US not to try and change China and said some Americans were risking a “new cold war”

- Hong Kong protesters held their biggest rally in months following China’s dramatic move to crack down on dissent in the city as lawmakers are set to consider legislation that would punish anyone who disrespects China’s national anthem

- China Investment Corp. is looking for more resilient assets as the nation’s $941 billion sovereign wealth fund seeks to boost long-term returns

- Germany’s 9 billion-euro ($9.8 billion) bailout of Deutsche Lufthansa AG is being slowed by discussions meant to ensure the rescue plan receives swift European Union approval once it’s finalized, people familiar with the matter said. Bild am Sonntag reported earlier that Lufthansa would face a three- year deadline for repayment of the aid package to save the ailing airline

- U.K. Prime Minister Boris Johnson put his own authority on the line as he fought to save his most senior aide Dominic Cummings in the face of growing demands to fire the adviser for allegedly breaking lockdown rules

- The Japanese government was set to end its nationwide state of emergency by lifting the order for Tokyo, its surrounding areas and Hokkaido on Monday, allowing more parts of the economy to re-open as new coronavirus cases tail off

Asian equity markets began the week mostly higher following last Friday’s recovery on Wall St. where the US major indices gradually clawed back opening losses after encouraging comments from NIH’s Fauci and US plans for large Phase 2 trials, spurred vaccine-related optimism. ASX 200 (+1.5%) and Nikkei 225 (+1.5%) traded positive with tech and energy front running the broad gains seen across Australia’s sectors, while sentiment in Tokyo was underpinned by expectations the state of emergency will be lifted today in all remaining areas including the capital and with the government reportedly considering compiling a new package mostly consisting of financial support to companies which would be funded by a second supplementary budget valued more than JPY 100tln. Hang Seng (-1.0%) and Shanghai Comp. (Unch.) lagged their regional peers with the mainland bourse choppy amid ongoing US-China tensions and with the Hong Kong benchmark extending on last Friday’s near-6% slump after thousands of protester rallied on Sunday against China’s national security law, while the protests were met heavy handed by the police which used pepper spray and a water cannon to disperse the crowd. Finally, 10yr JGBs were marginally lower amid gains in Japanese stocks but with downside stemmed by the BoJ ‘s presence in the market for nearly JPY 1.1tln of JGBs mostly concentrated in 1yr-10yr maturities.

European bourses have kicked the week off on the front-foot after taking a positive lead from Asia. In the absence of UK and US participants, European indices initially eked out mild gains but sentiment picked up in recent trade (Eurostoxx 50 +1.1%) in spite of lingering tensions between US and China and ongoing concerns about an impending clash regarding the EU recovery fund with sentiment instead potentially lifted by a pick-up in reopening efforts across the continent. Sectors are higher across the board with outperformance seen in IT and industrial names, with performance for the latter bolstered by German heavyweight Bayer (+6.9%) after the Co. reportedly reached a verbal agreement regarding 50-85k of the 125k US Roundup lawsuits. Elsewhere, individual movers include Lagardere (+11.8%) with Co. shares boosted after French billionaire Arnault agreed to buy a stake in the Co., whilst Deutsche Lufthansa (+2.0%) shares have been supported amid ongoing hopes that the Co. can strike a deal with the German government and reports that the airline will resume more flights as of mid-June; something which has also provided a tailwind in the travel-space for Tui (+11.3%). Elsewhere, gains of over 2% for Renault were faded early doors (currently +1.1%) with the Co. and Nissan set to announce billions of USD in cost cutting measures this week, according to sources. Note, competitor Peugeot (+2.8%) has managed to maintain strength in early European trade as markets await details of support measures for the French auto sector that are due to be announced tomorrow.

In FX, the G10 underperformers thus far in holiday-thinned volumes as the Single Currency eyes a roadblock regarding the EU Recovery Fund – with the “frugal four” (Austria, Denmark, Netherlands, and Sweden) countering the Franco-German proposal of grant distributions. The perceived hawks call for loan allocations – a drawback for peripheries Italy, Spain, and Greece (among others) – with the former also facing a potential rise in domestic anti-Euro sentiment. EUR/USD breached Friday’s 1.0885 low which coincide with the 10DMA to a current low of 1.0871, having briefly dipped below its 21DMA at 1.0873. Further levels to the downside include a Fib at 1.0864 (61.8% of the 1.0775-1.1008 move) ahead of the psychological 1.0850. Unrevised German GDP finals and an overall mixed Ifo survey did little to shift the narrative. Option expiries see EUR 550mln at 1.0875-85, 800mln at 1.0895-1.0900, and EUR 1bln rolling off between 1.0910-20. The Franc meanwhile sees safe-haven outflows, albeit to a greater extent vs. its Japanese counterpart as EUR/CHF revisits support around the 1.0575 area.

- DXY, CNY, HKD – The broader Dollar and Index initially extends on overnight gains before pulling back, with support also derived from the heavy EUR basket contribution. DXY inched higher towards 100.000 (vs. low 99.716) to the upside with its 50DMA residing nearby at 100.02. Elsewhere, the Yuan remains on the backfoot amid heightened US-Sino tensions, coupled with international backlash for Mainland’s crackdown on anti-govt Hong Kong behaviour. Further, the PBOC set the weakest CNY fixing since 2008 (7.1209 vs. Prev. 7.0939) following Friday’s losses. HKD meanwhile unsurprisingly experienced weakness but USD/HKD sees itself just above the bottom end of the 7.75-7.85 peg.

- GBP, CAD – The marginally better performers ex-USD, but action remains minimal in thin conditions. Cable overnight remained restricted under 1.2200 as PM Johnson was said to face Cabinet revolt after supporting senior adviser Cummings who faced calls to resign after breaching the lockdown – potentially leading to Cabinet dissent and citizens disobeying lockdown rules. Brexit developments have also remained in focus amid the diminishing timeframe to hammer out an FTA by year-end. Weekend developments noted that the UK is in a fresh stand-off with the EU regarding delays in granting diplomatic status to the EU’s representation in London. Furthermore, relations with China should be watched over the Hong Kong developments – with PM Johnson reportedly looking to reduce Huawei’s involvement in UK 5G network within the next three years. Cable resides towards the bottom of the current 1.2162-91 intraday band, ahead of a 61.8% Fib of last week’s bounce coinciding with Friday’s low ~1.2160. The Loonie meanwhile tracks price action in the US energy benchmarks. USD/CAD resides just south of 1.4000, having earlier tested resistance at its 21DMA at 1.4007 (intraday high).

- AUD, NZD – Antipodeans tracked the weakness in the Yuan as tensions with China remain elevated and with the US-Sino spat also providing less basis to join in on global lockdown easing optimism/vaccine hopes. AUD/USD drifted off session lows ~0.6520 (vs. high 0.6550) amid a pullback in the DXY, with the 100 and 21DMAs both residing at 0.6490. The Kiwi meanwhile fares modestly worse as the AUD/NZD cross found a current base at 1.0700. NZD/USD meanwhile sees itself just under 0.6100 (vs. high 0.6108) but threatening Friday’s low at 0.6079.

- JPY – Modest losses for the Japanese currency, albeit more-so a function of the firmer Buck. Reports noted that Japan is to lift the state of emergency declaration in Tokyo, Kanagawa, Saitama, and Hokkaido today. USD/JPY sees itself hovering on either side of its 55 DMA (107.71) vs. its overnight low at 107.54 and ahead of its 50 DMA at 107.91..

In commodities, WTI and Brent front month futures see mild gains in early trade with traded volumes on the lighter side amid absences from UK and US markets/participants; while fresh fundamental news flow remains light. Eyes remain on the wider implications on global trade and sentiment from the fallout of the US-Sino trade spat threatening a cold war, whilst investors must not be distraction from the prospects of reinstated lockdowns should COVID-19 cases rise again. On Friday, the Baker Hughes rig count printed another decline in active rigs, whilst OPEC Secretary General Barkindo posited tentative signs of recovery and we believe the worst is behind us. WTI July meanders around USD 33.50/bbl (USD 32.50-33.75/bbl range), whilst Brent July sees itself oscillating between gains and losses, now residing north of USD 35/bbl (34.50-35.40 range). Spot gold moves in tandem to the Buck as sees itself with mild intraday losses around USD 1730/oz (USD 1724-35 band) whilst copper mimics price action in stocks to reclaim USD 2.40/lb to the upside.

US Event Calendar

- The US us closed for Memorial Day holiday

via ZeroHedge News https://ift.tt/2X1n3Py Tyler Durden