Morgan Stanley Explains The One Thing That Has Kept Treasury Rates Low

Tyler Durden

Tue, 05/26/2020 – 15:30

Over the weekend, Morgan Stanley’s rates strategist Matthew Hornbach, published an interesting report discussing the difference between narrow and broad liquidity, and whether soaring US deficits will “crowd out” the liquidity provided by the Fed, by draining it into Treasury purchases, thereby preventing it from entering the broader economy and resulting in an even greater collapse in the velocity of money.

While Hornbach’s conclusion is that such concerns are generally unwarranted (and in a remarkable coincidence, at exactly the same time on Friday, JPMorgan’s Nick Panigirtzoglou published a report on exactly the same topic, reaching the exact same conclusion), he did make the following key points:

- Concerns have risen that, given the large fiscal stimulus package the US government passed, the forthcoming issuance of Treasury securities will drain that liquidity provided by the Fed. Whether this concern is valid depends on how you define liquidity – in a narrow or broad sense – and how you think the portfolio balance channel operates in practice.

- The issuance of Treasury bills, notes, and bonds, along with the associated government deficit spending, does not drain the narrow liquidity. It’s only when Treasury keeps the proceeds of its debt sales on deposit at the Fed (in the Treasury General Account) without spending them does issuance drain the narrow liquidity.

- Recently, Treasury has drained $800bn of the narrow liquidity provided by the Fed over the past two months. However, Treasury should replenish that liquidity by $400bn between now and the end of June – a larger injection of narrow liquidity than we expect from the Fed’s Treasury purchases over the same time frame.

- However, Treasury issuance may drain broad liquidity, depending on how much Treasury issuance the Fed absorbs and when expectations form for both. Given that investors have already formed expectations for dramatically higher Treasury issuance and Fed purchases this year, we don’t expect the issuance to drain broad liquidity.

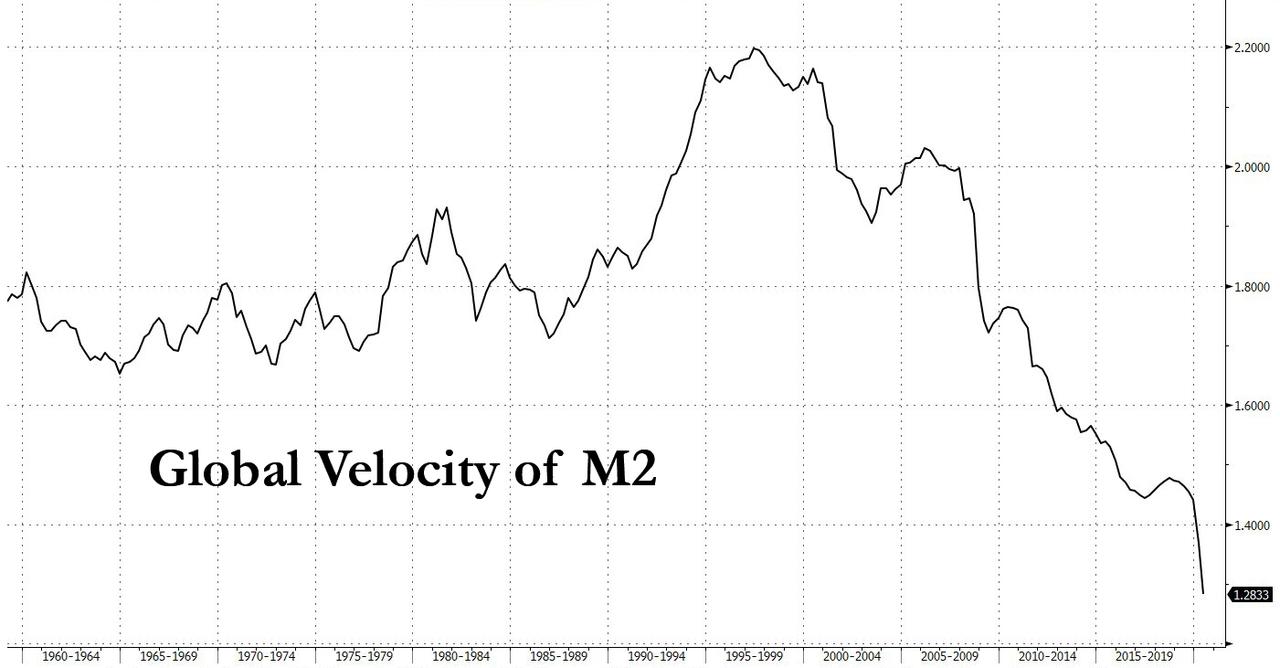

So far so good, and largely textbook, even if the past decade has shown that nothing in the economic textbook works under ZIRP/NIRP and QE, and instead the capital markets acts as one giant black hole for liquidity as newly injected money fails to enter the broader economy (see M2 velocity chart above).

However, two things in Hornbach’s note did catch our attention: first was his echo of the Goldman warning from two weeks ago, that the Treasury is facing trillions more in issuance yet the Fed has yet to commit to a matched amount of QE (see “Goldman Spots A Huge Problem For The Fed“), to wit.

If expectations for even more Treasury issuance form in the coming months, without expectations for more Fed purchases, then Treasury yields could move higher and spark a portfolio rebalancing, which could drain broad liquidity

The second, and tied to this, highlight from Hornbach’s note is a point so critical that every single MMT cultist and fanatic should be forced to write it on the wall a few hundred billion times. As a reminder, MMT – in a nutshell – is the “theory” that a sovereign can issue virtually infinite amounts of debt as long as rates are low. And since rates are low, MMT has suddenly become the pet theory du jour, the same way chartalism (the predecessor of MMT) was in vogue just before the Weimar Republic tried it. Well, there is just one snag: there is a very simple reason why yields aren’t blowing out and it has nothing at all to do with equilibrium supply and demand, or frankly with the capital markets which post-March 23 no longer exist. In fact, it is only due to the Fed’s direct intervention in capital markets that yields haven’t gone full Zimbabwe yet. But don’t take our word for it, here is Morgan Stanley:

What has kept Treasury yields low? Fed purchases of Treasuries, year-to-date, and expectations for further Fed purchases played a critical role. In that sense, the Fed’s addition of broad liquidity via Treasury purchases offset the broad liquidity drain that expectations of more Treasury supply created.

So simple, even an MMTer (or central banker) can understand.

via ZeroHedge News https://ift.tt/3c3FrMi Tyler Durden