“Fiscal Firehose”: Japan Approves Record 117 Trillion Stimulus Package

Tyler Durden

Wed, 05/27/2020 – 09:58

It’s a fiscal firehose.

On the same day as Europe’s “Watershed Moment” saw the European Commission propose a €750BN virus recovery fund, funded by joint debt, and which would offer €500BN in grants to struggling European nations, Japanese Prime Minister Shinzo Abe’s cabinet approved a new $1.1 trillion stimulus package that includes significant direct spending, to counteract the coronavirus pandemic pushing the world’s third-largest economy deeper into recession.

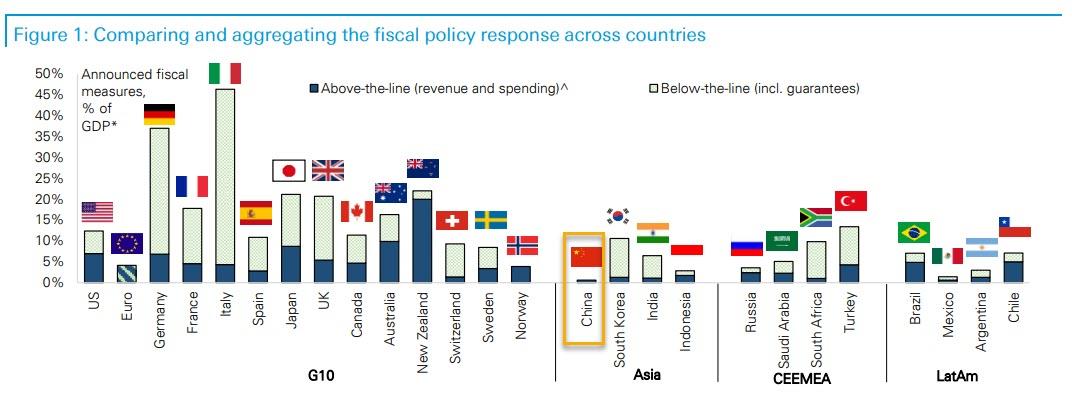

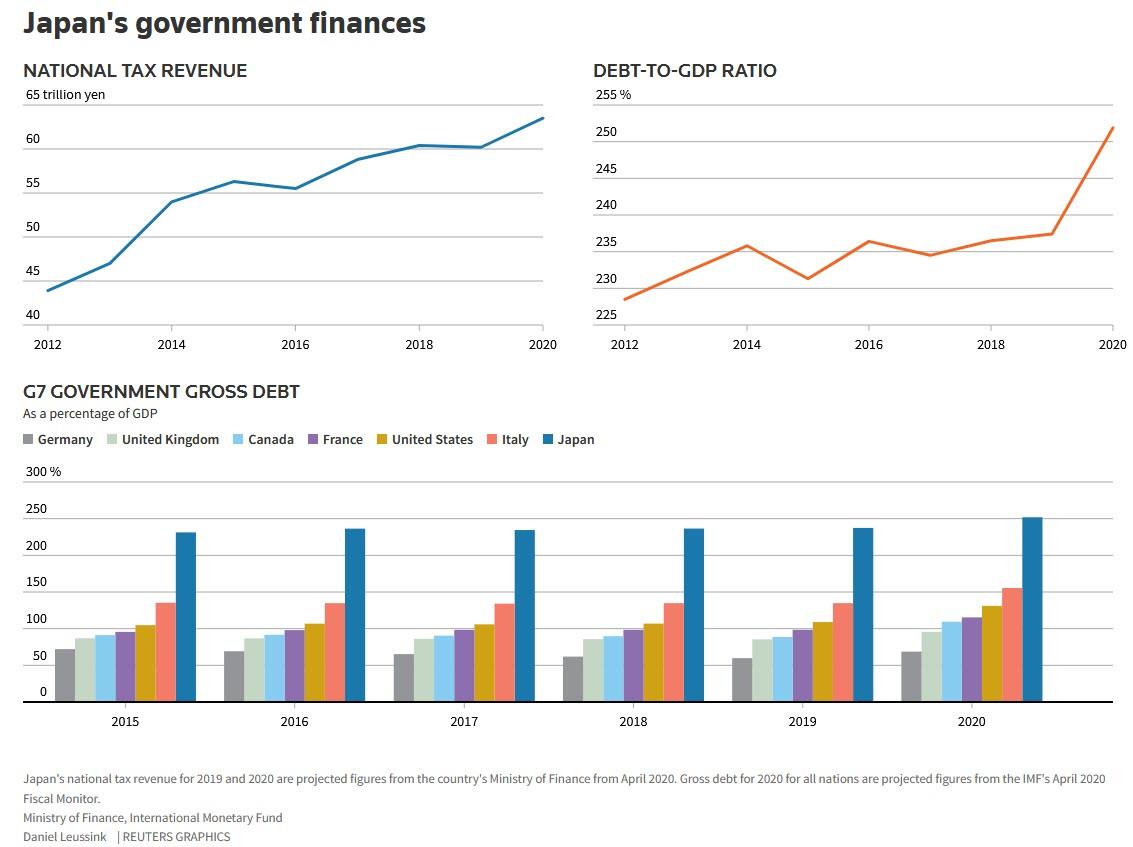

The record stimulus of 117 trillion yen, which as Reuters reported, will be funded partly by a second extra budget, followed another 117 trillion yen package rolled out last month. The new package takes Japan’s total spending to combat the virus fallout to 234 trillion yen ($2.18 trillion), or about 40% of gross domestic product, and will send its already world-record debt load into the stratosphere.

The combined spending ranks among the world’s largest fiscal packages to deal with the coronavirus, approaching the size of the United States’ $2.3 trillion aid programme.

According to the Ministry of Finance, the latest package includes 33 trillion yen in direct spending, and the balance will consists of guarantees and backstops. The new package will include measures such as higher medical spending, aid to firms struggling to pay rent and more subsidies to companies hit by slumping sales.

“We must protect business and employment by any means in the face of the tough road ahead,” Abe told a meeting of ruling party lawmakers. “We must also take all necessary measures to prepare for another wave of epidemic.”

To fund the costs, Japan will issue an additional 31.9 trillion yen in government bonds under the second supplementary budget for the current fiscal year ending in March 2021.

That record double-stimulus will push new JGB issuance this fiscal year to a record 90 trillion yen. Inclusive of issuance to roll over debt maturing during the year, Japan’s total calendar-base annual market issuance would hit a record 212 trillion yen, further straining already tattered finances.

While the Bank of Japan is likely to keep borrowing costs low with aggressive bond buying, the surprise increase in issuance of super-long bonds could trigger some market volatility, analysts quoted by Reuters said.

“The BOJ’s yield curve control should prevent a spike in long-term interest rates,” said Chotaro Morita, the chief bond strategist at SMBC Nikko Security. “Volatility in the JGB market will depend on the BOJ’s ability to control its bond purchases.”

Under Japan’s yield curve control policy, which will soon be adopted by the Fed, the BOJ guides the short-term interest rate at -0.1% and the 10-year bond yield at around 0%.

To prepare for a possible second wave of infections, the government also set aside 10 trillion yen in reserves that can be tapped for emergency spending. To facilitate financing, the government pledged to top up financial assistance to firms hit by the pandemic to 140 trillion yen, from 45 trillion yen in the previous package, by boosting interest-free lending, offering subordinate loans and supply of capital.

* * *

The packages took the size of this fiscal year’s budget to a record 160 trillion yen, with new bond issuance making up 56.3% of annual budget revenue and raising the spectre of more bond issues later to offset falling tax income.

And the punchline: Japan may not be done with helicopter money. “There’s a possibility of a third extra budget,” said Ayako Sera, market strategist at Sumitomo Mitsui Trust Bank.

“Japan may face the risk of credit downgrade in the medium to long run.” Of course it does, the question is not if but when, and that would be the beginning of the end for the world’s foremost experiment in monetary and fiscal stimulus insanity.

via ZeroHedge News https://ift.tt/3epuplX Tyler Durden