Moderna Shares Tumble 6.8% As Insiders Caught Running For The Exits

Tyler Durden

Wed, 05/27/2020 – 08:29

In his classic book “the Intelligent Investor”, Benjamin Graham, considered the founder of value investing, warned readers that evidence of company insiders and management selling large slugs of shares should be an immediate red flag for the discerning investor. If management seems more interested in cashing out than running the company, then they’re likely prioritizing their own financial interests over the long-term viability of the company.

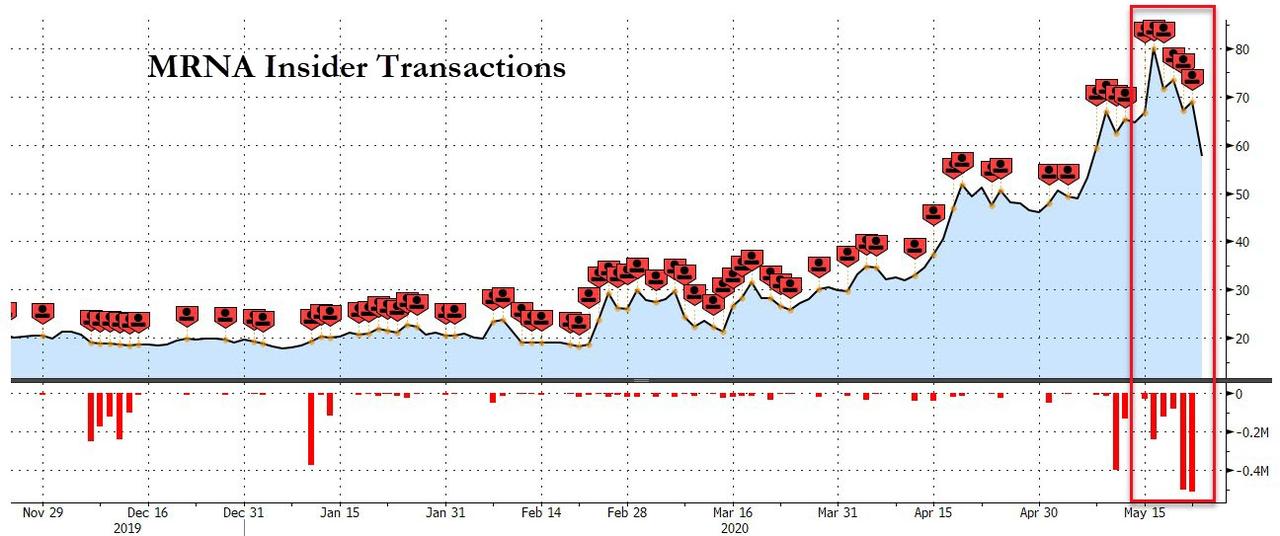

A little over a week ago, shares of American biotech stock Moderna soared more than 30% following a bullish statement on the company’s vaccine results. A few days later, CNN reported that company insiders, including the company’s chief medical officer and chief financial officer, cashed out some $30 million in options. CEO Stephane Bancel has also cashed out enough Moderna shares to cement his status as a billionaire.

The high-flying biotech stock was forced to reckon with the confidence-draining impact of insider sales when StatNews reported on Wednesday that insiders have sold more than $89 million in stock so far this year. Statnews didn’t say where it obtained this info; that $89 million number is larger than the sales that have already been disclosed to the SEC.

The news, which follows a secondary offering by Moderna last week seemingly timed to take advantage of the rally, sent Moderna shares down 6.8% in premarket trading on Wednesday.

Time for another vaguely positive vaccine-headline pump?

via ZeroHedge News https://ift.tt/3c5LAYb Tyler Durden