WTI Extends Losses After Huge Surprise Crude Inventory Build

Tyler Durden

Wed, 05/27/2020 – 16:35

Oil prices slipped notably today (WTI below $33) as investors weighed whether or not Russia would agree to extend output curbs when OPEC+ meets in two weeks.

“It’s really important to provide stability in the market going forward and have some kind of coordinated effort together that helps not only Russia but OPEC and provides stability in the prices,” said Phil Streible, chief market strategist for Blue Line Futures LLC.

OPEC+’s commitment to reducing output by almost 10 million barrels a day starting in May has helped to lift oil prices by about 75% this month. But the market’s recovery remains fragile, with higher prices likely to prompt producers to turn the taps back on even as the pandemic continues to quash energy demand.

So all eyes will now be focused back on inventories (delayed reporting this week due to Monday’s holiday).

API

-

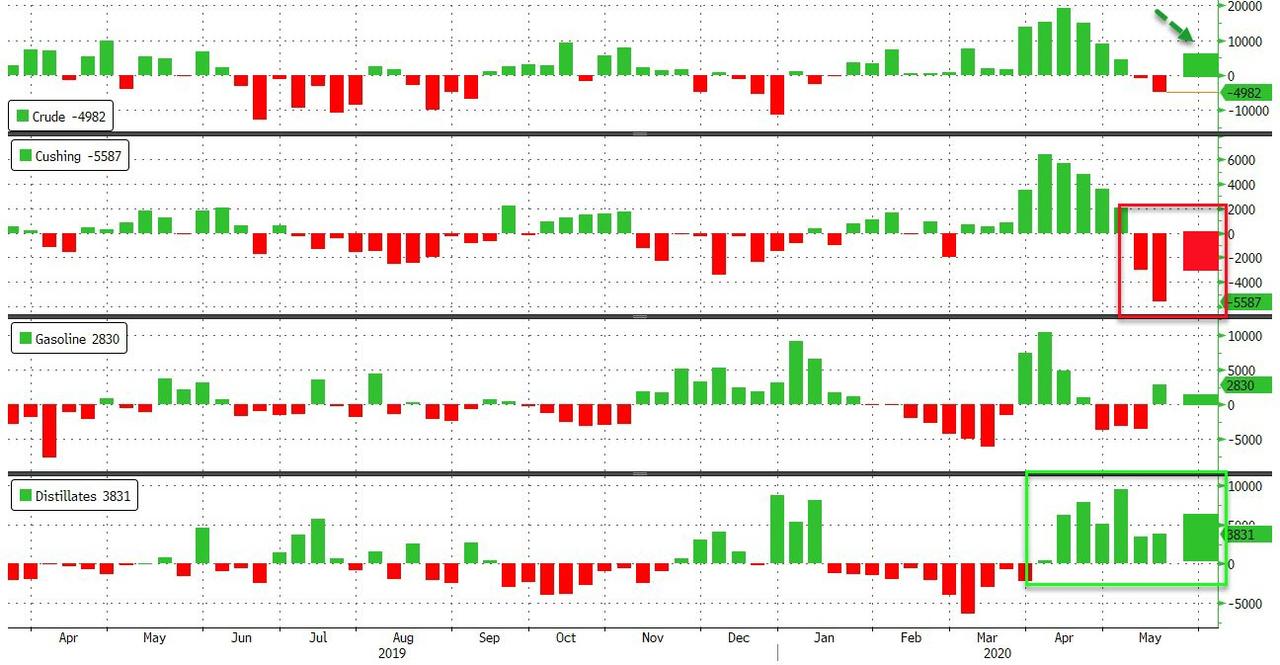

Crude +8.731mm (-2.32mm exp)

-

Cushing -3.37mm

-

Gasoline +1.12mm (-675k exp)

-

Distilates +6.907mm (+2.55mm exp)

US crude inventories were expected to fall for the 3rd week in a row but instead saw a major 8.73mm barrel build (and a big distillates build)…

Source: Bloomberg

Notably, warning signals remain. Demand for gasoline fell 25% to 35% from a year earlier over the U.S. Memorial Day weekend, which usually heralds the start of the summer driving season and the peak of fuel consumption.

BREAKING: GasBuddy gasoline demand data shows Monday gasoline demand -0.5% from the Monday prior. Thur-Mon demand is now -1.34% from same period a week ago. #gasoline #oil #OOTT pic.twitter.com/P2z9LoYRRy

— Patrick De Haan ⛽️📊 (@GasBuddyGuy) May 26, 2020

WTI (July 2020) was hovering between $32.50 and $33 ahead of the print and extended losses down to a $31 handle…

Separately, as Bloomberg reports, the U.S. is considering a range of sanctions to punish China for its crackdown on Hong Kong, including controls on transactions and freezing assets of Chinese officials and businesses. Additionally, the U.S. certified Wednesday that Hong Kong is no longer politically autonomous from China. The deteriorating relationship between the world’s two largest economies could complicate the market’s comeback from a historic demand crash.

via ZeroHedge News https://ift.tt/3gtbSXE Tyler Durden