Restaurant Recovery Begins As Money Spent On Dining Posts First Increase In Weeks

Today’s -4.8% GDP print was dire, but it would have been even worse had it not been for a spike in discretionary spending as Americans found themselves under house arrest for the second half of March. Given the importance of consumer spending on GDP, we looked at trends in the restaurant space amidst Covid-19 related headwinds, courtesy of Clover data compiled by Morgan Stanley. What we found is that for the first time in weeks there was a clear WoW improvement in dining spend, an indication that the worst is over for the restaurant industry.

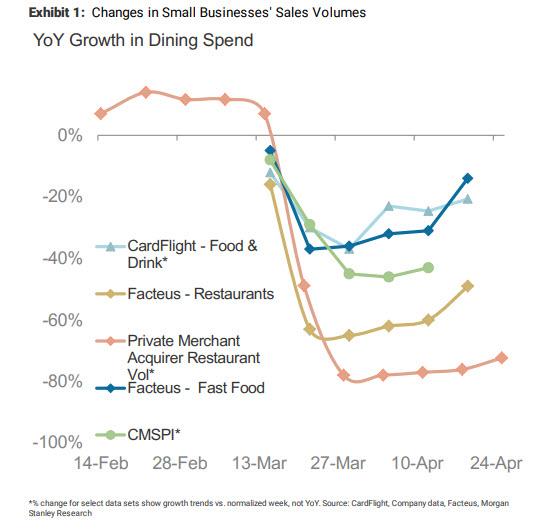

Here are some observations from the dining trends chart below:

- Small business food and drink saw a slight WoW improvement, with volumes down 21% the week ending April 19th vs a normalized level, compared to the prior week’s down 25%.

- Broader restaurant trends also improved WoW, with restaurant sales now down 49% YoY the week ending April 19th (vs. -60% YoY the week prior). QSR continues to perform better than restaurants,now down 14% YoY (vs. down 31% YoY the week prior)

Confirming the above observations, a new survey from Hospitality Trends indicates that pent-up demand for restaurants is elevated, even as many consumers maintain their off-premises frequency.

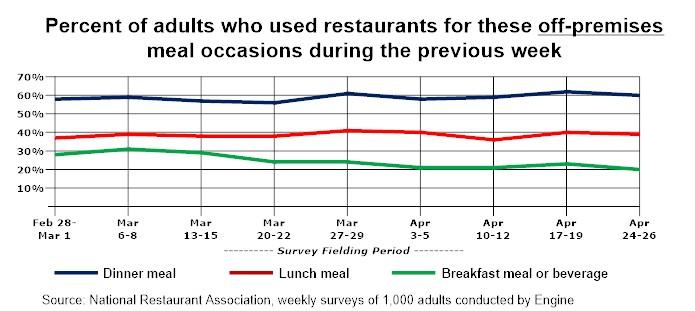

While takeout and delivery are the only restaurant options available for the vast majority of consumers across the country, based on weekly surveys conducted by the National Restaurant Association beginning in late-February, the proportion of consumers using these off-premises options remained remarkably consistent throughout the coronavirus crisis.

In fact, six in 10 adults say they ordered takeout or delivery from a restaurant for a dinner meal last week – a level that has held relatively steady during the past two months. In addition, an off-premises lunch purchase was made by roughly four in 10 adults during each of the last nine weeks. 20% of consumers say they picked up a breakfast meal, snack or beverage in the morning from a coffee shop or restaurant last week. This is down from roughly three in 10 adults who reported similarly in late-February.

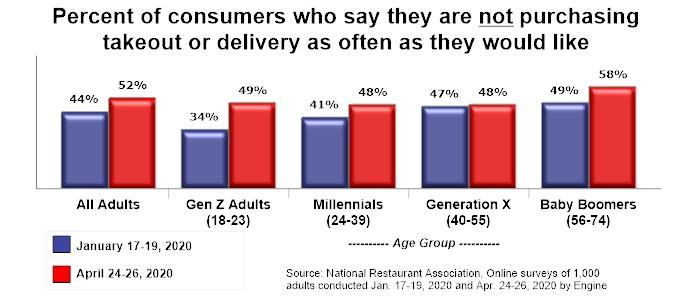

For restaurants that are offering off-premises options, the good news is that many consumers want more. 52% of adults say they are not ordering takeout or delivery from restaurants as often as they would like. As a point of comparison, 44% reported similarly when the Association fielded the same question in mid-January.

58% percent of baby boomers say they would like to order takeout or delivery more frequently right now. This is roughly 10% points higher than their counterparts in the younger generations.

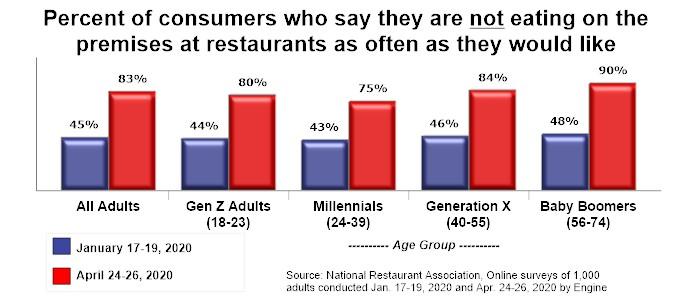

Not surprisingly, a strong majority of consumers say they would like to be dining out at restaurants more frequently – as this option is largely unavailable throughout most of the country. 83% of adults say they are not eating on the premises at restaurants as often as they would like. This is up from 45% who reported similarly in mid-January, and by far the highest level in the two decades that the Association has been fielding this survey question.

Baby boomers (90%) are the most likely to report that they would like to be eating at restaurants more often, though at least three in four adults in each age group want to increase their frequency. This suggests that as dining room doors being to reopen, pent-up demand among consumers will be strong.

Tyler Durden

Thu, 04/30/2020 – 22:40

via ZeroHedge News https://ift.tt/3f5QYNH Tyler Durden